Automatic Faucet Market Synopsis

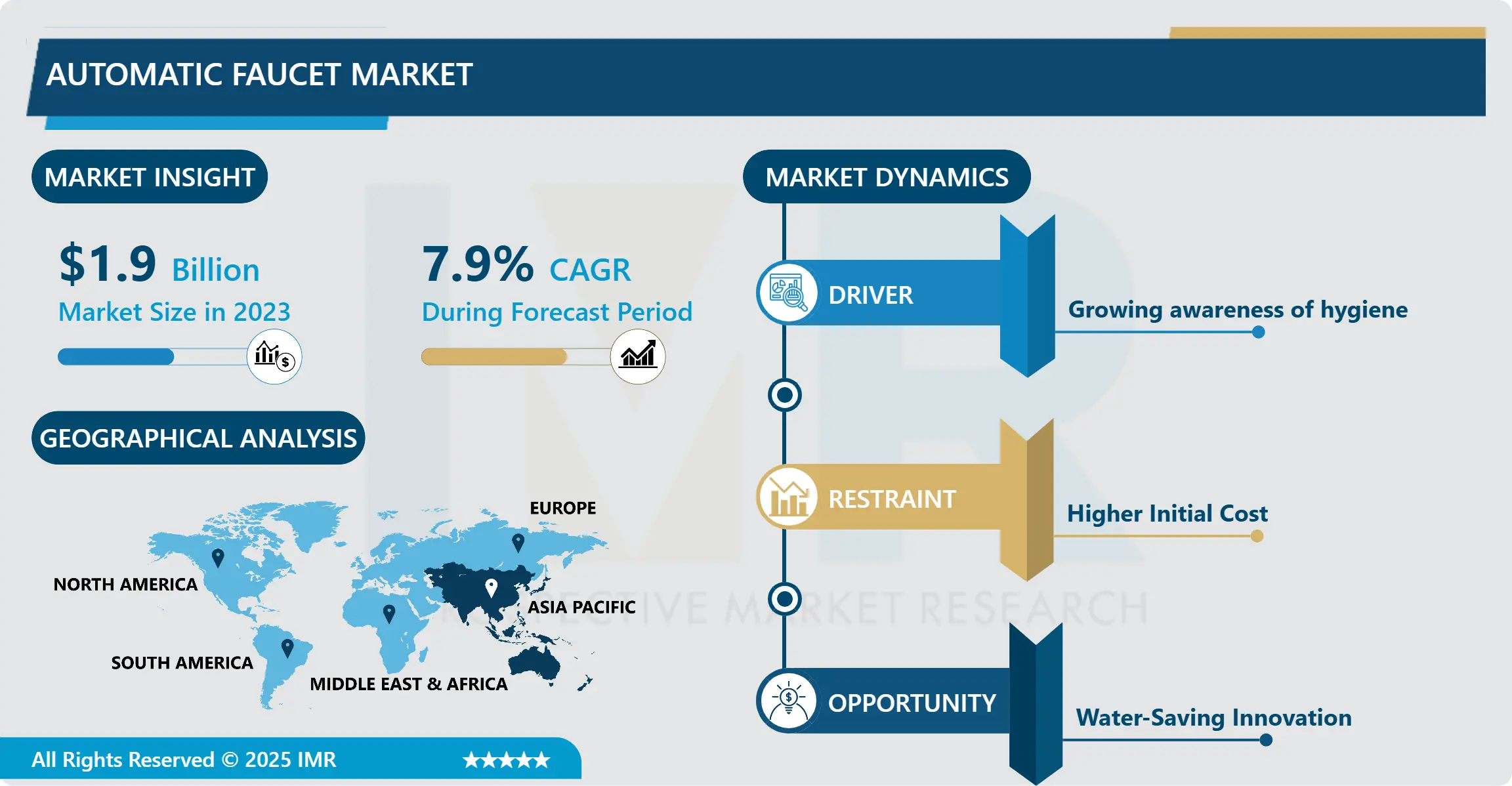

Automatic Faucet Market Size Was Valued at USD 1.9 Billion in 2023, and is Projected to Reach USD 3.77 Billion by 2032, Growing at a CAGR of 7.9% From 2024-2032

An automatic faucet, or a touchless or sensor faucet, is a new type of plumbing fixture that is intended to add comfort, sanitation, and water-saving features to homes and businesses. Automatic faucets are different from handles or knobs and are fitted with sensors that can detect hands or other objects around them. This technology enables users to turn on or off the water supply without coming into contact with the handle, which is a source of germ and bacteria transmission.

The working of automatic faucets usually entails the use of infrared sensors which are used to detect motion or the presence of hands under the faucet spout. When the temperature reaches the set limit, an alarm is sounded and the solenoid valve which regulates the water flow is energized to allow water to pass through it. When the user is out of range or takes his/her hands off the valve, the sensor is able to inform the valve that there is no activity and thus closes it to avoid wastage of water. Besides, it eliminates the need for contact with surfaces that may be contaminated with the virus, and it also helps in water conservation, which is an essential aspect of sustainable architecture and construction.

Apart from the practical use, automatic faucets come in different designs and finishes to match the different interiors and exteriors of homes and offices and can be used in homes’ kitchens and bathrooms and commercial places like airports, hospitals, and restaurants. These faucets are installed in a way that they may need to be powered, for instance by batteries or an electrical outlet, depending on the type of the faucet. In summary, automatic faucets still embody a contemporary innovation to enhance the availability of clean water and reduce wastage.

Automatic Faucet Market Trend Analysis

Smart Faucet Integration

- Smart faucet integration has become one of the most popular trends in the automatic faucet market because of the constant development of technology and the need for people to have better products that will simplify their lives. These faucets come with sensors and smart controls to ensure that they do not require people to touch them to operate and therefore helping in the prevention of the spread of germs and bacteria in public and private places. This feature is especially useful in areas that are sensitive in terms of hygiene like hospitals, restaurants, and homes where bathrooms are located.

- The other major factor that has led to the use of smart faucets is the fact that they reduce the use of water. These faucets often have features such as the automatic shut off and flow rate control depending on the usage, which can greatly help in saving water as compared to the conventional faucets. This is not only in line with the global measures towards water conservation, but it also captures the market of environmentally conscious clients who are willing to invest in sustainable water saving solutions for their homes or businesses.

- Furthermore, smart faucets provide users with more comfortable experiences through compatibility with smart home devices. They are also programmable to be operated through smartphone applications or even voice commands, thus enabling users to manage settings and usage from a distance. It also allows for things like setting specific preset options for the water temperature and flow, which only serve to improve the experience and enjoyment of the users.

- Therefore, the trend in smart faucet integration in the automatic faucet market is a perfect combination of technology, environmentalism, and user friendliness. With these faucets continuing to develop more functionality and compatibility with smart homes and buildings, they are expected to remain a central part of plumbing fixtures in the future, providing functionality and innovation for the modern management of water.

Water-Saving Innovation

- The automatic faucet is an excellent chance for water-saving innovations that can solve the vital environmental and economic problems. This is because with the increase in water scarcity in the global world there is a focus on efficient water management systems. Automatic faucets are those faucets that have sensors that determine the amount of water to be allowed through depending on the occupancy of the area and the time taken hence they are very instrumental in preventing wastage of water as compared to the manual faucets. It also contributes to the reduction of overall water usage and helps consumers and businesses to save money on their utility costs.

- Additionally, the need for clean products has increased, especially in places that people frequently visit and touch, such as offices, restaurants, and other business spaces. Automatic faucets provide ease of use and do not require contact with the tap which helps in avoiding the spread of germs and increases the safety of the user. It can be seen that this feature is especially useful in the current situation with the COVID-19 pandemic as the aspect of sanitation is crucial in the present days. With the introduction of better hygiene practices, the market for automatic faucets is expected to grow as organizations pay attention to cleanliness.

- Moreover, the enhancements in the technology of the sensors in terms of accuracy and energy consumption have made automatic faucets more dependable and affordable than in the past. These faucets are becoming more connected with smart building platforms to facilitate remote monitoring, analysis, and diagnostics.

- Such capabilities not only improve the operational effectiveness but also help to achieve sustainable objectives in terms of water usage by offering real time consumption patterns. As the market continues to develop and becomes more environmentally conscious, the automatic faucet industry remains at the forefront of offering products that are compliant with current legislation and that cater to consumers’ desire for environmentally friendly and hygienic options.

Automatic Faucet Market Segment Analysis:

Automatic Faucet Market Segmented on the basis of type and application.

By Product Type, Electric Powered segment is expected to dominate the market during the forecast period

- As for the Automatic Faucet Market, it is worth noting that the segment, which uses electricity as a power source, can exceed the segment with battery-operated faucets for several reasons. Battery operated faucets are normally preferred for their efficiency and consistency in their working. They are interfaced to a power supply, commonly to mains electricity, this means that there is a constant and unintermittent supply of power. This helps in doing away with the constant battery replacement or charging, saving much effort and costs to the users.

- In addition, electric-powered faucets include a sophisticated sensor system and other features, including accurate motion detectors or infrared sensors that enhance its functionality. These sensors can easily identify the presence of hands or objects under the faucet and turn on the flow of water as well as turn it off when there is no activity. This functionality not only adds convenience to the user experience but also encourages water saving which is a crucial factor in the current market with a focus on environmental protection.

- In addition, electric faucets are used in areas like airports, hotels, restaurants, and healthcare facilities since they are easier to maintain, durable, and reliable. These faucets are more robust and are manufactured to meet the hygiene requirements of busy facilities, and therefore are ideal for use in areas that require a lot of traffic, and where sanitation and functionality are paramount

- All in all, battery-operated faucets are convenient for installation and may be preferred for residential applications or regions where it is difficult to connect the faucet to electricity; however, the electric-powered faucets are more popular in the market because they are more reliable, equipped with more functions, and are more suitable for commercial applications. Owing to the advancement in technology, the electric powered faucets are expected to dominate the Automatic Faucet Market due to constant research on sensor technology and environmentally friendly solutions.

By Energy Type, DC (Direct Current) segment expected to held the largest share

- The Segment of Automatic Faucet Market powered by DC (Direct Current) is likely to outdo the AC (Alternating Current) powered segment for a number of reasons. The primary reason for selecting DC-powered faucets is the energy and safety benefits that these faucets offer. They are powered by low voltage DC electricity, which could be from batteries or power adapters and hence consumes less power than most AC faucets. This efficiency not only cuts costs on operations but also supports sustainability objectives of using less energy in the process.

- Furthermore, the faucets that are powered by direct current are usually preferred for their flexibility when it comes to the mode of installation. They can be easily installed in areas where AC power may be unavailable or is difficult to obtain, for example in locations that are remote or in retrofitting where the cost of rewiring would be prohibitive. This versatility of the DC power supply makes the faucet ideal for installation in various settings, including homes, hotels, restaurants, offices, and public amenities.

- In addition, it is worth noting that the majority of faucets that operate with the help of DC power have built-in high-grade sensors that enhance the performance of the equipment. Some of these sensors are motion or proximity sensors, which make the devices free from contact, improving their cleanliness and ease of use. The use of DC power allows for greater precision in the faucet’s operation since it is always on and can turn water flow on and off as needed depending on the user’s input.

- There are also AC-powered faucets being offered and can be used especially in areas where power supply is constant like in newly built structures or buildings that already have electrical installations; however, the prevalence of DC-powered faucets in the market indicates the benefits of using DC systems in relation to energy consumption, installation, and compatibility with modern technologies. The market is expected to remain dominated by DC-powered faucets as innovations in sensing and energy control are set to persist in the Automatic Faucet Market to address the changing consumer needs for eco-friendly and effective water fixtures.

Automatic Faucet Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Automatic faucet market is highly influenced by several factors and the Asia Pacific region has become prominent in this market due to the following reasons. The first feature is the manufacturing capacity of the region where countries such as China, Japan, and South Korea boast of advanced manufacturing technology and skilled labor. These countries have also been able to produce automatic faucets on a large scale and at a cheap and efficient manner that has met the global demand.

- Increased urbanization and construction in many Asia Pacific countries have created the need for the integration of automated technologies in the various sectors such as the commercial and residential buildings. The general public, through automatic faucets, will be able to have a convenient way of accessing water, save on water and at the same time be healthy since the faucets do not come into contact with the water.

- Also, a large population base and a growing population of the middle class in Asia Pacific has resulted in higher spending on home improvement as well as on commercial construction. This trend has also contributed towards the increasing call for automatic faucets in the market as consumers and businesses look for the latest technologies that provide ease, efficiency and hygiene.

- In conclusion, Asia Pacific has emerged as the largest consumer of automatic faucet due to its robust manufacturing capacity, urbanization, and burgeoning demand for smart and sustainable products. These factors have placed the region at the forefront of both manufacture and use of automatic faucets thereby fostering its growth and advancement in this segment across the world.

Active Key Players in the Automatic Faucet Market

- American Standard Brands (United States)

- Chicago Faucets (United States)

- Delta Faucet Company (United States)

- EcoSmart, LLC (United States)

- Geberit AG (Switzerland)

- GROHE AG (Germany)

- Jaquar Group (India)

- Kohler Co. (United States)

- LIXIL Group Corporation (Japan)

- Moen Incorporated (United States)

- Oras Group (Finland)

- Pfister (United States)

- Roca Sanitario S.A. (Spain)

- Rubinetterie Bresciane Bonomi S.p.A. (Italy)

- SensorTap (China)

- Sloan Valve Company (United States)

- Sloan Valve Company (United States)

- Swarovski AG (Austria)

- TOTO Ltd. (Japan)

- Zurn Industries, LLC (United States)

- Other key Players

|

Automatic Faucet Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 3.77 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Energy Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automatic Faucet Market by Product Type (2018-2032)

4.1 Automatic Faucet Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Powered

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Electric Powered

Chapter 5: Automatic Faucet Market by Energy Type (2018-2032)

5.1 Automatic Faucet Market Snapshot and Growth Engine

5.2 Market Overview

5.3 DC

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 AC

Chapter 6: Automatic Faucet Market by Application (2018-2032)

6.1 Automatic Faucet Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automatic Faucet Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMERICAN STANDARD BRANDS (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHICAGO FAUCETS (UNITED STATES)

7.4 DELTA FAUCET COMPANY (UNITED STATES)

7.5 ECOSMART

7.6 LLC (UNITED STATES)

7.7 GEBERIT AG (SWITZERLAND)

7.8 GROHE AG (GERMANY)

7.9 JAQUAR GROUP (INDIA)

7.10 KOHLER CO. (UNITED STATES)

7.11 LIXIL GROUP CORPORATION (JAPAN)

7.12 MOEN INCORPORATED (UNITED STATES)

7.13 ORAS GROUP (FINLAND)

7.14 PFISTER (UNITED STATES)

7.15 ROCA SANITARIO S.A. (SPAIN)

7.16 RUBINETTERIE BRESCIANE BONOMI S.P.A. (ITALY)

7.17 SENSORTAP (CHINA)

7.18 SLOAN VALVE COMPANY (UNITED STATES)

7.19 SLOAN VALVE COMPANY (UNITED STATES)

7.20 SWAROVSKI AG (AUSTRIA)

7.21 TOTO LTD. (JAPAN)

7.22 ZURN INDUSTRIES

7.23 LLC (UNITED STATES)

7.24 OTHER KEY PLAYERS

7.25

Chapter 8: Global Automatic Faucet Market By Region

8.1 Overview

8.2. North America Automatic Faucet Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Battery Powered

8.2.4.2 Electric Powered

8.2.5 Historic and Forecasted Market Size by Energy Type

8.2.5.1 DC

8.2.5.2 AC

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automatic Faucet Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Battery Powered

8.3.4.2 Electric Powered

8.3.5 Historic and Forecasted Market Size by Energy Type

8.3.5.1 DC

8.3.5.2 AC

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automatic Faucet Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Battery Powered

8.4.4.2 Electric Powered

8.4.5 Historic and Forecasted Market Size by Energy Type

8.4.5.1 DC

8.4.5.2 AC

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automatic Faucet Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Battery Powered

8.5.4.2 Electric Powered

8.5.5 Historic and Forecasted Market Size by Energy Type

8.5.5.1 DC

8.5.5.2 AC

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automatic Faucet Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Battery Powered

8.6.4.2 Electric Powered

8.6.5 Historic and Forecasted Market Size by Energy Type

8.6.5.1 DC

8.6.5.2 AC

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automatic Faucet Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Battery Powered

8.7.4.2 Electric Powered

8.7.5 Historic and Forecasted Market Size by Energy Type

8.7.5.1 DC

8.7.5.2 AC

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Automatic Faucet Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 3.77 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Energy Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||