Choline Chloride Market Synopsis

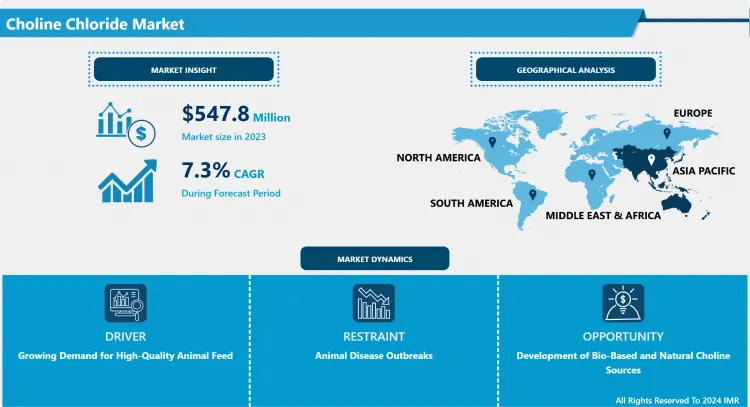

Choline Chloride Market Size Was Valued at USD 547.8 Million in 2023, and is Projected to Reach USD 1032.81 Million by 2032, Growing at a CAGR of 7.3% From 2024-2032.

Choline chloride is an essential nutrient and a vital source of choline, which supports liver function, brain development, and fat metabolism in animals and humans. Often used as a feed additive, it enhances growth and productivity in livestock by ensuring proper cell structure and function. It also plays a key role in the synthesis of neurotransmitters. Choline chloride is widely used across various industries, primarily as a nutritional supplement in animal feed. It serves as an essential nutrient for livestock, promoting healthy growth, liver function, and metabolic processes. Additionally, choline chloride finds application in the pharmaceutical industry for treating liver disorders and as a component in supplements to enhance cognitive function. Its versatility extends to the industrial sector, where it's used as a catalyst in chemical processes and as a stabilizer in coatings and resins.

A critical role in improving animal health and productivity. By supporting fat metabolism, it helps prevent fatty liver disease in poultry and livestock, ensuring better feed efficiency and overall growth. In humans, choline contributes to cognitive health, making it valuable for mental well-being and brain development. Moreover, its use in various industrial applications adds to its importance as a multipurpose compound. Looking ahead, the demand for choline chloride is expected to grow, driven by rising meat consumption and the increasing focus on livestock health. The expanding pharmaceutical and nutraceutical sectors also contribute to this upward trend, as choline-based supplements gain popularity for cognitive enhancement. Additionally, the compound’s industrial applications in resins and coatings are likely to further boost its demand in the future.

Choline Chloride Market Trend Analysis

Growing Demand for High-Quality Animal Feed

- The Choline Chloride market is influenced by factors such as the increased need for high-quality animal feed, nutrient-rich diets for livestock, and the emphasis on organic feed additives. Progress in animal nutrition science involves improved feed formulations and precision feeding technologies to enhance livestock health and productivity.

- The rising global desire for poultry and pork products is fueling the demand for choline chloride in animal feed. Increasing incomes are driving expansion in the livestock sector, resulting in an increased need for this essential nutrient. Choline's significance in human health is increasingly acknowledged, resulting in its presence in dietary supplements and public health initiatives. Advances in technology in production are enhancing the effectiveness and sustainability of manufacturing procedures for choline chloride.

- The increase in the livestock sector in developing regions such as Asia-Pacific, Africa, and Latin America is fueling the need for choline chloride. Businesses are broadening their reach to access new markets in different locations.

Development of Bio-Based and Natural Choline Sources

- Businesses can take advantage of opportunities in the choline chloride market by investing in research and development to create bio-based and natural sources. Receiving regulatory backing for natural alternatives gives a competitive edge, and tapping into new sectors such as human nutrition, pharmaceuticals, and industrial applications provides substantial expansion opportunities.

- Partnering with universities, research institutes, and businesses can lead to the development of groundbreaking choline chloride products. Collaborating with suppliers, distributors, and logistics providers strategically enhances supply chain efficiency, cuts costs, and broadens market coverage.

- Tailored choline chloride mixtures can distinguish livestock producers' products. Specialized grades with improved features cater to specific markets. Understanding and adhering to local regulations and establishing production sites in the region can help businesses access high-growth markets when entering new areas.

Choline Chloride Market Segment Analysis:

Choline Chloride Market Segmented on the basis of Grade, Form, Application, End-User, and Region

By Grade, Feed Grade Segment Is Expected to Dominate the Market During the Forecast Period

- Feed Grade Choline Chloride is the leading product in the market because of its crucial function in animal nutrition. Choline plays a crucial role in numerous biological functions, such as creating cell membranes, processing fats, and functioning nerves. It stops illnesses in chickens and promotes development in pigs. Adding choline to the diet enhances growth rates and feed efficiency, resulting in reduced feed expenses and higher profits for farmers. The economic advantages fuel the need for Feed Grade Choline Chloride.

- Choline Chloride is commonly utilized in poultry and swine nutrition to stimulate growth and overall well-being. It is crucial for the best growth of chickens and sows, especially in areas where meat is widely consumed.

- Customers desire top-notch meat and dairy products, which means livestock producers must prioritize keeping animals robust and growing effectively to meet these demands. The Feed Grade segment needs Choline Chloride to meet these objectives. The increasing consumption of meat in developing regions drives the use of Choline Chloride to meet the growing demand caused by the growth of the global livestock industry.

By Application, Animal Feed Segment Held the Largest Share in 2023

- The Choline Chloride market is mainly controlled by the animal feed sector because of its crucial function in maintaining livestock health. It is essential for overall productivity and profitability as it aids in fat metabolism, liver function, and growth in poultry, swine, cattle, and aquaculture.

- As the worldwide need for animal protein continues to grow, there is a rising use of Choline Chloride in livestock production. This affordable feed supplement helps farmers improve animal growth, feed efficiency, and overall health. The increasing dairy sector in areas such as Asia-Pacific and Europe is also pushing the demand for Choline Chloride to aid milk production and herd health maintenance, leading to market expansion in emerging regions.

- Numerous nations have strict rules regarding the safety and quality of animal feed, and Choline Chloride plays a vital role in meeting these requirements. Continual improvements in feed compositions underscore its significance.

Choline Chloride Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Choline Chloride market in the Asia-Pacific region is primarily led by the growth of the livestock sector, the fast-paced development of livestock farming, major livestock producers in China and India, and a large population with increasing consumption of animal-derived goods.

- In the Asia-Pacific region, there is a rising emphasis on animal health and nutrition due to the expanding livestock sector. Governments endorse improved agriculture methods and supplementation usage. Demand for feed additives is fueled by economic growth and foreign investments. The increase in meat and dairy intake is driving the demand for Choline Chloride in feed mixes.

- The already established manufacturing hub in Asia-Pacific for feed additives such as Choline Chloride enables cost-effective local production and guarantees a consistent supply to the livestock sector. Furthermore, the region's ability to export helps boost its standing in the global market.

Choline Chloride Market Active Players

- Balchem Corporation (USA)

- BASF SE (Germany)

- Eastman Chemical Company (USA)

- Taminco Corporation (USA, a subsidiary of Eastman Chemical Company)

- Jubilant Life Sciences (India)

- NB Group Co., Ltd. (China)

- Givaudan (Switzerland)

- Yokkaichi Chemical Co., Ltd. (Japan)

- Balaji Amines Ltd. (India)

- Hebei Dayang Animal Health Products Co., Ltd. (China)

- Algry Química, S.L. (Spain)

- Balchem Italia Srl (Italy, a subsidiary of Balchem Corporation)

- Liaoning Biochemicals Co., Ltd. (China)

- Jubilant Ingrevia Limited (India, a subsidiary of Jubilant Life Sciences)

- Hangzhou Tiangfeng Chemical Co., Ltd. (China)

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- Vitamin Group LLC (Russia)

- Vitamins & Fine Chemicals (Evonik Industries AG) (Germany)

- Shandong NB Technology Co., Ltd. (China)

- Shandong Luba Chemical Co., Ltd. (China)

- Pestell Nutrition (Canada)

- A&C Co., Ltd. (South Korea)

- Zhejiang Dazhou Pharmaceutical Co., Ltd. (China)

- Balchem Netherlands B.V. (Netherlands, a subsidiary of Balchem Corporation)

- Chengdu Chelation Biology Technology Co., Ltd. (China)

- Balaji Specialty Chemicals (India, a subsidiary of Balaji Amines Ltd.)

- Zhejiang Medicine Co., Ltd. (China)

- Be-Long Corporation Ltd. (China)

- GlycosBio (part of GEVO) (USA)

- Cargill, Incorporated (USA), and Other Active Players

Key Industry Developments in the Choline Chloride Market:

- In May 2024, Methanol Chemicals Co. (Chemanol) announced the signing of a land allocation agreement worth over SAR 420 million with Jubail and Yanbu Industrial Cities Services Co. (JABEEN). The deal, disclosed in a filing to Tadawul, secures a land plot for Chemanol in PlasChem Park, the allocated site will be used for the establishment and operation of a new plant dedicated to producing choline chloride and methyl diethanolamine methane, further enhancing Chemanol's chemical production capabilities.

|

Choline Chloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 547.8 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

USD 1032.81 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Choline Chloride Market by Grade (2018-2032)

4.1 Choline Chloride Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Feed Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical Grade

4.5 Industrial Grade

Chapter 5: Choline Chloride Market by Form (2018-2032)

5.1 Choline Chloride Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Powder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid

Chapter 6: Choline Chloride Market by Application (2018-2032)

6.1 Choline Chloride Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Animal Feed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Human Nutrition

6.5 Oil & Gas Industry

Chapter 7: Choline Chloride Market by End-User (2018-2032)

7.1 Choline Chloride Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Poultry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Swine

7.5 Ruminants

7.6 Aquaculture

7.7 Human Nutrition

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Choline Chloride Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BALCHEM CORPORATION (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BASF SE (GERMANY)

8.4 EASTMAN CHEMICAL COMPANY (USA)

8.5 TAMINCO CORPORATION (USA

8.6 A SUBSIDIARY OF EASTMAN CHEMICAL COMPANY)

8.7 JUBILANT LIFE SCIENCES (INDIA)

8.8 NB GROUP COLTD. (CHINA)

8.9 GIVAUDAN (SWITZERLAND)

8.10 YOKKAICHI CHEMICAL COLTD. (JAPAN)

8.11 BALAJI AMINES LTD. (INDIA)

8.12 HEBEI DAYANG ANIMAL HEALTH PRODUCTS COLTD. (CHINA)

8.13 ALGRY QUÍMICA

8.14 S.L. (SPAIN)

8.15 BALCHEM ITALIA SRL (ITALY

8.16 A SUBSIDIARY OF BALCHEM CORPORATION)

8.17 LIAONING BIOCHEMICALS COLTD. (CHINA)

8.18 JUBILANT INGREVIA LIMITED (INDIA

8.19 A SUBSIDIARY OF JUBILANT LIFE SCIENCES)

8.20 HANGZHOU TIANGFENG CHEMICAL COLTD. (CHINA)

8.21 MITSUBISHI GAS CHEMICAL COMPANY INC. (JAPAN)

8.22 VITAMIN GROUP LLC (RUSSIA)

8.23 VITAMINS & FINE CHEMICALS (EVONIK INDUSTRIES AG) (GERMANY)

8.24 SHANDONG NB TECHNOLOGY COLTD. (CHINA)

8.25 SHANDONG LUBA CHEMICAL COLTD. (CHINA)

8.26 PESTELL NUTRITION (CANADA)

8.27 A&C COLTD. (SOUTH KOREA)

8.28 ZHEJIANG DAZHOU PHARMACEUTICAL COLTD. (CHINA)

8.29 BALCHEM NETHERLANDS B.V. (NETHERLANDS

8.30 A SUBSIDIARY OF BALCHEM CORPORATION)

8.31 CHENGDU CHELATION BIOLOGY TECHNOLOGY COLTD. (CHINA)

8.32 BALAJI SPECIALTY CHEMICALS (INDIA

8.33 A SUBSIDIARY OF BALAJI AMINES LTD.)

8.34 ZHEJIANG MEDICINE COLTD. (CHINA)

8.35 BE-LONG CORPORATION LTD. (CHINA)

8.36 GLYCOSBIO (PART OF GEVO) (USA)

8.37 CARGILL INCORPORATED (USA)

8.38 AND

Chapter 9: Global Choline Chloride Market By Region

9.1 Overview

9.2. North America Choline Chloride Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Grade

9.2.4.1 Feed Grade

9.2.4.2 Pharmaceutical Grade

9.2.4.3 Industrial Grade

9.2.5 Historic and Forecasted Market Size by Form

9.2.5.1 Powder

9.2.5.2 Liquid

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Animal Feed

9.2.6.2 Human Nutrition

9.2.6.3 Oil & Gas Industry

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Poultry

9.2.7.2 Swine

9.2.7.3 Ruminants

9.2.7.4 Aquaculture

9.2.7.5 Human Nutrition

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Choline Chloride Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Grade

9.3.4.1 Feed Grade

9.3.4.2 Pharmaceutical Grade

9.3.4.3 Industrial Grade

9.3.5 Historic and Forecasted Market Size by Form

9.3.5.1 Powder

9.3.5.2 Liquid

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Animal Feed

9.3.6.2 Human Nutrition

9.3.6.3 Oil & Gas Industry

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Poultry

9.3.7.2 Swine

9.3.7.3 Ruminants

9.3.7.4 Aquaculture

9.3.7.5 Human Nutrition

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Choline Chloride Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Grade

9.4.4.1 Feed Grade

9.4.4.2 Pharmaceutical Grade

9.4.4.3 Industrial Grade

9.4.5 Historic and Forecasted Market Size by Form

9.4.5.1 Powder

9.4.5.2 Liquid

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Animal Feed

9.4.6.2 Human Nutrition

9.4.6.3 Oil & Gas Industry

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Poultry

9.4.7.2 Swine

9.4.7.3 Ruminants

9.4.7.4 Aquaculture

9.4.7.5 Human Nutrition

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Choline Chloride Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Grade

9.5.4.1 Feed Grade

9.5.4.2 Pharmaceutical Grade

9.5.4.3 Industrial Grade

9.5.5 Historic and Forecasted Market Size by Form

9.5.5.1 Powder

9.5.5.2 Liquid

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Animal Feed

9.5.6.2 Human Nutrition

9.5.6.3 Oil & Gas Industry

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Poultry

9.5.7.2 Swine

9.5.7.3 Ruminants

9.5.7.4 Aquaculture

9.5.7.5 Human Nutrition

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Choline Chloride Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Grade

9.6.4.1 Feed Grade

9.6.4.2 Pharmaceutical Grade

9.6.4.3 Industrial Grade

9.6.5 Historic and Forecasted Market Size by Form

9.6.5.1 Powder

9.6.5.2 Liquid

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Animal Feed

9.6.6.2 Human Nutrition

9.6.6.3 Oil & Gas Industry

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Poultry

9.6.7.2 Swine

9.6.7.3 Ruminants

9.6.7.4 Aquaculture

9.6.7.5 Human Nutrition

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Choline Chloride Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Grade

9.7.4.1 Feed Grade

9.7.4.2 Pharmaceutical Grade

9.7.4.3 Industrial Grade

9.7.5 Historic and Forecasted Market Size by Form

9.7.5.1 Powder

9.7.5.2 Liquid

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Animal Feed

9.7.6.2 Human Nutrition

9.7.6.3 Oil & Gas Industry

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Poultry

9.7.7.2 Swine

9.7.7.3 Ruminants

9.7.7.4 Aquaculture

9.7.7.5 Human Nutrition

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Choline Chloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 547.8 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

USD 1032.81 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||