Biopharma Buffer Market Synopsis:

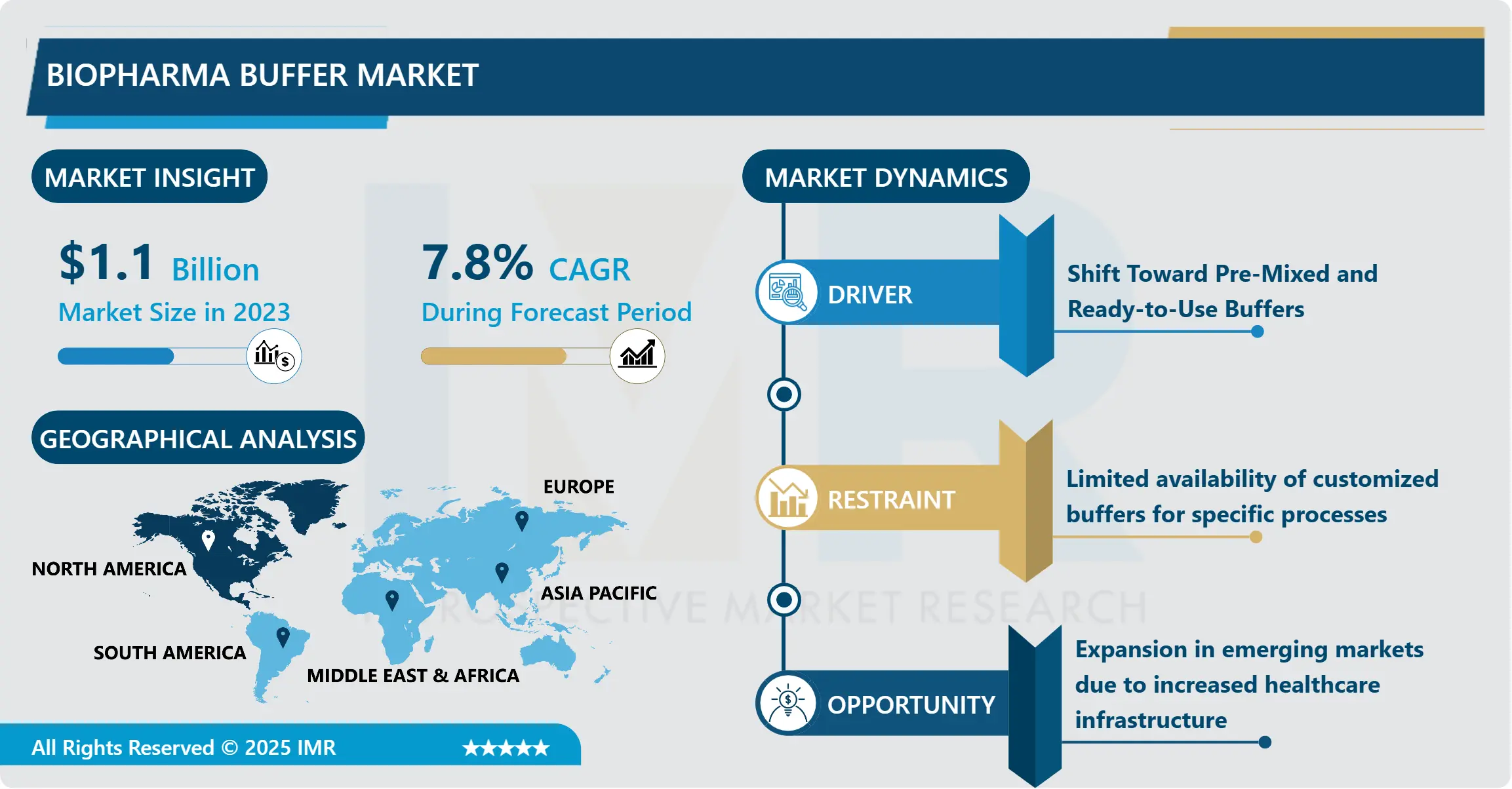

Biopharma Buffer Market Size Was Valued at USD 1.1 Billion in 2023, and is Projected to Reach USD 2.16 Billion by 2032, Growing at a CAGR of 7.80% From 2024-2032.

The biopharma buffer market is used to denote the range associated to the manufacturing, sale and use of buffer solutions required in the bio pharma industry, particularly for production of humane pharmaceuticals. A buffer is an important ingredient used in the manufacturing, storage, and transportation of a pharmaceutical product it controls the stability, pH and efficiency.

It is anticipated that the biopharma buffer market has been growing at a gradual pace in the past few years mainly because of the rising use of biologics as well as biosimilars. For instance, in biopharmaceutical manufacturing the kind of processes that need buffer solution include purifying proteins, cell culture, and fermentation among others. Buffers are critical for keeping these processes as near perfect as it is possible meaning that therapeutic products that are manufactured are of good quality and safe for use. Rapid increase in global incidence of chronic diseases like cancer, diabetes, autoimmune diseases has boosted the usage of biologic drugs and this has propelled the growth of the biopharma buffer market.

The biopharma industry is steadily growing and as the great variabilities of today’s manufacturing processes demand, companies are putting their efforts into invest on the creating of sophisticated and special-cased buffer solutions. From a geographical perspective, the global biopharma buffers market has also been categorized based on type that includes phosphate buffers, acetate buffers and others with different usability based on the production process involved. We continue to observe the increase of efficiency in biomanufacturing processes and the application of automated processes in coming up with and administering buffers to augment this market.

Biopharma Buffer Market Trend Analysis

Shift Toward Pre-Mixed and Ready-to-Use Buffers

- The biopharma buffer market include a shift from formulations which require mixing of the buffers upon arrival to ready-to-use buffers as a way of enhancing convenience, shortening the cycle time and reducing human interference. These pre-mixed solutions help avoid the problems of procuring and preparing own stock solutions; defined and reproducible buffer solutions can be prepared with the right pH and molar concentrations. This trend is particularly evident in large scale biomanufacturing production systems where throughput and productivity are of paramount importance. Pre-mixed buffers mean lower preparation time and less impact of human error while meeting the strict requirements for quality control in biopharmaceutical production.

- The increasing market for pre-mixed buffers complements the industry’s focus on the reduction of costs, processes, and supply chain complexity in biopharma. These solutions are integrating well with automated manufacturing systems which enhance its precision and reliability in manufacturing. The usage of advanced technologies in the biopharmaceutical manufacturing is still growing and to handle the complexity of the process, there is a need for ready to use buffers. This aligns perfectly well with the potential for suppliers to extend their portfolios of pre-blended systems capable of satisfying the requirement from a quickly evolving sector together with the growing demand for higher output superior automation.

Rising Demand for Biosimilars and Biologics

- Increased use of biologics and biosimilars is the major advantage that provides significant growth to the biopharma buffer market. In the present day, the rate of growth of chronic diseases like cancer, diabetes, and autoimmune diseases, is rising globally, demanding more specialized therapeutic treatments. Many of these diseases are consequently being treated with Biologic drugs since they are dated from living organisms and thus the need for more biopharma buffers. Investment interest in biosimilars or generic versions of expensive branded biologics also raises the demand for buffers as these less expensive drugs are typically as complex,

- The pharmaceutical companies start to invest in biosimilars and biologic drugs are used more frequently, there is a growing requirement for economic and high-quality buffer solutions, which enable those sophisticated production processes. In addition, some specific developmental trends that are worth realizing in the biopharma buffer sector include the constantly extending regulatory bodies in the developing markets including Asia Pacific region. Potential buffer solutions suppliers also see a great scope for expanding their capacities on the expanding base of businesses that strive for increasing the scale of their production capabilities.

Biopharma Buffer Market Segment Analysis:

Biopharma Buffer Market Segmented on the basis of type, application, end user, and region

By Type, phosphate buffers segment is expected to dominate the market during the forecast period

- The phosphate buffers segment is anticipated to dominate the biopharma buffer market during the forecast period due to its widespread application in biopharmaceutical manufacturing processes. Phosphate buffers are known for their excellent pH stability, biocompatibility, and compatibility with various biological systems, making them ideal for cell culture, protein purification, and downstream processing.

- The growing demand for monoclonal antibodies, vaccines, and other biologics has increased the need for reliable buffering systems. The scalability and cost-effectiveness of phosphate buffers further contribute to their preference among manufacturers, solidifying their leading position in the global biopharma buffer market throughout the forecast period.

By Application, Protein Drug Production segment expected to held the largest share

- The protein drug production segment is expected to hold the largest share of the biopharma buffer market during the forecast period. This dominance is driven by the growing demand for biologics, including monoclonal antibodies, therapeutic proteins, and enzymes, which require consistent and high-quality buffer systems for production, purification, and formulation processes.

- Biopharma buffers play a critical role in maintaining pH stability and ensuring protein stability and activity throughout manufacturing. As biopharmaceutical companies continue to expand protein-based drug development pipelines, the demand for specialized buffers in this segment is projected to rise significantly, securing its leading market position.

Biopharma Buffer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America region is expected to have the largest market share for biopharma buffer This leadership is due to the fact that the region has well developed biopharmaceutical sector, advanced health care technology and stringent policies. This particular type of dominance is especially paramount to the United States, where many of the leading biopharmaceutical companies are situated and dominant players in the development of biologic drugs. The importance of Handle, index and strength within the biologics process Biologics manufacturers,

- The rising trends of biotechnology advancement, individually tailored therapy, and genetic therapies in North America so significantly boost the growth of the market. As will be explained in the subsequent sections, the increased use of these advanced therapies raises the demand for more specialized buffer solutions for the production of such products. The regulatory authorities such as the U.S Food and Drug Administration (FDA) set extremely high standards of quality, which in extension compels biopharmaceutical firms to use high quality buffers that meet those high stakes. North America retains its prominence in the biologic drugs market and focuses on the advancements as well as the commercialization of those products, the need for the biopharma buffers remains high with companies in the region dominating the market.

Active Key Players in the Biopharma Buffer Market

- Avantor, Inc. (USA)

- Becton Dickinson and Company (USA)

- Bio-Rad Laboratories, Inc. (USA)

- Bosch Packaging Technology (Germany)

- CAMO Software AS (Norway)

- Danaher Corporation (USA)

- EMD Millipore (Germany)

- GE Healthcare Life Sciences (USA)

- Merck KGaA (Germany)

- Pall Corporation (USA)

- ProBioGen AG (Germany)

- Repligen Corporation (USA)

- Sartorius AG (Germany)

- Thermo Fisher Scientific, Inc. (USA)

- Other Active Players

|

Biopharma Buffer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Billion |

|

Forecast Period 2024-32 CAGR: |

7.80 % |

Market Size in 2032: |

USD 2.16 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biopharma Buffer Market by Type

4.1 Biopharma Buffer Market Snapshot and Growth Engine

4.2 Biopharma Buffer Market Overview

4.3 Phosphate Buffers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Phosphate Buffers: Geographic Segmentation Analysis

4.4 Acetate Buffers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Acetate Buffers: Geographic Segmentation Analysis

4.5 Citrate Buffers

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Citrate Buffers: Geographic Segmentation Analysis

4.6 Tris Buffers

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Tris Buffers: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Biopharma Buffer Market by Application

5.1 Biopharma Buffer Market Snapshot and Growth Engine

5.2 Biopharma Buffer Market Overview

5.3 Protein Drug Production

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Protein Drug Production: Geographic Segmentation Analysis

5.4 Monoclonal Antibodies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Monoclonal Antibodies: Geographic Segmentation Analysis

5.5 Gene Therapy

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Gene Therapy: Geographic Segmentation Analysis

5.6 Vaccine Production

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Vaccine Production: Geographic Segmentation Analysis

5.7 Cell Culture

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Cell Culture: Geographic Segmentation Analysis

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Geographic Segmentation Analysis

Chapter 6: Biopharma Buffer Market by End User

6.1 Biopharma Buffer Market Snapshot and Growth Engine

6.2 Biopharma Buffer Market Overview

6.3 Biopharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Biopharmaceutical Companies: Geographic Segmentation Analysis

6.4 Contract Manufacturing Organizations (CMO)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Manufacturing Organizations (CMO): Geographic Segmentation Analysis

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biopharma Buffer Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AVANTOR INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BECTON DICKINSON AND COMPANY (USA)

7.4 BIO-RAD LABORATORIES INC. (USA)

7.5 CYTIVA (USA)

7.6 DANAHER CORPORATION (USA)

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Biopharma Buffer Market By Region

8.1 Overview

8.2. North America Biopharma Buffer Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Phosphate Buffers

8.2.4.2 Acetate Buffers

8.2.4.3 Citrate Buffers

8.2.4.4 Tris Buffers

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Protein Drug Production

8.2.5.2 Monoclonal Antibodies

8.2.5.3 Gene Therapy

8.2.5.4 Vaccine Production

8.2.5.5 Cell Culture

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Biopharmaceutical Companies

8.2.6.2 Contract Manufacturing Organizations (CMO)

8.2.6.3 Research Institutes

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biopharma Buffer Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Phosphate Buffers

8.3.4.2 Acetate Buffers

8.3.4.3 Citrate Buffers

8.3.4.4 Tris Buffers

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Protein Drug Production

8.3.5.2 Monoclonal Antibodies

8.3.5.3 Gene Therapy

8.3.5.4 Vaccine Production

8.3.5.5 Cell Culture

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Biopharmaceutical Companies

8.3.6.2 Contract Manufacturing Organizations (CMO)

8.3.6.3 Research Institutes

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biopharma Buffer Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Phosphate Buffers

8.4.4.2 Acetate Buffers

8.4.4.3 Citrate Buffers

8.4.4.4 Tris Buffers

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Protein Drug Production

8.4.5.2 Monoclonal Antibodies

8.4.5.3 Gene Therapy

8.4.5.4 Vaccine Production

8.4.5.5 Cell Culture

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Biopharmaceutical Companies

8.4.6.2 Contract Manufacturing Organizations (CMO)

8.4.6.3 Research Institutes

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biopharma Buffer Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Phosphate Buffers

8.5.4.2 Acetate Buffers

8.5.4.3 Citrate Buffers

8.5.4.4 Tris Buffers

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Protein Drug Production

8.5.5.2 Monoclonal Antibodies

8.5.5.3 Gene Therapy

8.5.5.4 Vaccine Production

8.5.5.5 Cell Culture

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Biopharmaceutical Companies

8.5.6.2 Contract Manufacturing Organizations (CMO)

8.5.6.3 Research Institutes

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biopharma Buffer Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Phosphate Buffers

8.6.4.2 Acetate Buffers

8.6.4.3 Citrate Buffers

8.6.4.4 Tris Buffers

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Protein Drug Production

8.6.5.2 Monoclonal Antibodies

8.6.5.3 Gene Therapy

8.6.5.4 Vaccine Production

8.6.5.5 Cell Culture

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Biopharmaceutical Companies

8.6.6.2 Contract Manufacturing Organizations (CMO)

8.6.6.3 Research Institutes

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biopharma Buffer Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Phosphate Buffers

8.7.4.2 Acetate Buffers

8.7.4.3 Citrate Buffers

8.7.4.4 Tris Buffers

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Protein Drug Production

8.7.5.2 Monoclonal Antibodies

8.7.5.3 Gene Therapy

8.7.5.4 Vaccine Production

8.7.5.5 Cell Culture

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Biopharmaceutical Companies

8.7.6.2 Contract Manufacturing Organizations (CMO)

8.7.6.3 Research Institutes

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Biopharma Buffer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.1 Billion |

|

Forecast Period 2024-32 CAGR: |

7.80 % |

Market Size in 2032: |

USD 2.16 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||