Bean Ingredients Market Synopsis

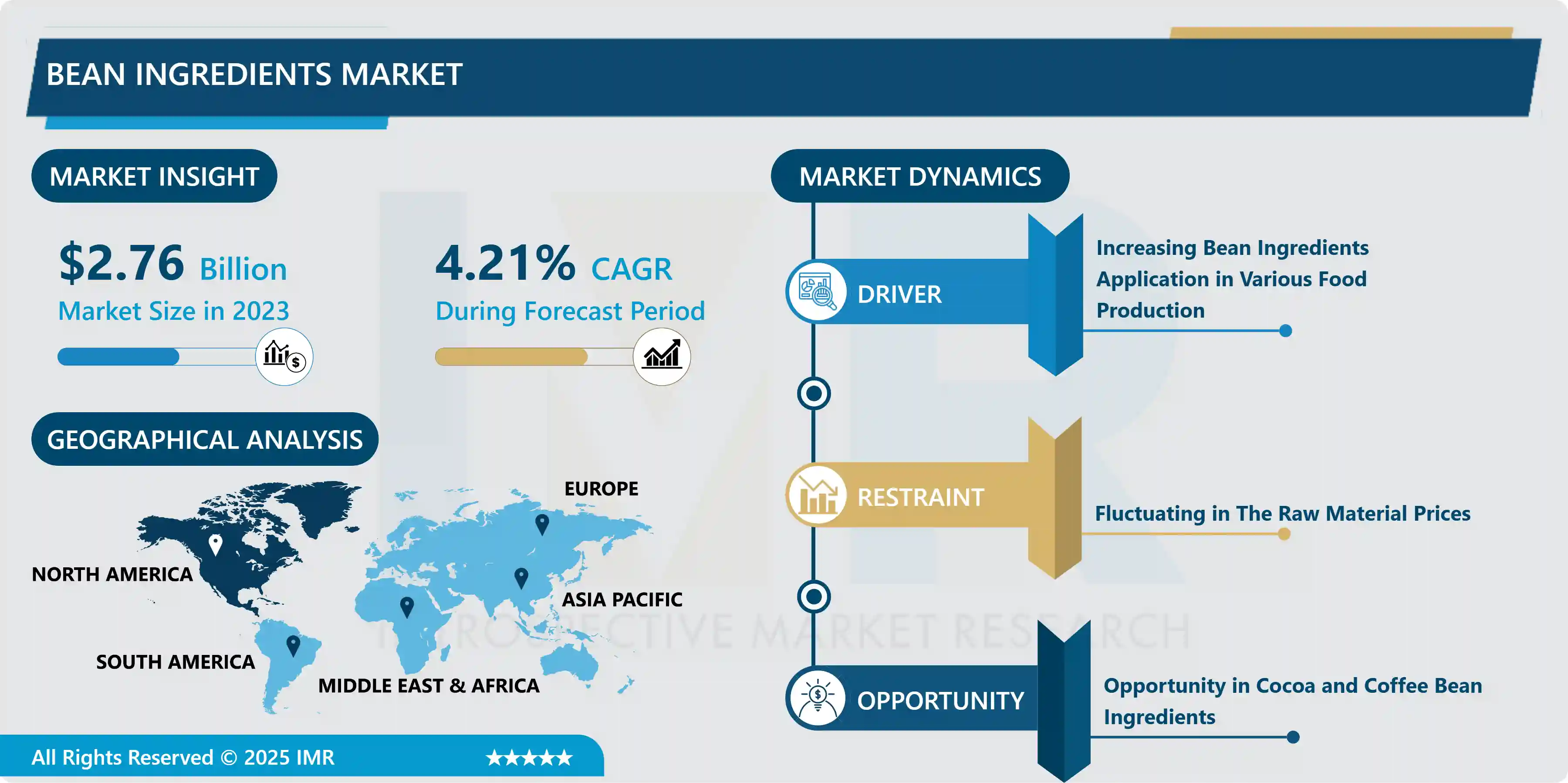

Bean Ingredients Market Was Valued at USD 2.76 Billion in 2023 and is Projected to Reach USD 4.36 Billion by 2032, Growing at a CAGR of 4.21% from 2024 to 2032.

Bean ingredients are one of the most cost-effective and environmentally friendly sources of protein. It is regarded as a healthy food because of its high fiber, low fat, and nutrients like iron and folic acid.

The minerals included in beans, such as calcium, potassium, magnesium, folate, and antioxidants, are important for overall health. Bean components are utilized in a variety of processes, including those that produce coffee flour, chocolate, and other organic foods. Many suppliers offer organic, gluten-free, and allergen-free beans, which are quite healthy. The industry that makes coffee is where materials from beans are most commonly used. The market for bean ingredients is expanding significantly and, it is expected to expand more.

The most cost-effective and nutritious sources of protein are found in beans. Iron, folic acid, and low-fat, high-fiber nutrients are found in beans. The increased use of beans in the creation of various organic foods, chocolate, and coffee flour is driving the need for bean-based components. The production of gluten-free, allergen-free, and organic bean ingredients which are not only good for health but are also rich in nutritional value, including antioxidants, calcium, potassium, magnesium, and folate which has been made possible by consistent product improvements and moderations in response to consumer needs.

The Bean Ingredients Market Trend Analysis

Increasing Bean Ingredients Application in Various Food Production

-

The increase in the application of beans due to their convenient consumption and high nutritional content is boosting the growth of the bean ingredients market. The increase in demand for coffee and cocoa products is supplementing the upsurge in the production of bean ingredients. This is attributed due to the easy availability, and affordability of the bean ingredients, thereby driving the growth of the market.

- The demand for bean ingredients is driven by their rise in application in various organic food production, chocolate, as well as coffee flour production. Consistent product improvements and moderations as per the consumer needs have given increase to the production of gluten-free, allergen-free, and organic bean ingredients, which are not just beneficial for health but are also rich in nutritional value, including antioxidants, potassium, magnesium, folate, and calcium which drives the growth of the market.

- Moreover, continuous technological advancements are remarkably replacing the conventional and high-cost methods of bean ingredient processing, which is emerging as an opportunity for manufacturers. With the rising demand for bean ingredients, the market is expected to boost in the coming years.

Opportunity in Cocoa and Coffee Bean Ingredients

-

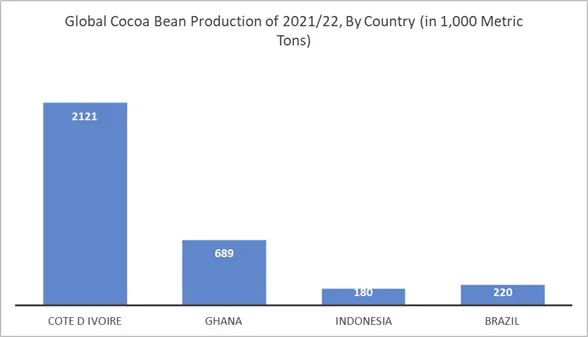

Most of the global bean raw material is collected from coffee and cocoa beans, which gives major market players the opportunity to increase production in them. Due to the growing global demand for coffee, the coffee powder was made from coffee beans. Cocoa beans are widely used in various products such as cocoa butter, cosmetics, soaps, moisturizing creams, and emulsions. Thus, the health and beauty benefits of coffee and cocoa encourage customers to develop strong demands for it.

- These growing applications for coffee and cocoa beans are driving global bean ingredient production. For instance, according to Statista, the production of cocoa beans of by country in the crop year 2021/2022, about 2.1 million metric tons of cocoa beans were produced in Côte d'Ivoire.

- Moreover, the presence of major key players in the dean ingredients market drives the growth of the market. The launch of the new product by manufacturers has penetrated the market in compliance with different consumer demands. The demand for beans has been significantly increasing, due to the nutritional benefits they offer, such factors create growth opportunities for the growth of the market.

Segmentation Analysis of The Bean Ingredients Market

Bean ingredients market segments cover the Type, Ingredient Type, End-Use Industry, and Distribution Channel. By Type, the Organic Bean Ingredients segment is anticipated to dominate the Market Over the Forecast period.

- Organic beans are produced and processed without the use of synthetic fertilizers and pesticides. Increasing consumer awareness of the health benefits of organic products and a preference for natural products with fewer chemicals and additives are rising the demand for organic bean ingredients products. Nowadays consumers are becoming more interested in organic and natural foods due to health issues such as diabetes, high blood pressure, obesity, and other diseases which are driving them to live healthier lifestyles. Henceforth, functional foods containing plant-based proteins, such as organic protein-based products, are more appealing to them which drives the demand for organic bean ingredients.

- The organic Bean Ingredients provide the same nutritional content as nonorganic beans; however, they are grown without the use of synthetic fertilizers or chemical pesticides. Additionally, organic farming is designed to promote soil fertility and reduce pollution as well as concern water and energy. This makes them an ideal choice for health-conscious individuals who wish to provide their bodies with nutrients free from chemicals or adulterants. Furthermore, consuming organic beans may help reduce exposure to certain toxins which can lead to long-term illnesses such as cancer or diabetes.

Regional Analysis of The Bean Ingredients Market

North America is Expected to Dominate the Bean Ingredients Market Over the Forecast Period.

- North America is known for its high consumption of beans, which is a major factor contributing to the dominance of this region. Beans are an important part of the North American diet, and their high protein and fiber content make them a popular ingredient in many foods. The North American population is becoming increasingly health conscious and the demand for healthy and natural foods is increasing. The bean is considered a healthy and natural ingredient, which increases the demand for beans in the region. Additionally, due to the growing trend of veganism and plant-based diets, the demand for plant-based ingredients in food is increasing. Beans are a popular ingredient in vegan and plant-based products, increasing the demand for beans in the region.

- North American governments have enacted favorable regulations to promote the use of natural and healthy ingredients in food. This led to increased production and consumption of beans in the region. Moreover, the North American region has a favorable climate for growing beans, and raw materials for the manufacture of beans are constantly ensured. This made it easier for manufacturers to produce bean ingredients in the region, leading to a dominant position in the market during the forecast period.

Top Key Players Covered in The Bean Ingredients Market

- Archer Daniels Midland Company (US)

- Cargill Incorporated (US)

- Mara Global Foods (Australia)

- Olam International (Singapore)

- Vermont Bean Crafters (US)

- Inland Empire Foods (US)

- BENEO(Germany)

- Faribault Foods, Inc. (US)

- Better Bean (US)

- Globeways Canada Inc (Canada), and Other Major Players

Key Industry Developments in the Bean Ingredients Market

- In May 2024 – Roquette, a global leader in plant-based ingredients, announced the launch of NUTRALYS® Fava S900M fava bean protein isolate in Europe and North America – the latest addition and first protein isolate derived from fava bean in Roquette’s NUTRALYS® plant protein range. Delivering 90% protein content across various applications, including meat substitutes, non-dairy alternatives, and baked goods, NUTRALYS® Fava S900M also offers a clean taste, light color, and functional excellence.

- In November 2022, BENEO Showcases New Faba Bean Ingredients. The new faba bean protein concentrate and starch-rich flour at the IFT Food Expo. Themed “Rooted in Nature the Power of Plants,” visitors will learn how faba bean ingredients are providing food manufacturers with innovative opportunities for texture improvement in meat and dairy alternatives as well as protein enrichment in a vast array of foods.

|

Bean Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.76 Billion |

|

Forecast Period 2024-32 CAGR: |

4.21 % |

Market Size in 2032: |

USD 4.36 Billion |

|

|

By Type |

|

|

|

By Ingredient Type |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bean Ingredients Market by Type (2018-2032)

4.1 Bean Ingredients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic Bean Ingredients

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Conventional Bean Ingredients

4.5 Gluten-free

4.6 Allergen-free

Chapter 5: Bean Ingredients Market by Ingredient Type (2018-2032)

5.1 Bean Ingredients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flour

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Protein

Chapter 6: Bean Ingredients Market by End-Use Industry (2018-2032)

6.1 Bean Ingredients Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Processed Food Production

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Coffee-Based Products

6.5 Cocoa-Based Products

6.6 Others

Chapter 7: Bean Ingredients Market by Distribution Channel (2018-2032)

7.1 Bean Ingredients Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarket and Hypermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience Store

7.5 Online Store

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bean Ingredients Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NESTLE (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 COFFEE-MATE (U.S)

8.4 INTERNATIONAL DELIGHT (U.S)

8.5 WHITEWAVE (U.S)

8.6 CAPRIMO (SWEDEN)

8.7 NUTPODS (U.S)

8.8 YEARRAKARN (BANGKOK)

8.9 CALIFIA FARMS (U.S)

8.10 BIGTREE GROUP (U.S)

8.11 GREAT VALUE (U.S)

8.12 DUNKIN' DONUTS (U.S)

8.13 STARBUCKS (U.S)

8.14 CUSTOM FOOD GROUP (MALAYSIA)

8.15 MAXWELL HOUSE (U.S)

8.16 HILLS BROS (U.S)

Chapter 9: Global Bean Ingredients Market By Region

9.1 Overview

9.2. North America Bean Ingredients Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Organic Bean Ingredients

9.2.4.2 Conventional Bean Ingredients

9.2.4.3 Gluten-free

9.2.4.4 Allergen-free

9.2.5 Historic and Forecasted Market Size by Ingredient Type

9.2.5.1 Flour

9.2.5.2 Protein

9.2.6 Historic and Forecasted Market Size by End-Use Industry

9.2.6.1 Processed Food Production

9.2.6.2 Coffee-Based Products

9.2.6.3 Cocoa-Based Products

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Supermarket and Hypermarket

9.2.7.2 Convenience Store

9.2.7.3 Online Store

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bean Ingredients Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Organic Bean Ingredients

9.3.4.2 Conventional Bean Ingredients

9.3.4.3 Gluten-free

9.3.4.4 Allergen-free

9.3.5 Historic and Forecasted Market Size by Ingredient Type

9.3.5.1 Flour

9.3.5.2 Protein

9.3.6 Historic and Forecasted Market Size by End-Use Industry

9.3.6.1 Processed Food Production

9.3.6.2 Coffee-Based Products

9.3.6.3 Cocoa-Based Products

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Supermarket and Hypermarket

9.3.7.2 Convenience Store

9.3.7.3 Online Store

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bean Ingredients Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Organic Bean Ingredients

9.4.4.2 Conventional Bean Ingredients

9.4.4.3 Gluten-free

9.4.4.4 Allergen-free

9.4.5 Historic and Forecasted Market Size by Ingredient Type

9.4.5.1 Flour

9.4.5.2 Protein

9.4.6 Historic and Forecasted Market Size by End-Use Industry

9.4.6.1 Processed Food Production

9.4.6.2 Coffee-Based Products

9.4.6.3 Cocoa-Based Products

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Supermarket and Hypermarket

9.4.7.2 Convenience Store

9.4.7.3 Online Store

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bean Ingredients Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Organic Bean Ingredients

9.5.4.2 Conventional Bean Ingredients

9.5.4.3 Gluten-free

9.5.4.4 Allergen-free

9.5.5 Historic and Forecasted Market Size by Ingredient Type

9.5.5.1 Flour

9.5.5.2 Protein

9.5.6 Historic and Forecasted Market Size by End-Use Industry

9.5.6.1 Processed Food Production

9.5.6.2 Coffee-Based Products

9.5.6.3 Cocoa-Based Products

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Supermarket and Hypermarket

9.5.7.2 Convenience Store

9.5.7.3 Online Store

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bean Ingredients Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Organic Bean Ingredients

9.6.4.2 Conventional Bean Ingredients

9.6.4.3 Gluten-free

9.6.4.4 Allergen-free

9.6.5 Historic and Forecasted Market Size by Ingredient Type

9.6.5.1 Flour

9.6.5.2 Protein

9.6.6 Historic and Forecasted Market Size by End-Use Industry

9.6.6.1 Processed Food Production

9.6.6.2 Coffee-Based Products

9.6.6.3 Cocoa-Based Products

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Supermarket and Hypermarket

9.6.7.2 Convenience Store

9.6.7.3 Online Store

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bean Ingredients Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Organic Bean Ingredients

9.7.4.2 Conventional Bean Ingredients

9.7.4.3 Gluten-free

9.7.4.4 Allergen-free

9.7.5 Historic and Forecasted Market Size by Ingredient Type

9.7.5.1 Flour

9.7.5.2 Protein

9.7.6 Historic and Forecasted Market Size by End-Use Industry

9.7.6.1 Processed Food Production

9.7.6.2 Coffee-Based Products

9.7.6.3 Cocoa-Based Products

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Supermarket and Hypermarket

9.7.7.2 Convenience Store

9.7.7.3 Online Store

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Bean Ingredients Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.76 Billion |

|

Forecast Period 2024-32 CAGR: |

4.21 % |

Market Size in 2032: |

USD 4.36 Billion |

|

|

By Type |

|

|

|

By Ingredient Type |

|

||

|

By End-Use Industry |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||