Global Cell Line Development Market Overview

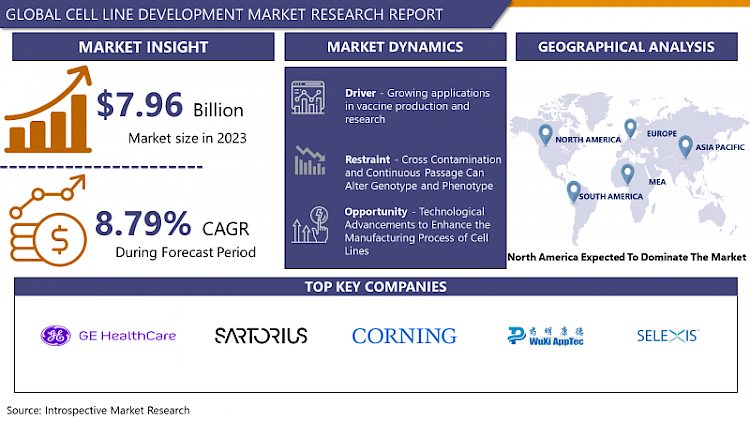

The Global Cell Line Development Market size was valued at USD 7.96 billion in 2023 and is projected to reach USD 16.99 billion by 2032, growing at a CAGR of 8.79% from 2024 to 2032.

The cell line development industry plays a pivotal role in the biopharmaceutical and biotechnology sectors by providing essential tools to produce therapeutic proteins, vaccines, and other biologics. Cell lines are immortalized cells that can be grown indefinitely in culture, serving as factories to produce complex biomolecules. This process involves selecting and optimizing cell lines that exhibit high productivity, stability, and compatibility with manufacturing processes, ensuring consistent quality and yield of biopharmaceutical products.

Key components of cell line development include cell line engineering, cell culture optimization, and characterization. Cell line engineering techniques, such as gene editing and transfection, enhance cell productivity and modify cellular traits to meet specific production requirements. Optimization of cell culture conditions, including media composition, growth factors, and bioreactor parameters, aims to maximize cell growth and productivity while maintaining product quality and purity. Characterization involves assessing cell line stability, genetic integrity, and product consistency through rigorous testing and analysis to ensure regulatory compliance and manufacturing robustness.

Technological advancements, particularly in genomics, CRISPR-Cas9 gene editing, and high-throughput screening, have revolutionized cell line development, accelerating the identification and optimization of high-performance cell lines. These innovations enable faster timelines from research to commercial production, reducing costs and improving overall efficiency in biopharmaceutical manufacturing.

Market Dynamics and Factors for Cell Line Development

Drivers:

Growing applications in vaccine production and research

In research, immortal cell lines are frequently used in place of primary cells. They have several advantages, including being cost-effective, simple to use, providing an infinite supply of material, and avoiding ethical concerns associated with the usage of animal and human tissue. Cell lines also provide a pure population of cells, which is advantageous as it ensures a consistent sample and reproducible results. Cell lines have revolutionized scientific research and are now used in vaccine production, drug metabolism and cytotoxicity testing, antibody production, gene function studies, the generation of artificial tissues (e.g., artificial skin), and the synthesis of biological compounds such as therapeutic proteins. The numerous publications that use cell lines and the American Type Culture Collection (ATCC) Cell Biology Collection, which contains over 3,600 cell lines from over 150 different species, can be used to estimate cell line popularity.

The cell lines that are currently being utilized in the production of vaccines have been collected decades ago. Fetal cells are one of the most utilized cell lines for the production of vaccines. For instance, Leonard Hayflick has frozen ten million human fetal lung cells—derived from an aborted fetus in the early 1960s—in 700 glass vials after the original cell population had doubled seven times. Given their ability to double at least another 30 times, each vial can produce tens of thousands of kilos of WI-38 cells, enough to supply the world's vaccine manufacturers for several years. WI-38 is the name of the cell line and is the oldest fetal cell strain. These lung cells are predominantly utilized for the production of vaccines for varicella, rubella, hepatitis A, and rabies thus, supporting the development of the cell line development market during the analysis period.

The production of COVID-19 vaccines using fetal cell lines

The emergence of COVID-19 increased the usage of cell lines to develop effective vaccines in a short time. For instance, the PER.C6 cell line is derived from immortalized retinal cells from an 18-week-old fetus aborted in 1985. Johnson & Johnson used this cell line to create the COVID-19 vaccine. These cells were used to grow adenoviruses that had been modified so that they would not replicate or cause disease, which was then purified and used to deliver the genetic code for SARS-CoV-2's signature spike protein. The J&J vaccine does not contain any of the adenoviruses.

Pfizer and Moderna used HEK-293, an immortal cell line derived from the kidney of an aborted fetus in the 1970s for the production of its COVID-19 vaccine. During development, the cells were used to confirm that the genetic instructions for producing the SARS-CoV-2 spike protein worked in human cells. According to Alessondra Speidel, the cell lines were used as a proof-of-concept test, and neither of these mRNA vaccines was produced using fetal cells. Thus, the growing prevalence of viral outbreaks and the need to develop efficient vaccines to prevent viral outbreaks are the main factors supporting the growth of the cell line development market in the projected timeframe.

Restraints:

Cross Contamination and Continuous Passage Can Alter Genotype and Phenotype

Cell lines should have functional features that are as close to primary cells as possible. Since cell lines are genetically manipulated, their phenotype, native functions, and responsiveness to stimuli may change. Serial passage of cell lines can result in genotypic and phenotypic variation over time, and genetic drift can also result in heterogeneity in cultures at a single point in time. As a result, cell lines may not accurately represent primary cells and may produce inconsistent results. Furthermore, contamination with other cell lines and mycoplasma are major issues associated with the usage of cell lines. Cross Contamination was reported for the first time in the early 1970s by Walter Nelson-Rees. When a rapidly proliferating cell line is introduced into a cell line, it only takes a few passages for the culture to be completely taken over by the contaminating cell line. Such issues are well known to be caused by HeLa cell contamination. Furthermore, mycoplasma contamination can persist undetected in cell cultures for long periods, causing significant changes in gene expression and cell behavior thus, hampering the growth of the cell line development market over the forecasted period.

Opportunities:

Technological Advancements to Enhance the Manufacturing Process of Cell Lines

Cell Line Engineering (CLE) methods and 3D cell culture are novel approaches based on obtaining human primary cells and/or animal cells from root tissues, growing them in all three dimensions with selective media, and allowing cells to form sphere-shaped aggregates known as spheroids. Growth conditions for 3D cell cultures include several raw materials, altogether known as scaffolds. CLE is an advanced technology that allows businesses to design cell lines using CRISPR products. According to the research project requirements requested by their collaborating clients, Thermo Fisher Scientific is engineering new cell lines using a wide variety of already available cell lines. This makes cancer cell research, artificial organ growth, and new treatments more relevant to live human tissues, while also eliminating contamination and uncontrolled mutations.

Investment by prominent companies is further stimulating the expansion of the market over the analysis period. For instance, in June 2022, FUJIFILM Corporation announced a USD 1.6 billion investment to improve and expand the cell culture manufacturing services of FUJIFILM Diosynth Biotechnologies, a FUJIFILM Corporation subsidiary and world-leading contract development and manufacturing organization (CDMO). This investment will help FUJIFILM Diosynth Biotechnologies' facilities in Hillerød, Denmark, and Texas, USA. Thus, investment in R&D, manufacturing facilities, and the development of innovative technologies for the production of a cell line are anticipated to create lucrative opportunities for the market players.

Segmentation Analysis of the Cell Line Development Market

By Product, the reagents & media segment is anticipated to have the highest share of the market over the analysis period. Reagents for cell culture are crucial to the success of physiologically relevant cell models in biomedical research and bioproduction. Media, sera, and supplements are essential to culture reagents that promote cell survival, proliferation, and biological function. Antibiotics and amino acid supplements are common cell culture reagents. Furthermore, the quality of these reagents has a direct impact on experimental results and biological production. Media utilized for the production of stable cell lines is of two types: natural and synthetic. Synthetic media is the most widely utilized culture medium as it contains all the essential supplements for the growth of cell lines. The concentration of the supplement can be altered to match the development of the specific cell line. The growing demand for biologic therapeutics necessitates an appropriate growth environment to increase production thus, increasing the demand for reagents & media.

By Source, the mammalian segment is expected to lead the growth of the cell line development market over the analysis period. Protein production in sufficient quantity and quality is a critical requirement. There has been a gradual increase in the use of mammalian cells for protein production. Mammalian cell-based expression systems for recombinant proteins can introduce proper protein folding, post-translational modifications, and product assembly, all of which are required for complete biological activity. Mammalian cell lines are used to create biological products like antibodies, synthetic hormones, and enzymes. For instance, Cerezyme, a recombinant enzyme produced in mammalian cells, can be used to treat patients with Gaucher's disease, a congenital disorder characterized by a lack of the functional enzyme β-glucocerebrosidase. thereby, supporting the growth of the segment.

By Type Of Cell Line, the recombinant cell line segment is anticipated to dominate the market in the projected period. One of humanity's most pressing needs is the mass production of therapeutic proteins for the treatment of diseases that affect millions of people. Recent advancements in recombinant DNA technologies have paved the way for the development of recombinant proteins that can be used as therapeutics, vaccines, and diagnostic reagents. Recombinant proteins for these applications are primarily produced in the laboratory and large-scale settings using prokaryotic and eukaryotic expression host systems such as mammalian cells, bacteria, yeast, insect cells, and transgenic plants. These expression cell lines have fewer side effects and perform better during biological processes thus, strengthening the development of the segment in the forecasted period.

By Application, the bioproduction segment is forecasted to have the highest share of the market. Protein therapeutics, which include monoclonal antibodies [mAbs], peptides, and recombinant proteins, is the biopharmaceutical industry's largest group of new products in development. The most commonly used expression system for mAb production in mammalian cells. The primary advantage of a mammalian expression system is that the cellular machinery is designed to produce, process, and secrete highly complex molecules. The vast majority of commercial mAbs are produced in Chinese hamster ovary (CHO) and NS0 cells, which are derived from plasmacytoma cells that have been modified to produce IgG in nonsecreting B cells. Genetic changes in CHO cells have resulted in cell lines capable of producing a large number of humanized mAbs. With the growing demand for personalized medications coupled with the continuous rising need for other biotherapeutics products, the future of the bioproduct segment is bright.

Regional Analysis Of the Cell Line Development Market

In North America, particularly in the United States, cell line development is characterized by a robust infrastructure supported by advanced biotechnological research and development. Academic institutions and biotechnology companies collaborate closely, leveraging cutting-edge technologies such as CRISPR-Cas9 for precise genome editing in cell lines. The regulatory environment, governed by the FDA, emphasizes stringent quality control and validation processes, ensuring compliance with Good Manufacturing Practices (GMP) to meet global standards.

Asia-Pacific represents a rapidly growing region in cell line development, driven by increasing investments in biotechnology and healthcare infrastructure. Countries like China, India, and South Korea are prominent players, with a burgeoning biopharmaceutical sector and supportive government policies encouraging research and development. This region is characterized by diverse approaches in cell line engineering, from traditional hybridoma technology to advanced bioprocess optimization using artificial intelligence and automation. Regulatory frameworks vary, with stringent guidelines evolving to align with international standards, promoting global market access for biopharmaceutical products.

Overall, the regional landscape of cell line development is diverse, reflecting unique strengths and challenges in scientific innovation, regulatory oversight, and industrial infrastructure. Collaboration across borders and disciplines continues to drive progress, aiming to meet global demand for safe and effective biopharmaceutical products through optimized cell line development strategies.

Top Key Players Covered in Cell Line Development Market

- GE Healthcare

- Sartorious AG

- Corning Inc.

- WuXi AppTec Inc.

- Selexis SA

- Sigma-Aldrich Corporation

- Lonza Group AG

- Sartorius

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Merck KGaA

- Promega Corporation

- Beckman Coulter Inc.

- European Collection of Cell Cultures, and Other Major Players.

Key Industry Developments in Cell Line Development Market

- In March 2024, Sartorius and LFB BIOMANUFACTURING are set to collaborate on cell line development and manufacturing, with LFB BIOMANUFACTURING outsourcing cell line development services to Sartorius. This collaboration aims to increase customer value and speed up protein therapy development, as Sartorius specializes in therapeutic protein biomanufacturing, a leading European company providing plasma-derived medicinal products to healthcare professionals.

- In January 2023, Berkeley Lights, Inc. launched the Beacon Select™, a new optofluidic system for cell line development (CLD). This builds on the original Beacon system, which has over 130 systems globally. The Beacon Select offers optofluidic and NanoPen® chamber technology and CLD applications, with the right features to meet the research and budgetary needs of new market segment customers.

- In November 2023, Lonza unveils GS Effex® cell line, a breakthrough in therapeutic antibody development aimed at boosting potency in immunotherapy. Derived from Lonza’s GS Xceed® platform, GS Effex® promises enhanced production capabilities for antibodies with increased antibody-dependent cellular cytotoxicity (ADCC). This innovation caters to the growing demand for more effective antibody therapeutics in oncology and beyond, available for licensing or as a comprehensive service offering worldwide.

|

Global Cell Line Development Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.79% |

Market Size in 2032: |

USD 16.99 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Cell Line Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Source

3.3 By Cell Line Type

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Cell Line Development Market by Product

5.1 Cell Line Development Market Overview Snapshot and Growth Engine

5.2 Cell Line Development Market Overview

5.3 Equipment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Equipment: Geographic Segmentation

5.4 Reagents & Media

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Reagents & Media: Geographic Segmentation

5.5 Accessories & Consumables

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Accessories & Consumables: Geographic Segmentation

Chapter 6: Cell Line Development Market by Source

6.1 Cell Line Development Market Overview Snapshot and Growth Engine

6.2 Cell Line Development Market Overview

6.3 Mammalian

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Mammalian: Geographic Segmentation

6.4 Non-Mammalian

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Non-Mammalian: Geographic Segmentation

Chapter 7: Cell Line Development Market by Cell Line Type

7.1 Cell Line Development Market Overview Snapshot and Growth Engine

7.2 Cell Line Development Market Overview

7.3 Recombinant Cell Lines

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Recombinant Cell Lines: Geographic Segmentation

7.4 Hybridomas

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Hybridomas: Geographic Segmentation

7.5 Continuous Cell Lines

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Continuous Cell Lines: Geographic Segmentation

7.6 Primary Cell Lines

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Primary Cell Lines: Geographic Segmentation

Chapter 8: Cell Line Development Market by Application

8.1 Cell Line Development Market Overview Snapshot and Growth Engine

8.2 Cell Line Development Market Overview

8.3 Bioproduction

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Bioproduction: Geographic Segmentation

8.4 Drug Discovery

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Drug Discovery: Geographic Segmentation

8.5 Toxicity Testing

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Toxicity Testing: Geographic Segmentation

8.6 Tissue Engineering

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Tissue Engineering: Geographic Segmentation

8.7 Research

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Research: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Cell Line Development Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Cell Line Development Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Cell Line Development Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 GE HEALTHCARE

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 SARTORIOUS AG

9.4 CORNING INC.

9.5 WUXI APPTEC INC.

9.6 SELEXIS SA

9.7 SIGMA-ALDRICH CORPORATION

9.8 LONZA GROUP AG

9.9 SARTORIUS

9.10 THERMO FISHER SCIENTIFIC INC.

9.11 DANAHER CORPORATION

9.12 MERCK KGAA

9.13 PROMEGA CORPORATION

9.14 BECKMAN COULTER INC.

9.15 EUROPEAN COLLECTION OF CELL CULTURES

9.16 OTHER MAJOR PLAYERS

Chapter 10: Global Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Product

10.2.1 Equipment

10.2.2 Reagents & Media

10.2.3 Accessories & Consumables

10.3 Historic and Forecasted Market Size By Source

10.3.1 Mammalian

10.3.2 Non-Mammalian

10.4 Historic and Forecasted Market Size By Cell Line Type

10.4.1 Recombinant Cell Lines

10.4.2 Hybridomas

10.4.3 Continuous Cell Lines

10.4.4 Primary Cell Lines

10.5 Historic and Forecasted Market Size By Application

10.5.1 Bioproduction

10.5.2 Drug Discovery

10.5.3 Toxicity Testing

10.5.4 Tissue Engineering

10.5.5 Research

Chapter 11: North America Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Equipment

11.4.2 Reagents & Media

11.4.3 Accessories & Consumables

11.5 Historic and Forecasted Market Size By Source

11.5.1 Mammalian

11.5.2 Non-Mammalian

11.6 Historic and Forecasted Market Size By Cell Line Type

11.6.1 Recombinant Cell Lines

11.6.2 Hybridomas

11.6.3 Continuous Cell Lines

11.6.4 Primary Cell Lines

11.7 Historic and Forecasted Market Size By Application

11.7.1 Bioproduction

11.7.2 Drug Discovery

11.7.3 Toxicity Testing

11.7.4 Tissue Engineering

11.7.5 Research

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Equipment

12.4.2 Reagents & Media

12.4.3 Accessories & Consumables

12.5 Historic and Forecasted Market Size By Source

12.5.1 Mammalian

12.5.2 Non-Mammalian

12.6 Historic and Forecasted Market Size By Cell Line Type

12.6.1 Recombinant Cell Lines

12.6.2 Hybridomas

12.6.3 Continuous Cell Lines

12.6.4 Primary Cell Lines

12.7 Historic and Forecasted Market Size By Application

12.7.1 Bioproduction

12.7.2 Drug Discovery

12.7.3 Toxicity Testing

12.7.4 Tissue Engineering

12.7.5 Research

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Equipment

13.4.2 Reagents & Media

13.4.3 Accessories & Consumables

13.5 Historic and Forecasted Market Size By Source

13.5.1 Mammalian

13.5.2 Non-Mammalian

13.6 Historic and Forecasted Market Size By Cell Line Type

13.6.1 Recombinant Cell Lines

13.6.2 Hybridomas

13.6.3 Continuous Cell Lines

13.6.4 Primary Cell Lines

13.7 Historic and Forecasted Market Size By Application

13.7.1 Bioproduction

13.7.2 Drug Discovery

13.7.3 Toxicity Testing

13.7.4 Tissue Engineering

13.7.5 Research

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product

14.4.1 Equipment

14.4.2 Reagents & Media

14.4.3 Accessories & Consumables

14.5 Historic and Forecasted Market Size By Source

14.5.1 Mammalian

14.5.2 Non-Mammalian

14.6 Historic and Forecasted Market Size By Cell Line Type

14.6.1 Recombinant Cell Lines

14.6.2 Hybridomas

14.6.3 Continuous Cell Lines

14.6.4 Primary Cell Lines

14.7 Historic and Forecasted Market Size By Application

14.7.1 Bioproduction

14.7.2 Drug Discovery

14.7.3 Toxicity Testing

14.7.4 Tissue Engineering

14.7.5 Research

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Cell Line Development Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Product

15.4.1 Equipment

15.4.2 Reagents & Media

15.4.3 Accessories & Consumables

15.5 Historic and Forecasted Market Size By Source

15.5.1 Mammalian

15.5.2 Non-Mammalian

15.6 Historic and Forecasted Market Size By Cell Line Type

15.6.1 Recombinant Cell Lines

15.6.2 Hybridomas

15.6.3 Continuous Cell Lines

15.6.4 Primary Cell Lines

15.7 Historic and Forecasted Market Size By Application

15.7.1 Bioproduction

15.7.2 Drug Discovery

15.7.3 Toxicity Testing

15.7.4 Tissue Engineering

15.7.5 Research

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Cell Line Development Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.79% |

Market Size in 2032: |

USD 16.99 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Cell Line Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CELL LINE DEVELOPMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CELL LINE DEVELOPMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CELL LINE DEVELOPMENT MARKET COMPETITIVE RIVALRY

TABLE 005. CELL LINE DEVELOPMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. CELL LINE DEVELOPMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. CELL LINE DEVELOPMENT MARKET BY PRODUCT

TABLE 008. EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 009. REAGENTS & MEDIA MARKET OVERVIEW (2016-2028)

TABLE 010. ACCESSORIES & CONSUMABLES MARKET OVERVIEW (2016-2028)

TABLE 011. CELL LINE DEVELOPMENT MARKET BY SOURCE

TABLE 012. MAMMALIAN MARKET OVERVIEW (2016-2028)

TABLE 013. NON-MAMMALIAN MARKET OVERVIEW (2016-2028)

TABLE 014. CELL LINE DEVELOPMENT MARKET BY CELL LINE TYPE

TABLE 015. RECOMBINANT CELL LINES MARKET OVERVIEW (2016-2028)

TABLE 016. HYBRIDOMAS MARKET OVERVIEW (2016-2028)

TABLE 017. CONTINUOUS CELL LINES MARKET OVERVIEW (2016-2028)

TABLE 018. PRIMARY CELL LINES MARKET OVERVIEW (2016-2028)

TABLE 019. CELL LINE DEVELOPMENT MARKET BY APPLICATION

TABLE 020. BIOPRODUCTION MARKET OVERVIEW (2016-2028)

TABLE 021. DRUG DISCOVERY MARKET OVERVIEW (2016-2028)

TABLE 022. TOXICITY TESTING MARKET OVERVIEW (2016-2028)

TABLE 023. TISSUE ENGINEERING MARKET OVERVIEW (2016-2028)

TABLE 024. RESEARCH MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA CELL LINE DEVELOPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 026. NORTH AMERICA CELL LINE DEVELOPMENT MARKET, BY SOURCE (2016-2028)

TABLE 027. NORTH AMERICA CELL LINE DEVELOPMENT MARKET, BY CELL LINE TYPE (2016-2028)

TABLE 028. NORTH AMERICA CELL LINE DEVELOPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 029. N CELL LINE DEVELOPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE CELL LINE DEVELOPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 031. EUROPE CELL LINE DEVELOPMENT MARKET, BY SOURCE (2016-2028)

TABLE 032. EUROPE CELL LINE DEVELOPMENT MARKET, BY CELL LINE TYPE (2016-2028)

TABLE 033. EUROPE CELL LINE DEVELOPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 034. CELL LINE DEVELOPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC CELL LINE DEVELOPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 036. ASIA PACIFIC CELL LINE DEVELOPMENT MARKET, BY SOURCE (2016-2028)

TABLE 037. ASIA PACIFIC CELL LINE DEVELOPMENT MARKET, BY CELL LINE TYPE (2016-2028)

TABLE 038. ASIA PACIFIC CELL LINE DEVELOPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 039. CELL LINE DEVELOPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA CELL LINE DEVELOPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA CELL LINE DEVELOPMENT MARKET, BY SOURCE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA CELL LINE DEVELOPMENT MARKET, BY CELL LINE TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA CELL LINE DEVELOPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 044. CELL LINE DEVELOPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 045. SOUTH AMERICA CELL LINE DEVELOPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 046. SOUTH AMERICA CELL LINE DEVELOPMENT MARKET, BY SOURCE (2016-2028)

TABLE 047. SOUTH AMERICA CELL LINE DEVELOPMENT MARKET, BY CELL LINE TYPE (2016-2028)

TABLE 048. SOUTH AMERICA CELL LINE DEVELOPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 049. CELL LINE DEVELOPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 050. GE HEALTHCARE: SNAPSHOT

TABLE 051. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 052. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 053. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SARTORIOUS AG: SNAPSHOT

TABLE 054. SARTORIOUS AG: BUSINESS PERFORMANCE

TABLE 055. SARTORIOUS AG: PRODUCT PORTFOLIO

TABLE 056. SARTORIOUS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CORNING INC.: SNAPSHOT

TABLE 057. CORNING INC.: BUSINESS PERFORMANCE

TABLE 058. CORNING INC.: PRODUCT PORTFOLIO

TABLE 059. CORNING INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. WUXI APPTEC INC.: SNAPSHOT

TABLE 060. WUXI APPTEC INC.: BUSINESS PERFORMANCE

TABLE 061. WUXI APPTEC INC.: PRODUCT PORTFOLIO

TABLE 062. WUXI APPTEC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SELEXIS SA: SNAPSHOT

TABLE 063. SELEXIS SA: BUSINESS PERFORMANCE

TABLE 064. SELEXIS SA: PRODUCT PORTFOLIO

TABLE 065. SELEXIS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SIGMA-ALDRICH CORPORATION: SNAPSHOT

TABLE 066. SIGMA-ALDRICH CORPORATION: BUSINESS PERFORMANCE

TABLE 067. SIGMA-ALDRICH CORPORATION: PRODUCT PORTFOLIO

TABLE 068. SIGMA-ALDRICH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LONZA GROUP AG: SNAPSHOT

TABLE 069. LONZA GROUP AG: BUSINESS PERFORMANCE

TABLE 070. LONZA GROUP AG: PRODUCT PORTFOLIO

TABLE 071. LONZA GROUP AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SARTORIUS: SNAPSHOT

TABLE 072. SARTORIUS: BUSINESS PERFORMANCE

TABLE 073. SARTORIUS: PRODUCT PORTFOLIO

TABLE 074. SARTORIUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. THERMO FISHER SCIENTIFIC INC.: SNAPSHOT

TABLE 075. THERMO FISHER SCIENTIFIC INC.: BUSINESS PERFORMANCE

TABLE 076. THERMO FISHER SCIENTIFIC INC.: PRODUCT PORTFOLIO

TABLE 077. THERMO FISHER SCIENTIFIC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. DANAHER CORPORATION: SNAPSHOT

TABLE 078. DANAHER CORPORATION: BUSINESS PERFORMANCE

TABLE 079. DANAHER CORPORATION: PRODUCT PORTFOLIO

TABLE 080. DANAHER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. MERCK KGAA: SNAPSHOT

TABLE 081. MERCK KGAA: BUSINESS PERFORMANCE

TABLE 082. MERCK KGAA: PRODUCT PORTFOLIO

TABLE 083. MERCK KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. PROMEGA CORPORATION: SNAPSHOT

TABLE 084. PROMEGA CORPORATION: BUSINESS PERFORMANCE

TABLE 085. PROMEGA CORPORATION: PRODUCT PORTFOLIO

TABLE 086. PROMEGA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. BECKMAN COULTER INC.: SNAPSHOT

TABLE 087. BECKMAN COULTER INC.: BUSINESS PERFORMANCE

TABLE 088. BECKMAN COULTER INC.: PRODUCT PORTFOLIO

TABLE 089. BECKMAN COULTER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. EUROPEAN COLLECTION OF CELL CULTURES: SNAPSHOT

TABLE 090. EUROPEAN COLLECTION OF CELL CULTURES: BUSINESS PERFORMANCE

TABLE 091. EUROPEAN COLLECTION OF CELL CULTURES: PRODUCT PORTFOLIO

TABLE 092. EUROPEAN COLLECTION OF CELL CULTURES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 093. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 094. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 095. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CELL LINE DEVELOPMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CELL LINE DEVELOPMENT MARKET OVERVIEW BY PRODUCT

FIGURE 012. EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. REAGENTS & MEDIA MARKET OVERVIEW (2016-2028)

FIGURE 014. ACCESSORIES & CONSUMABLES MARKET OVERVIEW (2016-2028)

FIGURE 015. CELL LINE DEVELOPMENT MARKET OVERVIEW BY SOURCE

FIGURE 016. MAMMALIAN MARKET OVERVIEW (2016-2028)

FIGURE 017. NON-MAMMALIAN MARKET OVERVIEW (2016-2028)

FIGURE 018. CELL LINE DEVELOPMENT MARKET OVERVIEW BY CELL LINE TYPE

FIGURE 019. RECOMBINANT CELL LINES MARKET OVERVIEW (2016-2028)

FIGURE 020. HYBRIDOMAS MARKET OVERVIEW (2016-2028)

FIGURE 021. CONTINUOUS CELL LINES MARKET OVERVIEW (2016-2028)

FIGURE 022. PRIMARY CELL LINES MARKET OVERVIEW (2016-2028)

FIGURE 023. CELL LINE DEVELOPMENT MARKET OVERVIEW BY APPLICATION

FIGURE 024. BIOPRODUCTION MARKET OVERVIEW (2016-2028)

FIGURE 025. DRUG DISCOVERY MARKET OVERVIEW (2016-2028)

FIGURE 026. TOXICITY TESTING MARKET OVERVIEW (2016-2028)

FIGURE 027. TISSUE ENGINEERING MARKET OVERVIEW (2016-2028)

FIGURE 028. RESEARCH MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA CELL LINE DEVELOPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE CELL LINE DEVELOPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC CELL LINE DEVELOPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA CELL LINE DEVELOPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA CELL LINE DEVELOPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Cell Line Development Market research report is 2024-2032.

GE Healthcare, Sartorious AG, Corning Inc., WuXi AppTec Inc., Selexis SA, Sigma-Aldrich Corporation, Lonza Group AG, Thermo Fisher Scientific Inc., and Other Major Players.

The Cell Line Development Market is segmented into Product, Source, Cell Line Type, Application, and Region. By Product the market is categorized into Equipment, Reagents & Media, and Accessories & Consumables. By Source, the market is categorized into Mammalian, and Non-Mammalian. By Cell Line Type, the market is categorized into Recombinant Cell Lines, Hybridomas, Continuous Cell Lines, and Primary Cell Lines. By Application, the market is categorized into Bioproduction, Drug Discovery, Toxicity Testing, Tissue Engineering, and Research. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

The process of co-opting the cellular machinery to create therapeutic biologics or other proteins of interest is known as cell line development. Cell line development can be done using a variety of expression systems, including bacterial, plant-based, yeast, and mammalian.

The Global Cell Line Development Market size was valued at USD 7.96 billion in 2023 and is projected to reach USD 16.99 billion by 2032, growing at a CAGR of 8.79% from 2024 to 2032.