Big data as a Service Market Synopsis

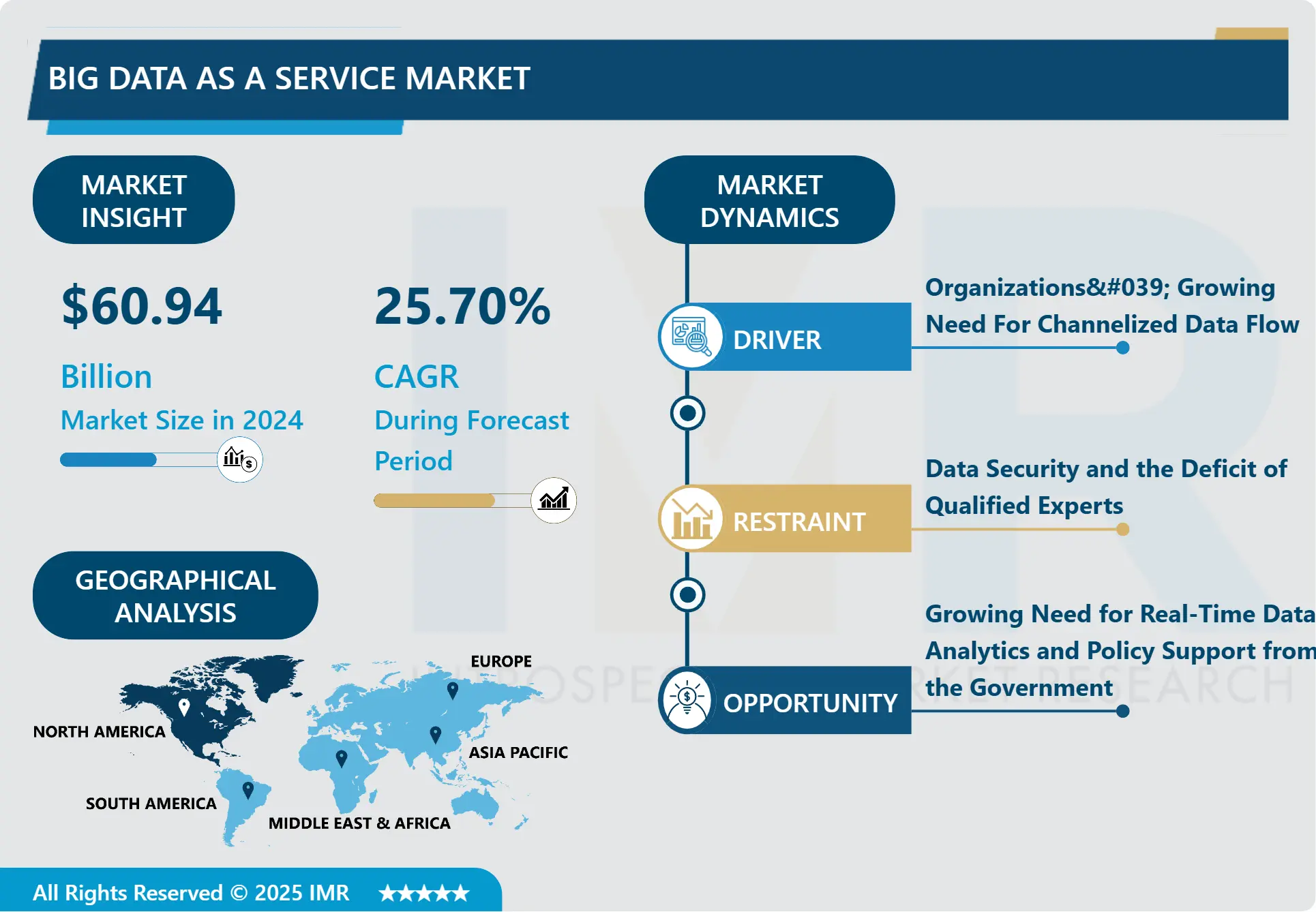

Big data as a Service Market Size is Valued at USD 60.94 Billion in 2024, and is Projected to Reach USD 379.83 Billion by 2032, Growing at a CAGR of 25.70% From 2025-2032.

BDaaS market can be described as the market of Big Data solutions that are provided through the cloud-computing platform with the main focus on the aspects of scalability and cost-efficiency on analysis and storage. BDaaS providers offer data management, processing, and analysis services which do not require enterprises to invest in related hardware or software; helping enterprises fulfil their flexible data needs. This market is being boosted by the rising data traffic, need for faster analysis, and a new trend of integrating cloud computing to improve operations and gain more insights.

Currently, the BDaaS market is growing fast due to the rising need for comprehensive and inexpensive solutions for Big Data handling. One of the significant actors of this segment is Driver, which provides versatile BDaaS services considering the specific features of various industries. Built on the cloud, Driver offers the enterprises efficient technologies to integrate, store, process and analyse massive data. Their services are for structured and unstructured data processing in an effort to allow the business to make valuable decisions within the shortest time possible.

Within the BDaaS space, dRiver’s services include real-time analysis, forecasting, and machine learning. Therefore, by tapping on dRiver’s deep understanding of the implementation of scalable infrastructure and protection of data and information, dDriver delivers solutions that meet the industry’s rules and requirements. As the requirements for the operational agility involving the data rises, Driver persists in developing the BDaaS solutions that provide organizations with customizable approaches to manage their data resources and turn them into the sources of competitive advantages in the modern digital environment.

Big data as a Service Market Trend Analysis

Driving Innovation through BDaaS, Trends and Future Outlook

- The future of the BDaaS market is vivid as the amount of data being produced in diverse industries keeps growing, and there is a need to manage such data effectively and at a reasonable cost. BDaaS allows the companies to handle petabytes of data and analyse them at the same time with no need to invest in hardware like in case of on-premises solutions. Such scalability is especially appealing to entities that use data analytics for planning, strategic, and management purposes.

- BDaaS market comprises key players that are introducing new services by focusing on such aspects as real-time analytics, AI-based data analysis, and advanced solutions in the sphere of data protection. The use of the cloud-based BDaaS solutions continues to grow around the world because the need for the innovative and flexible data management solutions for the digital business across the healthcare, finical/ banking, retail, and telecommunication industries among others is increasing steadily. Due to the current trend of organizations focusing on metrics and analytics to make informed decisions the BDaaS market has the potential to grow at a faster rate in future with predictions showing progressive growth and development in relation to data analytics services.

The Next Frontier, Exploring the Untapped Potential of BDaaS

- The market segment of Big Data as a Service (BDaaS) has a huge opportunity arising from the rising volumes, velocity, and variety of data produced across the business sectors. BDaaS solutions are designed at a large scale to provide an organization with a way to deal with large amounts of data without having to build up the same amount of internal hardware. Besides, it cuts the number of operations which in addition to saving operational costs it increases the flexibility of deals to better utilize the data gathered.

- Some factors explaining the BDaaS market development include the increased usage of the cloud services that provide any business with an opportunity to implement data services without high investments, such as the ones that are made by small enterprises. Also, incorporating intelligent technologies such as Artificial Intelligence and Machine Learning have increased the efficiency of BDaaS in developing innovative analytics mechanisms for organizations to drive more insights from their data. The growing importance of big data for the decision-making process in today’s companies ensures that the BDaaS market will have numerous opportunities for development in the future, covering the USA as well as other states, fields such as healthcare, finance, retail, and manufacturing. This constantly changing environment presents a lot of opportunities for BDaaS providers to develop and adapt to the changing customer needs as well as increase the market’s competitiveness.

Big data as a Service Market Segment Analysis:

Big data as a Service Market is Segmented on the basis of Solution type, Deployment Model, and end-users.

By Solution Type, Hadoop-As-A-Service segment is expected to dominate the market during the forecast period

- The Big Data as a Service (BDaaS) market comprises several solutions for various consumption types required by different organizations. Some are Hadoop as a Service which is another way of cost effective management of Hadoop clusters to dealing with large data sets. Today, a number of vendors have developed Data Analytics-as-a-Service platforms that provide enhanced, business-friendly analytical solutions. Moreover, Data-as-a-Service solutions give an opportunity to obtain the datasets and information that were chosen according to certain criteria and improve the rate of decision-making and organizational performance in various sectors. Altogether, all these BDaaS solutions will address the need for efficient and flexible data management and analytic solutions in today’s highly competitive environment.

By Deployment Model, Public Cloud segment held the largest share in 2024

- The Big Data as a Service (BDaaS) market deployment option are the Public Cloud that entails large data availability and shareable access to the infrastructure provided by third-party vendors based on large infrastructure. Private Cloud solutions ensure that the private corporation has exclusive use of the Cloud infrastructure and can safeguards the data being used in such organizations that strictly adheres to compliance regulations. Hybrid Cloud plays the role of keeping the necessary data in both the public and the private Cloud zones; at the same time, it allows choosing when the data transfer occurs based on the load or sensitivity. These deployment types allow the BDaaS solutions to be customized according to operational requirements and delivered on a scalable cloud architecture that reduces costs and can easily integrate with organizations’ existing IT environments.

Big data as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American BDaaS market has a great potential due to the excessive development of technological industries and the growing demand for advanced analytics in the region. Strengthened by a strong and quite saturated IT market, high connectivity, and continuing investments in cloud computing, North America is still one of the main markets worldwide. They are key to the faster growth of BDaaS, helping corporations find efficient and affordable methods of managing big data.

- While large enterprises such as IBM, Microsoft, and HP held substantial stakes in BDaaS in North America, several startups were intensively vying for the market with highly specific BDaaS solutions. When considering the core industries that rely on BDaaS to drive changes in operations, decision-making, and competitive advantage, key sectors include healthcare, finance, retail and telecommunication. Such market trends are only spurred further by new developments in artificial intelligence, machine learning, and data security, which will continue to support BDaaS innovation and growth in North America as a crucial regional market.

Active Key Players in the Big data as a Service Market

- Amazon Web Services Inc. (United States)

- Hewlett Packard Enterprise (United States)

- IBM Corporation (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- SAS Institute Inc. (United States)

- Teradata Corporation (United States)

- Google Inc. (United States)

- Accenture (Ireland)

- Salesforce (United States)

- Hitachi Vantara (United States)

- CenturyLink Inc. (United States)

- Wipro Limited (India)

- Snowflake Inc. (United States)

- Other Active Player

|

Global Big data as a Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 60.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.70 % |

Market Size in 2032: |

USD 379.83 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Type |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Big data as a Service Market by Solution Type (2018-2032)

4.1 Big data as a Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hadoop-as-a-Service

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Data Analytics-as-a-Service

4.5 Data-as-a-Service

Chapter 5: Big data as a Service Market by Deployment Type (2018-2032)

5.1 Big data as a Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private Cloud

5.5 Hybrid Cloud

5.6 End User

5.7 IT & Telecom

5.8 Food & Beverage

5.9 BFSI

5.10 Logistics

5.11 Healthcare

5.12 Defense

5.13 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Big data as a Service Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ACCENTURE PLC (IRELAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMAZON WEB SERVICES INC (UNITED STATES)

6.4 CHARLES RIVER SYSTEMS INC (UNITED STATES)

6.5 COGNOSYS TECHNOLOGIES (INDIA)

6.6 COSENTRY INC (UNITED STATES)

6.7 DATAPIPE INC (UNITED STATES)

6.8 DELL SECUREWORKS INC (UNITED STATES)

6.9 FIREHOST INC (UNITED STATES)

6.10 LINEDATA (FRANCE)

6.11 PEAK 10 INC (UNITED STATES)

6.12 SCALEMATRIX INC (UNITED STATES)

6.13 TRUSTWAVE HOLDINGS INC (UNITED STATES)

6.14 OTHERS ACTIVE KEY PLAYERS

Chapter 7: Global Big data as a Service Market By Region

7.1 Overview

7.2. North America Big data as a Service Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Solution Type

7.2.4.1 Hadoop-as-a-Service

7.2.4.2 Data Analytics-as-a-Service

7.2.4.3 Data-as-a-Service

7.2.5 Historic and Forecasted Market Size by Deployment Type

7.2.5.1 Public Cloud

7.2.5.2 Private Cloud

7.2.5.3 Hybrid Cloud

7.2.5.4 End User

7.2.5.5 IT & Telecom

7.2.5.6 Food & Beverage

7.2.5.7 BFSI

7.2.5.8 Logistics

7.2.5.9 Healthcare

7.2.5.10 Defense

7.2.5.11 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Big data as a Service Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Solution Type

7.3.4.1 Hadoop-as-a-Service

7.3.4.2 Data Analytics-as-a-Service

7.3.4.3 Data-as-a-Service

7.3.5 Historic and Forecasted Market Size by Deployment Type

7.3.5.1 Public Cloud

7.3.5.2 Private Cloud

7.3.5.3 Hybrid Cloud

7.3.5.4 End User

7.3.5.5 IT & Telecom

7.3.5.6 Food & Beverage

7.3.5.7 BFSI

7.3.5.8 Logistics

7.3.5.9 Healthcare

7.3.5.10 Defense

7.3.5.11 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Big data as a Service Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Solution Type

7.4.4.1 Hadoop-as-a-Service

7.4.4.2 Data Analytics-as-a-Service

7.4.4.3 Data-as-a-Service

7.4.5 Historic and Forecasted Market Size by Deployment Type

7.4.5.1 Public Cloud

7.4.5.2 Private Cloud

7.4.5.3 Hybrid Cloud

7.4.5.4 End User

7.4.5.5 IT & Telecom

7.4.5.6 Food & Beverage

7.4.5.7 BFSI

7.4.5.8 Logistics

7.4.5.9 Healthcare

7.4.5.10 Defense

7.4.5.11 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Big data as a Service Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Solution Type

7.5.4.1 Hadoop-as-a-Service

7.5.4.2 Data Analytics-as-a-Service

7.5.4.3 Data-as-a-Service

7.5.5 Historic and Forecasted Market Size by Deployment Type

7.5.5.1 Public Cloud

7.5.5.2 Private Cloud

7.5.5.3 Hybrid Cloud

7.5.5.4 End User

7.5.5.5 IT & Telecom

7.5.5.6 Food & Beverage

7.5.5.7 BFSI

7.5.5.8 Logistics

7.5.5.9 Healthcare

7.5.5.10 Defense

7.5.5.11 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Big data as a Service Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Solution Type

7.6.4.1 Hadoop-as-a-Service

7.6.4.2 Data Analytics-as-a-Service

7.6.4.3 Data-as-a-Service

7.6.5 Historic and Forecasted Market Size by Deployment Type

7.6.5.1 Public Cloud

7.6.5.2 Private Cloud

7.6.5.3 Hybrid Cloud

7.6.5.4 End User

7.6.5.5 IT & Telecom

7.6.5.6 Food & Beverage

7.6.5.7 BFSI

7.6.5.8 Logistics

7.6.5.9 Healthcare

7.6.5.10 Defense

7.6.5.11 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Big data as a Service Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Solution Type

7.7.4.1 Hadoop-as-a-Service

7.7.4.2 Data Analytics-as-a-Service

7.7.4.3 Data-as-a-Service

7.7.5 Historic and Forecasted Market Size by Deployment Type

7.7.5.1 Public Cloud

7.7.5.2 Private Cloud

7.7.5.3 Hybrid Cloud

7.7.5.4 End User

7.7.5.5 IT & Telecom

7.7.5.6 Food & Beverage

7.7.5.7 BFSI

7.7.5.8 Logistics

7.7.5.9 Healthcare

7.7.5.10 Defense

7.7.5.11 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Big data as a Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 60.94 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.70 % |

Market Size in 2032: |

USD 379.83 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Type |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||