Key Market Highlights

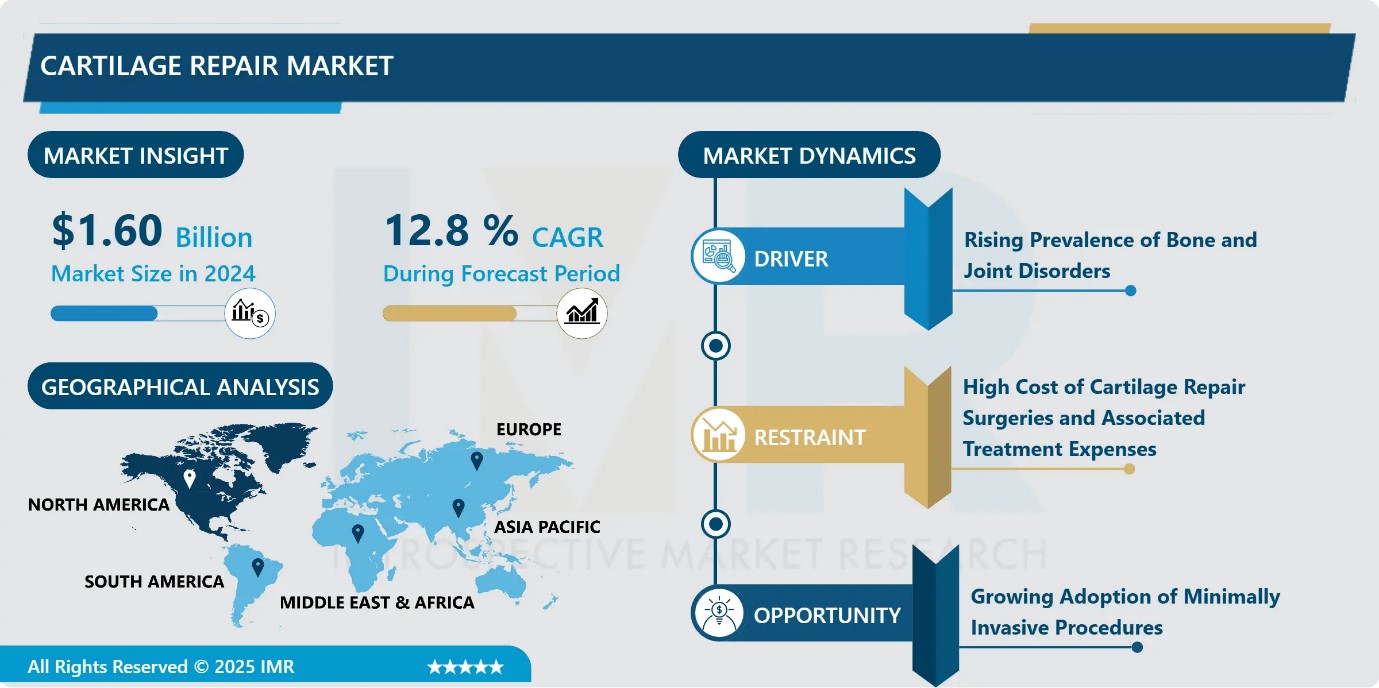

Cartilage Repair Market Size Was Valued at USD 1.60 Billion in 2024, and is Projected to Reach USD 6.02 Billion by 2035, Growing at a CAGR of 12.8% from 2025-2035.

- Market Size in 2024: USD 1.60 Billion

- Projected Market Size by 2035: USD 6.02 Billion

- CAGR (2025–2035): 12.8%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Cartilage Type: The Hyaline Cartilage segment is anticipated to lead the market by accounting for 60% of the market share throughout the forecast period.

- By Treatment Modality: The Cell-Based Therapies segment is expected to capture 58.8% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 30.11% of the market share during the forecast period.

- Active Players: AlloSource (US), Anika Therapeutics, Inc. (US), Arthrex, Inc. (US), B. Braun SE (Germany), Bioventus LLC (US), and Other Active Players.

Cartilage Repair Market Synopsis:

The cartilage repair market comprises technologies, products, and procedures designed to restore or regenerate damaged cartilage caused by degenerative diseases, trauma, sports injuries, and aging-related joint deterioration. The market is witnessing steady growth due to the rising prevalence of osteoarthritis, rheumatoid arthritis, obesity, and diabetes, all of which accelerate cartilage degeneration. An aging global population and increasing participation in sports further amplify the need for effective cartilage repair solutions. Advancements in regenerative medicine, including cell-based therapies, biologics, tissue engineering, and 3D bioprinting, are transforming treatment outcomes. Growing preference for minimally invasive procedures with faster recovery times also supports market expansion. Despite challenges such as high treatment costs and regulatory constraints, increasing research investments and technological innovation continue to strengthen the market outlook globally.

Cartilage Repair Market Dynamics and Trend Analysis:

Cartilage Repair Market Growth Driver-Rising Prevalence of Bone and Joint Disorders

- The cartilage repair market is being driven by the increasing incidence of bone and joint disorders, particularly osteoporosis and osteoarthritis. Osteoporosis, a widespread non-communicable bone disease, significantly impacts aging populations worldwide, creating a growing need for treatments that prevent fractures and maintain mobility. Concurrently, the rising prevalence of osteoarthritis and traumatic cartilage injuries, including sports-related cartilage lesions, is expanding the pool of patients seeking effective and long-lasting cartilage repair solutions. This trend is particularly evident among younger adults and active individuals who prefer definitive interventions over palliative care, sustaining robust demand for innovative cartilage repair and regenerative therapies globally.

Cartilage Repair Market Limiting Factor-High Cost of Cartilage Repair Surgeries and Associated Treatment Expenses

- The cartilage repair market faces a major restraint due to the high costs of surgical procedures and associated treatments. Advanced interventions, including autologous chondrocyte implantation, osteochondral allograft transplantation, and the use of premium biomaterials such as hyaluronic acid and collagen scaffolds, significantly increase overall healthcare expenditures. Patients in regions with limited insurance coverage or low affordability often delay or avoid treatment. Additional factors such as complex post-operative rehabilitation, scarcity of skilled professionals, supply chain disruptions, and the availability of lower-cost alternatives further impede market growth, restricting access to advanced cartilage repair solutions globally.

Cartilage Repair Market Expansion Opportunity-Growing Adoption of Minimally Invasive Procedures

- The cartilage repair market is witnessing significant growth opportunities due to the rising adoption of minimally invasive surgical procedures, including arthroscopy, microfracture, and minimally invasive autologous chondrocyte implantation. These techniques offer key advantages over traditional open surgery, such as reduced recovery time, less post-operative pain, smaller incisions, and minimal trauma to surrounding tissues.

- Healthcare providers benefit from lower resource requirements and increased procedural efficiency, while patients gain faster rehabilitation and improved outcomes. The expansion of advanced surgical tools and imaging technologies, along with growing patient awareness and preference for quicker, less painful treatments, is driving the widespread adoption of these procedures globally.

Cartilage Repair Market Challenge and Risk-Complex Biomechanics and Cartilage Regeneration Limitations

- The cartilage repair market faces challenges due to the complex biomechanics of weight-bearing joints, particularly the knee, which endures constant stress from daily activities and exercise. Continuous load and movement can compromise repair success, while large cartilage lesions are difficult to treat and often require advanced, resource-intensive interventions. Additionally, the absence of standardized treatment protocols leads to variability in clinical outcomes and complicates comparisons between therapeutic approaches. Cartilage’s limited natural healing ability further complicates regeneration, making it challenging to achieve outcomes that closely replicate native tissue. These biological and procedural complexities hinder the effectiveness and scalability of cartilage repair solutions.

Cartilage Repair Market Trend-Technological Advancements in Cartilage Repair:

- The cartilage repair market is increasingly shaped by technological innovations, including 3D bioprinting, gene therapy, and advanced stem cell applications. These breakthroughs enable patient-specific implants, enhanced cartilage regeneration, and less invasive procedures, improving outcomes and integration. Tissue-engineered scaffolds and cell-based implants, such as nanofiber “dancing molecule” technology and allogeneic mesenchymal stromal cell therapies, are enhancing repair efficacy and supporting premium treatments. Growing government support and reimbursement for advanced therapies further facilitate adoption. Continuous innovation in regenerative approaches and personalized treatments is expanding the therapeutic potential, driving market growth, and positioning cartilage repair as a dynamic and high-value segment within orthopedic care.

Cartilage Repair Market Segment Analysis:

Cartilage Repair Market is segmented based on Treatment Modality, Cartilage Type, Application Type, Treatment Type, Surgical Procedure, Cartilage Defect Type, Application, End User and Region.

By Cartilage Type, Hyaline cartilage segment is expected to dominate the market with around 60% share during the forecast period.

- Hyaline cartilage dominates the cartilage repair market due to its critical role in load-bearing joints, which are most susceptible to wear and degeneration. Its structural and functional importance in maintaining joint mobility drives strong demand for effective repair solutions. Technological advancements, such as bilayer atelocollagen scaffolds, now better replicate hyaline morphology, improving long-term outcomes for patients. While fibrocartilage repair is growing, particularly in meniscal applications, hyaline cartilage remains the largest segment because it supports essential joint function and is more prone to damage from daily activities and weight-bearing stress, making its restoration a top clinical priority globally.

By Treatment Modality, Cell-based therapies is expected to dominate with close to 58.8% market share during the forecast period.

- Cell-based therapies lead the cartilage repair market due to their superior ability to regenerate damaged tissue and reduce pain, making them the preferred choice for treating chondral and osteochondral lesions. Techniques such as autologous chondrocyte implantation (ACI) and stem cell therapies offer personalized, clinically effective solutions that restore joint function more reliably than cell-free alternatives.

- While cell-free implants are gaining traction due to lower cost and off-the-shelf availability, cell-based modalities dominate because of their proven regenerative outcomes, growing adoption for osteoarthritis management, and increasing patient and physician preference for long-term, customized cartilage repair treatments.

Cartilage Repair Market Regional Insights:

North America region is estimated to lead the market with around 30.11% share during the forecast period.

- North America held the largest share of the global cartilage repair market in 2024, accounting for over 51% of revenue, driven by the high prevalence of musculoskeletal diseases, an aging population, and active lifestyles. The U.S. leads with advanced healthcare infrastructure, strong regulatory support, and established players like Stryker, Zimmer Biomet, and DePuy Synthes.

- Knee cartilage repair dominates the region, fueled by sports injuries, road accidents, and geriatric demand. FDA approvals, private-payer reimbursement, and innovations in regenerative medicine further boost growth. The region’s dominance stems from robust healthcare systems, high disposable income, technological advancements, and a large target population.

Cartilage Repair Market Active Players:

- AlloSource (US)

- Anika Therapeutics, Inc. (US)

- Arthrex, Inc. (US)

- B. Braun SE (Germany)

- Bioventus LLC (US)

- CONMED Corporation (US

- DePuy Synthes (Johnson & Johnson) (US)

- Geistlich Pharma AG (Switzerland

- Hy2Care (Netherlands)

- Johnson & Johnson (US)

- Medtronic plc (Ireland)

- Smith & Nephew plc (UK)

- Stryker Corporation (US)

- Vericel Corporation (US)

- Zimmer Biomet Holdings, Inc. (US)

- Other Active Players

Key Industry Developments in the Cartilage Repair Market:

- In January 2025, Zimmer Biomet announced its acquisition of Paragon 28 for approximately USD 1.1 billion to strengthen its orthopedic surgical device portfolio, especially in foot and ankle treatments. The deal is expected to expand Zimmer Biomet’s product offerings and accelerate growth in the foot and ankle segment. It will also create a dedicated sales channel by leveraging Paragon 28’s specialized team to better serve patients globally.

- In January 2025, UK-based Smith & Nephew acquired CartiHeal, a company specializing in sports injury treatments. This acquisition aims to enhance Smith & Nephew’s knee cartilage repair product portfolio. It is expected to broaden the company’s offerings and strengthen its position in the cartilage repair market.

Advanced Surgical Techniques, Regenerative Therapies, and Biomaterials Driving the Cartilage Repair Market

- The cartilage repair market relies on advanced surgical and regenerative technologies to restore damaged cartilage in weight-bearing and non-weight-bearing joints. Key technical approaches include cell-based therapies, such as autologous chondrocyte implantation (ACI) and mesenchymal stem cell treatments, which promote tissue regeneration and structural repair. Non-cell-based methods use biomaterials like collagen scaffolds, hyaluronic acid, and synthetic hydrogels to support cartilage healing.

- Surgical procedures range from microfracture, debridement, and abrasion arthroplasty to osteochondral autograft and allograft transplantation, as well as minimally invasive techniques for faster recovery. Innovations in 3D bioprinting and gene therapy are enhancing personalized implant design and targeted cartilage regeneration. Imaging guidance, arthroscopy, and scaffold integration technologies improve procedural precision and long-term outcomes, making the market highly dependent on technical expertise, advanced instrumentation, and continuous research in tissue engineering and regenerative medicine.

|

Cartilage Repair Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

US 1.60 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.8% |

Market Size in 2035: |

USD 6.02 Bn. |

|

Segments Covered: |

By Treatment Modality |

|

|

|

By Cartilage Type

|

|

||

|

By Application Site |

|

||

|

By Treatment Type |

|

||

|

By Surgical Procedure |

|

||

|

By Cartilage Defect Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Cartilage Repair Market by Treatment Modality (2018-2035)

4.1 Cartilage Repair Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cell-Based Therapies

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Cell-Based/Cell-Free

Chapter 5: Cartilage Repair Market by Cartilage Type (2018-2035)

5.1 Cartilage Repair Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hyaline Cartilage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fibrocartilage

5.5 and Others

Chapter 6: Cartilage Repair Market by Application Site (2018-2035)

6.1 Cartilage Repair Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Knee

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hip

6.5 Ankle

6.6 Shoulder

6.7 Spine

6.8 and Others

Chapter 7: Cartilage Repair Market by Treatment Type (2018-2035)

7.1 Cartilage Repair Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Palliative and Intrinsic Repair Stimulation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

Chapter 8: Cartilage Repair Market by Surgical Procedure (2018-2035)

8.1 Cartilage Repair Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Microfracture

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Debridement

8.5 Abrasion Arthroplasty

8.6 Autologous Chondrocyte Implantation (ACI)

8.7 Osteochondral Autograft Transplantation (OATS)

8.8 Osteochondral Allograft Transplantation

8.9 Cell-Based Cartilage Resurfacing

8.10 and Others

Chapter 9: Cartilage Repair Market by Cartilage Defect Type (2018-2035)

9.1 Cartilage Repair Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Osteoarthritis

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Post-Traumatic Cartilage Defects

9.5 Osteochondritis Dissecans

9.6 Degenerative Meniscal Tears

Chapter 10: Cartilage Repair Market by Application (2018-2035)

10.1 Cartilage Repair Market Snapshot and Growth Engine

10.2 Market Overview

10.3 Primary Knee Cartilage Repair

10.3.1 Introduction and Market Overview

10.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

10.3.3 Key Market Trends, Growth Factors, and Opportunities

10.3.4 Geographic Segmentation Analysis

10.4 Revision Knee Cartilage Repair

10.5 Partial-Thickness Cartilage Defects

10.6 Full-Thickness Cartilage Defects

Chapter 11: Cartilage Repair Market by End User (2018-2035)

11.1 Cartilage Repair Market Snapshot and Growth Engine

11.2 Market Overview

11.3 Hospitals and Clinics

11.3.1 Introduction and Market Overview

11.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

11.3.3 Key Market Trends, Growth Factors, and Opportunities

11.3.4 Geographic Segmentation Analysis

11.4 Ambulatory Surgical Centers

11.5 and Others

Chapter 12: Company Profiles and Competitive Analysis

12.1 Competitive Landscape

12.1.1 Competitive Benchmarking

12.1.2 Cartilage Repair Market Share by Manufacturer/Service Provider(2024)

12.1.3 Industry BCG Matrix

12.1.4 PArtnerships, Mergers & Acquisitions

12.2 ALLOSOURCE (US)

12.2.1 Company Overview

12.2.2 Key Executives

12.2.3 Company Snapshot

12.2.4 Role of the Company in the Market

12.2.5 Sustainability and Social Responsibility

12.2.6 Operating Business Segments

12.2.7 Product Portfolio

12.2.8 Business Performance

12.2.9 Recent News & Developments

12.2.10 SWOT Analysis

12.3 ANIKA THERAPEUTICS

12.4 INC. (US)

12.5 ARTHREX

12.6 INC. (US)

12.7 B. BRAUN SE (GERMANY)

12.8 BIOVENTUS LLC (US)

12.9 CONMED CORPORATION (US)

12.10 DEPUY SYNTHES (JOHNSON & JOHNSON) (US)

12.11 GEISTLICH PHARMA AG (SWITZERLAND)

12.12 HY2CARE (NETHERLANDS)

12.13 JOHNSON & JOHNSON (US)

12.14 MEDTRONIC PLC (IRELAND)

12.15 SMITH & NEPHEW PLC (UK)

12.16 STRYKER CORPORATION (US)

12.17 VERICEL CORPORATION (US)

12.18 ZIMMER BIOMET HOLDINGS

12.19 INC. (US)

12.20 AND OTHER ACTIVE PLAYERS.

Chapter 13: Global Cartilage Repair Market By Region

13.1 Overview

13.2. North America Cartilage Repair Market

13.2.1 Key Market Trends, Growth Factors and Opportunities

13.2.2 Top Key Companies

13.2.3 Historic and Forecasted Market Size by Segments

13.2.4 Historic and Forecast Market Size by Country

13.2.4.1 US

13.2.4.2 Canada

13.2.4.3 Mexico

13.3. Eastern Europe Cartilage Repair Market

13.3.1 Key Market Trends, Growth Factors and Opportunities

13.3.2 Top Key Companies

13.3.3 Historic and Forecasted Market Size by Segments

13.3.4 Historic and Forecast Market Size by Country

13.3.4.1 Russia

13.3.4.2 Bulgaria

13.3.4.3 The Czech Republic

13.3.4.4 Hungary

13.3.4.5 Poland

13.3.4.6 Romania

13.3.4.7 Rest of Eastern Europe

13.4. Western Europe Cartilage Repair Market

13.4.1 Key Market Trends, Growth Factors and Opportunities

13.4.2 Top Key Companies

13.4.3 Historic and Forecasted Market Size by Segments

13.4.4 Historic and Forecast Market Size by Country

13.4.4.1 Germany

13.4.4.2 UK

13.4.4.3 France

13.4.4.4 The Netherlands

13.4.4.5 Italy

13.4.4.6 Spain

13.4.4.7 Rest of Western Europe

13.5. Asia Pacific Cartilage Repair Market

13.5.1 Key Market Trends, Growth Factors and Opportunities

13.5.2 Top Key Companies

13.5.3 Historic and Forecasted Market Size by Segments

13.5.4 Historic and Forecast Market Size by Country

13.5.4.1 China

13.5.4.2 India

13.5.4.3 Japan

13.5.4.4 South Korea

13.5.4.5 Malaysia

13.5.4.6 Thailand

13.5.4.7 Vietnam

13.5.4.8 The Philippines

13.5.4.9 Australia

13.5.4.10 New Zealand

13.5.4.11 Rest of APAC

13.6. Middle East & Africa Cartilage Repair Market

13.6.1 Key Market Trends, Growth Factors and Opportunities

13.6.2 Top Key Companies

13.6.3 Historic and Forecasted Market Size by Segments

13.6.4 Historic and Forecast Market Size by Country

13.6.4.1 Turkiye

13.6.4.2 Bahrain

13.6.4.3 Kuwait

13.6.4.4 Saudi Arabia

13.6.4.5 Qatar

13.6.4.6 UAE

13.6.4.7 Israel

13.6.4.8 South Africa

13.7. South America Cartilage Repair Market

13.7.1 Key Market Trends, Growth Factors and Opportunities

13.7.2 Top Key Companies

13.7.3 Historic and Forecasted Market Size by Segments

13.7.4 Historic and Forecast Market Size by Country

13.7.4.1 Brazil

13.7.4.2 Argentina

13.7.4.3 Rest of SA

Chapter 14 Analyst Viewpoint and Conclusion

Chapter 15 Our Thematic Research Methodology

15.1 Research Process

15.2 Primary Research

15.3 Secondary Research

Chapter 16 Case Study

Chapter 17 Appendix

17.1 Sources

17.2 List of Tables and figures

17.3 Short Forms and Citations

17.4 Assumption and Conversion

17.5 Disclaimer

|

Cartilage Repair Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

US 1.60 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.8% |

Market Size in 2035: |

USD 6.02 Bn. |

|

Segments Covered: |

By Treatment Modality |

|

|

|

By Cartilage Type

|

|

||

|

By Application Site |

|

||

|

By Treatment Type |

|

||

|

By Surgical Procedure |

|

||

|

By Cartilage Defect Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||