Account-Based Execution Software Market Synopsis

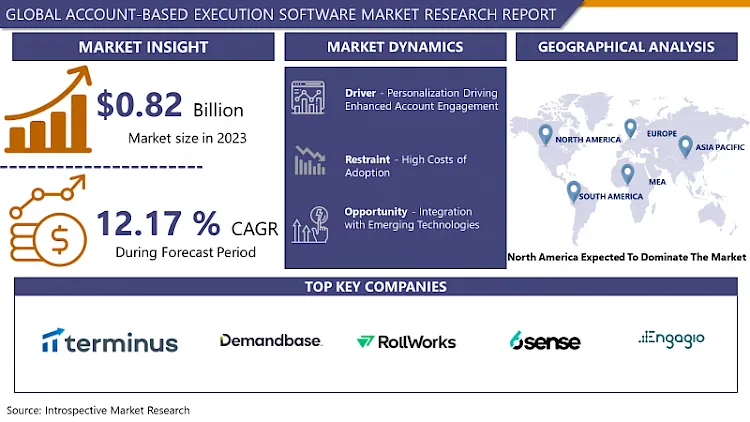

Account-Based Execution Software Market Size Was Valued at USD 0.82 Billion in 2023, and is Projected to Reach USD 2.31 Billion by 2032, Growing at a CAGR of 12.17 % From 2024-2032.

Account-Based Execution Software refers to a specialized tool or platform designed to streamline and optimize the process of executing account-based marketing (ABM) strategies. It typically includes features for identifying and prioritizing high-value target accounts, personalizing outreach efforts, coordinating multi-channel campaigns, and tracking engagement metrics. This software empowers sales and marketing teams to collaborate more effectively, focusing their efforts on key accounts to drive revenue and growth.

The Account-Based Execution (ABE) software market is experiencing robust growth and innovation, driven by the increasing adoption of account-based marketing (ABM) strategies across various industries. ABM has emerged as a powerful approach for B2B organizations to target high-value accounts with personalized campaigns and engagement efforts. This shift towards ABM has propelled the demand for specialized software solutions designed to facilitate and optimize account-based execution.

The ABE software market is the growing recognition among businesses of the need for more targeted and personalized marketing efforts. Traditional spray-and-pray marketing tactics are becoming less effective in a crowded digital landscape where consumers are inundated with generic messaging. In contrast, ABM enables companies to focus their resources on the accounts most likely to yield significant returns, thereby increasing the efficiency and effectiveness of their marketing efforts. As a result, organizations are investing in ABE software to help them identify, prioritize, and engage with their most valuable accounts in a more strategic and coordinated manner.

Moreover, advancements in technology have played a pivotal role in shaping the ABE software market. The proliferation of data analytics, artificial intelligence (AI), and automation tools has empowered marketers to gain deeper insights into their target accounts and deliver highly personalized experiences at scale. ABE software leverages these technologies to enable features such as predictive analytics, account scoring, dynamic content personalization, and multichannel orchestration, allowing marketers to tailor their outreach efforts based on the unique characteristics and behaviors of each account.

The COVID-19 pandemic has accelerated the adoption of ABE software as businesses seek to adapt to remote work environments and navigate the challenges of virtual selling. With in-person interactions limited, organizations have turned to digital channels to engage with prospects and customers. ABE software provides the infrastructure and capabilities needed to execute effective virtual account-based marketing campaigns, enabling teams to collaborate, track engagement, and measure.

The ABE software market is poised for continued growth as companies prioritize account-based strategies to drive revenue growth and maximize customer lifetime value. Vendors in this space are likely to focus on enhancing their platforms with advanced AI and machine learning capabilities, as well as integrations with other marketing and sales technologies to provide a seamless end-to-end solution. Furthermore, as the market matures, we can expect to see increased competition and consolidation among ABE software providers as they vie for market share and strive to differentiate themselves through innovation and value-added services.

Account-Based Execution Software Market Trend Analysis:

Personalization Driving Enhanced Account Engagement

- The Account-Based Execution Software market, a notable trend is the increasing emphasis on personalization to drive enhanced account engagement. As businesses strive to deepen relationships with key accounts, they are leveraging advanced software solutions that allow for tailored messaging, content, and interactions at every stage of the buyer's journey. This trend reflects a shift towards hyper-targeted strategies that prioritize understanding individual account needs and preferences, ultimately leading to more meaningful and impactful engagements.

- In the Account-Based Execution Software market, a notable trend is the increasing emphasis on personalization to drive enhanced account engagement. As businesses strive to deepen relationships with key accounts, they are leveraging advanced software solutions that allow for tailored messaging, content, and interactions at every stage of the buyer's journey. This trend reflects a shift towards hyper-targeted strategies that prioritize understanding individual account needs and preferences, ultimately leading to more meaningful and impactful engagements. advancements in artificial intelligence and machine learning are enabling companies to analyze vast amounts of data to uncover valuable insights about their target accounts, facilitating even more personalized and effective communication strategies.

Integration with Emerging Technologies

- The Account-Based Execution (ABE) software market is undergoing a transformative integration with emerging technologies, reshaping how businesses engage with their target accounts. With the advent of artificial intelligence (AI) and machine learning (ML), ABE platforms are becoming more sophisticated in identifying ideal accounts, predicting buyer behavior, and personalizing outreach strategies. the integration of big data analytics enables deeper insights into customer preferences and market trends, empowering companies to tailor their approach with precision.

- The incorporation of automation technologies streamlines repetitive tasks, allowing sales and marketing teams to focus on high-value activities and nurture relationships effectively. As augmented reality (AR) and virtual reality (VR) gain traction, ABE solutions are exploring immersive experiences for account engagement, enhancing client interactions and driving brand engagement. Furthermore, blockchain technology is revolutionizing data security and transparency, safeguarding sensitive customer information and ensuring trust in account-based initiatives. The convergence of these emerging technologies is propelling the ABE software market towards unprecedented levels of efficiency, effectiveness, and customer-centricity, empowering businesses to achieve sustainable growth and competitive advantage in the digital age.

Account-Based Execution Software Market Segment Analysis:

Micro-perforated Food Packaging Market Segmented based on Deployment Model, Company Size, Application and Industry Vertical

By Deployment Model, Cloud-Based segment is expected to dominate the market during the forecast period

- On-premises: This refers to software that is installed and operated from the organization's in-house server and computing infrastructure. In this mode, the organization is responsible for managing and maintaining the software, including updates, security, and backups. On-premises deployment provides full control over the software and data but requires a significant investment in infrastructure and IT resources.

- Cloud-based: Also known as Software as a Service (SaaS), cloud-based deployment involves accessing software applications over the internet through a third-party provider's servers. Users typically pay a subscription fee to use the software, and the provider is responsible for managing and maintaining the software infrastructure, including updates, security, and scalability. Cloud-based deployment offers flexibility, scalability, and cost-effectiveness as users can access the software from anywhere with an internet connection, without the need for on-site infrastructure.

By Application , Customer Relationship Management (CRM) segment held the largest share of XX% in 2023

- The Account-Based Execution Software Market encompasses a diverse range of applications tailored to optimize marketing, sales, and customer relationship management (CRM) efforts. In marketing, these tools empower businesses to personalize their outreach by targeting specific accounts with tailored content and messaging, enhancing engagement and conversion rates. Sales teams benefit from streamlined processes, gaining insights into account priorities and behaviors to prioritize efforts effectively.

- CRM functionalities provide a centralized platform for managing customer interactions, fostering stronger relationships and driving long-term loyalty. Beyond these core applications, the market is witnessing innovation in areas like predictive analytics, AI-driven automation, and integrations with emerging technologies, further enhancing the effectiveness of account-based strategies across various industries and sectors. As businesses increasingly prioritize personalized engagement and efficient resource allocation, the demand for Account-Based Execution Software continues to grow, driving innovation and evolution within the market landscape.

Account-Based Execution Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's anticipated dominance in the Account-Based Execution Software Market over the forecast period is propelled by several key factors. Firstly, the region boasts a robust technological infrastructure and a high level of digital adoption across industries, providing a fertile ground for the uptake of advanced software solutions like account-based execution platforms.

- North America is home to a large number of major enterprises across various sectors, particularly in technology, finance, and healthcare, which are increasingly prioritizing personalized and targeted approaches to customer engagement and sales. This trend is driving the demand for account-based execution software, which enables companies to tailor their sales and marketing strategies to individual accounts, thereby enhancing effectiveness and ROI. Furthermore, the presence of established players and innovative startups in the region's tech ecosystem contributes to a competitive landscape that fosters innovation and drives the continuous evolution of account-based execution solutions.

Active Key Players in the Account-Based Execution Software Market

- Terminus (US)

- Demandbase (US)

- RollWorks ( US)

- Jabmo (France)

- 6sense (US)

- Engagio (US)

- Triblio (US)

- Kwanzoo (US)

- Madison Logic(US)

- Other Key Players

|

Global Account-Based Execution Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.17% |

Market Size in 2032: |

USD 2.31 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Company Size |

|

||

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Account-Based Execution Software Market by Deployment Mode (2018-2032)

4.1 Account-Based Execution Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud-based

Chapter 5: Account-Based Execution Software Market by Company Size (2018-2032)

5.1 Account-Based Execution Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium-sized Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Account-Based Execution Software Market by Application (2018-2032)

6.1 Account-Based Execution Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Marketing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Sales

6.5 Customer Relationship Management (CRM)

6.6 Others

Chapter 7: Account-Based Execution Software Market by Industry Vertical (2018-2032)

7.1 Account-Based Execution Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Information Technology (IT) and Telecommunications

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 BFSI (Banking

7.6 Financial Services) and Insurance

7.7 Retail and E-commerce

7.8 Manufacturing

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Account-Based Execution Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DOUXO

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SULFODENE

8.4 EARTHBATH

8.5 CURASEB

8.6 ADAMS

8.7 PETMD

8.8 DAVIS

8.9 SYNERGYLABS

8.10 PAWS & PALS

8.11 DECHRA DERMABENSS

8.12 OTHER KEY PLAYERS

Chapter 9: Global Account-Based Execution Software Market By Region

9.1 Overview

9.2. North America Account-Based Execution Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment Mode

9.2.4.1 On-premises

9.2.4.2 Cloud-based

9.2.5 Historic and Forecasted Market Size by Company Size

9.2.5.1 Small and Medium-sized Enterprises (SMEs)

9.2.5.2 Large Enterprises

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Marketing

9.2.6.2 Sales

9.2.6.3 Customer Relationship Management (CRM)

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 Information Technology (IT) and Telecommunications

9.2.7.2 Healthcare

9.2.7.3 BFSI (Banking

9.2.7.4 Financial Services) and Insurance

9.2.7.5 Retail and E-commerce

9.2.7.6 Manufacturing

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Account-Based Execution Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment Mode

9.3.4.1 On-premises

9.3.4.2 Cloud-based

9.3.5 Historic and Forecasted Market Size by Company Size

9.3.5.1 Small and Medium-sized Enterprises (SMEs)

9.3.5.2 Large Enterprises

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Marketing

9.3.6.2 Sales

9.3.6.3 Customer Relationship Management (CRM)

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 Information Technology (IT) and Telecommunications

9.3.7.2 Healthcare

9.3.7.3 BFSI (Banking

9.3.7.4 Financial Services) and Insurance

9.3.7.5 Retail and E-commerce

9.3.7.6 Manufacturing

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Account-Based Execution Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment Mode

9.4.4.1 On-premises

9.4.4.2 Cloud-based

9.4.5 Historic and Forecasted Market Size by Company Size

9.4.5.1 Small and Medium-sized Enterprises (SMEs)

9.4.5.2 Large Enterprises

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Marketing

9.4.6.2 Sales

9.4.6.3 Customer Relationship Management (CRM)

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 Information Technology (IT) and Telecommunications

9.4.7.2 Healthcare

9.4.7.3 BFSI (Banking

9.4.7.4 Financial Services) and Insurance

9.4.7.5 Retail and E-commerce

9.4.7.6 Manufacturing

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Account-Based Execution Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment Mode

9.5.4.1 On-premises

9.5.4.2 Cloud-based

9.5.5 Historic and Forecasted Market Size by Company Size

9.5.5.1 Small and Medium-sized Enterprises (SMEs)

9.5.5.2 Large Enterprises

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Marketing

9.5.6.2 Sales

9.5.6.3 Customer Relationship Management (CRM)

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 Information Technology (IT) and Telecommunications

9.5.7.2 Healthcare

9.5.7.3 BFSI (Banking

9.5.7.4 Financial Services) and Insurance

9.5.7.5 Retail and E-commerce

9.5.7.6 Manufacturing

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Account-Based Execution Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment Mode

9.6.4.1 On-premises

9.6.4.2 Cloud-based

9.6.5 Historic and Forecasted Market Size by Company Size

9.6.5.1 Small and Medium-sized Enterprises (SMEs)

9.6.5.2 Large Enterprises

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Marketing

9.6.6.2 Sales

9.6.6.3 Customer Relationship Management (CRM)

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 Information Technology (IT) and Telecommunications

9.6.7.2 Healthcare

9.6.7.3 BFSI (Banking

9.6.7.4 Financial Services) and Insurance

9.6.7.5 Retail and E-commerce

9.6.7.6 Manufacturing

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Account-Based Execution Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment Mode

9.7.4.1 On-premises

9.7.4.2 Cloud-based

9.7.5 Historic and Forecasted Market Size by Company Size

9.7.5.1 Small and Medium-sized Enterprises (SMEs)

9.7.5.2 Large Enterprises

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Marketing

9.7.6.2 Sales

9.7.6.3 Customer Relationship Management (CRM)

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 Information Technology (IT) and Telecommunications

9.7.7.2 Healthcare

9.7.7.3 BFSI (Banking

9.7.7.4 Financial Services) and Insurance

9.7.7.5 Retail and E-commerce

9.7.7.6 Manufacturing

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Account-Based Execution Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.17% |

Market Size in 2032: |

USD 2.31 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Company Size |

|

||

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||