Anti-Epileptic Drug for Pediatrics Market Synopsis:

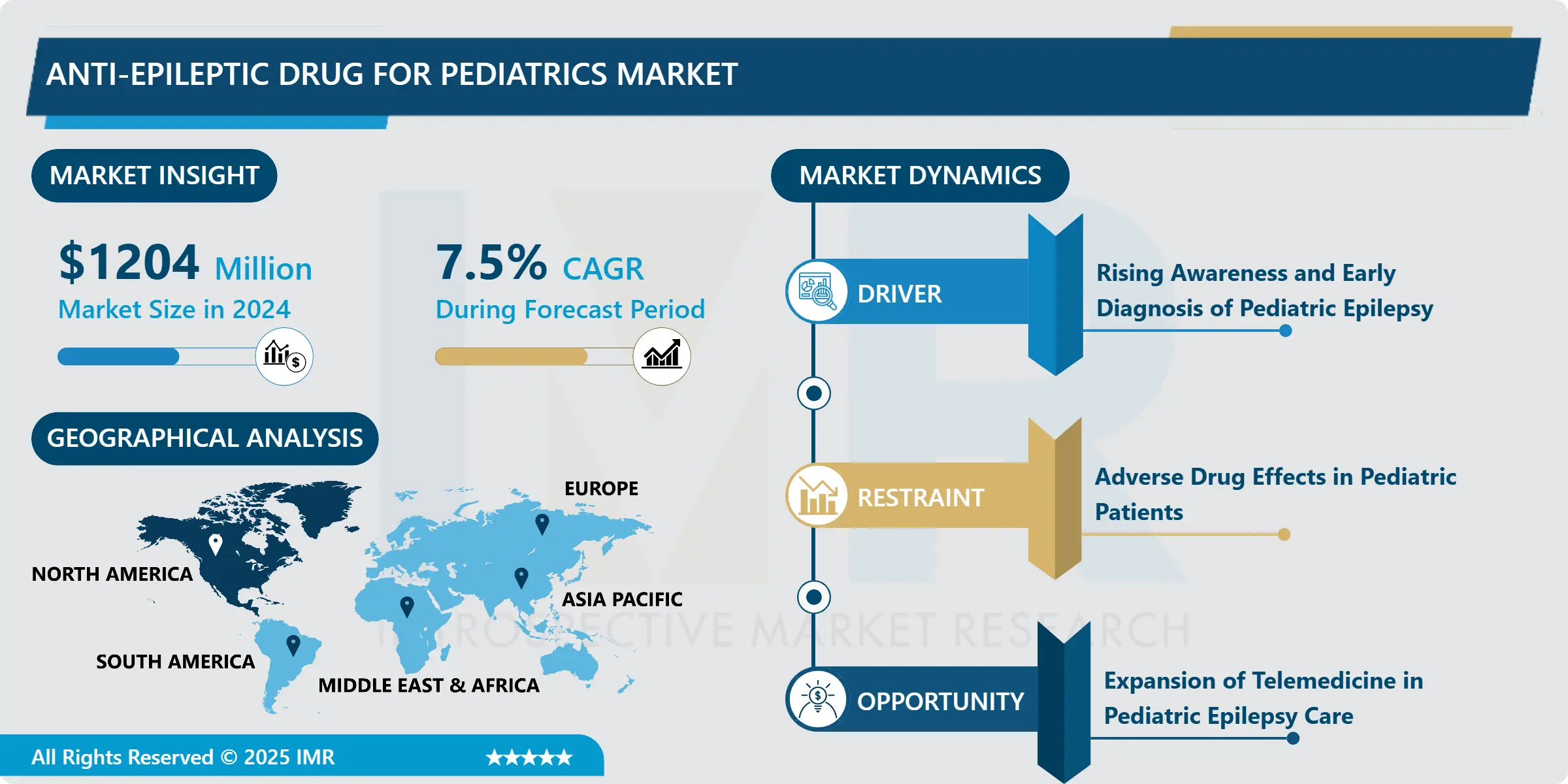

Anti-Epileptic Drug for Pediatrics Market Size Was Valued at USD 1204 Million in 2024, and is Projected to Reach USD 2147.31 Million by 2032, Growing at a CAGR of 7.5% from 2025-2032.

The pediatric anti-epileptic drug (AED) market is growing steadily, driven by the rising incidence of epilepsy in children and increasing awareness of early diagnosis and intervention. This market includes both first-generation drugs such as phenobarbital and valproic acid and newer AEDs with improved safety profiles and diverse mechanisms of action. Treatment choice often depends on seizure type, patient age, and individual tolerance, making personalized care essential in pediatric neurology.

Advancements in pharmacogenetics are enabling more targeted therapies, improving seizure control and minimizing side effects in children. Additionally, the development of child-friendly formulations and novel drug delivery systems is helping to address compliance challenges. The integration of telemedicine and mobile health apps supports continuous monitoring and improves adherence to treatment regimens.

Emerging economies offer significant growth potential due to the current lack of specialized medical care and access to newer treatments. Collaborative efforts between pharmaceutical companies and healthcare institutions are further enhancing distribution and education. Together, these factors are shaping a more responsive and innovative market for pediatric epilepsy treatment.

Anti-Epileptic Drug for Pediatrics Market Growth and Trend Analysis:

Rising Awareness and Early Diagnosis of Pediatric Epilepsy

- The World Health Organization (WHO) states that epilepsy affects approximately 50 million people worldwide. The increasing awareness of epilepsy in children has significantly driven the pediatric anti-epileptic drug (AED) market. Educational initiatives by healthcare systems, NGOs, and advocacy groups have enhanced public understanding of seizure symptoms and the importance of early medical attention. With better recognition, parents and caregivers are more likely to seek professional care during the early stages of epilepsy.

- This has led to earlier diagnosis and timely initiation of treatment, improving long-term outcomes for children. Pediatricians and neurologists are also now better equipped to differentiate between seizure types, allowing for more accurate prescriptions. Collectively, these advancements contribute to a rising demand for pediatric-specific AEDs and help drive innovation and investment in this sector. ?

Adverse Drug Effects in Pediatric Patients

- One of the major restraints in the pediatric anti-epileptic drug market is the concern over side effects in children. Anti-epileptic drugs can lead to a range of adverse reactions, such as drowsiness, behavioral issues, cognitive delays, and, in some cases, liver toxicity. These effects are particularly concerning in young, developing children and often result in treatment discontinuation or dosage adjustments.

- Parents may hesitate to maintain therapy due to fears of long-term developmental consequences. Moreover, children are less able to communicate discomfort, making it difficult to detect subtle side effects. This challenge reduces adherence to prescribed regimens and affects treatment success. Such safety concerns often limit the use of even the most effective AEDs in pediatric care.

Anti-Epileptic Drug for Pediatrics Market Expansion Opportunity

Expansion of Telemedicine in Pediatric Epilepsy Care

- Telemedicine has emerged as a significant opportunity in improving pediatric epilepsy management. With remote consultations, healthcare providers can monitor a child's response to anti-epileptic drugs more consistently, make timely dosage adjustments, and provide immediate support during breakthrough seizures. This is especially important in rural and underserved regions, where access to pediatric neurologists is limited.

- Mobile health apps and virtual platforms also allow caregivers to track symptoms, medication adherence, and side effects in real time. Telehealth reduces travel burdens for families and enables continuity of care without frequent hospital visits. These digital innovations are reshaping epilepsy management, making it more accessible, child-friendly, and efficient ultimately expanding the reach of the pediatric AED market.

Anti-Epileptic Drug for Pediatrics Market Challenge Barrier

Lack of Pediatric-Specific Clinical Trials

- A significant challenge in the pediatric anti-epileptic drug market is the limited availability of clinical trials specifically focused on children. Most anti-epileptic drugs are developed and tested in adult populations, with pediatric use relying on off-label prescriptions and dosage adjustments based on limited data. This results in uncertainty regarding safety, efficacy, and long-term effects in children.

- Furthermore, children metabolize drugs differently, and age-specific factors such as growth and brain development must be considered, yet remain understudied. Ethical concerns, recruitment challenges, and regulatory hurdles also complicate pediatric trials. This gap in research hinders physicians from making fully informed decisions and restricts the development of tailored, safer treatment options for children with epilepsy.

Anti-Epileptic Drug for Pediatrics Market Segment Analysis:

Anti-Epileptic Drug for Pediatrics Market is segmented based on Drug Type, Route of Administration, Therapeutic Class, Distribution Channel, and Region

By Drug type, Second generation anti-epileptic drugsSegment is Expected to Dominate the Market During the Forecast Period

- Second-generation anti-epileptic drugs (AEDs) are expected to dominate the pediatric anti-epileptic drug market. These drugs, which include medications such as levetiracetam, lamotrigine, oxcarbazepine, and topiramate, are increasingly preferred due to their improved safety profiles, lower toxicity, and better tolerability in children compared to first-generation AEDs like phenobarbital or phenytoin.

- Second-generation AEDs also offer fewer drug interactions and more targeted mechanisms of action, making them more suitable for individualized pediatric treatment plans. Moreover, many of these drugs are now available in child-friendly formulations (e.g., oral dissolvable tablets, syrups), which enhances adherence and treatment success. Their favorable balance between efficacy and side effects positions them as the treatment of choice in clinical practice for a variety of seizure types in children.

- While third-generation AEDs are gaining attention for their innovation, they are still emerging in terms of clinical adoption and global accessibility, especially in low- and middle-income countries.

By Route of administration, Oral route of administration Segment Held the Largest Share in 2024

- Oral route of administration held the largest share of the pediatric anti-epileptic drug market. This dominance is attributed to the convenience, safety, and patient compliance associated with oral formulations, especially in pediatric care. Oral medications such as syrups, chewable tablets, and dissolvable films are widely preferred for children due to their ease of administration and non-invasive nature.

- Moreover, a majority of commonly prescribed second-generation anti-epileptic drugs are available in oral forms, which further supports their extensive use. Caregivers and healthcare providers typically favor oral drugs for long-term epilepsy management because they are more practical for home administration and reduce the need for hospitalization or professional intervention, unlike injectables.

- Although injectable and topical forms are used in specific scenarios such as emergency seizure control or local treatments their usage remains limited compared to oral drugs in routine pediatric epilepsy therapy.

Anti-Epileptic Drug for Pediatrics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is expected to dominate the Anti-Epileptic Drug for Pediatrics Market over the forecast period, primarily due to its advanced healthcare infrastructure, high awareness of pediatric epilepsy, and early diagnosis rates. The region benefits from the strong presence of major pharmaceutical companies and active investment in research and development of pediatric-focused therapies.

- Supportive regulatory frameworks, such as expedited FDA approvals for pediatric drugs, and the growing integration of telemedicine and digital health tools further enhance treatment accessibility and adherence. These factors collectively position North America as the leading region in terms of market share and innovation in pediatric epilepsy care throughout the forecast period.

Anti-Epileptic Drug for Pediatrics Market Active Players:

- Abbott Laboratories (USA)

- Alkem Laboratories Ltd. (India)

- AstraZeneca plc (UK)

- Bausch Health Companies Inc. (Canada)

- Cephalon Inc. (USA)

- Cipla Inc (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Eisai Co., Ltd. (Japan)

- GlaxoSmithKline plc (GSK) (UK)

- GW Pharmaceuticals plc (UK)

- H. Lundbeck A/S (Denmark)

- Insys Therapeutics, Inc. (USA)

- Janssen Pharmaceuticals (Belgium)

- Jazz Pharmaceuticals plc (Ireland)

- Johnson & Johnson (USA)

- Lundbeck (Denmark)

- Novartis AG (Switzerland)

- Ovid Therapeutics Inc. (USA)

- Pfizer, Inc. (USA)

- Sanofi S.A. (French)

- Teva Pharmaceutical Industries Ltd. (Israel)

- UCB Pharma Limited (Belgium)

- Zogenix (USA)

- Other Active Players

Key Industry Developments in the Anti-Epileptic Drug for Pediatrics Market:

- In May 2025, AstraZeneca completed the acquisition of Belgium-based biotech company EsoBiotec on 20 May 2025 for up to $1 billion. The deal added EsoBiotec’s ENaBL platform, which enables rapid in vivo cell therapy delivery for cancer and immune diseases, to AstraZeneca’s expanding cell therapy portfolio.

- In March 2024, Sanofi India and Cipla announced an exclusive distribution partnership for Sanofi’s Central Nervous System (CNS) product range in India. Cipla was given responsibility for promoting and distributing six CNS brands, including the anti-epileptic drug Frisium®, to expand patient access across the country.

|

Anti-Epileptic Drug for Pediatrics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1204 Mn. |

|

Forecast Period 2025-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 2147.31 Mn. |

|

Segments Covered: |

By Drug Type |

|

|

|

By Route of Administration |

|

||

|

By Therapeutic Class |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Anti-Epileptic Drug for Pediatrics Market by Drug Type (2018-2032)

4.1 Anti-Epileptic Drug for Pediatrics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 First generation anti-epileptic drugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Second generation anti-epileptic drugs

4.5 Third generation anti-epileptic drugs

Chapter 5: Anti-Epileptic Drug for Pediatrics Market by Route of Administration (2018-2032)

5.1 Anti-Epileptic Drug for Pediatrics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Injectable

5.5 Topical

Chapter 6: Anti-Epileptic Drug for Pediatrics Market by Therapeutic Class (2018-2032)

6.1 Anti-Epileptic Drug for Pediatrics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Benzodiazepines

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Barbiturates

6.5 Hydantoins

6.6 Succinimides

Chapter 7: Anti-Epileptic Drug for Pediatrics Market by Distribution Channel (2018-2032)

7.1 Anti-Epileptic Drug for Pediatrics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospital Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Retail Pharmacies

7.5 Online Pharmacies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Anti-Epileptic Drug for Pediatrics Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABBOTT LABORATORIES (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ALKEM LABORATORIES LTD. (INDIA)

8.4 ASTRAZENECA PLC (UK)

8.5 BAUSCH HEALTH COMPANIES INC. (CANADA)

8.6 CEPHALON INC. (USA)

8.7 CIPLA INC (INDIA)

8.8 DR. REDDY'S LABORATORIES LTD. (INDIA)

8.9 EISAI CO.

8.10 LTD. (JAPAN)

8.11 GLAXOSMITHKLINE PLC (GSK) (UK)

8.12 GW PHARMACEUTICALS PLC (UK)

8.13 H. LUNDBECK A/S (DENMARK)

8.14 INSYS THERAPEUTICS

8.15 INC. (USA)

8.16 JANSSEN PHARMACEUTICALS (BELGIUM)

8.17 JAZZ PHARMACEUTICALS PLC (IRELAND)

8.18 JOHNSON & JOHNSON (USA)

8.19 LUNDBECK (DENMARK)

8.20 NOVARTIS AG (SWITZERLAND)

8.21 OVID THERAPEUTICS INC. (USA)

8.22 PFIZER

8.23 INC. (USA)

8.24 SANOFI S.A. (FRENCH)

8.25 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

8.26 UCB PHARMA LIMITED (BELGIUM)

8.27 ZOGENIX (USA)

8.28 OTHER ACTIVE PLAYERS

Chapter 9: Global Anti-Epileptic Drug for Pediatrics Market By Region

9.1 Overview

9.2. North America Anti-Epileptic Drug for Pediatrics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Anti-Epileptic Drug for Pediatrics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Anti-Epileptic Drug for Pediatrics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Anti-Epileptic Drug for Pediatrics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Anti-Epileptic Drug for Pediatrics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Anti-Epileptic Drug for Pediatrics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Anti-Epileptic Drug for Pediatrics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1204 Mn. |

|

Forecast Period 2025-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 2147.31 Mn. |

|

Segments Covered: |

By Drug Type |

|

|

|

By Route of Administration |

|

||

|

By Therapeutic Class |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||