Global Biodegradable Pharmaceutical Packaging Market Synopsis

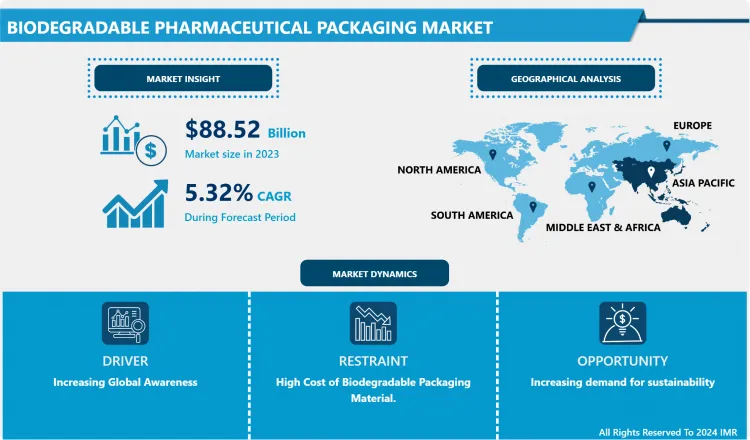

Biodegradable Packaging Market size was valued at USD 88.52 Billion in 2023 and is projected to reach USD 141.14 Billion by 2032, growing at a CAGR of 5.32% from 2024 to 2032.

Biodegradable pharmaceutical packaging refers to environmentally friendly materials used in the design and production of drug containers that can naturally break down into harmless components, reducing environmental impact. These packaging solutions utilize biodegradable polymers derived from renewable resources and decompose over time without leaving waste. Biodegradable pharmaceutical packaging contributes to a more sustainable approach to healthcare by lowering the environmental impact of conventional packaging materials and supporting eco-friendly activities. The market focuses on utilizing biodegradable materials for packaging drugs, reducing the ecological impact associated with traditional packaging. Advantages of biodegradable pharmaceutical packaging include its ability to break down naturally, mitigating pollution, and minimizing landfill waste. As the industry grows eco-friendly solutions, packaging materials contribute to the economy, supporting the principles of reducing, reusing, and recycling.

There is increasing adoption of bio-based polymers derived from renewable resources, such as corn starch and sugarcane, to create biodegradable pharmaceutical packaging. Manufacturers are innovating to enhance the performance and cost-effectiveness of these materials, ensuring they meet regulatory standards for drug packaging. The demand for biodegradable pharmaceutical packaging is growing both consumer preferences for sustainable products and regulatory initiatives promoting environmentally friendly practices in healthcare. The healthcare sector is growing greener practices, with collaboration between pharmaceutical companies and packaging manufacturers driving advancements in biodegradable packaging technologies for effective drug containment and reduced environmental impact.

.webp)

Biodegradable Pharmaceutical Packaging Market Trend Analysis:

Increasing Global Awareness

- There is increasing global awareness of the environmental impact of plastic waste in oceans and landfills, and consumers and regulatory bodies are promoting sustainable alternatives in various industries, including pharmaceuticals. Traditional plastic packaging in the pharmaceutical sector, due to its non-biodegradable nature, poses a significant threat to ecosystems and public health, intensifying the urgency to address plastic pollution. The Awareness of plastic waste's harmful effects on marine life and ecosystems has sparked a collective call for change. Consumers are now more informed and environmentally conscious, actively seeking pharmaceutical products packaged in materials that are biodegradable and eco-friendly.

- Pharmaceutical companies are adopting innovative biodegradable packaging solutions to meet evolving regulations and meet the expectations of a socially and environmentally responsible consumer base. The biodegradable pharmaceutical packaging market is expected to experience significant growth due to the global awareness of plastic pollution.

Increasing demand for sustainability

- The Biodegradable Pharmaceutical Packaging Market is growing due to rising demand for sustainability in the global environmental consciousness. The growing demand is raising awareness of the ecological impact of traditional packaging materials, prompting pharmaceutical companies to explore biodegradable alternatives. The pharmaceutical industry can capitalize on consumer preference for environmentally friendly products by implementing biodegradable packaging solutions.

- The trend is creating a strategic opportunity for companies operating in the Biodegradable Pharmaceutical Packaging Market to capitalize on the intersection of consumer values and industry practices. Pharmaceutical companies increasingly integrate sustainability into their core values, innovation, development of eco-friendly packaging materials and designs. The Biodegradable Pharmaceutical Packaging Market offers an opportunity for market players to meet regulatory and consumer expectations while gaining a competitive edge by positioning them as environmentally responsible contributors in the pharmaceutical supply chain.

Biodegradable Pharmaceutical Packaging Market Segment Analysis:

Biodegradable Pharmaceutical Packaging Market Segmented based on Product Type, Material, End User and Distribution Channel

By Product Type, Bags & Pouches segment is expected to dominate the market during the forecast Period

- Bags and pouches provide a flexible and lightweight option, accommodating a variety of pharmaceutical forms, including powders, granules, and liquid medications. Their user-friendly design and ease of portability make them a preferred choice for both consumers and manufacturers. The eco-friendly nature of biodegradable materials aligns with the trend toward sustainability, enhancing the appeal of Bags and pouches in the Biodegradable Pharmaceutical Packaging market. The prominence of this segment indicates the industry's recognition of the need for eco-friendly and convenient packaging solutions in the pharmaceutical sector.

Biodegradable Pharmaceutical Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The region's rapidly expanding pharmaceutical industry increasing healthcare needs and rising population create a substantial demand for innovative and sustainable packaging solutions. Pharmaceutical manufacturers in Asia Pacific are recognizing the strategic importance of adopting biodegradable packaging to comply with global sustainability trends. The Asia Pacific Biodegradable Pharmaceutical Packaging market is poised to dominate due to its commitment to eco-friendly practices and the evolving global landscape of responsible and sustainable packaging solutions. Economic growth and industrialization in countries such as China and India contribute to the demand for eco-friendly packaging alternatives. These nations are witnessing a surge in environmental awareness among consumers and a shift towards sustainable products, including biodegradable pharmaceutical packaging.

- Furthermore, the Asia Pacific region is a key player in the global supply chain, with many pharmaceutical companies and manufacturers based in this region. Production facilities are enhancing the accessibility and availability of biodegradable packaging materials, fostering their widespread adoption. The Asia Pacific Biodegradable Pharmaceutical Packaging market is going to dominate due to its commitment to eco-friendly practices and the evolving global landscape of responsible and sustainable packaging solutions.

Key Players Covered in Biodegradable Pharmaceutical Packaging Market:

- West Pharmaceutical Services (United States)

- WestRock (United States)

- Aptar Group Inc (United States)

- Bemis Company (United States)

- Berry Global (United States)

- Drug Plastics Group (United States)

- DS Smith (United Kingdom)

- Mondi Group(United Kingdom)

- Gerresheimer AG (Germany)

- Schott AG (Germany)

- Smurfit Kappa (Ireland)

- Amcor (Australia)

- Rengo (Japan), and Other Major Players

Key Industry Developments in the Biodegradable Pharmaceutical Packaging Market:

- In January 2023, Aptar Pharma, a division of AptarGroup, Inc., introduced APF Futurity, a metal-free nasal spray crafted from polyolefin materials integrated with recycling disruptors. This innovative product is designed with recyclability in mind, offering an easily recyclable solution for environmentally conscious consumers.

|

Biodegradable Pharmaceutical Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.32% |

Market Size in 2032: |

USD 141.14 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biodegradable Pharmaceutical Packaging Market by Product Type (2018-2032)

4.1 Biodegradable Pharmaceutical Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bottles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bags & Pouches

4.5 Sachets

4.6 Blisters

4.7 Vials & Ampoules

Chapter 5: Biodegradable Pharmaceutical Packaging Market by Material (2018-2032)

5.1 Biodegradable Pharmaceutical Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Paper & Paperboard

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Glass

5.5 Plastic

5.6 Metal

Chapter 6: Biodegradable Pharmaceutical Packaging Market by End User (2018-2032)

6.1 Biodegradable Pharmaceutical Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgery Centres

Chapter 7: Biodegradable Pharmaceutical Packaging Market by Distribution Channel (2018-2032)

7.1 Biodegradable Pharmaceutical Packaging Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct Sales

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Distributors

7.5 Wholesalers

7.6 Online Retailers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Biodegradable Pharmaceutical Packaging Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SHIPBOB (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HANDIFOX (US)

8.4 SKUSAVVY (US)

8.5 SHIPEDGE (US)

8.6 MANHATTAN ASSOCIATES (US)

8.7 INYXA (US)

8.8 EOSTAR (US)

8.9 K-STORE (UK)

8.10 VOXWARE (US)

8.11 ASC SOFTWARE (US)

8.12 BMOBILE ROUTE MOBILE SOFTWARE (US)

8.13 KENTUCKY (US)

8.14 CIRRUS TECH (US)

8.15 IVISION (US)

8.16 LIGHTNING PICK (US)

8.17 LUCAS SYSTEMS (US)

8.18 VEEQO (UK)

8.19 SCANDIT (SWITZERLAND)

8.20 ABB GROUP (SWITZERLAND)

8.21 BOLTRICS (NETHERLANDS)

8.22 TGW GROUP (AUSTRIA)

8.23 IPTOR (SWEDEN)

8.24 EUCLID LABS (ITALY) INCREFF (INDIA)

8.25 CALIDUS LLC (UAE)

8.26

Chapter 9: Global Biodegradable Pharmaceutical Packaging Market By Region

9.1 Overview

9.2. North America Biodegradable Pharmaceutical Packaging Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Bottles

9.2.4.2 Bags & Pouches

9.2.4.3 Sachets

9.2.4.4 Blisters

9.2.4.5 Vials & Ampoules

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Paper & Paperboard

9.2.5.2 Glass

9.2.5.3 Plastic

9.2.5.4 Metal

9.2.6 Historic and Forecasted Market Size by End User

9.2.6.1 Hospitals

9.2.6.2 Ambulatory Surgery Centres

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Direct Sales

9.2.7.2 Distributors

9.2.7.3 Wholesalers

9.2.7.4 Online Retailers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Biodegradable Pharmaceutical Packaging Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Bottles

9.3.4.2 Bags & Pouches

9.3.4.3 Sachets

9.3.4.4 Blisters

9.3.4.5 Vials & Ampoules

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Paper & Paperboard

9.3.5.2 Glass

9.3.5.3 Plastic

9.3.5.4 Metal

9.3.6 Historic and Forecasted Market Size by End User

9.3.6.1 Hospitals

9.3.6.2 Ambulatory Surgery Centres

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Direct Sales

9.3.7.2 Distributors

9.3.7.3 Wholesalers

9.3.7.4 Online Retailers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Biodegradable Pharmaceutical Packaging Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Bottles

9.4.4.2 Bags & Pouches

9.4.4.3 Sachets

9.4.4.4 Blisters

9.4.4.5 Vials & Ampoules

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Paper & Paperboard

9.4.5.2 Glass

9.4.5.3 Plastic

9.4.5.4 Metal

9.4.6 Historic and Forecasted Market Size by End User

9.4.6.1 Hospitals

9.4.6.2 Ambulatory Surgery Centres

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Direct Sales

9.4.7.2 Distributors

9.4.7.3 Wholesalers

9.4.7.4 Online Retailers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Biodegradable Pharmaceutical Packaging Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Bottles

9.5.4.2 Bags & Pouches

9.5.4.3 Sachets

9.5.4.4 Blisters

9.5.4.5 Vials & Ampoules

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Paper & Paperboard

9.5.5.2 Glass

9.5.5.3 Plastic

9.5.5.4 Metal

9.5.6 Historic and Forecasted Market Size by End User

9.5.6.1 Hospitals

9.5.6.2 Ambulatory Surgery Centres

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Direct Sales

9.5.7.2 Distributors

9.5.7.3 Wholesalers

9.5.7.4 Online Retailers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Biodegradable Pharmaceutical Packaging Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Bottles

9.6.4.2 Bags & Pouches

9.6.4.3 Sachets

9.6.4.4 Blisters

9.6.4.5 Vials & Ampoules

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Paper & Paperboard

9.6.5.2 Glass

9.6.5.3 Plastic

9.6.5.4 Metal

9.6.6 Historic and Forecasted Market Size by End User

9.6.6.1 Hospitals

9.6.6.2 Ambulatory Surgery Centres

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Direct Sales

9.6.7.2 Distributors

9.6.7.3 Wholesalers

9.6.7.4 Online Retailers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Biodegradable Pharmaceutical Packaging Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Bottles

9.7.4.2 Bags & Pouches

9.7.4.3 Sachets

9.7.4.4 Blisters

9.7.4.5 Vials & Ampoules

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Paper & Paperboard

9.7.5.2 Glass

9.7.5.3 Plastic

9.7.5.4 Metal

9.7.6 Historic and Forecasted Market Size by End User

9.7.6.1 Hospitals

9.7.6.2 Ambulatory Surgery Centres

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Direct Sales

9.7.7.2 Distributors

9.7.7.3 Wholesalers

9.7.7.4 Online Retailers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Biodegradable Pharmaceutical Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.32% |

Market Size in 2032: |

USD 141.14 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Biodegradable Pharmaceutical Packaging Market research report is 2024-2032.

The key players mentioned are Gerresheimer, Berry Plastics Corporation, DS Smith, Rengo, Bemis Company, Smurfit Kappa, Amcor.

Biodegradable pharmaceutical packaging refers to environmentally friendly materials used in the design and production of drug containers that can naturally break down into harmless components, reducing environmental impact. These packaging solutions utilize biodegradable polymers derived from renewable resources and decompose over time without leaving waste.