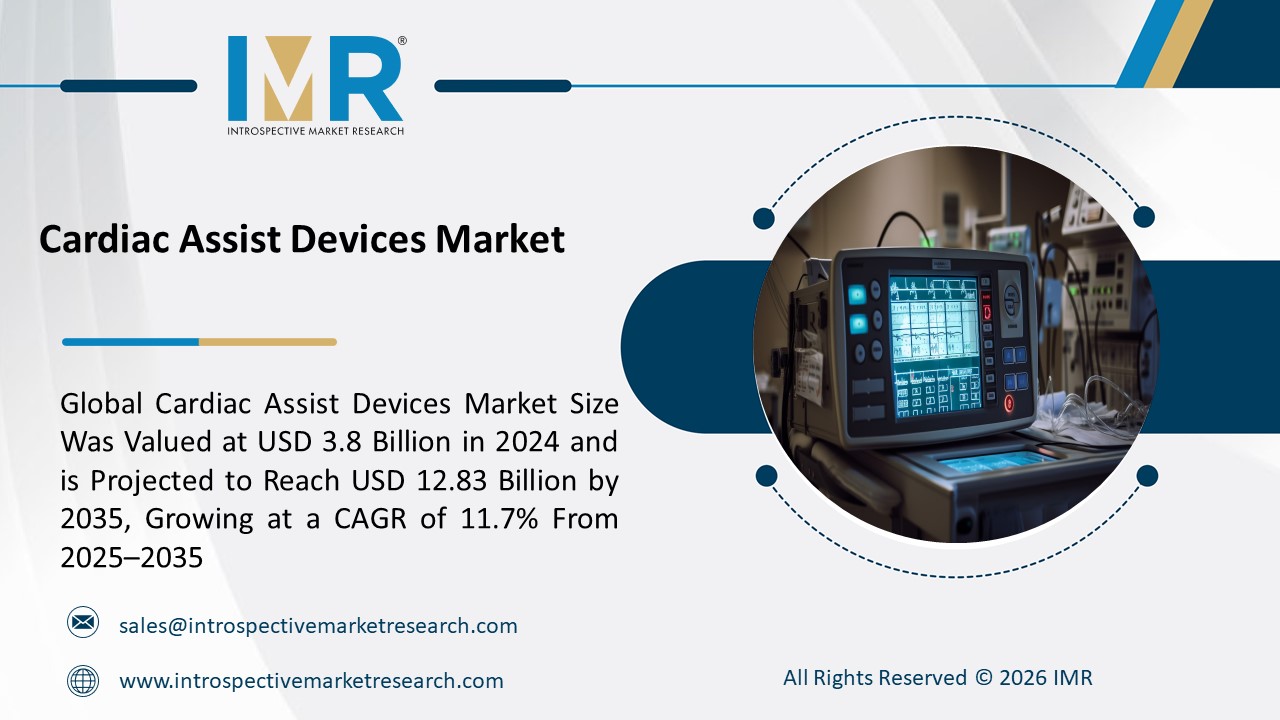

According to a new report published by Introspective Market Research, titled, “Cardiac Assist Devices Market by Product, Modality, and End-User,” The Global Cardiac Assist Devices Market Size Was Valued at USD 3.8 Billion in 2024 and is Projected to Reach USD 12.83 Billion by 2035, Growing at a CAGR of 11.7% From 2025–2035.

The Cardiac Assist Devices (CAD) market comprises advanced mechanical pumps designed to support or temporarily replace the pumping function of a failing heart. These devices are critical therapeutic options for patients with advanced heart failure, bridging them to recovery, transplantation, or serving as long-term destination therapy. Key products include Ventricular Assist Devices (VADs), Intra-Aortic Balloon Pumps (IABPs), and Total Artificial Hearts (TAHs). Compared to traditional pharmacological management, which often only manages symptoms, cardiac assist devices provide direct hemodynamic support, improving blood circulation, organ perfusion, and significantly enhancing patient survival rates and quality of life. They are primarily used in major healthcare sectors, including hospitals and specialized cardiac centers. Their adoption is pivotal in managing the growing global burden of heart failure, offering a lifeline where donor hearts for transplantation are severely limited.

The primary growth driver for the Cardiac Assist Devices market is the escalating global prevalence of heart failure, driven by an aging population, rising incidence of cardiovascular diseases, and improved survival rates from acute cardiac events that can lead to chronic heart failure. As the patient pool expands and the severe shortage of donor hearts for transplantation persists, the demand for durable, life-sustaining mechanical circulatory support solutions rises correspondingly. Technological advancements that improve device durability, reduce complication rates, and enhance patient mobility further solidify the role of these devices as a standard of care for end-stage heart failure.

A significant market opportunity lies in the technological evolution towards minimally invasive and transcutaneous devices. The development of next-generation, percutaneous ventricular assist devices (pVADs) that are easier and faster to implant with reduced surgical trauma presents a major growth avenue. These devices lower procedural risks, shorten hospital stays, and expand potential use to a broader, often less critically ill patient population for short-term support during high-risk procedures or acute cardiac failure, thereby penetrating new clinical segments beyond traditional bridge-to-transplant or destination therapy.

Cardiac Assist Devices Market, Segmentation

The Cardiac Assist Devices Market is segmented on the basis of Product, Modality, and End-User.

Product

The Product segment is further classified into Ventricular Assist Devices, Intra-Aortic Balloon Pumps, and Total Artificial Hearts. Among these, the Ventricular Assist Devices (VADs) sub-segment accounted for the highest market share in 2024. VADs dominate due to their versatility as long-term support solutions for left, right, or biventricular heart failure. Technological progress has led to smaller, more durable continuous-flow pumps with improved biocompatibility, making them the cornerstone for both bridge-to-transplant and destination therapy, directly addressing the core limitation of donor heart availability and driving sustained clinical adoption and revenue.

Modality

The Modality segment is further classified into Implantable and Transcutaneous. Among these, the Implantable sub-segment accounted for the highest market share in 2024. Implantable devices, particularly Left Ventricular Assist Devices (LVADs), lead the market as they are designed for long-term use, offering patients greater mobility and the potential for discharge from the hospital, significantly improving quality of life. Their dominance is linked to their established efficacy in managing chronic, end-stage heart failure, robust clinical evidence supporting long-term survival benefits, and their critical role in definitive treatment strategies where transplantation is not an option.

Some of The Leading/Active Market Players Are-

• Abbott Laboratories (US)

• Medtronic plc (Ireland)

• Abiomed, Inc. (US) [Part of Johnson & Johnson]

• Getinge AB (Sweden)

• SynCardia Systems, LLC (US)

• Berlin Heart GmbH (Germany)

• CardiacAssist, Inc. (US)

• LivaNova PLC (UK)

• Teleflex Incorporated (US)

• Jarvik Heart, Inc. (US)

• ReliantHeart, Inc. (US)

• Fresenius SE & Co. KGaA (Germany)

• and other active players.

Key Industry Developments

In January 2024, Abbott received CE Mark approval for its next-generation HeartMate 3+ LVAD system in Europe, featuring a smaller design and simplified implantation technique. This aims to reduce surgical complexity and expand access to life-saving therapy for a broader range of heart failure patients, including those with smaller body surface areas.

In March 2024, Medtronic initiated a pivotal clinical trial for its novel HVAD System successor, focusing on enhanced hemocompatibility and integrated remote monitoring. The trial seeks to demonstrate superior clinical outcomes by reducing pump-related complications like stroke, addressing a key concern in long-term VAD therapy and potentially setting a new standard for device safety.

Key Findings of the Study

Ventricular Assist Devices (VADs) and Implantable modality segments held the dominant market share.

North America led the regional market, supported by high healthcare expenditure and rapid technology adoption.

Rising heart failure prevalence and donor shortage are the key market drivers.

The trend is shifting towards miniaturization, enhanced durability, and minimally invasive implantation techniques