Supply Chain Management Software Market Synopsis

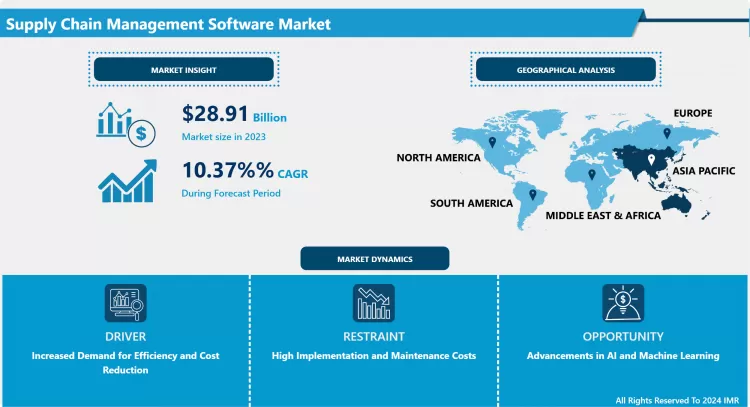

Supply Chain Management Software Market Size is Valued at USD 28.91 Billion in 2023, and is Projected to Reach USD 70.26 Billion by 2032, Growing at a CAGR of 10.37% From 2024-2032.

The global supply chain's increasing complexity and the necessity for improved visibility and efficiency are the primary factors driving the robust growth of the supply chain management (SCM) software market. Various software solutions aim to optimize and manage supply chain operations, including inventory management, order processing, logistics, and supplier relationships, within this market. AI, IoT, and blockchain technologies are among the primary drivers, as they provide real-time monitoring capabilities and improved data analytics. SAP, Oracle, and Microsoft are the most prominent competitors in the market, providing services to a wide range of industries, including manufacturing and retail. The increasing demand for cloud-based SCM solutions further stimulates the market's growth.

- The SCM software market is driven by a variety of factors, such as the necessity for real-time visibility into supply chain operations, the rise of e-commerce, and globalization. The market's expansion is also influenced by the heightened consumer expectations, the increasing complexity of supply chains, and the advancements in technology.

- The integration of the Internet of Things (IoT), machine learning (ML), and artificial intelligence (AI) into supply chain management (SCM) software improves overall efficiency, demand forecasting, and predictive analytics. Additionally, blockchain technology is acquiring popularity due to its capacity to generate transparent and secure transaction records.

- Planning, execution, procurement, and logistics comprise the SCM software market. Demand planning, inventory management, transportation management, and order fulfilment comprise each segment of supply chain management.

Supply Chain Management Software Market Trend Analysis

Supply Chain as a Service (SCaaS)

- The integration of blockchain technology, artificial intelligence (AI), and machine learning (ML) is revolutionizing supply chain management software. These technologies facilitate real-time monitoring, predictive analytics, and increased transparency, resulting in more resilient and efficient supply chains.

- The increased prevalence of cloud-based supply chain management software is attributable to its cost-effectiveness, flexibility, and scalability. It enables businesses to access real-time data, collaborate across multiple locations, and quickly adapt to evolving market conditions without the need for substantial initial investments in IT infrastructure.

- Companies are increasingly emphasizing sustainable supply chain practices in response to the growing recognition of environmental concerns. Supply chain management software now features the ability to monitor carbon footprints, optimize resource utilization, and guarantee adherence to environmental regulations, all of which are consistent with the sustainability objectives of corporations.

- SCaaS is a strategic approach that is gaining traction, in which third-party providers manage and optimize supply chain operations for businesses. This model provides access to sophisticated technologies, scalability, and flexibility without the necessity for substantial capital investments. By outsourcing supply chain management to specialized service providers, companies can enhance efficiency, reduce costs, concentrate on their primary competencies, and leverage SCaaS.

AI and Advanced Analytics

- AI-driven predictive analytics is revolutionizing supply chain management by enabling more precise inventory optimization, demand forecasting, and risk management. Companies can proactively alter their strategies in response to disruptions, resulting in increased efficiency and cost savings.

- The integration of AI and robotics is automating repetitive tasks, reducing human error, and enhancing operational efficiency. Robots equipped with AI capabilities streamline the supply chain process by handling inventory sorting, packing, and shipping in warehouse management. This trend is evident.

- Advanced analytics and AI facilitate real-time data processing and analysis, providing supply chain managers with actionable insights. This capability optimizes logistics and transportation management, enables immediate response to market changes, and enhances decision-making processes.

- The integration of AI and blockchain technology is improving the transparency and security of the supply chain. This integration guarantees the traceability of products from their origin to the end consumer, mitigates fraud, and enhances regulatory compliance. The collaboration between AI and blockchain is particularly advantageous in industries such as pharmaceuticals and food, where quality and authenticity are critical.

Supply Chain Management Software Market Segment Analysis:

Supply Chain Management Software Market Segmented on the basis of Deployment Mode and Industry Vertical.

By Deployment Mode, Cloud-based segment is expected to dominate the market during the forecast period

- This method entails the direct installation of supply chain management (SCM) software onto the company's servers. It is appropriate for organizations with particular security or regulatory obligations due to its enhanced customization and data management capabilities. Nevertheless, it necessitates a substantial initial investment in IT infrastructure and hardware.

- Cloud-delivered SCM software is becoming increasingly popular due to its scalability, flexibility, and lower initial costs. It is an ideal solution for companies with distributed operations, as it facilitates updates and maintenance and allows for remote access. The service provider alleviates security and data privacy concerns for smaller businesses with limited IT resources.

- The need for real-time data analytics, increased supply chain complexity, and globalization are driving the robust growth of the SCM software market. Cloud-based solutions, offering advantages in cost efficiency and deployment speed, are primarily driving this growth.

- Businesses must evaluate factors such as cost, scalability, data control, and IT capabilities when selecting between on-premises and cloud-based SCM software. Larger enterprises with specific requirements may prefer on-premises solutions, but small to medium-sized businesses often benefit from the cost savings and agility of cloud-based deployments.

Industry Vertical, Retail and Consumer Goods segment held the largest share in 2024

- SCM software is essential for optimizing delivery schedules, demand forecasting, and inventory management in this industry. The primary focus is on adaptability to consumer trends, efficiency, and rapidity. Real-time monitoring and sophisticated analytics are indispensable attributes.

- The primary objective of SCM software in this sector is to guarantee the availability of essential pharmaceuticals and medical supplies. It underscores the importance of real-time inventory tracking to prevent shortages, compliance with stringent regulatory standards, and cold chain logistics for temperature-sensitive products.

- SCM software enables manufacturers to optimize their operations, from raw material procurement to finished product distribution. It enhances operational efficiency and reduces costs by supporting production planning, supplier management, and demand forecasting.

- In this vertical, SCM software is necessary for the efficient management of perishable products, which ensures regulatory compliance and food safety. It facilitates the optimization of logistics, inventory management, and traceability to reduce waste and preserve product quality.

- Transportation and logistics, which rely on SCM software for fleet management and route optimization, as well as the automotive industry, which relies on it for the administration of complex supplier networks and just-in-time production processes, are other significant sectors. SCM software ultimately enhances efficiency, compliance, and customer satisfaction by addressing the unique supply chain challenges of each industry.

Supply Chain Management Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Advancements in technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are facilitating the transformation of SCM software. These technologies improve demand forecasting, optimize logistics, and enhance predictive analytics, thereby enhancing the efficiency and resilience of supply chains. Companies in the Asia-Pacific region are progressively implementing these technologies to optimize their operations.

- Countries like China, Japan, and India are leading the adoption of SCM software in the Asia-Pacific region. India's emphasis on digitalization, Japan's emphasis on smart industrial solutions, and China's emphasis on improving its manufacturing sector through the "Made in China 2025" initiative are significant factors. Furthermore, Southeast Asian nations are also experiencing rapid adoption as a result of e-commerce activity expansion.

- Despite the market's immense potential, challenges such as the complexity of integrating SCM software with existing systems, high implementation costs, and data security concerns continue to exist. Nevertheless, these obstacles offer vendors the chance to innovate and offer solutions that are more secure, cost-effective, and user-friendly, thereby promoting market growth and penetration.

Active Key Players in the Supply Chain Management Software Market

- Blue Yonder Group Inc. (Panasonic Holdings Corporation) (United States)

- Epicor Software Corporation (United States)

- Infor Inc. (Koch Industries Inc.) (United States)

- International Business Machines Corporation (IBM) (United States)

- Kinaxis Inc. (Canada)

- Körber AG (Germany)

- Manhattan Associates (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- The Descartes Systems Group Inc. (Canada)

|

Global Supply Chain Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.37% |

Market Size in 2032: |

USD 70.26 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Mode |

|

||

|

By Organisation Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

International Business Machines Corporation, Kinaxis Inc. Körber AG, Manhattan Associates, Oracle Corporation SAP SE, The Descartes Systems Group Inc., Other |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Supply Chain Management Software Market by Solution Type (2018-2032)

4.1 Supply Chain Management Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Transportation Management System

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Warehouse Management System

4.5 Supply Chain Planning

4.6 Procurement and Sourcing

4.7 Manufacturing Execution System

Chapter 5: Supply Chain Management Software Market by Deployment Mode (2018-2032)

5.1 Supply Chain Management Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Supply Chain Management Software Market by Organisation Size (2018-2032)

6.1 Supply Chain Management Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Supply Chain Management Software Market by Industry Vertical (2018-2032)

7.1 Supply Chain Management Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail and Consumer Goods

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare and Pharmaceuticals

7.5 Manufacturing

7.6 Food and Beverages

7.7 Transportation and Logistics

7.8 Automotive

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Supply Chain Management Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BLUE YONDER GROUP INC. (PANASONIC HOLDINGS CORPORATION) (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EPICOR SOFTWARE CORPORATION (UNITED STATES)

8.4 INFOR INC. (KOCH INDUSTRIES INC.) (UNITED STATES)

8.5 INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM) (UNITED STATES)

8.6 KINAXIS INC. (CANADA)

8.7 KÖRBER AG (GERMANY)

8.8 MANHATTAN ASSOCIATES (UNITED STATES)

8.9 ORACLE CORPORATION (UNITED STATES)

8.10 SAP SE (GERMANY)

8.11 THE DESCARTES SYSTEMS GROUP INC. (CANADA)

8.12

Chapter 9: Global Supply Chain Management Software Market By Region

9.1 Overview

9.2. North America Supply Chain Management Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Solution Type

9.2.4.1 Transportation Management System

9.2.4.2 Warehouse Management System

9.2.4.3 Supply Chain Planning

9.2.4.4 Procurement and Sourcing

9.2.4.5 Manufacturing Execution System

9.2.5 Historic and Forecasted Market Size by Deployment Mode

9.2.5.1 On-premises

9.2.5.2 Cloud-based

9.2.6 Historic and Forecasted Market Size by Organisation Size

9.2.6.1 Small and Medium-sized Enterprises

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by Industry Vertical

9.2.7.1 Retail and Consumer Goods

9.2.7.2 Healthcare and Pharmaceuticals

9.2.7.3 Manufacturing

9.2.7.4 Food and Beverages

9.2.7.5 Transportation and Logistics

9.2.7.6 Automotive

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Supply Chain Management Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Solution Type

9.3.4.1 Transportation Management System

9.3.4.2 Warehouse Management System

9.3.4.3 Supply Chain Planning

9.3.4.4 Procurement and Sourcing

9.3.4.5 Manufacturing Execution System

9.3.5 Historic and Forecasted Market Size by Deployment Mode

9.3.5.1 On-premises

9.3.5.2 Cloud-based

9.3.6 Historic and Forecasted Market Size by Organisation Size

9.3.6.1 Small and Medium-sized Enterprises

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by Industry Vertical

9.3.7.1 Retail and Consumer Goods

9.3.7.2 Healthcare and Pharmaceuticals

9.3.7.3 Manufacturing

9.3.7.4 Food and Beverages

9.3.7.5 Transportation and Logistics

9.3.7.6 Automotive

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Supply Chain Management Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Solution Type

9.4.4.1 Transportation Management System

9.4.4.2 Warehouse Management System

9.4.4.3 Supply Chain Planning

9.4.4.4 Procurement and Sourcing

9.4.4.5 Manufacturing Execution System

9.4.5 Historic and Forecasted Market Size by Deployment Mode

9.4.5.1 On-premises

9.4.5.2 Cloud-based

9.4.6 Historic and Forecasted Market Size by Organisation Size

9.4.6.1 Small and Medium-sized Enterprises

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by Industry Vertical

9.4.7.1 Retail and Consumer Goods

9.4.7.2 Healthcare and Pharmaceuticals

9.4.7.3 Manufacturing

9.4.7.4 Food and Beverages

9.4.7.5 Transportation and Logistics

9.4.7.6 Automotive

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Supply Chain Management Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Solution Type

9.5.4.1 Transportation Management System

9.5.4.2 Warehouse Management System

9.5.4.3 Supply Chain Planning

9.5.4.4 Procurement and Sourcing

9.5.4.5 Manufacturing Execution System

9.5.5 Historic and Forecasted Market Size by Deployment Mode

9.5.5.1 On-premises

9.5.5.2 Cloud-based

9.5.6 Historic and Forecasted Market Size by Organisation Size

9.5.6.1 Small and Medium-sized Enterprises

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by Industry Vertical

9.5.7.1 Retail and Consumer Goods

9.5.7.2 Healthcare and Pharmaceuticals

9.5.7.3 Manufacturing

9.5.7.4 Food and Beverages

9.5.7.5 Transportation and Logistics

9.5.7.6 Automotive

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Supply Chain Management Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Solution Type

9.6.4.1 Transportation Management System

9.6.4.2 Warehouse Management System

9.6.4.3 Supply Chain Planning

9.6.4.4 Procurement and Sourcing

9.6.4.5 Manufacturing Execution System

9.6.5 Historic and Forecasted Market Size by Deployment Mode

9.6.5.1 On-premises

9.6.5.2 Cloud-based

9.6.6 Historic and Forecasted Market Size by Organisation Size

9.6.6.1 Small and Medium-sized Enterprises

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by Industry Vertical

9.6.7.1 Retail and Consumer Goods

9.6.7.2 Healthcare and Pharmaceuticals

9.6.7.3 Manufacturing

9.6.7.4 Food and Beverages

9.6.7.5 Transportation and Logistics

9.6.7.6 Automotive

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Supply Chain Management Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Solution Type

9.7.4.1 Transportation Management System

9.7.4.2 Warehouse Management System

9.7.4.3 Supply Chain Planning

9.7.4.4 Procurement and Sourcing

9.7.4.5 Manufacturing Execution System

9.7.5 Historic and Forecasted Market Size by Deployment Mode

9.7.5.1 On-premises

9.7.5.2 Cloud-based

9.7.6 Historic and Forecasted Market Size by Organisation Size

9.7.6.1 Small and Medium-sized Enterprises

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by Industry Vertical

9.7.7.1 Retail and Consumer Goods

9.7.7.2 Healthcare and Pharmaceuticals

9.7.7.3 Manufacturing

9.7.7.4 Food and Beverages

9.7.7.5 Transportation and Logistics

9.7.7.6 Automotive

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Supply Chain Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.37% |

Market Size in 2032: |

USD 70.26 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Mode |

|

||

|

By Organisation Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

International Business Machines Corporation, Kinaxis Inc. Körber AG, Manhattan Associates, Oracle Corporation SAP SE, The Descartes Systems Group Inc., Other |

||

Frequently Asked Questions :

The forecast period in the Supply Chain Management Software Market research report is 2024-2032.

Blue Yonder Group Inc. (Panasonic Holdings Corporation), Epicor Software Corporation, Infor Inc. (Koch Industries Inc.), International Business Machines Corporation, Kinaxis Inc.,Körber AG, Manhattan Associates, Oracle Corporation, SAP SE, The Descartes Systems Group Inc., Others

The Supply Chain Management Software Market is segmented into by Solution Type (Transportation Management System, Warehouse Management System, Supply Chain Planning, Procurement and Sourcing, Manufacturing Execution System), Deployment Mode (On-premises, Cloud-based), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), Industry Vertical (Retail and Consumer Goods, Healthcare and Pharmaceuticals, Manufacturing, Food and Beverages, Transportation and Logistics, Automotive, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The goal of supply chain management (SCM) software is to optimize and improve the various processes involved in the production and distribution of goods and services. It includes a variety of applications and tools that help businesses manage the entire supply chain, from the procurement of raw materials to the delivery of products. Inventory management, demand forecasting, order processing, logistics optimization, and supplier relationship management comprise the primary functionalities of SCM software. This software enhances efficiency, facilitates improved decision-making, and provides real-time insights by integrating data from various stages of the supply chain. Ultimately, the objective of SCM software is to facilitate the timely and cost-effective delivery of products to consumers, as well as to reduce costs and improve productivity.

Supply Chain Management Software Market Size is Valued at USD 28.91 Billion in 2023, and is Projected to Reach USD 70.26 Billion by 2032, Growing at a CAGR of 10.37% From 2024-2032.