Automated Drug Kiosk Market Synopsis:

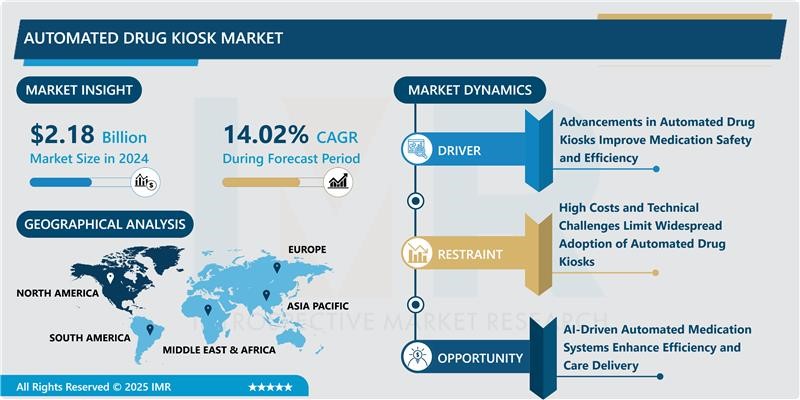

Automated Drug Kiosk Market Size Was Valued at USD 2.18 Billion in 2024, and is Projected to Reach USD 6.23 Billion by 2032, Growing at a CAGR of 14.02% from 2025-2032.

Automated drug kiosks represent advanced self-service medication dispensing units that employ computer-controlled systems to perform efficient medication processing and delivery functions. These systems that operate with pharmacist supervision go by the name of self?serve drug kiosks while containing pre-loaded packaged medicines inside. These units' Operational accuracy improves through integrating systems that use facial recognition and biometric data, medication image capture technology, and barcode readers. The pharmacies' kiosks execute prescription verifications, insurance operations, and automated labeling functions alongside data collection while lowering operational delays and removing errors in the process.

The global automated drug kiosk market is expanding rapidly, with promising opportunities in the retail pharmacy and hospital & clinic sectors. Emerging countries experience a growing interest in automated drug kiosks because they need accessible and cost-effective healthcare solutions priority. The market continues to grow which demonstrates its ability to revolutionize global healthcare delivery because healthcare providers need to deliver personalized efficient secure medication management services.

Automated Drug Kiosk Market Growth and Trend Analysis:

Growth Driver

Advancements in Automated Drug Kiosks Improve Medication Safety and Efficiency

-

The adoption of automated drug kiosks has been increasing due to advancements in technology that enhance medication safety, efficiency, and accuracy. The implementation of Automated dispensing machines (ADMs) as well as automated dispensing cabinets (ADCs) and robotic original pack dispensing systems prevents medication errors by verifying the appropriate drugs and doses and correct delivery timing for patients. Such systems replace traditional dispensing approaches through their workflow optimization capabilities which redirect pharmacists toward providing better care services.

- The integration with digital health systems through computerized physician order entry (CPOE) and computerized medication administration records (CMARs) established better tracking capabilities and cut down medication distribution discrepancies. The growth of decentralized and point-of-care systems provides healthcare professionals with both quick and secure drug administration capabilities. Multiple studies demonstrate automated dispensing technologies reduce medication errors through their main applications in the preparation and administration phases. The robotic dispensing systems track medication usage with accuracy which results in improved inventory management and decreased medication waste. The combination of these changes delivers an effective and economical system that focuses on patient needs in medication management.

High Costs and Technical Challenges Limit Widespread Adoption of Automated Drug Kiosks

-

The most substantial drawback of automated drug kiosks appears as their exorbitant installation expenses alongside routine support costs. Small healthcare facilities together with pharmacies find it difficult to purchase these systems which hinders their adoption. The integration of automated drug kiosks with existing healthcare software normally presents problems that demand specialized technical knowledge. Effective utilization of automated systems by healthcare professionals requires both time and financial resources for training purposes. Automated medication dispensers face breakdowns and technical problems that interfere with drug delivery systems thus endangering patient healthcare.

AI-Driven Automated Medication Systems Enhance Efficiency and Care Delivery

-

Systems that dispense medications automatically reduce the errors that occur through human involvement during distribution. The world needs decentralized healthcare solutions and automated systems at this current time. AI along with machine learning technology helps produce new methods to boost system operational efficiency. Through these systems, pharmacists can concentrate more energy on delivering quality care. Achieving economic benefits alongside improved inventory systems provides organizations with compelling reasons to start using these systems.

Regulatory, Security, and Resistance Challenges Slow Adoption of Automated Drug Kiosks

-

The evaluation requirements from regulatory bodies make automated drug kiosks reach the market at a slower pace. Data security together with patient privacy constitute substantial barriers to the successful adoption of digital healthcare. Healthcare professionals who prefer manual dispensing show resistance which blocks the adoption of automated dispensing systems. The implementation and maintenance of automated drug kiosks require constant financial commitment and technical assistance. Different healthcare institutions face significant challenges in implementing unified system practices

Automated Drug Kiosk Market Segment Analysis:

Automated Drug Kiosk Market is segmented based on Application, Type, End-Users, Technology, Region

By Type, Standalone kiosks Segment is Expected to Dominate the Market During the Forecast Period

-

Standalone kiosks dominate the Global Automated Drug Kiosk Market due to their superior convenience, accessibility, and comprehensive functionality. One reason automated drug dispensing prefers robots is their independence to work in pharmacies together with hospitals as well as remote healthcare settings. Widespread market adoption of automated drug dispensing systems occurs because of their ability to engage patients directly while providing cost-effective solutions for treating growing chronic disease cases.

- Pharmacy kiosks lead to faster drug distribution while helping patients follow their medication plan effectively and boost healthcare operational processes. The round-the-clock availability of these kiosks provides constant access to necessary medicines, especially for underprivileged communities and busy medical locations. The combination of AI prescription verification with secure dispensing technologies through advanced technologies enhances kiosks both in reliability and customer attraction levels. The healthcare industry relies on standalone kiosks to lead innovation and market dominance since they provide scalable and efficient dispensing solutions.

By Application, Touchscreen Interface Segment Held the Largest Share in the projected period

-

The Touchscreen Interface segment is expected to dominate the Global Automated Drug Kiosk Market during the forecast period. The fundamental impact of touchscreens drives the improvement of patient care through better interaction methods automated drug distribution technologies and greater accessibility across different demographic groups. The touchscreen user interface operates as the main interface of the kiosks to provide patients with a convenient way to manage prescriptions and payment processes and view dosage information.

- The adoption of advanced touchscreen technologies has become widespread due to the growing healthcare industry's need for user-friendly healthcare solutions. The market position of these kiosks received additional strength due to their integration with artificial intelligence guidance and their support of multiple languages and accessibility features.

Automated Drug Kiosk Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is expected to continue dominating the Automated Drug Kiosk Market over the forecast period, driven by a combination of advanced technological developments and robust healthcare infrastructure. Healthcare-focused innovations and modern pharmacy delivery system requirements in this region create a growing market demand for automated drug kiosks.

- Market leaders are actively developing new kiosks because consumers need better methods to obtain efficient and secure medication at their convenience. The implementation of multiple digital payment systems as well as touchscreen interfaces and telemedicine interfaces across North America has strengthened market growth. The North American market will maintain its robust leadership position in healthcare delivery because providers and pharmacies dedicate efforts to patient interaction improvement and medication accessibility improvements through dispensing automation.

Automated Drug Kiosk Market Active Players:

-

Accu Chart Plus Healthcare Systems, Inc. (USA)

- AmerisourceBergen Corporation (USA)

- ARxIUM (Canada)

- Asteres Inc. (USA)

- Capsa Healthcare (USA)

- Diebold Nixdorf (USA)

- Distributed Delivery Networks Corp. (USA)

- MC HealthGrid Pvt Ltd. (India)

- MedAvail Technologies, Inc. (USA)

- MedifriendRx (USA)

- Omnicell, Inc. (USA)

- OnMed (USA)

- PharmaSmart International Inc. (Canada)

- PickPoint (Germany)

- ScriptPro LLC (USA)

- Sehatpro Technologies Private Limited (India)

- Smart RX Systems (USA)

- Stericycle, Inc. (USA)

- TES America LLC (USA)

- Yuyama Co., Ltd. (Japan)

- Other Active Players

Key Industry Developments in the Automated Drug Kiosk Market:

-

In October 2024, ITOKI CORPORATION jointly developed with Medical Fields Corporation the Drug Automatic Picking system with MediMonitor, which combines a device that can automatically store and retrieve drugs with an audit support system.

- In October 2023, A state-of-the-art, next-generation automated drug dispensing machine equipped with a robotic arm, independently developed by JVM, an affiliate of Hanmi Science, was successfully launched in the European market.JVM announced on the 13th that it entered a supply contract with Brocacef, a company that operates large, factory-type dispensing pharmacies in Europe, for ‘MENITH,’ an automatic dispensing machine equipped with an articulated robotic arm.

|

Global Automated Drug Kiosk Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.02% |

Market Size in 2032: |

USD 6.23 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Type |

|

||

|

By Technology |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automated Drug Kiosk Market by Application

4.1 Automated Drug Kiosk Market Snapshot and Growth Engine

4.2 Automated Drug Kiosk Market Overview

4.3 Pharmacy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pharmacy: Geographic Segmentation Analysis

4.4 Healthcare Facility

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Healthcare Facility: Geographic Segmentation Analysis

4.5 Hospital

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hospital: Geographic Segmentation Analysis

Chapter 5: Automated Drug Kiosk Market by Type

5.1 Automated Drug Kiosk Market Snapshot and Growth Engine

5.2 Automated Drug Kiosk Market Overview

5.3 Standalone Kiosks

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Standalone Kiosks: Geographic Segmentation Analysis

5.4 Wall-Mounted Kiosks

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Wall-Mounted Kiosks: Geographic Segmentation Analysis

5.5 Mobile Kiosks

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Mobile Kiosks: Geographic Segmentation Analysis

Chapter 6: Automated Drug Kiosk Market by End Use

6.1 Automated Drug Kiosk Market Snapshot and Growth Engine

6.2 Automated Drug Kiosk Market Overview

6.3 Retail Consumers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retail Consumers: Geographic Segmentation Analysis

6.4 Patients

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Patients: Geographic Segmentation Analysis

6.5 Healthcare Professionals

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare Professionals: Geographic Segmentation Analysis

Chapter 7: Automated Drug Kiosk Market by Technology

7.1 Automated Drug Kiosk Market Snapshot and Growth Engine

7.2 Automated Drug Kiosk Market Overview

7.3 Touchscreen Interface

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Touchscreen Interface: Geographic Segmentation Analysis

7.4 Digital Payment Systems

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Digital Payment Systems: Geographic Segmentation Analysis

7.5 Telemedicine Integration

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Telemedicine Integration: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automated Drug Kiosk Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MEDAVAIL TECHNOLOGIES INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SMART RX SYSTEMS (USA)

8.4 MEDIFRIENDRX (USA)

8.5 STERICYCLE INC. (USA)

8.6 OMNICELL INC. (USA)

8.7 SCRIPTPRO LLC (USA)

8.8 PICKPOINT (GERMANY)

8.9 MC HEALTHGRID PVT LTD. (INDIA)

8.10 ASTERES INC. (USA)

8.11 DISTRIBUTED DELIVERY NETWORKS CORP. (USA)

8.12 TES AMERICA LLC (USA)

8.13 AMERISOURCEBERGEN CORPORATION (USA)

8.14 ACCU CHART PLUS HEALTHCARE SYSTEMS INC. (USA)

8.15 PHARMASMART INTERNATIONAL INC. (CANADA)

8.16 CAPSA HEALTHCARE (USA)

8.17 YUYAMA CO. LTD. (JAPAN)

8.18 ARXIUM (CANADA)

8.19 SEHATPRO TECHNOLOGIES PRIVATE LIMITED (INDIA)

8.20 DIEBOLD NIXDORF (USA)

8.21 ONMED (USA)

8.22 OTHER ACTIVE PLAYERS.

Chapter 9: Global Automated Drug Kiosk Market By Region

9.1 Overview

9.2. North America Automated Drug Kiosk Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Application

9.2.4.1 Pharmacy

9.2.4.2 Healthcare Facility

9.2.4.3 Hospital

9.2.5 Historic and Forecasted Market Size By Type

9.2.5.1 Standalone Kiosks

9.2.5.2 Wall-Mounted Kiosks

9.2.5.3 Mobile Kiosks

9.2.6 Historic and Forecasted Market Size By End Use

9.2.6.1 Retail Consumers

9.2.6.2 Patients

9.2.6.3 Healthcare Professionals

9.2.7 Historic and Forecasted Market Size By Technology

9.2.7.1 Touchscreen Interface

9.2.7.2 Digital Payment Systems

9.2.7.3 Telemedicine Integration

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automated Drug Kiosk Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Application

9.3.4.1 Pharmacy

9.3.4.2 Healthcare Facility

9.3.4.3 Hospital

9.3.5 Historic and Forecasted Market Size By Type

9.3.5.1 Standalone Kiosks

9.3.5.2 Wall-Mounted Kiosks

9.3.5.3 Mobile Kiosks

9.3.6 Historic and Forecasted Market Size By End Use

9.3.6.1 Retail Consumers

9.3.6.2 Patients

9.3.6.3 Healthcare Professionals

9.3.7 Historic and Forecasted Market Size By Technology

9.3.7.1 Touchscreen Interface

9.3.7.2 Digital Payment Systems

9.3.7.3 Telemedicine Integration

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automated Drug Kiosk Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Application

9.4.4.1 Pharmacy

9.4.4.2 Healthcare Facility

9.4.4.3 Hospital

9.4.5 Historic and Forecasted Market Size By Type

9.4.5.1 Standalone Kiosks

9.4.5.2 Wall-Mounted Kiosks

9.4.5.3 Mobile Kiosks

9.4.6 Historic and Forecasted Market Size By End Use

9.4.6.1 Retail Consumers

9.4.6.2 Patients

9.4.6.3 Healthcare Professionals

9.4.7 Historic and Forecasted Market Size By Technology

9.4.7.1 Touchscreen Interface

9.4.7.2 Digital Payment Systems

9.4.7.3 Telemedicine Integration

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automated Drug Kiosk Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Application

9.5.4.1 Pharmacy

9.5.4.2 Healthcare Facility

9.5.4.3 Hospital

9.5.5 Historic and Forecasted Market Size By Type

9.5.5.1 Standalone Kiosks

9.5.5.2 Wall-Mounted Kiosks

9.5.5.3 Mobile Kiosks

9.5.6 Historic and Forecasted Market Size By End Use

9.5.6.1 Retail Consumers

9.5.6.2 Patients

9.5.6.3 Healthcare Professionals

9.5.7 Historic and Forecasted Market Size By Technology

9.5.7.1 Touchscreen Interface

9.5.7.2 Digital Payment Systems

9.5.7.3 Telemedicine Integration

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automated Drug Kiosk Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Application

9.6.4.1 Pharmacy

9.6.4.2 Healthcare Facility

9.6.4.3 Hospital

9.6.5 Historic and Forecasted Market Size By Type

9.6.5.1 Standalone Kiosks

9.6.5.2 Wall-Mounted Kiosks

9.6.5.3 Mobile Kiosks

9.6.6 Historic and Forecasted Market Size By End Use

9.6.6.1 Retail Consumers

9.6.6.2 Patients

9.6.6.3 Healthcare Professionals

9.6.7 Historic and Forecasted Market Size By Technology

9.6.7.1 Touchscreen Interface

9.6.7.2 Digital Payment Systems

9.6.7.3 Telemedicine Integration

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automated Drug Kiosk Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Application

9.7.4.1 Pharmacy

9.7.4.2 Healthcare Facility

9.7.4.3 Hospital

9.7.5 Historic and Forecasted Market Size By Type

9.7.5.1 Standalone Kiosks

9.7.5.2 Wall-Mounted Kiosks

9.7.5.3 Mobile Kiosks

9.7.6 Historic and Forecasted Market Size By End Use

9.7.6.1 Retail Consumers

9.7.6.2 Patients

9.7.6.3 Healthcare Professionals

9.7.7 Historic and Forecasted Market Size By Technology

9.7.7.1 Touchscreen Interface

9.7.7.2 Digital Payment Systems

9.7.7.3 Telemedicine Integration

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automated Drug Kiosk Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.02% |

Market Size in 2032: |

USD 6.23 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Type |

|

||

|

By Technology |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||