Global Coffee Beans Market Overview

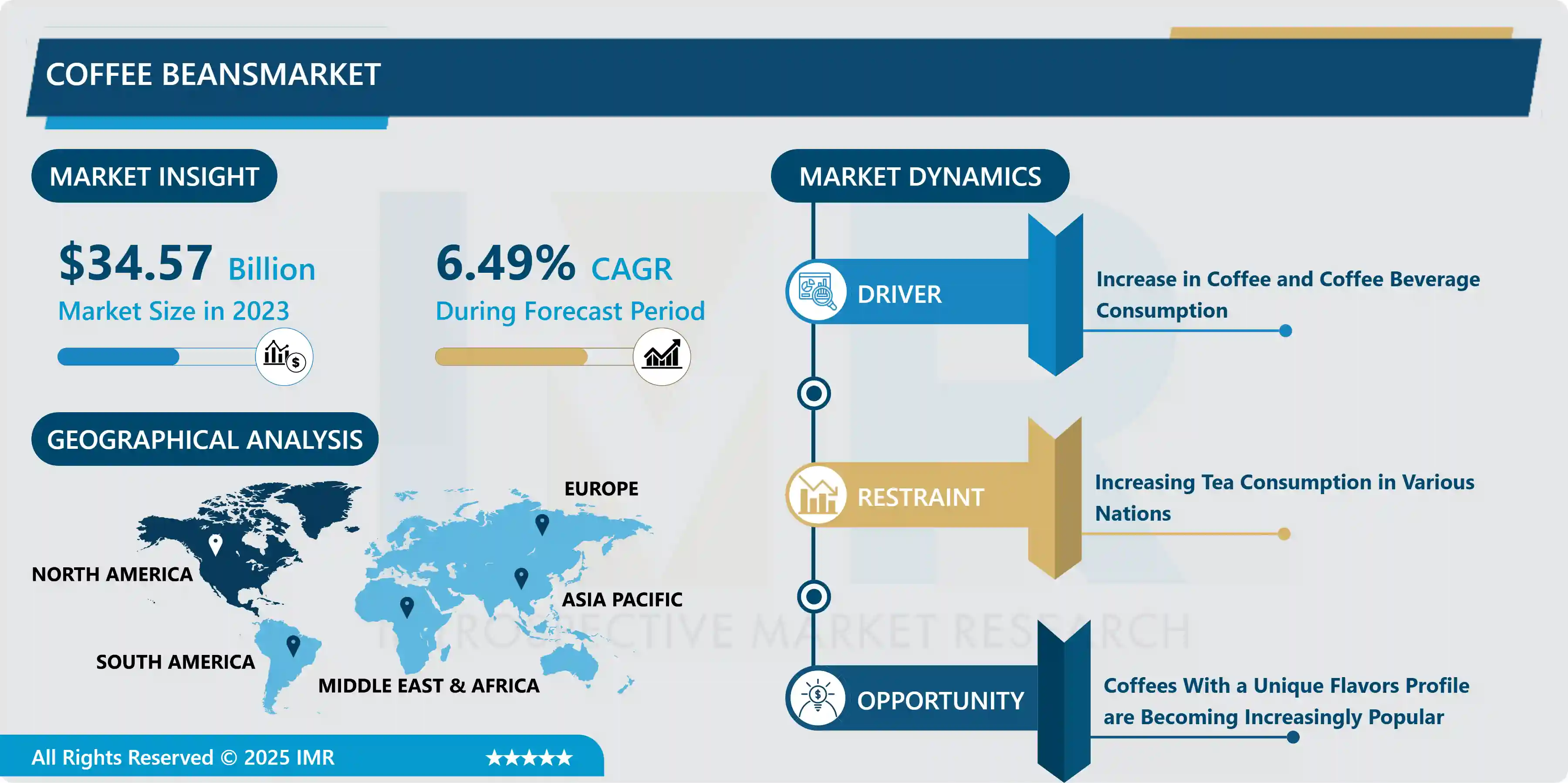

Global Coffee Beans Market Size Was Valued at USD 34.57 Billion In 2023 And Is Projected to Reach USD 60.88 Billion By 2032, Growing at A CAGR of 6.49 % From 2024-2032

The global market for coffee beans has been steadily expanding as a result of growing coffee consumption across the world and changing consumer preferences towards high-quality and specialty coffee types. The increasing demand in developed and emerging markets, including the U.S., Brazil, Germany, and China, is fueling this growth. Specialty coffee has become increasingly popular, as consumers are willing to pay more for beans that are high-quality, ethically sourced, organic, or single-origin, due to unique roasting techniques. Moreover, the growth of coffee culture, encompassing cafés, specialty coffee shops, and home brewing, has increased demand in various sectors.

The coffee beans market is divided into different segments depending on type, with Arabica and Robusta being the most important varieties. Arabica beans are the most common in the market, making up about 60% of worldwide output, valued for their mellow taste, whereas Robusta is recognized for its bold, bitter flavor and increased caffeine levels.

Market Dynamics And Factors For Coffee Beans Market

Drivers:

Increase in Coffee and Coffee Beverage Consumption

- Coffee is one of the most popular drinks on the planet. Coffee's popularity among the youthful population is increasing, especially in nations like India, China, and the Philippines, fueling demand for coffee beans. Coffee is used for a variety of reasons, including utilitarian, taste & pleasure, habit, tradition, culture, and sociability. The development of the middle class and generally improved living conditions lead to increased demand for coffee and coffee drinks. Coffee consumption has also increased dramatically among office workers. Another element driving demand for coffee is the opening and expansion of local coffee shops and new coffee shops, which helps to the growth of the coffee bean market. Additionally, since customers mix coffee with milk for a greater flavor, an increase in milk consumption promotes market expansion. Consumers are drawn to coffee shops because they have the option to linger and spend quality time there, which raises demand for coffee. Aside from that, coffee shops might be used as a substitute for the library. Furthermore, among young people, drinking coffee is seen as a kind of fashion and a relaxed lifestyle, which contributes to an increase in coffee demand. Coffee beans are processed in a variety of methods before being sold in a variety of coffee mixes at retail stores, grocery stores, and online.

Restraints:

- Water contamination is a problem in some areas due to the wet processing of coffee beans, which has a harmful influence on the environment. Furthermore, increasing tea consumption in various nations is expected to somewhat stifle market expansion throughout the projection period.

Opportunities:

Coffees With a Unique Flavors Profile Are Becoming Increasingly Popular

- According to the CBI, while most consumers continue to buy mainstream coffee blends, there is a growing demand (and willingness to pay) for high-quality coffee with cupping ratings of 80 points or above. Customers will pay for coffee with a good story relating to its environmental and social features, according to CBI. This aligns with findings on socially conscious consumers searching for a genuine experience. However, there is no universally accepted definition of "specialty" coffee. Coffee brewers and other associated firms interested in tapping into this industry should focus on high-scoring beverages with strong eco-conscious origins.

Market Segmentation

Segmentation Analysis of Coffee Beans Market:

- Based on the Type, the arabica segment is expected to dominate the coffee beans market over the forecast period. Arabica has a 70 percent market share in the coffee beans section of the worldwide coffee bean industry. Arabica coffee has a sweeter, gentler taste with a hint of sugar, as well as fruit and berry flavors on the palate. As a result, for the greatest coffee blends, major consumers and coffee businesses choose Arabica coffee beans. Because of the increased caffeine level, Robusta coffee beans have less acidity and a considerably bolder flavor. Robusta coffee beans account for a quarter of worldwide demand. Arabica coffee beans will likely continue to dominate the market in the coming years due to their rich flavor and high quality.

- Based on the product, Instant coffee is expected to dominate the coffee beans market over the forecast period. Instant coffee is widely eaten since it is simple to prepare and has a pleasant flavor. This is why big coffee companies have experienced a surge in demand for instant coffee. It's also found in vending machines, tiny eateries, and private residences. Ground coffee and specialty coffee have a sizable market share, owing to the enormous rise in ground coffee consumption. Specialty coffee has grown in popularity as coffee connoisseurs have pushed the market for specialty coffee.

- Based on the application, the food and beverages segment is anticipated to hold the largest coffee beans market share over the projected period. Over the projected period, growth in coffee consumption, as well as coffee-flavored drinks, is likely to fuel demand for coffee beans. The fact that these beans are utilized in cakes, cookies, and muffins is projected to boost the market growth. Because of its robust and intense flavor, espresso is gaining flavor in the food and beverage industry. Due to its high caffeine level, this taste is commonly utilized in cakes, cookies, and numerous dietary supplements. Furthermore, throughout the projected period, rising consumption of coffee-flavored drinks and ice cream is predicted to drive demand for these beans.

- Based on the distribution channel, the online segment is expected to hold the highest market share throughout the forecast period. Many business categories have been influenced by Covid19 to move online to survive the epidemic. The coffee market is one of the companies that has made the transition to the internet by offering limited door-to-door service. Premium retailers have gone online because European consumers have swiftly adapted to internet commerce. As social distance rules are implemented all around the world, offline shops have suffered a significant drop in sales. As immunization campaigns gain traction, offline coffee shops and coffee shops are likely to revive by 2022.

Regional Analysis of Coffee Beans Market:

- South America plays a key role in the global coffee beans industry, with a strong focus on Brazil and Colombia, both ranking among the leading coffee producers worldwide. Brazil, the biggest coffee producer in the world, has a significant impact as it represents approximately 40% of global coffee output. The large coffee-producing areas, such as Minas Gerais, São Paulo, and Espírito Santo, are renowned for growing high-quality Arabica beans, appreciated for their smooth taste. Moreover, Brazil's strong coffee infrastructure, which includes modern processing techniques and effective supply networks, enables it to keep up with increasing global demand. Colombia, famous for its high-quality Arabica coffee, ranks as the third-biggest coffee producer globally. The elevated areas in Colombia, like the Andes, are perfect for growing beans with a unique, robust taste, which has contributed to the worldwide popularity of Colombian coffee.

- In addition to these two dominant figures, Peru and Ecuador are also becoming significant contributors to the specialty coffee industry, with a focus on producing organic and fair-trade coffee. Coffee sourced from these areas is becoming more popular, especially in markets where customers are willing to spend extra money for environmentally friendly practices and distinct tastes. The varied landscapes and weather in South America play a part in the region's capacity to grow a range of coffee beans, ranging from mild and sweet to strong and intricate. Due to growing global interest in specialty and sustainable coffee, South America is in a strong position to maintain its dominant role in the worldwide coffee industry.

Players Covered in Coffee Beans Market are:

- Nestle

- Steamy Beans Coffee

- JM Smucker Company

- The Busy Bean

- Starbucks Corporation

- Boston Barista

- Jumpstart Coffee

- F. Gavina and Sons Inc.

- Mugs Coffee

- The Steam Room

- Luigi Lavazza S.P.A.

- Espresso Express

- The Kraft Heinz Company

- Trung Nguyen

- Keurig Dr. Pepper

- JDE Peets

- AMT Coffee Ltd

- Coffee Beans International Inc.

- La Colombe Torrefaction INC.

- Hawaiian Isles Kona Coffee Company Ltd.

- Death Wish Coffee and others major players.

Key Industry Developments in Coffee Beans Market

- In August 2024, GRM Overseas, a leading exporter of basmati rice, announced its acquisition of a 44% stake in Swmabhan Commerce Pvt Ltd, the parent company of Virat Kohli-backed digital-first brand, Rage Coffee. This strategic investment, comprising both primary infusion and secondary buyouts, aligns with GRM’s diversification into the FMCG sector. Rage Coffee has gained a significant foothold in India's rapidly expanding coffee market.

|

Global Coffee Beans Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.49% |

Market Size in 2032: |

USD 60.88 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Coffee Beans Market by Type (2018-2032)

4.1 Coffee Beans Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Arabica

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Robusta

Chapter 5: Coffee Beans Market by Product (2018-2032)

5.1 Coffee Beans Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Whole Bean

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ground Coffee

5.5 Instant Coffee

5.6 Special Coffee

5.7 Kopi Luwak

5.8 Others

Chapter 6: Coffee Beans Market by Distribution Channel (2018-2032)

6.1 Coffee Beans Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Coffee Beans Market by Application (2018-2032)

7.1 Coffee Beans Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceuticals

7.5 Cosmetics

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Coffee Beans Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALBUMEDIX LTD. (UK)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ALBUMIN BIOSCIENCE(US)

8.4 BIOTEST AG (GERMANY)

8.5 CSL BEHRING (US)

8.6 GRIFOLS INTERNATIONAL SA (SPAIN)

8.7 HIMEDIA LABORATORIES PVT. LTD. (INDIA)

8.8 INVITRIA (US)

8.9 MEDXBIO PTE. LTD. (SINGAPORE)

8.10 MILLIPORESIGMA (US)

8.11 OCTAPHARMA AG (SWITZERLAND)

8.12 RAYBIOTECH INC. (GEORGIA)

8.13 SERACARE LIFE SCIENCES INC. (THE US)

8.14 AKRON BIOTECH (US)

8.15 BRISTOL-MYERS SQUIBB COMPANY (US)

Chapter 9: Global Coffee Beans Market By Region

9.1 Overview

9.2. North America Coffee Beans Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Arabica

9.2.4.2 Robusta

9.2.5 Historic and Forecasted Market Size by Product

9.2.5.1 Whole Bean

9.2.5.2 Ground Coffee

9.2.5.3 Instant Coffee

9.2.5.4 Special Coffee

9.2.5.5 Kopi Luwak

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Online

9.2.6.2 Offline

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Food & Beverages

9.2.7.2 Pharmaceuticals

9.2.7.3 Cosmetics

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Coffee Beans Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Arabica

9.3.4.2 Robusta

9.3.5 Historic and Forecasted Market Size by Product

9.3.5.1 Whole Bean

9.3.5.2 Ground Coffee

9.3.5.3 Instant Coffee

9.3.5.4 Special Coffee

9.3.5.5 Kopi Luwak

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Online

9.3.6.2 Offline

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Food & Beverages

9.3.7.2 Pharmaceuticals

9.3.7.3 Cosmetics

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Coffee Beans Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Arabica

9.4.4.2 Robusta

9.4.5 Historic and Forecasted Market Size by Product

9.4.5.1 Whole Bean

9.4.5.2 Ground Coffee

9.4.5.3 Instant Coffee

9.4.5.4 Special Coffee

9.4.5.5 Kopi Luwak

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Online

9.4.6.2 Offline

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Food & Beverages

9.4.7.2 Pharmaceuticals

9.4.7.3 Cosmetics

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Coffee Beans Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Arabica

9.5.4.2 Robusta

9.5.5 Historic and Forecasted Market Size by Product

9.5.5.1 Whole Bean

9.5.5.2 Ground Coffee

9.5.5.3 Instant Coffee

9.5.5.4 Special Coffee

9.5.5.5 Kopi Luwak

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Online

9.5.6.2 Offline

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Food & Beverages

9.5.7.2 Pharmaceuticals

9.5.7.3 Cosmetics

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Coffee Beans Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Arabica

9.6.4.2 Robusta

9.6.5 Historic and Forecasted Market Size by Product

9.6.5.1 Whole Bean

9.6.5.2 Ground Coffee

9.6.5.3 Instant Coffee

9.6.5.4 Special Coffee

9.6.5.5 Kopi Luwak

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Online

9.6.6.2 Offline

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Food & Beverages

9.6.7.2 Pharmaceuticals

9.6.7.3 Cosmetics

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Coffee Beans Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Arabica

9.7.4.2 Robusta

9.7.5 Historic and Forecasted Market Size by Product

9.7.5.1 Whole Bean

9.7.5.2 Ground Coffee

9.7.5.3 Instant Coffee

9.7.5.4 Special Coffee

9.7.5.5 Kopi Luwak

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Online

9.7.6.2 Offline

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Food & Beverages

9.7.7.2 Pharmaceuticals

9.7.7.3 Cosmetics

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Coffee Beans Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.49% |

Market Size in 2032: |

USD 60.88 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||