Global Virtual Office Market Overview

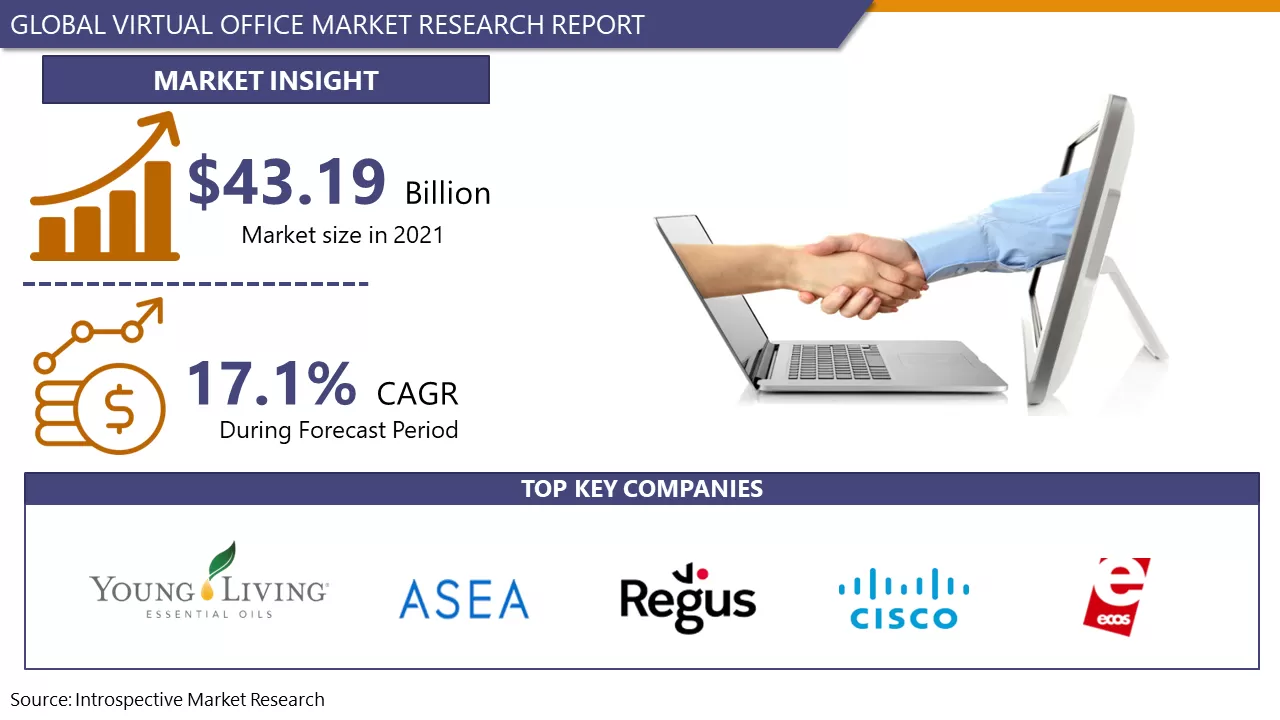

The Global Virtual Office Market size was USD 43.19 Billion in 2021 and is expected to generate around USD 130.40 Billion by 2028, at a CAGR of around 17.1% between 2022 and 2028.

A virtual office provides a real address as well as office-related services without the cost of a long lease or administrative staff. Employees can work from anywhere in a virtual office while still having access to things like a mailing address, phone answering services, conference rooms, and videoconferencing. Virtual offices serve consumers as a single entity but do not have a physical location. This type of configuration is particularly common among startups and small enterprises looking to cut costs. The growth of virtual offices has been aided by the development of web-based office productivity software and services, such as videoconferencing.

A virtual workplace appeals to consumers in two ways. For starters, a virtual office costs significantly less per month than a typical workplace. After all, it doesn't require any maintenance or upkeep, and it doesn't need to be staffed. A virtual office can also be rented on a month-to-month basis, giving users more flexibility if their company needs change (no waiting for a lease to expire or incurring the cost of a broken lease). Second, a virtual office can give services such as a mailing address, phone answering, and videoconferencing. As a result, a small business may look to be larger than it is. It can also give users a physical address (or many addresses) where they can meet with clients. As a result, the virtual office market is predicted to develop over the forecast period.

Major Key Players for Virtual Office Market

- Opus Virtual Offices

- The Executive Centre

- thinkspace

- Regus Group Companies

- Rovva

- Servcorp

- Northwest Registered Agent LLC

- OBC Suisse AG

- Office Evolution and its affiliate

- Virtual Headquarters

- Alliance Virtual Offices

- Davinci Virtual Offices

- Intelligent Office

- Sococo

Market Dynamics and Factors

Virtual offices, as one of the most important parts of the flexible workspace industry, provide a variety of services to businesses without the upfront costs of leasing or purchasing traditional office space. A wide spectrum of employees can benefit from virtual office technology, which includes digital storage, coworking spaces, and communication services. Growing demand from IT enterprises and a growing need for remote working as a result of the epidemic have provided attractive opportunities for virtual office market participants. Furthermore, firms that have adopted virtual offices have been able to cut employee commute time and make more efficient use of office space. The aforementioned causes enhanced the acceptance of virtual offices among startups and small and medium businesses, and as a result, the virtual office market is expected to develop in 2020. However, the whole reliance on the internet for work is a significant roadblock. Interruptions in internet access could lead the entire organization to shut down, wasting time and money. The Global Virtual Office Market's growth is being stifled by the rising requirement for human contact for training and monitoring employee performance.

Virtual Office Market Report Highlight

- By type, the cloud-based segment is anticipated to hold the major market share over the forecast period. SD-WAN, a cloud-based product, is ideal for businesses that are transitioning to or expanding their distributed workforce.

- By service, the remote working access segment is anticipated to lead the market during the projected period.

- By type, the large organization's segment is anticipated to hold the major market share over the forecast period. For larger or established businesses, a virtual office allows them to test new markets. Companies that want to expand into a new market might test their ideas in a virtual office without risking financial loss.

- In 2020-21, the worldwide virtual office market was dominated by North America, followed by Europe. The increasing consumer appetite for flexible working can be related to the rise in these locations. The virtual office markets in the United Kingdom and the United States are mostly mature.

Key Industry Development

In January 2022, Deutsche Telekom is launching its first-ever Virtual Office utilizing Aurea's Sococo platform, according to Aurea Software Inc., the "Netflix of business software." The test will run until March and will be used to better link the company's remote workers as well as promote culture and collaboration across the company's customer support teams.

In May 2022, SBN Wisconsin, a subsidiary of London-based flexible workplace solutions provider SBN Ltd., has opened, offering the worldwide company's virtual office services to entrepreneurs and business owners in Wisconsin, Illinois, and Michigan.

Virtual Office Market Segmentation

By Type

- Cloud-Based

- Web-Based

- Others

By Services

- Team Apps

- Remote Working Access

- Teleconferencing

- Videoconferencing

- Cloud Storage

- Others

By End-User

- ITES Services

- Government Organizations

- Freelancers

- Start-Ups

- Large Organizations

- Others

For this report, Introspective Market Research has segmented the Virtual Office Market based on region

Regional Outlook (Revenue in USD Million; Volume in Units, 2022-2028)

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Turkey

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Vietnam

- Thailand

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- Iran

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of LATAM