Global Automotive Keyless Entry System Market Overview

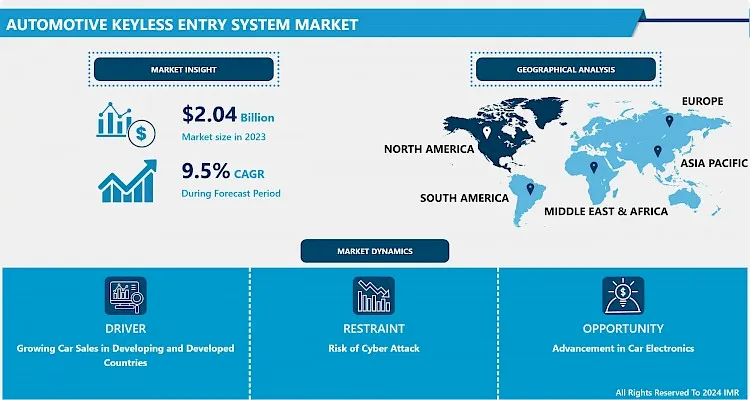

Global Automotive Keyless Entry System Market was valued at USD 2.04 Billion in 2023 and is expected to reach USD 4.62 Billion by the year 2032, at a CAGR of 9.5%.

The automobile keyless access system is an electronic lock that allows a vehicle's owner to obtain physical entry and unlock and lock the car without the need for a traditional mechanical key. The automotive keyless entry system secures access to the car by employing biometric scanning, electronic locks, radio frequency identification locks, and Bluetooth unlocking systems. The most popular method for gaining keyless entry into a car is to send a radio frequency signal from a distant transmitter to a control module/receiver in the vehicle. This radio frequency signal, or RF for short, is transferred to the automobile as an encrypted data stream. Furthermore, the global vehicle keyless access system business, particularly in Germany and the United States, is quickly expanding. Furthermore, rising vehicle sales in developing economies, the convenience of keyless entry systems, and increasing regulatory regulations focusing on vehicular safety are expected to drive demand for automotive keyless access systems throughout the projected period.

.webp)

Market Dynamics and Factors:

Drivers

Growing car sales in developing and developed countries.

- Growing car sales, as well as rising safety and security concerns, particularly in emerging nations, are the primary drivers of market expansion. Advanced applications for the keyless entry control system include safety features such as opening the tailgate, front and rear seat settings, tire pressure monitoring systems, automobile alarms, light control, and multimedia file storage. Additionally, strict automobile safety requirements such as the Canadian Motor Vehicle Safety Standards, the Bharat New Car Assessment Program (BNCAP), and the Federal Motor Vehicle Safety Standards are in place (FMVSS). As a result, the use of automotive keyless vehicle entry systems is predicted to increase, supporting market growth over the forecast period.

Rising installation of keyless entry systems in commercial vehicles.

- The rising advancement in add-on technological features in commercial vehicles boosting the automotive keyless entry system market. The need for keyless entry systems in goods transport vehicles, as well as supply chain trucks and vans, provide a promising application. Many commercial vehicles are now installing keyless entry systems in the vehicle to easy and quick access while delivering the goods and services. Therefore, it is estimated to be boosting the automotive keyless entry system market.

Restraints

- Over the last two decades, passenger automobiles and commercial vehicles have evolved from mechanical to electronically controlled machines. The data transfer between these keyless entry devices and the car is often powered by an RF or Bluetooth signal, which raises the danger of cyberattack. Furthermore, the customer finds it difficult to adjust to the keyless access system, and the cost of repair and maintenance is quite expensive; all of these primary concerns function as market restrictions.

Opportunities

- With the advancement of car electronics, manufacturers were able to build the contemporary ignition system and convert it to a push-button system. This system is linked to an ignition system that uses signals from the key fob to turn on the car. Over the predicted period, such high-end systems will change the automobile sector. Keyless entry access systems are being significantly invested in by major automotive manufacturers. Many automotive manufacturers are introducing new models, as well as updated versions of existing ones, that have keyless entry access system technology. Renault, for example, introduced a new version of the Duster featuring keyless entry technology in March 2020. The remote engine start feature also allows activating the air conditioning before getting inside the car. Kia and Hyundai, two South Korean automakers, are investing in research and development for the Keyless Entry Access System. Kia introduced the Carnival with a keyless entry system in February 2020, while Hyundai introduced a new version of the Creta with a keyless entry system in March 2020.

Challenges

- Although a keyless entry system provides convenience to owners of the vehicles to access the vehicles remotely, a certain challenging factor can affect the market adversely. The repair and replacement costs are relatively higher as the chips and sensors involved in the system are not cost-efficient at all. The biggest hurdle to getting keyless entry and starting with the vehicle is the pricing. If the keyless entry doesn't come with most of the vehicle, the aftermarket kit has to install special modules into the vehicle to enable the feature. The replacement can get pricey as well due to the unique nature of the transponder codes. Reprogramming a key fob is much pricier than re-cutting and re-coding a key.

Market Segmentation

- By Product, Remote Keyless Entry Systems dominate the Automotive Keyless Entry System Market. Because of greater security, better access control, and high convenience, the RKES category dominates the market. End-users prefer it, and it's found in a wide range of automobiles, including budget and premium vehicles. Remote keyless entry is a car security access solution that uses digital keys stored on a mobile phone to operate. The app allows the user to access the car and start the engine. Passive keyless entry is an automobile security system that activates and unlocks the vehicle doors when a user with a key approaches the system's operation region around the vehicle. It also allows the start of a vehicle with only a push of a button and without having to be put into the vehicle. In addition, the segment's growth will be fueled by its lower cost than PKES and greater functionality over standard keys throughout the projection period.

- By Application, Passenger cars are dominating in the application segment of the Automotive Keyless Entry System Market. The keyless entry feature in the passenger vehicle is a value-adding feature which allow allows convenience to the owner of the vehicle. Most of the brand's premium includes the keyless entry system. Rising automation in the passenger vehicles lures in the larger potential customers which demands the extra specifications and value-adding technologies in the car. Therefore, the automobile manufacturer is constantly investing in developing such technology which can add technological competitiveness to the market. A growing number of automobile owners can also boost the aftermarket automotive keyless entry systems.

Players Covered in Automotive Keyless Entry System market are :

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Continental AG

- ALPS ALPINE CO. LTD

- Mitsubishi Electric Corporation

- Valeo S.A

- Microchip Technology Inc

- Robert Bosch GmbH

- NXP Semiconductors and others major layers.

Regional Analysis of Automotive Keyless Entry System Market

- North America is dominating the Automotive Keyless Entry System Market. Because of growing purchasing power parity (PPP), greater involvement of the area's main automotive businesses, and suitable technical infrastructure, the North American region generates higher demand for vehicle keyless entry systems. The OEMs and aftermarket options are equally adopted customers, especially in the United States and Canada. Furthermore, the United States, Mexico, and Canada account for the majority of the market's income. Furthermore, rising internet penetration and an increase in the number of smartphone users are propelling the automobile sector forward, further boosting market expansion.

- Due to the implementation of severe safety requirements, rising penetration of expensive automobiles, and key companies such as Mitsubishi Electric, Continental AG, Alps Automotive Inc., and Denso Corporation, Asia Pacific is likely to emerge as the most profitable regional market. Over the projection period, rising markets such as India, Japan, South Korea, and China will fuel market expansion. Furthermore, with a CAGR of 12.4% between 2021 and 2028, Europe is predicted to become the second-fastest-growing industry in terms of growth. Furthermore, modern car safety features like intrusion alarms, theft assist, keyless entry, and others are being adopted by nations in the Rest of the World (RoW), which is fuelling the market's growth.

Key Industry Developments in the Global Automotive Keyless Entry System Market

- In September 2023, Autonomy, the largest electric vehicle subscription company in the U.S., and EV Mobility, LLC, the leading all-electric vehicle car-sharing platform, announced a strategic agreement. Under this deal, Autonomy will acquire the technology, assets, and customer accounts of EV Mobility upon the fulfillment of certain conditions. The acquisition aims to enhance access to electric vehicles for individuals with a valid driver's license, credit card, and smartphone, offering flexible vehicle access on an hourly, daily, weekly, monthly, or annual basis to a broader market.

- June 2021, HELLA launches digital car key with ultra-wideband technology, this new technology offers the greatest possible convenience using completely hands-free, smartphone-based vehicle access with the highest safety.

|

Global Automotive Keyless Entry System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.5% |

Market Size in 2032: |

USD 4.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Keyless Entry System Market by Type (2018-2032)

4.1 Automotive Keyless Entry System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passive Keyless Entry Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Remote Keyless Entry Systems Fast

Chapter 5: Automotive Keyless Entry System Market by Application (2018-2032)

5.1 Automotive Keyless Entry System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Automotive Keyless Entry System Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 NESTLE S.ANUTRASTAR MANUFACTURING LTDSUPPLEMENT FACTORY LTDPROCAPS GROUP

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SANTA CRUZ NUTRITIONALS

6.4 BETTER NUTRITIONALS

6.5 AMAPHARM

6.6 HERBALAND CANADA

6.7 VITUX AS

6.8 BOSCOGEN INCLEXICARE PHARMA PVT. LTDBETTERA BRANDS LLC

6.9 VITAKEM NUTRACEUTICAL INCNATURE'S TRUTH

6.10 PRIME HEALTH LTDAJES PHARMACEUTICALS LLC

6.11 LACTONOVA

6.12 WELL ALIMENTS

6.13 SMPNUTRA

6.14 SUPERIOR SUPPLEMENT MANUFACTURING

6.15 ALLSEPS PTY. LTDBAYER AG

Chapter 7: Global Automotive Keyless Entry System Market By Region

7.1 Overview

7.2. North America Automotive Keyless Entry System Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Passive Keyless Entry Systems

7.2.4.2 Remote Keyless Entry Systems Fast

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Passenger Cars

7.2.5.2 Commercial Vehicles

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Automotive Keyless Entry System Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Passive Keyless Entry Systems

7.3.4.2 Remote Keyless Entry Systems Fast

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Passenger Cars

7.3.5.2 Commercial Vehicles

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Automotive Keyless Entry System Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Passive Keyless Entry Systems

7.4.4.2 Remote Keyless Entry Systems Fast

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Passenger Cars

7.4.5.2 Commercial Vehicles

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Automotive Keyless Entry System Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Passive Keyless Entry Systems

7.5.4.2 Remote Keyless Entry Systems Fast

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Passenger Cars

7.5.5.2 Commercial Vehicles

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Automotive Keyless Entry System Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Passive Keyless Entry Systems

7.6.4.2 Remote Keyless Entry Systems Fast

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Passenger Cars

7.6.5.2 Commercial Vehicles

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Automotive Keyless Entry System Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Passive Keyless Entry Systems

7.7.4.2 Remote Keyless Entry Systems Fast

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Passenger Cars

7.7.5.2 Commercial Vehicles

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Automotive Keyless Entry System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.5% |

Market Size in 2032: |

USD 4.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||