Collaborative Robot Market Synopsis:

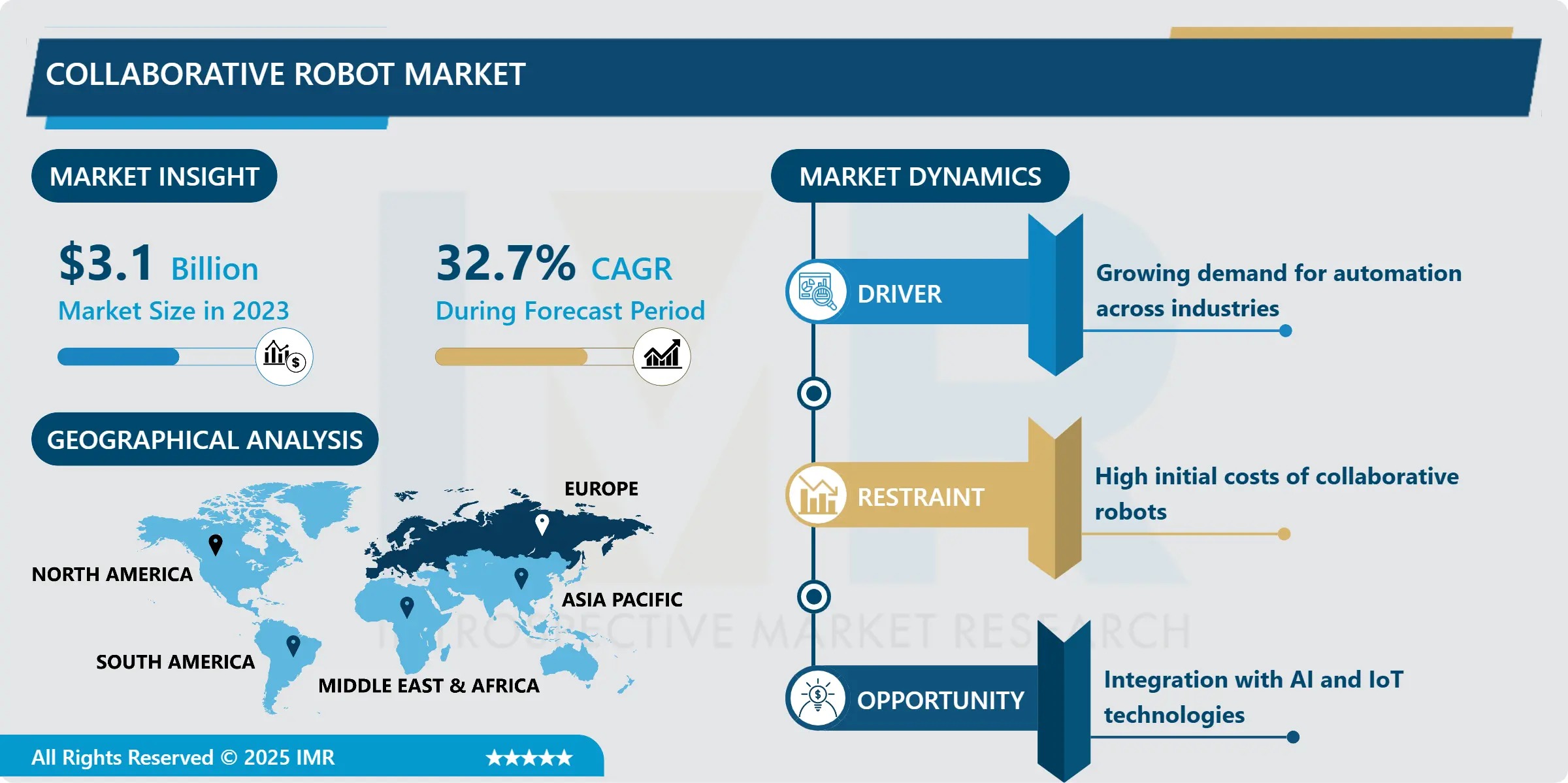

Collaborative Robot Market Size Was Valued at USD 3.1 Billion in 2023, and is Projected to Reach USD 40.4 Billion by 2032, Growing at a CAGR of 32.7% From 2024-2032.

Robots are sophisticated robotic tools developed for operation in increasingly integrated human-occupied environments intended to increase efficiency and reduce risks to workers. While industrial robots are standalone structures that move about in a limited way and are generally not designed for direct interaction with human, Robots are purpose-built with better sensors, AI-based computing, and natural interfaces capable of integration into human environments. These devices are used in manufacturing industries, clinics, supply chain management, and husbandry because of flexible use, simplicity, and affordable prices. Some of these robots are useful for repetitive or risky operations, and then human operators can practice discretion on the remaining work. The need for the integration of automation in the various industries is highly contributing to the use of collaborative robots.

The global collaborative robot market is escalating dramatically by growing industrial automation, scarcity of labor, and moving towards the Industry 4.0. Companies need flexible and inexpensive automation systems, thus, Robots become the best fit for SMEs because of lower acquisition costs and ease of programming. Moreover, these robots are being used across various sectors including automotive industry, electronics and related products including pharmaceuticals industries where there is need for quick, accurate and safe operation of machines. By diversification of the workforce, the user-friendly properties and variable loading capacity of Robots is driving demand for the market.

Recent developments on artificial intelligence and machine learning have added more features to the Robots so they can manually perform some duties like quality checking, pick and place operations, and can also be used into operations carrying surgeries in medical fields. The fact that Robots are being integrated with IoT and cloud technologies is also expanding other associated opportunities for remote control and real-time monitoring of the industrial automation processes that Robots are participating in and contributing to.

Collaborative Robot Market Trend Analysis:

Increased Adoption in E-commerce

-

One of the most significant factors for the procuring adoption of collaborative robots is the flourishing e-commerce business. We have seen Robots widely used in e-commerce fulfillment centers especially for packaging, sorting and picking. Manufacturers are using Robots to deal with unpredictable demand rates, in areas such as Sharp, during periods of high demands to avoid hitches and mistakes. As the consumers demand is increasing the faster deliveries, it becomes more important to have Robots that offer flexibility and high rates in huge centers like the fulfillment for just-in-time supply systems.

Integration with AI and IoT

-

The synergistic combination of collaborative robots, and AI and IoT applications represent a sizeable growth prospect. AI-based Robots can pick new features from their surrounding and can adjust the mode of their execution without requiring substantial redesigning. At the same time, IoT connectivity allows the Robot to share information on its functionality, helping diagnose breakdowns and optimise the functioning process. Such developments ensure that Robots become critical to enhancing smart manufacturing and development of other opportunities within the market.

Collaborative Robot Market Segment Analysis:

Collaborative Robot Market is Segmented on the basis of Payload Capacity, application, end user, and Region.

By Payload Capacity, Up to 10kg segment is expected to dominate the market during the forecast period

-

The industry analysis shows that Robots capable of holding up to 10kg of payload are expected to remain most popular during the forecast period given their versatility across sectors. This segment is especially suitable in typical applications like handling, tending, assembly operations, where primarily low to medium weight loads are involved. These Robots are relatively small-sized, portable, and easily adaptable to manufacturing environments and perfect for SMEs.

- Nevertheless, it is vital to state that leaders in up to 10 kg segment can be explained with the fact that such a segment is successfully applied in electronics and foods & beverages producers where the speed and accuracy plays a decisive role. Cobotics is still a relatively young field, yet the segment associated with industries applying these Robots for repetitive chores is projected to expand sharply. Moreover, the improvement of high-performance end-of-arm tools such as grippers and end-effectors boost the usability of Robots in this payload range and fuel its adoption.

By Application, Packaging segment expected to held the largest share

-

End-of-line packaging segment had the largest market share due to increasing use of collaborative robots for end-of-line applications. This kind of tasks as carton packing, labeling, palletizing, and wrapping have become trendy for the usage of Robots in various industries like e-commerce, food & beverage, and consumer goods. Robots provide versatility and can therefore adapt to packing lines that experience high variation in product type and quantity.

- Furthermore, the use of Robots in packaging also fit the operational costs hence minimizing on chances of time wastage through errors. Even though consumer requirements are changing and organizations are becoming increasingly concerned with sustainability, Robots with additional sensors and AI algorithms are making it possible to create novel packaging processes that are not only affordable, fast, and flexible but are also eco-friendly. This trend is expected to continue to drive the packaging segment to be dominant with the market share in the collaborative robot.

Collaborative Robot Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

-

Europe occupies a leading position in the collaborative robot market. This dominance is due to the fact that region is highly inclined towards industrial automation and innovations. Today, Germany, Denmark, Sweden, and several other countries are leaders in robot development, primarily benefiting from well-developed manufacturing industries and the governmental focus on automation. Automotive and electronics are among the sectors in Europe that value Robots due to the precision they deliver and increased efficiency coupled with labor deficit. Also, the importance of safety aspects of the workers and meeting of challenging and complex regulatory standards across the region solidifies the use of Robots.

Active Key Players in the Collaborative Robot Market

- ABB (Switzerland)

- AUBO Robotics (China)

- Comau (Italy)

- Denso Robotics (Japan)

- Doosan Robotics (South Korea)

- Fanuc Corporation (Japan)

- Festo (Germany)

- Kawasaki Heavy Industries (Japan)

- Mitsubishi Electric Corporation (Japan)

- Nachi-Fujikoshi (Japan)

- Omron Corporation (Japan)

- Rethink Robotics (Germany)

- Staubli International AG (Switzerland)

- Universal Robots (Denmark)

- Yaskawa Electric Corporation (Japan)

- Other Active Players.

|

Global Collaborative Robot Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.1 Billion |

|

Forecast Period 2024-32 CAGR: |

32.7% |

Market Size in 2032: |

USD 40.4 Billion |

|

Segments Covered: |

By Payload Capacity |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Collaborative Robot Market by Payload Capacity

4.1 Collaborative Robot Market Snapshot and Growth Engine

4.2 Collaborative Robot Market Overview

4.3 Up to 5kg

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Up to 5kg: Geographic Segmentation Analysis

4.4 Up to 10kg

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Up to 10kg: Geographic Segmentation Analysis

4.5 Above 10kg

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Above 10kg: Geographic Segmentation Analysis

Chapter 5: Collaborative Robot Market by Application

5.1 Collaborative Robot Market Snapshot and Growth Engine

5.2 Collaborative Robot Market Overview

5.3 Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Packaging: Geographic Segmentation Analysis

5.4 Pick & Place

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pick & Place: Geographic Segmentation Analysis

5.5 Handling

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Handling: Geographic Segmentation Analysis

5.6 Assembly

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Assembly: Geographic Segmentation Analysis

5.7 Quality Testing

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Quality Testing: Geographic Segmentation Analysis

5.8 Machine Tending

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Machine Tending: Geographic Segmentation Analysis

5.9 Gluing & Welding

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Gluing & Welding: Geographic Segmentation Analysis

5.10 Others

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Others: Geographic Segmentation Analysis

Chapter 6: Collaborative Robot Market by End User

6.1 Collaborative Robot Market Snapshot and Growth Engine

6.2 Collaborative Robot Market Overview

6.3 Electronics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electronics: Geographic Segmentation Analysis

6.4 Metal & Machinery

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Metal & Machinery: Geographic Segmentation Analysis

6.5 Furniture & Equipment

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Furniture & Equipment: Geographic Segmentation Analysis

6.6 Plastic & Polymers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Plastic & Polymers: Geographic Segmentation Analysis

6.7 Food & Beverage

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Food & Beverage: Geographic Segmentation Analysis

6.8 Automotive

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Automotive: Geographic Segmentation Analysis

6.9 Pharma

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Pharma: Geographic Segmentation Analysis

6.10 Others

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Collaborative Robot Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AUBO ROBOTICS (CHINA)

7.4 COMAU (ITALY)

7.5 DENSO ROBOTICS (JAPAN)

7.6 DOOSAN ROBOTICS (SOUTH KOREA)

7.7 FANUC CORPORATION (JAPAN)

7.8 FESTO (GERMANY)

7.9 KAWASAKI HEAVY INDUSTRIES (JAPAN)

7.10 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

7.11 NACHI-FUJIKOSHI (JAPAN)

7.12 OMRON CORPORATION (JAPAN)

7.13 RETHINK ROBOTICS (GERMANY)

7.14 STAUBLI INTERNATIONAL AG (SWITZERLAND)

7.15 UNIVERSAL ROBOTS (DENMARK)

7.16 YASKAWA ELECTRIC CORPORATION (JAPAN)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Collaborative Robot Market By Region

8.1 Overview

8.2. North America Collaborative Robot Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Payload Capacity

8.2.4.1 Up to 5kg

8.2.4.2 Up to 10kg

8.2.4.3 Above 10kg

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Packaging

8.2.5.2 Pick & Place

8.2.5.3 Handling

8.2.5.4 Assembly

8.2.5.5 Quality Testing

8.2.5.6 Machine Tending

8.2.5.7 Gluing & Welding

8.2.5.8 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Electronics

8.2.6.2 Metal & Machinery

8.2.6.3 Furniture & Equipment

8.2.6.4 Plastic & Polymers

8.2.6.5 Food & Beverage

8.2.6.6 Automotive

8.2.6.7 Pharma

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Collaborative Robot Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Payload Capacity

8.3.4.1 Up to 5kg

8.3.4.2 Up to 10kg

8.3.4.3 Above 10kg

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Packaging

8.3.5.2 Pick & Place

8.3.5.3 Handling

8.3.5.4 Assembly

8.3.5.5 Quality Testing

8.3.5.6 Machine Tending

8.3.5.7 Gluing & Welding

8.3.5.8 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Electronics

8.3.6.2 Metal & Machinery

8.3.6.3 Furniture & Equipment

8.3.6.4 Plastic & Polymers

8.3.6.5 Food & Beverage

8.3.6.6 Automotive

8.3.6.7 Pharma

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Collaborative Robot Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Payload Capacity

8.4.4.1 Up to 5kg

8.4.4.2 Up to 10kg

8.4.4.3 Above 10kg

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Packaging

8.4.5.2 Pick & Place

8.4.5.3 Handling

8.4.5.4 Assembly

8.4.5.5 Quality Testing

8.4.5.6 Machine Tending

8.4.5.7 Gluing & Welding

8.4.5.8 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Electronics

8.4.6.2 Metal & Machinery

8.4.6.3 Furniture & Equipment

8.4.6.4 Plastic & Polymers

8.4.6.5 Food & Beverage

8.4.6.6 Automotive

8.4.6.7 Pharma

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Collaborative Robot Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Payload Capacity

8.5.4.1 Up to 5kg

8.5.4.2 Up to 10kg

8.5.4.3 Above 10kg

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Packaging

8.5.5.2 Pick & Place

8.5.5.3 Handling

8.5.5.4 Assembly

8.5.5.5 Quality Testing

8.5.5.6 Machine Tending

8.5.5.7 Gluing & Welding

8.5.5.8 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Electronics

8.5.6.2 Metal & Machinery

8.5.6.3 Furniture & Equipment

8.5.6.4 Plastic & Polymers

8.5.6.5 Food & Beverage

8.5.6.6 Automotive

8.5.6.7 Pharma

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Collaborative Robot Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Payload Capacity

8.6.4.1 Up to 5kg

8.6.4.2 Up to 10kg

8.6.4.3 Above 10kg

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Packaging

8.6.5.2 Pick & Place

8.6.5.3 Handling

8.6.5.4 Assembly

8.6.5.5 Quality Testing

8.6.5.6 Machine Tending

8.6.5.7 Gluing & Welding

8.6.5.8 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Electronics

8.6.6.2 Metal & Machinery

8.6.6.3 Furniture & Equipment

8.6.6.4 Plastic & Polymers

8.6.6.5 Food & Beverage

8.6.6.6 Automotive

8.6.6.7 Pharma

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Collaborative Robot Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Payload Capacity

8.7.4.1 Up to 5kg

8.7.4.2 Up to 10kg

8.7.4.3 Above 10kg

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Packaging

8.7.5.2 Pick & Place

8.7.5.3 Handling

8.7.5.4 Assembly

8.7.5.5 Quality Testing

8.7.5.6 Machine Tending

8.7.5.7 Gluing & Welding

8.7.5.8 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Electronics

8.7.6.2 Metal & Machinery

8.7.6.3 Furniture & Equipment

8.7.6.4 Plastic & Polymers

8.7.6.5 Food & Beverage

8.7.6.6 Automotive

8.7.6.7 Pharma

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Collaborative Robot Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.1 Billion |

|

Forecast Period 2024-32 CAGR: |

32.7% |

Market Size in 2032: |

USD 40.4 Billion |

|

Segments Covered: |

By Payload Capacity |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||