Smart Factory Market Synopsis

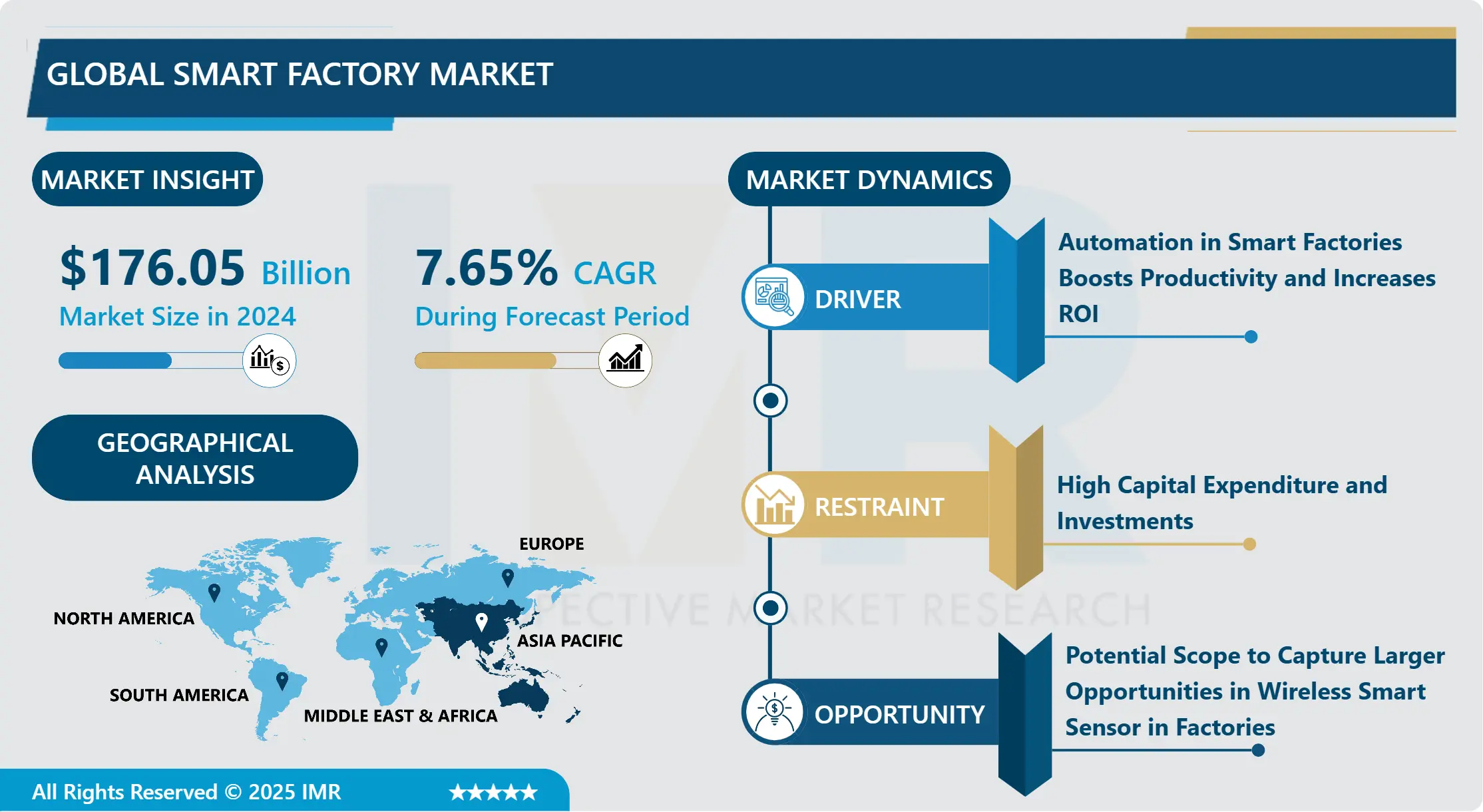

The Global Smart Factory market size was valued at USD 176.05 Billion in 2024 and is projected to reach USD 317.5 Billion by 2032, growing at a CAGR of 7.65% from 2025 to 2032.

The smart factory is a flexible system that can run complete manufacturing processes autonomously, self-optimize performance across a larger network, and self-adapt to and learns from new situations in real or near-real time.

The market is expanding at a faster rate as a result of Industry 4.0's expanding implementation and adoption. The market share has increased as a result of rising automation and software-based procedures. Real-time analysis and synchronization have been made available to the worldwide market by smart technologies, helping to cut costs and save time.

The market grows in direct proportion to technological advancements when they go hand in hand. New technologies including machine learning, big data, cloud computing, and artificial intelligence are expected to accelerate industry expansion.

Additionally, the Machine-to-Machine (M2M) and Wireless Sensor Networks (WSN) ideas and Big Data in terms of the content outputs generated are all strongly tied to the Internet of Things (IoT). Data created and exchanged between machines (M2M), as well as between machines and people, is included in the Internet of Things (M2P). It is anticipated that these technologies would expand the market.

Smart Factory Market Trend Analysis

Automation in Smart Factories Boosts Productivity and Increases ROI

- Massive amounts of data are produced by every part of the smart factory, and constant analysis of this data reveals flaws with asset performance that may call for some sort of remedial optimization. One of the most obvious advantages of a smart factory is the ability to self-correct, which sets it apart from traditional automation and can result in higher total asset efficiency.

- Among other potential advantages, increased asset efficiency should result in decreased downtime, optimized capacity, and shorter changeover times. The self-optimization inherent to the smart factory can foresee and detect quality defect patterns earlier and assist in pinpointing specific environmental, mechanical, or human sources of subpar quality. This might reduce lead times and scrap rates while raising yield and fill rates. A higher-quality product with fewer flaws and recalls might result from a more optimized quality procedure. Process optimization typically results in more cost-effective processes, including those with predictable inventory needs, effective hiring, and personnel decisions, and decreased process and operations variability.

- An integrated picture of the supplier network with quick, no-latency reactions to sourcing demands could be indicative of a higher-quality process and result in significant cost savings. Additionally, as a better procedure might result in a higher-quality product, it might also result in lower warranty and maintenance expenses.

Potential Scope to Capture Larger Opportunities in Wireless Smart Sensors in Factories

- A wireless sensor network is a wireless network that includes distributed autonomous devices with sensors to keep an eye on the physical or environmental conditions (WSN). WSNs are employed in sectors like water and wastewater treatment, oil and gas, and medicines. Oil and gas facilities are typically found in isolated locations with challenging environmental conditions.

- A SCADA system in an oil and gas facility uses sensors placed in a WSN to monitor, manage, and operate tanks, compressors, generators, and separators. The price of setting up a sensor network and communication system is decreased by using a WSN. Because more gear, such as cables, networking equipment, routers, and network adapters are needed for wired technology than for wireless technology, the price difference between the two is relatively large.

- A WSN is used to measure and detect parameters in plant operations such as pressure, temperature, flow, and level of fluids and gases. Real-time data monitoring and process control are made possible by incorporating a WSN into SCADA and other smart factory components and systems. The application areas of smart factories would therefore expand because of the expanding WSN R&D and active adoption in such facilities. Wireless sensor networks are also well suited for the present automated systems in the sectors embracing smart factory components and solutions due to the regular software updates.

Smart Factory Market Segment Analysis:

Smart Factory Market Segmented based on Type, Deployment, End-User Industry.

By Type, Industrial Sensors segment is expected to dominate the market during the forecast period

- Industrial Sensors are dominating the Smart Factory Market. Smart industrial sensors help manufacturers lower their Replacement Asset Value (RAV) by lowering the costs of unneeded scheduled maintenance, part replacement expenses, and potential downtime for their operations. Manufacturers can switch from scheduled maintenance to predictive maintenance more easily thanks to smart technologies.

- Data can identify patterns, indicating the need for equipment maintenance. This information can be used by intelligent sensors to advise users of possible problems so they can be fixed before they become points of failure. For instance, Sensata Technologies has unveiled the Sensata IQ platform, which makes it simple to install asset health monitoring in manufacturing environments and reduce unscheduled downtime. Therefore, such sensor-based development in the industry is likely to contribute to the growth of the Smart Factory Market.

By Deployment, the Cloud segment held the largest share of 56.2% in 2022

- Cloud segment is expected to dominate the Smart Factory Market. The fact that IoT used in manufacturing and other industries produces a lot of data is one of the main issues. Businesses require a location where they can keep and retrieve that data. They use the cloud to achieve this. Google Cloud Platform, Microsoft Azure, and Amazon Web Services (AWS) are the top three providers of public clouds. With a 38% market share of AWS.

- Cloud computing and Smart Manufacturing are the perfect amalgamations of technology with advanced manufacturing methods to improve productivity in the factory. Manufacturers now have access to new technologies, infrastructure, and communication opportunities thanks to cloud computing, which will help them realize their vision for smart manufacturing. This is particularly significant since Smart Manufacturing links and optimizes the entire value chain, going beyond the confines of the facility.

- Depending on their requirements, each manufacturer will draw a different distinction between on-premises and on-cloud services. Some businesses will decide to move all their IT systems to the cloud, while others may find that pursuing hybrid scenarios is the best course of action.

Smart Factory Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific is dominating the Smart Factory Market. The Asia-Pacific area is very diversified with localized features, ranging from low-cost, poor productivity countries to technologically advanced, high-cost industrial countries. China, Japan, South Korea, Taiwan, and Singapore can be categorized as mature manufacturing countries, but India, Thailand, Vietnam, Malaysia, and Indonesia are still regarded as developing manufacturing nations when the following important aspects are considered.

- China, the world's largest manufacturer in terms of output and where manufacturing will make up approximately 38% of the country's GDP in 2020, has put policies in place to capitalize on advanced manufacturing to strengthen its position as a manufacturing giant. The "Made in China 2025" 10-year government plan, which was launched in China, aims to rapidly expand the nation's manufacturing capabilities, which are essential to its fourth industrial revolution. China's efforts to improve its manufacturing skills by 2025 were strengthened as part of a new 5-year plan with the installation of smart factories with huge government investment which makes a prominent market for smart factories.

- Currently, sectors that prioritize high-volume, low-margin production are more likely to implement smart manufacturing. Additionally, it is used in heavily regulated sectors like the food and beverage and pharmaceutical industries, where tracking and traceability are crucial. Robotic inspections, for example, can be used to automate entire value-chain activities and cut down on human error. Smart factories use machine learning and AI to properly discover flaws through automated inspection processes.

Smart Factory Market Top Key Players:

- Rockwell Automation, Inc. (USA)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Honeywell International Inc. (USA)

- Bosch GmbH (, Germany)

- Mitsubishi Electric Corporation (Japan)

- FANUC Corporation (Japan)

- Emerson Electric Co. (USA)

- Yokogawa Electric Corporation (Japan)

- GE Digital (USA)

- SAP SE (Germany)

- Cisco Systems, Inc. (USA)

- Oracle Corporation (USA)

- KUKA Aktiengesellschaft (Germany)

- Stratasys Ltd. (USA)

- Autodesk, Inc. (USA)

- PTC Inc. (USA)

- Dassault Systèmes SE (France)

- Microsoft Corporation (USA)

- Other Active Players

Key Industry Developments in the Smart Factory Market:

- In January 2023, Siemens Mind Sphere, an industrial IoT platform, announced partnerships with several new technology providers, including SAP, Microsoft, and Amazon Web Services, to expand its capabilities and reach. This move aims to make Mind Sphere more accessible and attractive to a wider range of industrial companies.

- In February 2023, Rockwell Automation unveiled the latest version of its FactoryTalk VantagePoint SCADA system, featuring enhanced security, performance, and scalability for smarter and more connected manufacturing operations.

- In March 2023, ABB introduced ABB Ability Power Inspect, a cloud-based solution that leverages AI and machine learning to provide real-time insights into the health and performance of electrical assets. This helps manufacturers anticipate potential issues and take preventive maintenance actions.

|

Global Smart Factory Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 176.05 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.65% |

Market Size in 2032: |

USD 317.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Factory Market by Type (2018-2032)

4.1 Smart Factory Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Industrial Sensors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Industrial Robots

4.5 Industrial 3D Printers

4.6 Machine Vision Systems

Chapter 5: Smart Factory Market by Deployment (2018-2032)

5.1 Smart Factory Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 In Premises

Chapter 6: Smart Factory Market by End User Industry (2018-2032)

6.1 Smart Factory Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aerospace & Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Semiconductor & Electronics

6.5 Manufacturing

6.6 Medical Devices

6.7 Oil & Gas

6.8 Chemicals

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Factory Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PEPPERI

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BELAVIER COMMERCE LLC

7.4 MAGENTO INC

7.5 CS-CART

7.6 SAP SE

7.7 CHETU INC

7.8 VENDIO SERVICES INC

7.9 BIGCOMMERCE PTY. LTD

7.10 ABILITY COMMERCE

7.11 INFUSIONSOFT

7.12 VOLUSION LLC

7.13 BRIGHTPEARL

7.14 AUTOMATTIC INC

7.15 EPISERVER GROUP

7.16 KIVA LOGIC LLC

Chapter 8: Global Smart Factory Market By Region

8.1 Overview

8.2. North America Smart Factory Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Industrial Sensors

8.2.4.2 Industrial Robots

8.2.4.3 Industrial 3D Printers

8.2.4.4 Machine Vision Systems

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 On Cloud

8.2.5.2 In Premises

8.2.6 Historic and Forecasted Market Size by End User Industry

8.2.6.1 Aerospace & Defense

8.2.6.2 Semiconductor & Electronics

8.2.6.3 Manufacturing

8.2.6.4 Medical Devices

8.2.6.5 Oil & Gas

8.2.6.6 Chemicals

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Factory Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Industrial Sensors

8.3.4.2 Industrial Robots

8.3.4.3 Industrial 3D Printers

8.3.4.4 Machine Vision Systems

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 On Cloud

8.3.5.2 In Premises

8.3.6 Historic and Forecasted Market Size by End User Industry

8.3.6.1 Aerospace & Defense

8.3.6.2 Semiconductor & Electronics

8.3.6.3 Manufacturing

8.3.6.4 Medical Devices

8.3.6.5 Oil & Gas

8.3.6.6 Chemicals

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Factory Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Industrial Sensors

8.4.4.2 Industrial Robots

8.4.4.3 Industrial 3D Printers

8.4.4.4 Machine Vision Systems

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 On Cloud

8.4.5.2 In Premises

8.4.6 Historic and Forecasted Market Size by End User Industry

8.4.6.1 Aerospace & Defense

8.4.6.2 Semiconductor & Electronics

8.4.6.3 Manufacturing

8.4.6.4 Medical Devices

8.4.6.5 Oil & Gas

8.4.6.6 Chemicals

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Factory Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Industrial Sensors

8.5.4.2 Industrial Robots

8.5.4.3 Industrial 3D Printers

8.5.4.4 Machine Vision Systems

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 On Cloud

8.5.5.2 In Premises

8.5.6 Historic and Forecasted Market Size by End User Industry

8.5.6.1 Aerospace & Defense

8.5.6.2 Semiconductor & Electronics

8.5.6.3 Manufacturing

8.5.6.4 Medical Devices

8.5.6.5 Oil & Gas

8.5.6.6 Chemicals

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Factory Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Industrial Sensors

8.6.4.2 Industrial Robots

8.6.4.3 Industrial 3D Printers

8.6.4.4 Machine Vision Systems

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 On Cloud

8.6.5.2 In Premises

8.6.6 Historic and Forecasted Market Size by End User Industry

8.6.6.1 Aerospace & Defense

8.6.6.2 Semiconductor & Electronics

8.6.6.3 Manufacturing

8.6.6.4 Medical Devices

8.6.6.5 Oil & Gas

8.6.6.6 Chemicals

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Factory Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Industrial Sensors

8.7.4.2 Industrial Robots

8.7.4.3 Industrial 3D Printers

8.7.4.4 Machine Vision Systems

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 On Cloud

8.7.5.2 In Premises

8.7.6 Historic and Forecasted Market Size by End User Industry

8.7.6.1 Aerospace & Defense

8.7.6.2 Semiconductor & Electronics

8.7.6.3 Manufacturing

8.7.6.4 Medical Devices

8.7.6.5 Oil & Gas

8.7.6.6 Chemicals

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Smart Factory Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 176.05 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.65% |

Market Size in 2032: |

USD 317.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||