Carotenoids Market Synopsis

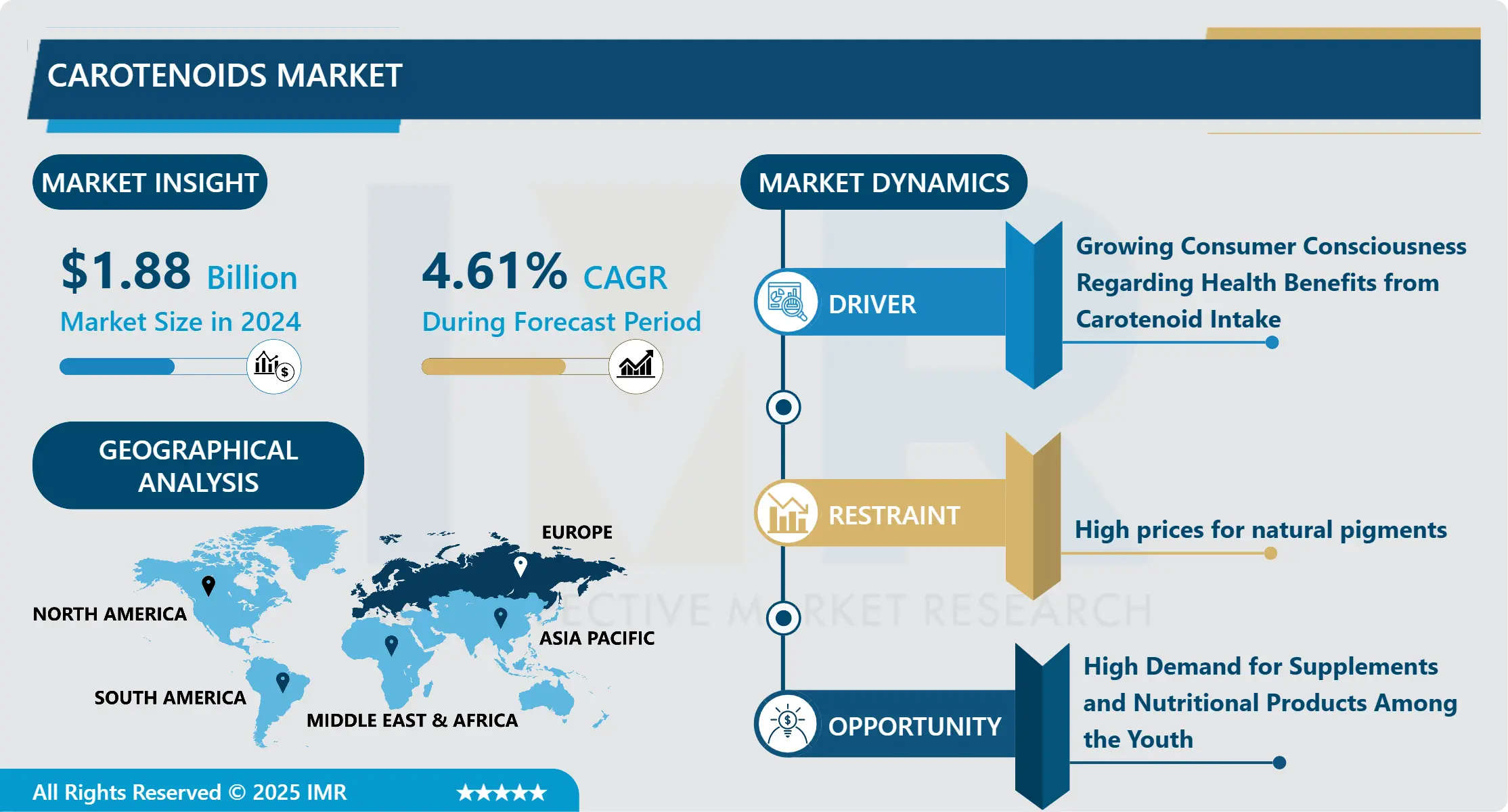

Carotenoids Market Size Was Valued at USD 1.88 Billion in 2024 and is Projected to Reach USD 2.70 Billion by 2032, Growing at a CAGR of 4.61% From 2025-2032.

Carotenoids are hydrophilic colorants blended by plants, fungi, algae, and bacteria. In plants, carotenoids contribute to the photosynthetic functions and defend them as anti-photodamage, in addition to supporting the production of phytohormones. As pigments, they are at fault for the red, orange, pink, and yellow colors of the leaves of plants, fruits, vegetables, and some birds, insects, fish, and crustaceans. About 750 types of carotenoids have been recognized in nature, but only about 100 are present in detectable amounts within the human diet. From 30 and 40 carotenoids have been discovered in human blood samples and the six most massive carotenoids are made of around 95% of the carotenoids discovered in blood plasma

The Carotenoids market's expansion is the growing awareness and demand for natural and healthy ingredients in the food and beverage sector. Consumers are increasingly seeking products that provide nutritional benefits, and carotenoids, being potent antioxidants and precursors to vitamin A, fit the bill perfectly. Their incorporation into a wide range of food products not only enhances the visual appeal but also contributes to the overall nutritional value.

Additionally, the rising trend of clean-label products has spurred the utilization of carotenoids as natural colorants in the food industry. With consumers becoming more discerning about the origin and composition of the products they consume, the use of carotenoids as natural colourants offers a sustainable and health-conscious alternative to synthetic counterparts.

In the pharmaceutical and nutraceutical sectors, carotenoids are gaining traction due to their proven health benefits. Research highlighting their role in promoting eye health, supporting the immune system, and exhibiting anti-inflammatory properties has fueled their incorporation into dietary supplements. This increasing recognition of carotenoids as functional ingredients has further propelled market growth.

Carotenoids Market Trend Analysis

Growing Consumer Consciousness Regarding Health Benefits from Carotenoid Intake

- Growing consumer consciousness regarding health benefits from carotenoid intake is probable to turn market demand. Rising the prevalence of lifestyle and early age problems in the present generation is motivating the consumers to consume naturally derived food ingredients. In addition, the market also stands to benefit from the innovations in biotechnological processes that help the industrial production of natural carotenoids. ?

- Alternative treatment methods asides from allelopathic products for diabetes, eye disorders, and many lifestyle diseases are observing the vigorous popularity of carotenoids. Inhibitory medicine is the buzzword that has motivated producers and processors to come up with nutraceuticals such as dietary supplements and functional foods that utilized natural ingredients. Geriatric nutrition is one of the major sectors for carotenes due to its high antioxidant potential as they protect against oxidative stress, especially attributed to aging processes, pollution, and others. Thus, owing these all factors lead to the growth of the market during the forecast period.

- Switching consumer preference for ingredients that help health functions such as bone density and immunity will give new avenues for product penetration. Rising demand for antioxidants, micronutrients, and vitamins will propel product adoption all over myriad end-use sectors. Furthermore, the growing demand for natural food colors such as lycopene and beta-carotene will further accelerate overall market growth.

High Demand for Supplements and Nutritional Products Among the Youth

- Carotenoids are organic pigments found in plants, algae, and photosynthetic bacteria, and they play a crucial role in providing vibrant colors to various fruits and vegetables. Additionally, some carotenoids, such as beta-carotene, have been recognized for their potential health benefits, making them a valuable component in the formulation of dietary supplements and nutritional products.

- Young consumers are becoming more conscious of their lifestyles and are actively seeking ways to improve their overall well-being. Carotenoids, being natural antioxidants, have been associated with various health benefits, including immune system support, skin health, and vision protection. As a result, the youth demographic is increasingly turning to supplements containing carotenoids to enhance their nutritional intake and address potential health concerns.

- Moreover, the rise of fitness and sports culture among the youth has fueled the demand for nutritional products that can support physical performance and recovery. Carotenoids, with their potential anti-inflammatory properties and contribution to cellular health, align with the needs of individuals engaged in active lifestyles. Products catering to this demographic often include carotenoids to address the nutritional requirements of those looking to optimize their fitness goals.

Carotenoids Market Segment Analysis:

Carotenoids Market Segmented on the basis of type, source, and application.

By Type, Astaxanthin segment is expected to dominate the market during the forecast period

- Based on Type, the lutein segment accounted for the largest market share during the forecast period. Astaxanthin is a naturally occurring red pigment found in microalgae, plants, and seafood, and it is particularly known for its potent antioxidant capabilities. As consumers become increasingly health-conscious, there is a growing demand for natural antioxidants that can combat oxidative stress and inflammation. Astaxanthin's superior antioxidant power compared to other carotenoids, such as beta-carotene or lutein, is driving its popularity in various industries, including pharmaceuticals, cosmetics, and food supplements.

By Application, Animal Feed segment held the largest share in 2024

- Based on Application, animal feed is projected to account for the largest share in the market over the forecast period. Carotenoids are highly utilized in animal nutrition products owing to their coloring characteristics and are integrated into feed to pigment the egg yolks, broiler skin, fishes, and crustaceans. These also support enhancing immunity and increasing the health of livestock by boosting the quality of feed. The prolificacy of cattle, swine, and horses can be enhanced by feeding beta-carotene, whereas astaxanthin and canthaxanthin help in boosting the growth of salmons and larval fishes.

Carotenoids Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe region is dominating the market during the forecast period owing to the huge application of carotenoids in animal feed sectors and also well-established personal care and cosmetics industry all over the region are key factors that drive the market growth. Additionally, these are also high preferring for food coloring ingredients in the European market.

- The Asia Pacific is projected to high growth rate for the carotenoids market due to the higher application of these additives in the feed, supplement, food, pharmaceutical, and cosmetic sectors. The industry is expected to be driven by technological innovations, industrial growth, economic growth, and low manufacturing costs in economies such as China, Japan, and India. In addition, an increasing middle-class population, educational development, and growing disposable incomes in the region have led to growing consumer consciousness about the health benefits of dietary supplements. Furthermore, the presence of key pharmaceutical players such as Dr. Reddy's Laboratories, Cipla, Sun Pharmaceutical, GSK, Roche, and Novo Nordisk will further help in market developments.

Carotenoids Market Top Key Players:

- Allied Biotech (Taiwan)

- BASF SE (Germany)

- Dohler GmbH (Germany)

- FMC Corporation (USA)

- Sensient Technologies (USA)

- Chr Hansen Holdings A/S (Denmark)

- Kemin Industries (USA)

- Algatech Tech (Israel)

- Novus International Inc. (USA)

- DDW The Color House (USA)

- Lycored Ltd (Israel)

- Fuji Chemical Industry Co. Ltd. (Japan)

- E.I.D. Parry (India)

- Divi's Laboratories (India)

- Farbest Brands (USA)

- Deinove SAS (France)

- Lonza (Switzerland)

- Kerry Group Plc (Ireland)

- and Other Active Player

Key Industry Developments in the Carotenoids Market:

- In July 2023: Chr. Hansen, a leading Danish bioscience company, merged with BI Nutraceuticals, a US-based carotenoid producer. This merger created a global leader in natural colors and nutritional ingredients, with a strong presence in carotenoids like beta-carotene and lutein.

- In February 2023: Dutch multinational Royal DSM acquired Verdure Nutrition, a leading natural astaxanthin producer. This acquisition strengthened DSM's carotenoid portfolio and expanded its reach in the dietary supplement and food & and beverage markets.

|

Global Carotenoids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025: |

USD 1.88 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.61 % |

Market Size in 2032: |

USD 2.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Carotenoids Market by Type (2018-2032)

4.1 Carotenoids Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Astaxanthin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Beta-Carotene

4.5 Canthaxanthin

4.6 Capsanthin

Chapter 5: Carotenoids Market by Source (2018-2032)

5.1 Carotenoids Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Synthetic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Natural

Chapter 6: Carotenoids Market by Application (2018-2032)

6.1 Carotenoids Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Animal Feed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food & Beverages

6.5 Personal Care & Cosmetics

6.6 Dietary Supplements

6.7 Pharmaceuticals

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Carotenoids Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CYNOTECH CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALGENOL

7.4 FEMICO

7.5 ALGAE HEALTH SCIENCE

7.6 POND TECHNOLOGIES HOLDINGS INC

7.7 SEAGRASS TECH PVT LTD

7.8 PARRY NUTRACEUTICAL

7.9 FIRGLAS

7.10 MANTA BIOFUEL

7.11 EARTHRISE NUTRITIONALS

7.12 OTHERS

Chapter 8: Global Carotenoids Market By Region

8.1 Overview

8.2. North America Carotenoids Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Astaxanthin

8.2.4.2 Beta-Carotene

8.2.4.3 Canthaxanthin

8.2.4.4 Capsanthin

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Synthetic

8.2.5.2 Natural

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Animal Feed

8.2.6.2 Food & Beverages

8.2.6.3 Personal Care & Cosmetics

8.2.6.4 Dietary Supplements

8.2.6.5 Pharmaceuticals

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Carotenoids Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Astaxanthin

8.3.4.2 Beta-Carotene

8.3.4.3 Canthaxanthin

8.3.4.4 Capsanthin

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Synthetic

8.3.5.2 Natural

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Animal Feed

8.3.6.2 Food & Beverages

8.3.6.3 Personal Care & Cosmetics

8.3.6.4 Dietary Supplements

8.3.6.5 Pharmaceuticals

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Carotenoids Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Astaxanthin

8.4.4.2 Beta-Carotene

8.4.4.3 Canthaxanthin

8.4.4.4 Capsanthin

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Synthetic

8.4.5.2 Natural

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Animal Feed

8.4.6.2 Food & Beverages

8.4.6.3 Personal Care & Cosmetics

8.4.6.4 Dietary Supplements

8.4.6.5 Pharmaceuticals

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Carotenoids Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Astaxanthin

8.5.4.2 Beta-Carotene

8.5.4.3 Canthaxanthin

8.5.4.4 Capsanthin

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Synthetic

8.5.5.2 Natural

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Animal Feed

8.5.6.2 Food & Beverages

8.5.6.3 Personal Care & Cosmetics

8.5.6.4 Dietary Supplements

8.5.6.5 Pharmaceuticals

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Carotenoids Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Astaxanthin

8.6.4.2 Beta-Carotene

8.6.4.3 Canthaxanthin

8.6.4.4 Capsanthin

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Synthetic

8.6.5.2 Natural

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Animal Feed

8.6.6.2 Food & Beverages

8.6.6.3 Personal Care & Cosmetics

8.6.6.4 Dietary Supplements

8.6.6.5 Pharmaceuticals

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Carotenoids Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Astaxanthin

8.7.4.2 Beta-Carotene

8.7.4.3 Canthaxanthin

8.7.4.4 Capsanthin

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Synthetic

8.7.5.2 Natural

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Animal Feed

8.7.6.2 Food & Beverages

8.7.6.3 Personal Care & Cosmetics

8.7.6.4 Dietary Supplements

8.7.6.5 Pharmaceuticals

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Carotenoids Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2025: |

USD 1.88 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.61 % |

Market Size in 2032: |

USD 2.70 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||