Vehicle Analytics Market Synopsis:

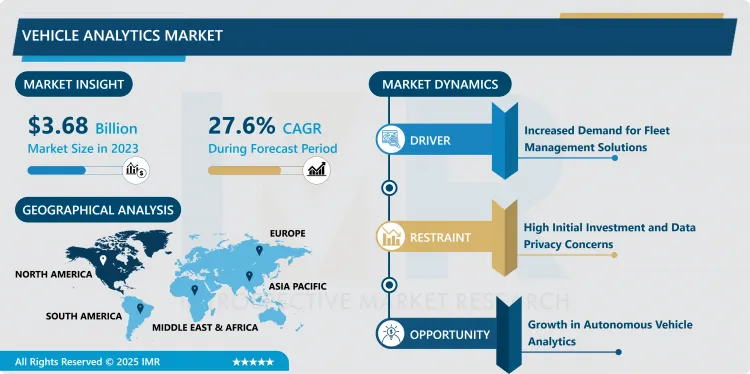

Vehicle Analytics Market Size Was Valued at USD 3.68 Billion in 2023, and is Projected to Reach USD 33.00 Billion by 2032, Growing at a CAGR of 27.6% From 2024-2032.

The vehicle analytics market is defined as the commercial use of data analysis technologies for tracking and managing various operational parameters of vehicles. For the connected vehicle to play its role in creating smarter transportation systems, it relies on data from semantically connected vehicles with key performance indicator data, driver behavior, existing vehicle maintenance data, as well as environmental factors. This analysis is useful in addressing issues related to how to manage vehicle fleets, minimize costs, increase safety, and enhance efficiency of undertakings for vehicle owners, fleet managers, insurers, and ministries of transport.

Industry experts have attributed the growth of the Vehicle Analytics Market to enhanced automobile connectivity, data analysis, smart city and smart car evolution. The use of connected vehicles has become rampant means by which real-time data from vehicles and their infrastructure can be harvested. Vehicle analytics solutions utilize this information to provide multiple service areas including fleet management, insurance risk assessment solutions, predictive maintenance, and driver behavior monitoring. Such knowledge can greatly improve the organization’s business processes, decrease expenses, and minimize the hazards encountered.

The growing usage of IoT (Internet of Things) is spurring the growth of vehicle analytics solutions. Connected cars use IoT sensors to gather data concerning the condition of automobiles, behaviors of their drivers, fuel efficiency, and conditions on the roads and utilize this information. Today, governments and businesses are applying these analytics for controlling the traffic, minimizing road density, increasing security, and optimizing transportation systems.

In the context of fleet management, vehicle analytics is significantly used in the management of vehicles in real-time, proper identification of vehicles for appropriate usage, and prevention of misuse while improving organization efficiency. With use of information on fuel consumption, service, and route planning, the commercial entities’ costs can be minimized, and services enhanced. In the automobile insurance market a field called vehicle analytics is utilized for evaluating risk by analysis of driving mannerism and thereby the insurance companies can offer flexible and variable prices.

As the AI and ML are increasingly integrated to analyze extensive data and actively use them to predict possible failures in a vehicle, the market for vehicle analytics is also progressing. This proactive approach of constructing predictive maintenance is revolutionashing the automotive and fleet management sectors by enfeebling the shrinking time and maintenance bills. Also, vehicle analytics solutions assist in changing the current transportation system by providing data for efficient fuel usage, as well as serving as organizational tools for managing vehicle use with regard to environmental impacts.

Vehicle Analytics Market Trend Analysis:

Data-Driven Insights for Predictive Maintenance

- Some of the trends that have been identified on the vehicle analytics market include… The demand for the predictive maintenance is among them. Predictive maintenance is an approach that uses statistical methods to recognize signs of likely vehicle failures in advance in order to minimize vehicle ‘downtime’ and increase the vehicle’s life expectancy. By using sensors and big data analysis the fleet operators can track the state of all the components in the vehicles and detect signs of wear or failure. This trend is emerging as managers attempt to maximize fleet management and minimize the maintenance of the vehicles in order to realize improved vehicle life cycle costs.

- Éfiscreated due to its effectiveness in specific industries, primarily the businesses that utilize significant numbers of vehicles, including logistics, transportation and delivery. Through the vehicle analytics platforms, the managers of the fleets will be able to monitor and control the engine, tire pressure, battery health among other factors that can lead to vehicle failure. This approach reduces the expenses incurred in repairing the vehicles, optimizes the use of fleet to deliver maximum productivity, and more importantly, ensures that the vehicles on the roads perform optimally, something that is crucial to any firm operating in a competitive environment.

Growth in Autonomous Vehicle Analytics

- However, with the progressing advancement of self-driven cars, the area of Vehicle Analytics has a chance to expand. Self-driving cars produce a great of information that can be used to improve the characteristics of cars, their safety, and operational effectiveness. In the emerging market of they car, analytics solutions can offer valuable optimisation capabilities for the operation of the vehicle: performance data in real time wherever an AV may be; data on the driving behaviour in the AV where it is partly autonomous; and vehicle-to-vehicle interaction. Thus, this data can be used to refine the algorithms used by the companies for developing auto-drive cars and moving towards making cars safer.

- Also, a number of new business models emerge in front of subscription-based or data-as-a service, so that players in the field of MVNOs have possibilities to offer analytics services to OEMs, autonomous vehicle creators and fleet providers. This can result in more unique and creative business strategies and methods of earning revenue such as in transportation and logistics where auto intends to drastically alter all the fleets. They also help to gather data that can be used to develop smart cities, how urban infrastructure should be planned and built.

Vehicle Analytics Market Segment Analysis:

Vehicle Analytics Market Segmented on the basis of Vehicle Type, Component, Deployment Mode, Application, End User, and Region.

By Component, Hardware segment is expected to dominate the market during the forecast period

- The vehicle analytics market is composed of three primary components: which include the usual hardware, software and services. Hardware refers to all the tangible equipment that is used to procure information from automobiles; examples are sensors, global positioning system devices, and telematics gadgets. Such devices are used to track and evaluate the status and location of vehicles and conditions of the atmosphere simultaneously. As more vehicles become connected, traditional technologies as well as IoT sensors and embedded systems needed to support connected vehicles are on the rise.

- Whereas, software is very much useful in order to analyze the data that has been built by the hardware. The use of AI and machine learning enables the vehicle analytics software platforms to extract patterns from all the data collected, thus making it easier for a business to make decisions. The software component is crucial in aspects of fleet management service offering, usage of predictive maintenance techniques, and driver behavioral analysis. Consulting services, support and data analytics services augment the core product offering of hardware systems and software applications by offering unique solutions to help the businesses to drive and maximize the usage of vehicle analytics systems

By Application, Fleet Management segment expected to held the largest share

- Minutely, the types of usage of vehicle analytics are very many and they cut of a cross section of industries. Fleet management is the biggest application of vehicle analytics solutions because it allows firms to monitor vehicles in real time, assess fuel efficiency, manage driver behaviour and correct routes. This application allows businesses to optimise on its operation costs, enhance service provision, and enhance vehicle management.

- Other important business uses include traffic analysis, which addresses the problems of traffic jams and uses vehicle analytics, offering information on the traffic density and adjusting traffic lights to activate the ideal timing arrangement. In the insurance industry, an application that takes into consideration vehicle analytics gives the insurers an ability to underwrite based on performance thus gives the consumer a more flexible and variable rate. Predictive maintenance is another of the major applications that allow minimizing the downtime and decreasing expenditures for maintenance due to indication of possible problems. Such newly explored things as the monitoring of driver’s behavior concerning the given characteristics can facilitate the search for solutions to how driving patterns may be made safer and insurance costs reduced.

Vehicle Analytics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Right now, the vehicular analytics market is centred in North America. It becomes clear that the dominance of this region could be because of the increased use of IoT and AI in the automotive and transport industries. Today, the United States and Canada lead the way in the use of connected vehicles; fleets purchase data from vehicle analytics to improve efficiency and minimize expenses, for example. In addition, such concerns as sustainability and environmental responsibility have extended analytics as a solution to control fuel use and emissions.

- Key participants in North America and ample investments in smart city projects and automobile technologies also contribute to the region’s dominance in the vehicle analytics market. Also the government regulations for road safety and control of traffic congestion are also greatly contributing to the demand of vehicle analytics solutions. With vehicle connectivity and automation in its growth stage, North America will retain dominance over this Combined A2P market, driven by constant innovation in analytics technologies and the rise of self-automated automobiles.

Active Key Players in the Vehicle Analytics Market:

- IBM (United States)

- Telogis (United States)

- Geotab (Canada)

- Fleet Complete (Canada)

- Wabco (Belgium)

- Verizon Connect (United States)

- GreenRoad (United States)

- Zonar Systems (United States)

- Continental AG (Germany)

- Harman International (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- Other Active Players

Key Industry Developments in the Vehicle Analytics Market:

- March 2023 - Latitude AI, a subsidiary of Ford, created advanced automated driving technology, initially concentrating on a hands-free, eyes-off driver assistance system for future Ford vehicles. With a team of 550 specialists in machine learning, robotics, software, sensors, systems engineering, and test operations, Ford is broadening its range of automated driving solutions to revolutionize the driving experience for millions of customers.

- February 2023 - Dassault Systèmes announced Renault's use of its 3DEXPERIENCE platform's data science to tackle rising raw material costs and optimize production expenses. Renault expands platform usage from design to strategic functions like costing and purchasing, aiding digital transformation. Data-driven insights projected on virtual vehicle twins offer innovative design-business balance.

- February 2023 - Cloud Theory was launched to revolutionize data insights for the automotive industry. It offers real-time, proprietary data platforms that provide VIN-level automotive insights for US markets and unique predictive modeling using artificial intelligence. Co-founded by ZeroSum, Cloud Theory addresses the industry's need for up-to-date, comprehensive data for informed decision-making.

- January 2023 - Qualcomm and Salesforce planned a joint platform for automakers to enhance customer connections and explore revenue avenues. By integrating Salesforce Automotive Cloud and Snapdragon Digital Chassis Solution, they aimed for personalized experiences using real-time analytics. Qualcomm's connected services platform will be part of Snapdragon Digital Chassis offerings for various automotive sectors.

|

Global Vehicle Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.68 Billion |

|

Forecast Period 2024-32 CAGR: |

27.6% |

Market Size in 2032: |

USD 33.00 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vehicle Analytics Market by Component (2018-2032)

4.1 Vehicle Analytics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Vehicle Analytics Market by Application (2018-2032)

5.1 Vehicle Analytics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fleet Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Traffic Management

5.5 Insurance

5.6 Predictive Maintenance

5.7 Driver Behavior Monitoring

5.8 Others

Chapter 6: Vehicle Analytics Market by Vehicle Type (2018-2032)

6.1 Vehicle Analytics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Vehicles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Vehicles

6.5 Electric Vehicles

Chapter 7: Vehicle Analytics Market by End-User (2018-2032)

7.1 Vehicle Analytics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive Manufacturers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Transportation and Logistics

7.5 Government

7.6 Insurance Companies

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Vehicle Analytics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TELOGIS (UNITED STATES)

8.4 GEOTAB (CANADA)

8.5 FLEET COMPLETE (CANADA)

8.6 WABCO (BELGIUM)

8.7 VERIZON CONNECT (UNITED STATES)

8.8 GREENROAD (UNITED STATES)

8.9 ZONAR SYSTEMS (UNITED STATES)

8.10 CONTINENTAL AG (GERMANY)

8.11 HARMAN INTERNATIONAL (UNITED STATES)

8.12 ORACLE CORPORATION (UNITED STATES)

8.13 SAP SE (GERMANY)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Vehicle Analytics Market By Region

9.1 Overview

9.2. North America Vehicle Analytics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Hardware

9.2.4.2 Software

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Fleet Management

9.2.5.2 Traffic Management

9.2.5.3 Insurance

9.2.5.4 Predictive Maintenance

9.2.5.5 Driver Behavior Monitoring

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Vehicle Type

9.2.6.1 Passenger Vehicles

9.2.6.2 Commercial Vehicles

9.2.6.3 Electric Vehicles

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Automotive Manufacturers

9.2.7.2 Transportation and Logistics

9.2.7.3 Government

9.2.7.4 Insurance Companies

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Vehicle Analytics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Hardware

9.3.4.2 Software

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Fleet Management

9.3.5.2 Traffic Management

9.3.5.3 Insurance

9.3.5.4 Predictive Maintenance

9.3.5.5 Driver Behavior Monitoring

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Vehicle Type

9.3.6.1 Passenger Vehicles

9.3.6.2 Commercial Vehicles

9.3.6.3 Electric Vehicles

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Automotive Manufacturers

9.3.7.2 Transportation and Logistics

9.3.7.3 Government

9.3.7.4 Insurance Companies

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Vehicle Analytics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Hardware

9.4.4.2 Software

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Fleet Management

9.4.5.2 Traffic Management

9.4.5.3 Insurance

9.4.5.4 Predictive Maintenance

9.4.5.5 Driver Behavior Monitoring

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Vehicle Type

9.4.6.1 Passenger Vehicles

9.4.6.2 Commercial Vehicles

9.4.6.3 Electric Vehicles

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Automotive Manufacturers

9.4.7.2 Transportation and Logistics

9.4.7.3 Government

9.4.7.4 Insurance Companies

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Vehicle Analytics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Hardware

9.5.4.2 Software

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Fleet Management

9.5.5.2 Traffic Management

9.5.5.3 Insurance

9.5.5.4 Predictive Maintenance

9.5.5.5 Driver Behavior Monitoring

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Vehicle Type

9.5.6.1 Passenger Vehicles

9.5.6.2 Commercial Vehicles

9.5.6.3 Electric Vehicles

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Automotive Manufacturers

9.5.7.2 Transportation and Logistics

9.5.7.3 Government

9.5.7.4 Insurance Companies

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Vehicle Analytics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Hardware

9.6.4.2 Software

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Fleet Management

9.6.5.2 Traffic Management

9.6.5.3 Insurance

9.6.5.4 Predictive Maintenance

9.6.5.5 Driver Behavior Monitoring

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Vehicle Type

9.6.6.1 Passenger Vehicles

9.6.6.2 Commercial Vehicles

9.6.6.3 Electric Vehicles

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Automotive Manufacturers

9.6.7.2 Transportation and Logistics

9.6.7.3 Government

9.6.7.4 Insurance Companies

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Vehicle Analytics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Hardware

9.7.4.2 Software

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Fleet Management

9.7.5.2 Traffic Management

9.7.5.3 Insurance

9.7.5.4 Predictive Maintenance

9.7.5.5 Driver Behavior Monitoring

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Vehicle Type

9.7.6.1 Passenger Vehicles

9.7.6.2 Commercial Vehicles

9.7.6.3 Electric Vehicles

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Automotive Manufacturers

9.7.7.2 Transportation and Logistics

9.7.7.3 Government

9.7.7.4 Insurance Companies

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Vehicle Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.68 Billion |

|

Forecast Period 2024-32 CAGR: |

27.6% |

Market Size in 2032: |

USD 33.00 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||