Aircraft Cabin Interior Market Synopsis:

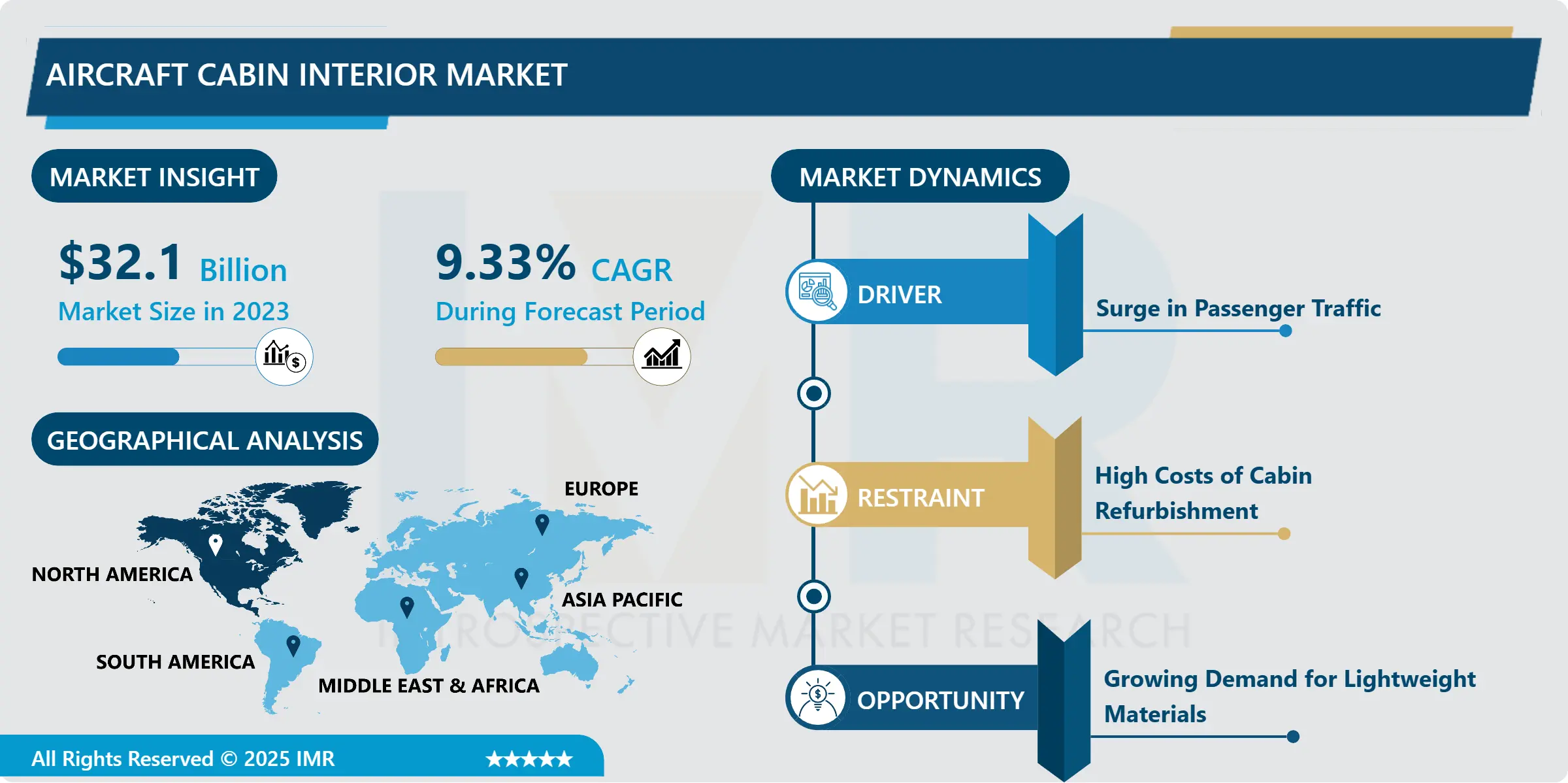

Aircraft Cabin Interior Market Size Was Valued at USD 32.10 Billion in 2023, and is Projected to Reach USD 71.64 Billion by 2032, Growing at a CAGR of 9.33% From 2024-2032.

The Aircraft Cabin Interior Market is concerned with the development, manufacturing and installation of parts and accessories that improve comfort, security and productivity to an aircraft cabin. These are the seats, lighting, entertainment system, loos, galley and windows. The key market drivers include changes in passenger needs, demands, emerging technologies, and carriers’ need to create product differentiation.

Aircraft Cabin Interior Market refers to the formal and functional interior space within any given aircraft which is an important sub-sector of aviation industry. These light weight yet high function parts as seating which can be optimized for passengers’ comfort, a wide entertainment system which is now modern and evolving cabin lighting has become crucial. Furthermore, the interiors of cabins are crafted for comfort and also serve safety and efficiency standards which are set.

The market is on the rise at the moment owing to the rising popularity of air travel in various countries particularly in the developing world. Airlines are extending their efforts to improve the cabin design in the business and first-class classes for passengers to get more comfortable while having functional and comfortable seats in the economy class. The use of lightweight materials and IoT related technologies etc are being used more and more. The push toward sustainable aviation has also affected the market, where manufacturers use green materials and technologies to decrease environmental footprint.

Aircraft Cabin Interior Market Trend Analysis:

Smart Cabin Systems

- Smart cabin systems are disrupting the Aircraft Cabin Interior Market as cabin interiors go digital, and passengers benefit from new technologies. Such systems include lighting, touchless controls, and IoT compatible interfaces that enable passengers to control their environment through person owned devices depending on their mood. Such technologies are being embraced by the airlines to cater for smart travelers as well as to market themselves.

- Smart cabins in aviation use AI and machine learning to improve operational efficiency of the aircraft through availability of real-time data to the crew. For example, alerts for predictive maintenance do not interrupt the flight frequently. In the same way, these systems enhance passengers’ on-board experience, including meal selection, type of movies, etc., through analysis of data collected, thus enhancing quality of service and improving customer retention.

Growing Demand for Lightweight Materials

- In the Aircraft Cabin Interior Market, the emerging focus towards lightweight materials is a major opportunity. The pressing need to decrease fuel consumption and consequently CO2 emissions causes airlines to look for lightweight materials and structures including composites, carbon fiber and aluminum alloys. They enhance fuel economy while at the same time reducing costs of operation of the vehicle.

- Several manufacturers are taking their time to research the best future shock solutions that are strong and light at the same time usually compromising safety and style. Lightweight cabin interior parts created through 3D printing technology for design as well as production is another emerging opportunity. Regulators and clients are increasingly concerned with environmental issues, while the utilization of lightweight materials is a part of the aviation industry’s strategy of a paradigm shift to make aviation more sustainable.

Aircraft Cabin Interior Market Segment Analysis:

Aircraft Cabin Interior Market is Segmented on the basis of Type, Material, Aircraft Type, End User, and Region.

By Type, Seating segment is expected to dominate the market during the forecast period

- seating has the highest percentage owing to its links with user experience and operating efficiency in terms of cabin space. New services and products in the business class as well as the organizational structure of the economy class cabin space that is dedicated to the economy class passengers are revolutionizing the segment.

- IFE&C is one of the emerging segments that has been receiving a lot of attention mainly because passengers require internet services besides entertainment on-board. Similar to cabin lighting, lavatories are also receiving enhancement, with LED mood lighting, and contactless, clean lavatory systems provided in trendy planes.

By End User, Original Equipment Manufacturer (OEM) segment expected to held the largest share

- This market is segmented into OEM and aftermarket zones. Manufacturing companies strongly lead the OEM market, as plane makers engage designers and suppliers more for integration during manufacturing. OEMs play an important role of overseeing that components meet the necessary regulatory requirements they also have a duty of ensuring that those components fit well within the aircraft structure.

- Continue and develop an aftermarket segment due to requirements in aircraft refurbishment and upgrades. Carriers commonly supply their new planes with contemporary cabin designs and periodically re-equip old aircraft for similar looks. This segment also serves the MRO (maintenance, repair, and overhaul) necessities to face wear and tear and augment customer experience.

Aircraft Cabin Interior Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the largest market in the Aircraft Cabin Interior Market due to its major airlines and key manufacturers. These two factors accompany high traffic passengers hence stimulates the development of the plush cabin interiors. To be specific, the U.S. has taken the center stage in achieving innovations in in-flight entertainment and seating systems.

- Strict safety and quality requirements stimulate innovation in the region’s production practices. This dominance is accompanied by vast investments in R&D and by combining suppliers and airlines as well as by the emerging need for lightweight and green cabin parts.

Active Key Players in the Aircraft Cabin Interior Market

- Astronics Corporation (USA)

- B/E Aerospace (now part of Collins Aerospace) (USA)

- Collins Aerospace (USA)

- Diehl Aviation (Germany)

- Geven S.p.A. (Italy)

- Honeywell International Inc. (USA)

- Jamco Corporation (Japan)

- Lufthansa Technik AG (Germany)

- Panasonic Avionics Corporation (USA)

- Recaro Aircraft Seating GmbH & Co. KG (Germany)

- Safran S.A. (France)

- Thales Group (France)

- Other Active Players.

Key Industry Developments in the Aircraft Cabin Interior Market:

- In February 2024, As part of a contract with Thales, Air India will equip 51 aircraft with Thales' AVANT Up in-flight entertainment system. These will include 40 existing aircraft (777 and 787) retrofit and 11 new aircraft (787 and A350) line fit.

- In December 2023, Panasonic Avionics Corporation signed an agreement with Icelandair for the installation of its Astrova in-flight entertainment solution and a suite of digital solutions on the airline's new fleet of Airbus A321neo LR aircraft.

- In November 2023, Safran was selected by Emirates airlines to supply Safran seats for Emirates' new fleet of Airbus 350, Boeing 777X-9, and upgradation of its existing Boeing 777-300 aircraft. According to the agreement Safran will provide its Business class, Premium Economy and Economy class seats

- In June 2023, Panasonic Avionics Corporation and SAUDIA, the national flag carrier of Saudi Arabia, signed an agreement for the installation of the Astrova seat-end solution on up to 30 aircraft

|

Global Aircraft Cabin Interior Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 32.10 Billion |

|

Forecast Period 2024-32 CAGR: |

9.33% |

Market Size in 2032: |

USD 71.64 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Aircraft Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aircraft Cabin Interior Market by Type

4.1 Aircraft Cabin Interior Market Snapshot and Growth Engine

4.2 Aircraft Cabin Interior Market Overview

4.3 Seating

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Seating: Geographic Segmentation Analysis

4.4 In-flight Entertainment and Connectivity

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 In-flight Entertainment and Connectivity: Geographic Segmentation Analysis

4.5 Cabin Lighting

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Cabin Lighting: Geographic Segmentation Analysis

4.6 Galley

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Galley: Geographic Segmentation Analysis

4.7 Lavatory

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Lavatory: Geographic Segmentation Analysis

4.8 Windows and Windshields

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Windows and Windshields: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others : Geographic Segmentation Analysis

Chapter 5: Aircraft Cabin Interior Market by Material

5.1 Aircraft Cabin Interior Market Snapshot and Growth Engine

5.2 Aircraft Cabin Interior Market Overview

5.3 Composites

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Composites: Geographic Segmentation Analysis

5.4 Aluminum Alloys

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Aluminum Alloys: Geographic Segmentation Analysis

5.5 Steel Alloys

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Steel Alloys: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Aircraft Cabin Interior Market by Aircraft Type

6.1 Aircraft Cabin Interior Market Snapshot and Growth Engine

6.2 Aircraft Cabin Interior Market Overview

6.3 Narrow-body Aircraft

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Narrow-body Aircraft: Geographic Segmentation Analysis

6.4 Wide-body Aircraft

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Wide-body Aircraft: Geographic Segmentation Analysis

6.5 Regional Aircraft

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Regional Aircraft: Geographic Segmentation Analysis

6.6 Business Jets

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Business Jets: Geographic Segmentation Analysis

Chapter 7: Aircraft Cabin Interior Market by End User

7.1 Aircraft Cabin Interior Market Snapshot and Growth Engine

7.2 Aircraft Cabin Interior Market Overview

7.3 Original Equipment Manufacturer (OEM)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Original Equipment Manufacturer (OEM): Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Aircraft Cabin Interior Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 COLLINS AEROSPACE (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DIEHL AVIATION (GERMANY)

8.4 SAFRAN S.A. (FRANCE)

8.5 HONEYWELL INTERNATIONAL INC. (USA)

8.6 THALES GROUP (FRANCE)

8.7 PANASONIC AVIONICS CORPORATION (USA)

8.8 RECARO AIRCRAFT SEATING GMBH & CO. KG (GERMANY)

8.9 GEVEN S.P.A. (ITALY)

8.10 B/E AEROSPACE (NOW PART OF COLLINS AEROSPACE) (USA)

8.11 LUFTHANSA TECHNIK AG (GERMANY)

8.12 JAMCO CORPORATION (JAPAN)

8.13 ASTRONICS CORPORATION (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Aircraft Cabin Interior Market By Region

9.1 Overview

9.2. North America Aircraft Cabin Interior Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Seating

9.2.4.2 In-flight Entertainment and Connectivity

9.2.4.3 Cabin Lighting

9.2.4.4 Galley

9.2.4.5 Lavatory

9.2.4.6 Windows and Windshields

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Composites

9.2.5.2 Aluminum Alloys

9.2.5.3 Steel Alloys

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size By Aircraft Type

9.2.6.1 Narrow-body Aircraft

9.2.6.2 Wide-body Aircraft

9.2.6.3 Regional Aircraft

9.2.6.4 Business Jets

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Original Equipment Manufacturer (OEM)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Aircraft Cabin Interior Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Seating

9.3.4.2 In-flight Entertainment and Connectivity

9.3.4.3 Cabin Lighting

9.3.4.4 Galley

9.3.4.5 Lavatory

9.3.4.6 Windows and Windshields

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Composites

9.3.5.2 Aluminum Alloys

9.3.5.3 Steel Alloys

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size By Aircraft Type

9.3.6.1 Narrow-body Aircraft

9.3.6.2 Wide-body Aircraft

9.3.6.3 Regional Aircraft

9.3.6.4 Business Jets

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Original Equipment Manufacturer (OEM)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Aircraft Cabin Interior Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Seating

9.4.4.2 In-flight Entertainment and Connectivity

9.4.4.3 Cabin Lighting

9.4.4.4 Galley

9.4.4.5 Lavatory

9.4.4.6 Windows and Windshields

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Composites

9.4.5.2 Aluminum Alloys

9.4.5.3 Steel Alloys

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size By Aircraft Type

9.4.6.1 Narrow-body Aircraft

9.4.6.2 Wide-body Aircraft

9.4.6.3 Regional Aircraft

9.4.6.4 Business Jets

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Original Equipment Manufacturer (OEM)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Aircraft Cabin Interior Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Seating

9.5.4.2 In-flight Entertainment and Connectivity

9.5.4.3 Cabin Lighting

9.5.4.4 Galley

9.5.4.5 Lavatory

9.5.4.6 Windows and Windshields

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Composites

9.5.5.2 Aluminum Alloys

9.5.5.3 Steel Alloys

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size By Aircraft Type

9.5.6.1 Narrow-body Aircraft

9.5.6.2 Wide-body Aircraft

9.5.6.3 Regional Aircraft

9.5.6.4 Business Jets

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Original Equipment Manufacturer (OEM)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Aircraft Cabin Interior Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Seating

9.6.4.2 In-flight Entertainment and Connectivity

9.6.4.3 Cabin Lighting

9.6.4.4 Galley

9.6.4.5 Lavatory

9.6.4.6 Windows and Windshields

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Composites

9.6.5.2 Aluminum Alloys

9.6.5.3 Steel Alloys

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size By Aircraft Type

9.6.6.1 Narrow-body Aircraft

9.6.6.2 Wide-body Aircraft

9.6.6.3 Regional Aircraft

9.6.6.4 Business Jets

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Original Equipment Manufacturer (OEM)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Aircraft Cabin Interior Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Seating

9.7.4.2 In-flight Entertainment and Connectivity

9.7.4.3 Cabin Lighting

9.7.4.4 Galley

9.7.4.5 Lavatory

9.7.4.6 Windows and Windshields

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Composites

9.7.5.2 Aluminum Alloys

9.7.5.3 Steel Alloys

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size By Aircraft Type

9.7.6.1 Narrow-body Aircraft

9.7.6.2 Wide-body Aircraft

9.7.6.3 Regional Aircraft

9.7.6.4 Business Jets

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Original Equipment Manufacturer (OEM)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Aircraft Cabin Interior Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 32.10 Billion |

|

Forecast Period 2024-32 CAGR: |

9.33% |

Market Size in 2032: |

USD 71.64 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Aircraft Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||