Key Market Highlights

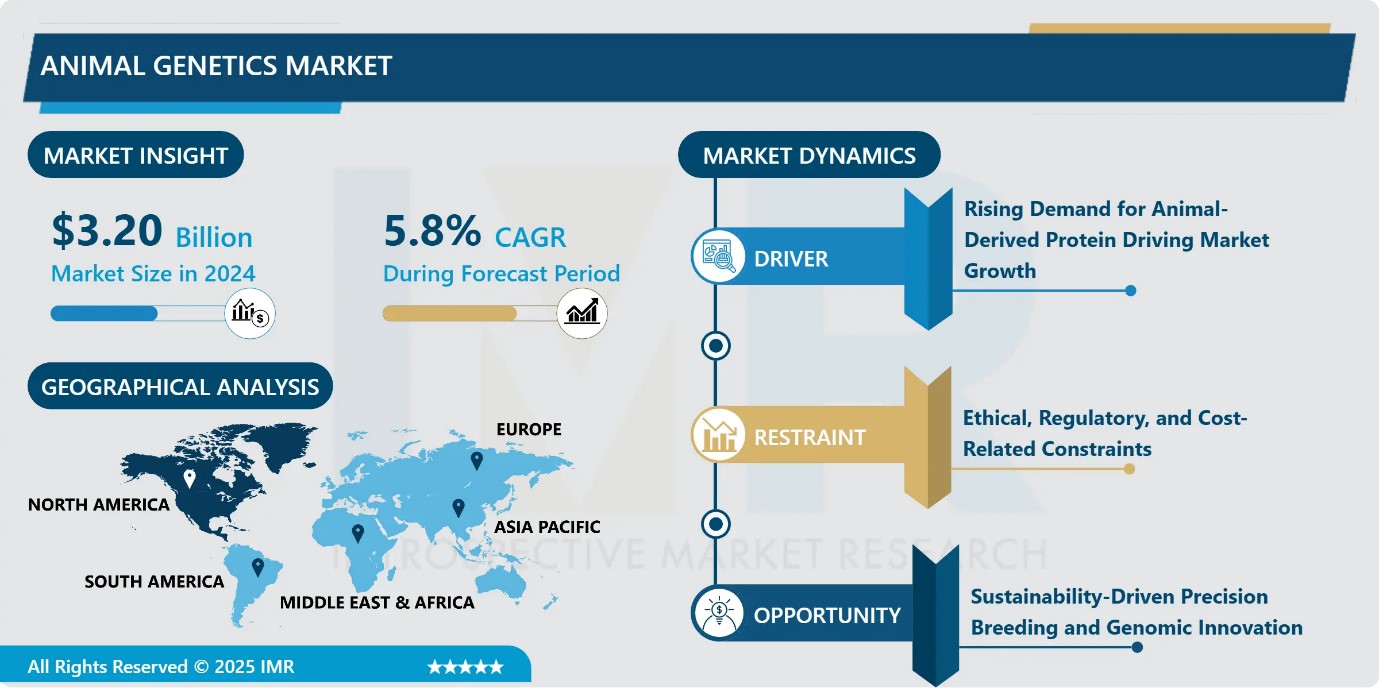

Animal Genetics Market Size Was Valued at USD 3.20 Billion in 2024, and is Projected to Reach USD 5.95 Billion by 2035, Growing at a CAGR of 5.8% from 2025-2035.

- Market Size in 2024: USD 3.20 Billion

- Projected Market Size by 2035: USD 5.95 Billion

- CAGR (2025–2035): 5.8%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Services: The Genetic Disease Testing segment is anticipated to lead the market by accounting for 27.3% of the market share throughout the forecast period.

- By End User: The Animal Breeding Companies segment is expected to capture 29.3% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.4% of the market share during the forecast period.

- Active Players: Alta Genetics Inc. (Canada), Animal Genetics Inc. (United States), Cobb-Vantress, LLC (United States), CRV Holding B.V. (Netherlands), EW Group GmbH (Germany), and Other Active Players.

Animal Genetics Market Synopsis:

The animal genetics market encompasses products and services focused on the study, analysis, and application of genetic science to improve desirable traits in livestock and companion animals. It includes genetic testing, genomic sequencing, selective breeding, and assisted reproductive technologies such as artificial insemination and embryo transfer. The market scenario is shaped by rising global demand for animal-derived protein, increasing livestock populations, and growing awareness of genetic disease prevention. Advancements in genomic technologies enable precise trait selection, improved disease resistance, and enhanced productivity, supporting sustainable agriculture and animal welfare. Market conditions are further strengthened by expanding veterinary care, increased pet adoption, and greater investment in animal health research. Despite regulatory and ethical considerations, continuous innovation and adoption of advanced genetic tools position the animal genetics market for steady long-term growth

Animal Genetics Market Dynamics and Trend Analysis:

Animal Genetics Market Growth Driver-Rising Demand for Animal-Derived Protein Driving Market Growth

- The growing global population, urbanization, and rising income levels are significantly increasing consumption of animal-derived protein, including meat, milk, and eggs. This shift in dietary preferences, particularly in emerging economies, is accelerating demand for high-yield and disease-resistant livestock. To meet food security and sustainability goals, producers are increasingly adopting animal genetics technologies such as genomic selection, artificial insemination, and embryo transfer. These tools improve productivity, reproductive efficiency, and animal health while reducing mortality rates. Additionally, rising awareness of animal welfare and quality standards is driving demand for genetic testing and breeding optimization. Collectively, the surge in animal-based protein consumption is a key driver propelling growth in the global animal genetics market.

Animal Genetics Market Limiting Factor-Ethical, Regulatory, and Cost-Related Constraints

- Ethical concerns surrounding genetic modification in animals remain a key restraint in the animal genetics market, as debates over animal welfare and natural biological boundaries influence public acceptance and policy decisions. These concerns are reinforced by stringent regulatory frameworks designed to ensure safety, environmental protection, and ethical compliance, which often extend approval timelines and increase development costs.

- Additionally, the high cost of advanced genetic technologies including genomic selection, CRISPR-based gene editing, and DNA testing limits adoption, particularly among small and medium-scale producers. Significant investments in infrastructure, skilled personnel, and research further restrict accessibility, slowing market penetration and confining advanced genetic solutions largely to large commercial farms and research institutions.

Animal Genetics Market Expansion Opportunity-Sustainability-Driven Precision Breeding and Genomic Innovation

- The growing emphasis on sustainable agriculture presents a strong opportunity for the animal genetics market. Modern genomic and precision breeding technologies enable the development of livestock breeds that are more resilient to climate variability, disease, and environmental stress.

- Advanced tools such as CRISPR gene editing, SNP genotyping, and whole-genome sequencing support accurate trait selection, improved feed efficiency, and reduced emissions, lowering the environmental footprint of animal farming. These innovations help optimize breeding programs, accelerate genetic gains, and enhance productivity while conserving natural resources. As consumer demand for ethically produced and environmentally responsible animal products rises, the adoption of sustainable genetic solutions is expected to significantly expand market opportunities and reshape the future of animal agriculture.

Animal Genetics Market Challenge and Risk

- The animal genetics market faces notable restraints due to the shortage of skilled veterinary professionals and inadequate veterinary infrastructure, particularly in rural and emerging regions. Limited availability of trained geneticists and veterinarians restricts the adoption of advanced genetic technologies and slows research and commercialization efforts. In many areas, insufficient diagnostic and testing facilities reduce awareness and implementation of genetic upgrades for livestock productivity. Additionally, technical challenges such as low gene-editing efficiency, off-target effects, and limited understanding of gene functions further impede progress. These constraints increase development timelines and limit market penetration, ultimately restricting the widespread adoption of animal genetics solutions despite growing demand for improved livestock health and productivity.

Animal Genetics Market Trend

Advancements in Genetic Engineering and Genomic Technologies

- Rapid technological progress in genetic engineering is a major trend shaping the global animal genetics market. Innovations such as CRISPR-Cas9 gene editing, genomic selection, next-generation sequencing, and SNP genotyping are enabling more precise, faster, and efficient breeding decisions. These technologies allow early identification of desirable traits, including disease resistance, productivity, fertility, and feed efficiency, accelerating genetic gains across generations. Improved accuracy in genetic testing reduces breeding risks and enhances livestock performance while supporting sustainable farming practices.

- As costs decline and accessibility improves, adoption among breeders and genetic service providers is increasing. This trend is attracting investments, fostering collaborations, and driving innovation across the animal genetics industry, supporting long-term food security and productivity goals.

Animal Genetics Market Segment Analysis:

Animal Genetics Market is segmented based on Animal Type, Product & Material, Services, Application, End User and Region.

By Services, Genetic disease testing segment is expected to dominate the market with around 27.3% share during the forecast period.

- Genetic disease testing represents the dominant service segment in the animal genetics market due to its critical role in improving animal health, welfare, and breeding outcomes. Growing awareness among livestock producers, breeders, veterinarians, and pet owners about inherited disorders has increased demand for early disease identification and prevention. These tests support responsible breeding by reducing the transmission of harmful genetic traits and enabling informed selection decisions. Veterinary professionals increasingly rely on genetic disease testing for accurate diagnosis and tailored treatment planning.

- Additionally, the rising adoption of companion animals has fueled demand for DNA-based health screening. Compared to DNA typing and trait testing, genetic disease testing offers direct health and economic benefits, making it the most widely adopted and influential service in the market.

By End User, Animal breeding companies is expected to dominate with close to 29.3% market share during the forecast period.

- Animal breeding companies represent the dominant end-user segment in the animal genetics market, accounting for over 40% of total revenue. Their dominance is driven by large-scale breeding operations and substantial investments in advanced genetic technologies to enhance productivity, disease resistance, and breed quality. These companies extensively adopt genomic selection, artificial insemination, embryo transfer, and genetic testing to achieve consistent and accelerated genetic improvement. Their strong focus on commercial livestock production, efficiency optimization, and long-term breeding programs creates sustained demand for animal genetics products and services, positioning animal breeding companies as the primary contributors to market growth.

Animal Genetics Market Regional Insights:

North America region is estimated to lead the market with around 31.4% share during the forecast period.

- North America leads the animal genetics market, accounting for over 30% of global revenue, driven by advanced livestock production systems, strong R&D infrastructure, and widespread adoption of genomic and reproductive technologies. The region benefits from high demand for disease-resistant, high-yield livestock and growing use of artificial insemination, embryo transfer, and genomic selection.

- The U.S. is the primary contributor, supported by government backing for biotechnology, strong veterinary healthcare systems, and the presence of major players such as Zoetis, Genus plc, and Neogen Corporation. Favorable regulatory frameworks, early adoption of CRISPR-based innovations, and a focus on sustainable, precision breeding further reinforce North America’s dominance in the global animal genetics market.

Animal Genetics Market Active Players:

- Alta Genetics Inc. (Canada)

- Animal Genetics Inc. (United States)

- Cobb-Vantress, LLC (United States)

- CRV Holding B.V. (Netherlands)

- EW Group GmbH (Germany)

- Genetics Australia (Australia)

- Genus plc (United Kingdom)

- Groupe Grimaud La Corbière SA (France)

- Hendrix Genetics B.V. (Netherlands)

- Neogen Corporation (United States)

- Semex (Canada)

- STgenetics (United States)

- Topigs Norsvin (Netherlands)

- Trans Ova Genetics (United States)

- Zoetis Inc. (United States)

- Other Active Players

Key Industry Developments in the Animal Genetics Market:

- In April 2025: Genus plc received U.S. FDA approval for its gene-edited pigs engineered to resist Porcine Reproductive and Respiratory Syndrome (PRRS). The approval marks a major advancement in disease-resistant livestock, with potential to significantly reduce productivity losses in the pork industry. Genus is actively seeking similar regulatory clearances across Canada, Mexico, Japan, and China to expand global adoption.

- In February 2025: Neogen Corporation introduced Igenity BCHF, the first genomic screening test designed to identify cattle genetically predisposed to bovine congestive heart failure. The test enables producers to make informed breeding decisions, improve herd health outcomes, and mitigate the growing impact of this fatal condition. This launch strengthens Neogen’s position in advanced livestock genetic testing.

Technological Foundations, Genetic Engineering Tools, and Reproductive Technologies Driving the Global Animal Genetics Market

- The animal genetics market is driven by advanced technologies that analyze, modify, and optimize genetic traits in livestock and companion animals. Core technical components include genomic selection, next-generation sequencing (NGS), SNP genotyping, and DNA typing, which enable early identification of desirable traits such as disease resistance, fertility, feed efficiency, and productivity. Assisted reproductive technologies artificial insemination, embryo transfer, in vitro fertilization (IVF), and cryopreservation of semen and embryos facilitate rapid dissemination of superior genetics across populations.

- Gene-editing tools, particularly CRISPR-Cas9, are increasingly explored to introduce beneficial traits and eliminate harmful mutations with high precision. Bioinformatics platforms and AI-driven analytics support large-scale genomic data interpretation, improving breeding accuracy and genetic gain. Rigorous validation, traceability, and regulatory compliance are essential to ensure biosafety and ethical standards. Collectively, these technologies enhance breeding efficiency, support sustainable livestock production, and strengthen disease management across global animal agriculture systems.

|

Animal Genetics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.20 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.8% |

Market Size in 2035: |

USD 5.95 Bn. |

|

Segments Covered: |

By Animal Type |

|

|

|

By Product & Material |

|

||

|

By Services |

|

||

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Animal Genetics Market by Animal Type (2018-2035)

4.1 Animal Genetics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cattle

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pigs

4.5 Sheep & Goats

4.6 Poultry

4.7 Companion Animals

4.8 Others

Chapter 5: Animal Genetics Market by Product & Material (2018-2035)

5.1 Animal Genetics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Genetic Materials—Semen

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Embryos

5.5 DNA Samples

5.6 Oocytes; Live Animals

Chapter 6: Animal Genetics Market by Services (2018-2035)

6.1 Animal Genetics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Genetic Disease Testing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 DNA Typing

6.5 Gene Trait Testing

6.6 Gene Editing

6.7 Artificial Insemination

6.8 Embryo Transfer

6.9 In Vitro Fertilization (IVF)

6.10 Others

Chapter 7: Animal Genetics Market by Application (2018-2035)

7.1 Animal Genetics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Genetic Trait Improvement

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Disease Testing

7.5 Product Development

7.6 Forensic Testing

7.7 Others

Chapter 8: Animal Genetics Market by End User (2018-2035)

8.1 Animal Genetics Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Veterinary Hospitals & Clinics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Research Centers & Academic Institutes

8.5 Animal Breeding Companies

8.6 Diagnostic Laboratories

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Animal Genetics Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ALTA GENETICS INC. (CANADA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ANIMAL GENETICS INC. (UNITED STATES)

9.4 COBB-VANTRESS

9.5 LLC (UNITED STATES)

9.6 CRV HOLDING B.V. (NETHERLANDS)

9.7 EW GROUP GMBH (GERMANY)

9.8 GENETICS AUSTRALIA (AUSTRALIA)

9.9 GENUS PLC (UNITED KINGDOM)

9.10 GROUPE GRIMAUD LA CORBIÈRE SA (FRANCE)

9.11 HENDRIX GENETICS B.V. (NETHERLANDS)

9.12 NEOGEN CORPORATION (UNITED STATES)

9.13 SEMEX (CANADA)

9.14 STGENETICS (UNITED STATES)

9.15 TOPIGS NORSVIN (NETHERLANDS)

9.16 TRANS OVA GENETICS (UNITED STATES)

9.17 ZOETIS INC. (UNITED STATES) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Animal Genetics Market By Region

10.1 Overview

10.2. North America Animal Genetics Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Animal Genetics Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Animal Genetics Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Animal Genetics Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Animal Genetics Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Animal Genetics Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Analyst Viewpoint and Conclusion

Chapter 14 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 15 Case Study

Chapter 16 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Animal Genetics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.20 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.8% |

Market Size in 2035: |

USD 5.95 Bn. |

|

Segments Covered: |

By Animal Type |

|

|

|

By Product & Material |

|

||

|

By Services |

|

||

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||