Smart Parcel Locker Market Overview

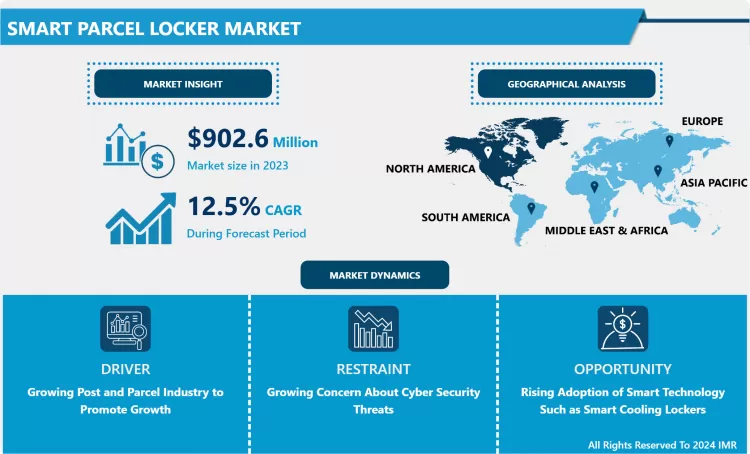

The Smart Parcel Locker Market size was valued at USD 902.6 Million in 2023 and is projected to reach USD 2605.53 Million by 2032, registering a CAGR of 12.5% from 2023 to 2032.

Smart parcel lockers are manufactured with innovative technology keeping in mind the importance of having strong exteriors and developed internal systems. The lockers are manufactured by utilizing corrosion-resistant steel, and the kiosk is run by a Windows operating system. This modern and innovative combination of hardware and software packs a punch. The uprising of smart technologies has rebuilt the traditional way of last-mile delivery from logistics outlets to IoT-based parcel lockers owing to the flexibility, convenience, and 24/7 accessibility. Smart parcel lockers are automated systems that offer convenience for businesses to store parcels. They offer secure access to inventories and assets from close and remote locations to the customers by automatically notifying them of details about their parcel. Moreover, they help retailers overcome costs on shipping and leverage the inventory at their stores.

As the number of parcels arriving at enterprise and university postal facilities rises, so does the number of online purchases. Employees and students are both consumers, therefore it makes sense to have online purchases delivered to the location where the client spends most of their day or the school where they attend. Most postal centers were not designed to handle or manage such a large volume of mail. Enter the smart parcel locker, which provides the security, tracking, and chain-of-custody features that busy postal center require to improve and expedite processes. While smart parcel lockers are most frequently associated with shipments, they are also being utilized as a safe, secure, and convenient means of distributing mail 24 hours a day, seven days a week. This explains why smart postal locker providers with established relationships with the USPS and the shipping industry are at the forefront of the effort. Smart lockers aren't intended to be used as post offices, but rather as a mechanism to manage inbound mail once it's arrived.

Market Dynamics and Factors of Smart Parcel Locker Market

Drivers:

Smart Parcel Lockers Overcome Labor Costs

Today's mail centers are covered with an influx of packages as well as both work-associated and personal deliveries and staff finds it difficult to keep pace, resulting in lost or mislaid packages. While there are upfront costs to a smart parcel locker system, they are offset by depletion in labor and reshipment costs and by the enhanced, contactless experience they provide employees. For corporate offices, a locker system enables the organization's mailroom to provide disregarded package retrieval without having to dedicate additional resources. This is primarily beneficial for hybrid office environments. Both remote and onsite employees can comfortably recover their deliveries when it best suits them, and mail center staff can avoid making multiple delivery attempts or discovering room for packages they're holding indefinitely. For large offices and smaller organizations that don't have a mail center, smart lockers generate an organized system that keeps incoming mail and packages secure and organized until recipients can pick them up with minimal staff needed to keep the process running smoothly.

Encourage Safety and Security

Smart lockers keep your personnel and guests safe while securing shipments and assets. PINs and barcodes, as well as comprehensive chain-of-custody tracking, keep products safe from the moment they're scanned into the system until they're picked up by the appropriate beneficiaries. Smart locker services are being utilized to safeguard items and valuables, control access, and assure responsibility in security-focused industries such as government, law enforcement, and higher education. Smart lockers' automation and self-service capabilities improve health and safety by reducing crowding and congestion in mail centers and other distribution sites and providing a contactless pick-up alternative for employees, customers, and visitors.

Restraints:

With the continuing growth in e-commerce, enterprises are handling a rising volume of parcel deliveries, and processing them presents several challenges. By sticking with established, largely manual, processes, pressures are only probably to rise, along with exasperation for both post room workers and parcel recipients. Furthermore, factor such as growing concern regarding cyber security threats is anticipated to hamper the smart parcel locker market growth across the globe over the forecast period. Moreover, the entry of new players in the market is probably to result in declined market share of leading players.

Opportunities:

Technological developments in the smart package and an increase in demand from emerging economies are some of the factors that are expected to generate lucrative opportunities for the smart parcel locker market in the upcoming years. For example, in July 2021, TZ Limited, a leading business in the creation of electronic locking devices, presented its initiatives. Through TZI Australia Pty Limited, Telezygology Inc., TZI UK Limited, and TZI Singapore, they are focusing on the expansion of smart devices and systems that allow the selling of software and hardware solutions to manage, control, and monitor company assets and deliver value-added services.

Market Segmentation

Segmentation Analysis of Smart Parcel Locker Market:

Based on the type, the modular parcel locker segment is expected to dominate the smart parcel locker market over the forecast period. These parcel lockers are designed in a modular format with one hanger rod per locker module, evenly distributed shelf loads, and high-quality stainless steel door hinges. The modular design has the advantage of being simple to install, maintain, and use.

Based on Product Type, the smart parcel locker market is segmented into Indoor and Outdoor. In 2016, the interior category accounted for a major portion of the Smart Parcel Locker market. The reduced risk of vandalism and burglary contributes to the appeal of indoor terminals. End-users find these terminals convenient, and they are simple to install owing to fewer regulatory and environmental restrictions. Furthermore, they make it simple to collect, transport, and reclaim items, even in inclement weather.

Based on the application, the retail segment is expected to dominate the smart parcel locker market over the forecast period. Smart parcel lockers enable the retail segment to adopt cheaper, quicker, and efficient delivery models. Furthermore, the capability of these terminals to operate as standalone units at metro stations, superstores, shopping malls, and walkways is also anticipated to turn the growth of this segment.

Regional Analysis of Smart Parcel Locker Market:

North America region is anticipated to dominate the smart parcel locker market during the forecast period. The rising popularity of online shopping in North America is entrancing e-commerce providers to adopt technology that helps accomplish the demand and enhance the customer experience.

Europe's established logistics networks are holding their second-place position in the smart locker market.

Asia Pacific is anticipated to observe the highest CAGR during the forecast period. In the Asia Pacific region, the acquisition of Internet of Things (IoT) based smart parcel lockers has emerged very fast due to the extensive applications from retailers, e-commerce companies, logistics companies, and consumers. Meanwhile, China is leading the Asia Pacific's CAGR owing to its large population and e-commerce giants like Alibaba.

Players Covered in Smart Parcel Locker Market are:

- Smartbox Ecommerce Solutions Pvt. Ltd. (India)

- TZ Limited (Australia)

- CleverBox Co. (U.K.)

- Quadient (France)

- Abell International Pte. Ltd. (Singapore)

- Cleveron (Estonia)

- Package Nexus (U.S.)

- DeBourgh Manufacturing Co. (U.S.)

- Mobiikey Technologies Pvt. Ltd. (India)

- KEBA AG (Austria) and others major players.

COVID-19 Impact on Smart Parcel Locker Market

The COVID-19 pandemic has led people in many global economies to significantly restrict their physical interactions. Self-inflicted social distancing to avoid contagion, together with the stringent confinement measures executed in many economies, have put a large share of traditional brick-and-mortar retail virtually on hold, at least temporarily. In the United States, retail and food services sales between February and April 2020 were declined by 7.7% compared to the same period in 2019. Nevertheless, sales increased for grocery stores and non-store retailers (mostly e-commerce suppliers), by 16% and 14.8% respectively. The retail sales via mail order houses or the Internet in April 2020 raised by 30% compared to April 2019, while total retail sales declined by 17.9%. Furthermore, demand for logistics fulfillment has augmented in the times of the COVID-19 crisis over the globe more than it could have in the last 5 years. In the last 10 years, the relocation of retailers to 'fulfillment models' was not so inspired by the approaching technological push as it has been in the last few weeks by the global health pandemic. As per the survey conducted by McKinsey, an average of 58.20% of customers observed would continue to adopt 'Safe Delivery Modes' for a long time after the eradication of COVID 19 as a global threat. Their prominence lies in the delivery and storage methods of the product more than the product itself. Interruptions in the end-point fulfillment of delivery and storage needs, inspired by COVID-19 have been listed as potentially here-to-stay technologies as compared to works for now and lower adoption models in which telemedicine, online gaming, and even video conferencing lie. Therefore, it is the right time for e-tailers and supply chain facilitators to look over the solutions for reducing these changes which might affect their business in the post COVID world.

Key Industry Developments In Smart Parcel Locker Market

- In April 2024, Homebase partnered with Quadient to provide convenient delivery and returns solutions for customers. Quadient, a leader in assisting businesses in establishing meaningful customer connections through digital and physical channels and a major global parcel locker operator, had announced a partnership with Homebase, one of the UK’s largest home improvement retailers.

|

Smart Parcel Locker Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 902.6 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 2605.53 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Parcel Locker Market by Type (2018-2032)

4.1 Smart Parcel Locker Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Modular Parcel Locker

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cooling Lockers for Fresh Food

4.5 Postal Lockers

4.6 Laundry Lockers

Chapter 5: Smart Parcel Locker Market by Deployment (2018-2032)

5.1 Smart Parcel Locker Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Indoor

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Outdoor

Chapter 6: Smart Parcel Locker Market by Application (2018-2032)

6.1 Smart Parcel Locker Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail BOPIS

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Banks

6.5 Apartments

6.6 Offices

6.7 Pharmacy

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Parcel Locker Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THALES GROUP(FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

7.4 SIEMENS AG(GERMANY)

7.5 IBM CORPORATION(US)

7.6 CISCO SYSTEMS INC.(US)

7.7 SAP (GERMANY)

7.8 CUBIC CORPORATION (US)

7.9 ALSTOM (FRANCE)

7.10 BOMBARDIER INC. (CANADA)

7.11 TOSHIBA (JAPAN)

7.12 HARRIS CORPORATION (US)

7.13 SAAB AB (SWEDEN)

7.14 VESON NAUTICAL (MASSACHUSETTS)

7.15 BASS SOFTWARE (NORWAY)

7.16 BENTLEY SYSTEMS (US)

7.17 INDRA SISTEMAS (SPAIN)

7.18 TRIMBLE (US)

7.19 TOMTOM INTERNATIONAL BV. (NETHERLANDS)

7.20 AMADEUS IT GROUP SA (SPAIN)

7.21 CONDUENT (US)

7.22 KAPSCH (AUSTRIA)

7.23 HITACHI LTD. (JAPAN)

7.24 DESCARTES (CANADA)

7.25 ACCENTURE (IRELAND)

7.26 DNV GL (NORWAY)

Chapter 8: Global Smart Parcel Locker Market By Region

8.1 Overview

8.2. North America Smart Parcel Locker Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Modular Parcel Locker

8.2.4.2 Cooling Lockers for Fresh Food

8.2.4.3 Postal Lockers

8.2.4.4 Laundry Lockers

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 Indoor

8.2.5.2 Outdoor

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Retail BOPIS

8.2.6.2 Banks

8.2.6.3 Apartments

8.2.6.4 Offices

8.2.6.5 Pharmacy

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Parcel Locker Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Modular Parcel Locker

8.3.4.2 Cooling Lockers for Fresh Food

8.3.4.3 Postal Lockers

8.3.4.4 Laundry Lockers

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 Indoor

8.3.5.2 Outdoor

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Retail BOPIS

8.3.6.2 Banks

8.3.6.3 Apartments

8.3.6.4 Offices

8.3.6.5 Pharmacy

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Parcel Locker Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Modular Parcel Locker

8.4.4.2 Cooling Lockers for Fresh Food

8.4.4.3 Postal Lockers

8.4.4.4 Laundry Lockers

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 Indoor

8.4.5.2 Outdoor

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Retail BOPIS

8.4.6.2 Banks

8.4.6.3 Apartments

8.4.6.4 Offices

8.4.6.5 Pharmacy

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Parcel Locker Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Modular Parcel Locker

8.5.4.2 Cooling Lockers for Fresh Food

8.5.4.3 Postal Lockers

8.5.4.4 Laundry Lockers

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 Indoor

8.5.5.2 Outdoor

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Retail BOPIS

8.5.6.2 Banks

8.5.6.3 Apartments

8.5.6.4 Offices

8.5.6.5 Pharmacy

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Parcel Locker Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Modular Parcel Locker

8.6.4.2 Cooling Lockers for Fresh Food

8.6.4.3 Postal Lockers

8.6.4.4 Laundry Lockers

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 Indoor

8.6.5.2 Outdoor

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Retail BOPIS

8.6.6.2 Banks

8.6.6.3 Apartments

8.6.6.4 Offices

8.6.6.5 Pharmacy

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Parcel Locker Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Modular Parcel Locker

8.7.4.2 Cooling Lockers for Fresh Food

8.7.4.3 Postal Lockers

8.7.4.4 Laundry Lockers

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 Indoor

8.7.5.2 Outdoor

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Retail BOPIS

8.7.6.2 Banks

8.7.6.3 Apartments

8.7.6.4 Offices

8.7.6.5 Pharmacy

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Smart Parcel Locker Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 902.6 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 2605.53 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Smart Parcel Locker Market research report is 2024-2032.

Smartbox Ecommerce Solutions Pvt. Ltd. (India), TZ Limited (Australia), CleverBox Co. (U.K.), Quadient (France), Abell International Pte. Ltd. (Singapore), Cleveron (Estonia), Package Nexus (U.S.), DeBourgh Manufacturing Co. (U.S.), Mobiikey Technologies Pvt. Ltd. (India), KEBA AG (Austria), and other major players.

The Smart Parcel Locker Market is segmented into Type, Deployment, Application, and region. By Type, the market is categorized into Modular Parcel Locker, Cooling Lockers for Fresh Food, Postal Lockers, and Laundry Lockers. By, Deployment the market is categorized into Indoor, Outdoor. By Application, the market is categorized into Retail BOPIS, Banks, Apartments, Offices, Pharmacy, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart parcel lockers are manufactured with innovative technology keeping in mind the importance of having strong exteriors and developed internal systems. The lockers are manufactured by utilizing corrosion-resistant steel, and the kiosk is run by a Windows operating system.

The Smart Parcel Locker Market size was valued at USD 902.6 Million in 2023 and is projected to reach USD 2605.53 Million by 2032, registering a CAGR of 12.5% from 2023 to 2032.