Sachet Packaging Machines Market Synopsis:

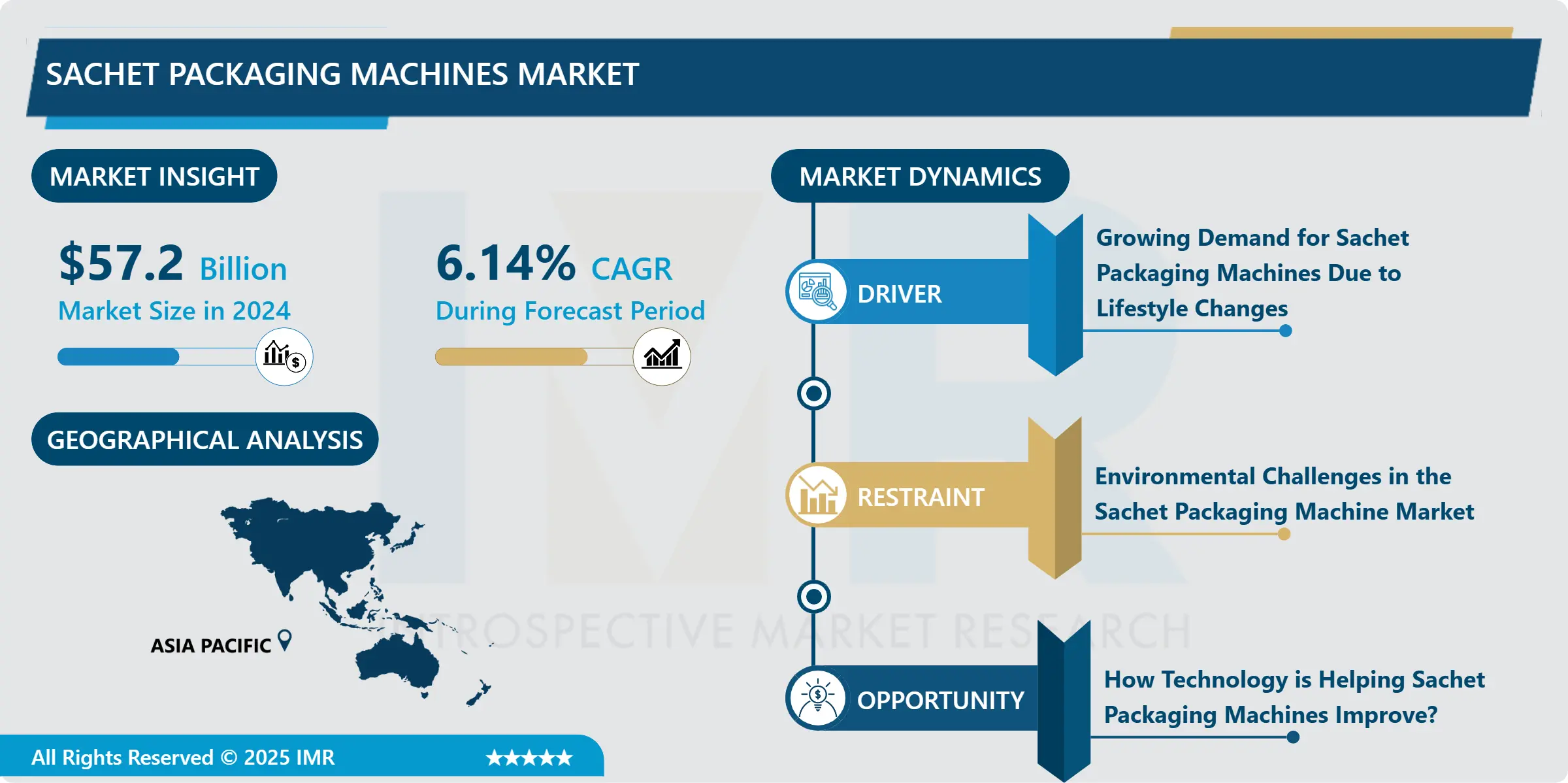

Market Size Was Valued at USD 57.2 Billion in 2024, and is Projected to Reach USD 110.17 Billion by 2035, Growing at a CAGR of 6.14% From 2025–2035.

Sachet packing machine is used to pack the product in the small pouches, which is automated. Such machines are used across industries to effectively pack food products in exactly required quantities and to maintain safety, hygiene, and ease of use of products.

The biggest users of sachet packaging machines are in the food and beverage industry, which makes up nearly 40% of the total market. Many consumers want convenient, single-serve packets, and sachets meet this demand well. Products like instant coffee, sauces, spices, condiments, and ready to drink beverages are commonly packed in sachets. The rise of online shopping and food delivery services has also increased the need for sachet packaging in this industry, as these packets are easy to transport and use.

Another important part of the market is powder sachet packaging. This area is mainly led by products such as instant coffee, protein powders, oral medicines, spices, and detergent powders. More people prefer quick, single-use packs of powdered products in both the food and pharmaceutical industries.

Sachet machines for powders are designed to provide precise amounts with very little waste, which helps keep products fresh for longer. This is especially useful for dry and semi-dry powdered goods. The demand for good sachet packaging has increased for products like health supplements and instant drink mixes, which need accurate dosing and protection from moisture. Overall, the sachet packaging machine market is growing because of the rising demand for convenient, single-use packs in food, beverages, health supplements, and medicines.

Sachet Packaging Machines Market Growth and Trend Analysis:

Sachet Packaging Machines Market Growth Driver- Growing Demand for Sachet Packaging Machines Due to Lifestyle Changes

- The sachet packaging machine market is steadily growing, mainly due to changes in how people live and shop. As more people move to cities and live fast-paced lives, they look for quick, easy-to-use, and portable products. Sachets small packets used for items like shampoo, ketchup, coffee, or medicine fit this need perfectly.

- Urban living often means smaller homes and busy schedules, so many people prefer buying small, ready-to-use products instead of large ones. This trend has increased the demand for sachet-packed goods, which in turn boosts the need for machines that can produce these packets quickly and efficiently.

- Sachet packaging machines are very useful for companies because they allow mass production of single-use packets in a short time. These small packets are not only convenient but also cost-effective, especially in developing countries where people often buy in small quantities to save money. Offering products in sachets helps companies reach more customers while keeping packaging affordable and easy to handle. These machines are also flexible and can pack different types of products, such as liquids, powders, or creams. This makes them suitable for many industries like food, personal care, and pharmaceuticals.

- In short, as more people look for convenience, affordability, and portability in their daily lives, sachet packaging machines are becoming more important. They help businesses meet modern consumer needs while keeping costs low and production fast. As urbanization and busy lifestyles continue to grow, so will the demand for sachets and the machines that produce them, making this market an essential part of the packaging industry’s future.

Sachet Packaging Machines Market Limiting Factor- Environmental Challenges in the Sachet Packaging Machine Market

- The sachet packaging machine market is growing quickly because many industries like food, medicine, beauty, and cleaning products use small packets, called sachets, to pack their items. These sachets are cheap, easy to carry, and very useful, especially in countries where people prefer buying small amounts of products. But even though the market is growing, there is a big problem these sachets are harming the environment.

- Most sachets are made from plastic and are used only once before being thrown away. These plastics are hard to recycle and often end up in landfills, rivers, and oceans, where they pollute the environment and harm animals. As people become more aware of these problems, both customers and governments are asking companies to stop using single-use plastics and find more eco-friendly options.

- To deal with this, manufacturers are now trying to make sachets from better materials, like biodegradable or recyclable ones. However, this is not easy. Most sachet packaging machines are made to work with plastic, so using new materials might mean changing the machines or buying new ones. This can be very costly, especially for smaller companies.

- In short, even though the sachet packaging machine market is growing because of its usefulness and low cost, it faces serious environmental problems. To succeed in the future, companies must find cleaner and greener ways to make sachets. This is not just good for business but also important for protecting our planet.

Sachet Packaging Machines Market Expansion Opportunity- How Technology is Helping Sachet Packaging Machines Improve?

- Technology is helping the sachet packaging machine market grow quickly. With new and better technology, these machines are becoming faster, smarter, and easier to use. This helps companies make sachets that are more convenient, affordable, and high in quality.

- One major improvement is automation. Automated sachet machines can work much faster than older ones and make fewer mistakes. This means companies can produce more sachets in less time, which saves money and meets customer needs faster. Also, these machines are easier for workers to use and don’t need a lot of training.

- Another important change is better accuracy. New machines can fill each sachet with the exact amount of product, whether it's a liquid, powder, or cream. This reduces waste and makes sure each packet has the same quality. This is especially useful for food, health, and beauty products where precision is very important.

- New machines are also more connected. They can link to computers or other systems to track their performance, fix problems quickly, and even make changes without stopping the machine. This helps keep production running smoothly and makes the machines more reliable.

- Overall, technology is giving manufacturers more choices. They can now use machines that are faster, more flexible, and easier to control. These improvements save time and money and help companies make better products. As technology keeps advancing, sachet packaging machines will continue to improve, becoming an even more important part of the packaging world.

Sachet Packaging Machines Market Challenge and Risk- Navigating Growth Amid Environmental Challenges

- While technology is helping the sachet packaging machine market grow, one major challenge the industry faces is its negative impact on the environment. Most sachets are made from single-use plastic materials. These small packets are used once and then thrown away, often ending up in landfills, rivers, or oceans. This causes pollution and harms animals and the environment.

- Because sachets are so small and made from multiple layers of plastic, they are very difficult to recycle. As more people become aware of plastic waste and its effects, both consumers and governments are pushing for eco-friendly alternatives. Many countries are starting to create strict rules to reduce the use of single-use plastics. This is putting pressure on companies to change how they package their products.

- To respond to this, manufacturers are trying to use better materials, like recyclable or biodegradable films. However, switching to these materials is not simple. Most existing sachet packaging machines are built to handle plastic. Using new materials may require companies to buy new machines or make expensive upgrades. This can be especially hard for small businesses that do not have large budgets.

- In conclusion, even though the sachet packaging machine market is growing, environmental problems remain a big challenge. To succeed in the future, companies must find ways to reduce plastic waste by using greener packaging solutions. This is important not only for business success but also for protecting the environment.

Sachet Packaging Machines Market Segment Analysis:

Sachet Packaging Machines Market is segmented based on Type, Application, End-Users, and Region

By Type, Sachet Packaging Machines segment is expected to dominate the market during the forecast period

- Horizontal packaging machines, also known as horizontal flow wrap machines, are automated systems designed for packaging a wide variety of solid products in a horizontal orientation. These machines are particularly well-suited for single solid goods that can be easily handled, such as cereal bars, soaps, small toys, and bakery products.

- Horizontal packaging machines utilize a continuous Packaging Process, making them highly efficient for high-volume production. They can be customized with various features to meet specific packaging requirements across different industries. These machines excel in precise product presentation, ensuring a professional and polished look for packaged items.

- One of the key advantages of horizontal packaging machines is their ability to handle a wide range of product sizes and shapes. This versatility makes them an ideal choice for businesses that need to package diverse product lines. Additionally, horizontal packaging machines often achieve higher speeds compared to vertical machines for certain products, particularly those with consistent shapes that can be easily counted and filled.

- However, horizontal packaging machines may have limitations when it comes to packaging powders, granules, or liquids, which are better suited for vertical packaging machines. They also typically require more floor space compared to vertical machines, which can be a consideration for facilities with limited space.

By Application, Sachet Packaging Machines segment held the largest share in 2024

- One of the main reasons for the growth of sachet packaging in this sector is the rising demand for convenience food. Busy lifestyles and changing eating habits have led people to look for quick, ready-to-use food products. Sachets fit perfectly into this trend because they make food easier to use, store, and transport.

- The fast-food industry is also growing rapidly, and sachets are widely used in this area. Restaurants and food delivery services often include small packets of sauces or seasonings with their meals. Also, more people now prefer single-serve packaging because it helps with portion control and reduces food waste.

- In summary, the food and beverage industry is driving the growth of sachet packaging due to increasing demand for easy, quick, and small-size food options. This trend is likely to continue as lifestyles become busier and people look for more practical packaging solutions.

Sachet Packaging Machines Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region became the leader in the global sachet packaging market, holding the largest share of total market revenue. This means that more sachet packaging products were sold in this region than anywhere else in the world. The market in Asia Pacific is also expected to grow the fastest over the next few years, with a growth rate (CAGR) of around 6.0%. Several reasons explain why this region is seeing such strong growth in sachet packaging.

- One of the main reasons is that many countries in Asia Pacific have large populations with price-sensitive consumers. In simple terms, many people in these countries have lower incomes and prefer to buy small, affordable amounts of products. Sachets, which are small, single-use packets, are perfect for this purpose. They allow people to buy items like shampoo, detergent, food products, and medicine in small quantities that cost less. This helps consumers manage their daily expenses while still having access to branded products.

- Sachet packaging is also useful in rural and remote areas where larger packaging may not be practical due to limited storage space or lower demand. In these areas, companies can reach more customers by offering their products in sachets.

- In short, the Asia Pacific region is leading the way in sachet packaging because of its large number of consumers who need affordable, convenient options, making it a key area for future growth.

Sachet Packaging Machines Market Active Players:

- Accolade Packaging (New Zealand)

- All-Fill Inc. (United States)

- Aranow Packaging Machinery (Spain)

- Bossar Packaging (Spain)

- Foshan Coretamp Packaging Machinery Co. Ltd. (China)

- Fres-co System USA Inc. (United States)

- HASSIA-REDATRON (South Korea)

- Hayssen Flexible Systems (United States)

- Honor Pack (China)

- IMA S.p.A. (Italy)

- Marchesini Group S.p.A (Italy)

- Matrix Packaging Machinery, LLC (United States)

- Mediseal GmbH (Germany)

- MentPack (Germany)

- Mespack (United States)

- Nichrome India Ltd. (India)

- Omag S.r.l. (Italy)

- QuadroPack (Netherlands)

- Rovema GmbH (Germany)

- Sanko Machinery Co., Ltd. (Japan)

- Sikri Packaging Corporation LLP (India)

- SmartPac Verpackungsmaschinen GmbH (Germany)

- Spack Machine (China)

- Syntegon Technology GmbH (Germany)

- Turpack Makine Sanayi ve Ticaret Ltd. Sti. (Turkey)

- Universal Pack S.r.l. (Italy)

- Viking Masek (United States)

- Winpak Ltd. (Canada)

- Wolf Verpackungsmaschinen GmbH (Germany)

- Y-FANG SEALING MACHINE LTD. (Taiwan)

- Other active players

|

Sachet Packaging Machines |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 57.2 Billion |

|

Forecast Period 2025-35 CAGR: |

6.14% |

Market Size in 2035: |

USD 110.17 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Accolade Packaging (New Zealand),All-Fill Inc.(United States), Aranow Packaging Machinery(Spain), Bossar Packaging (Spain), Foshan Coretamp Packaging Machinery Co. Ltd. (China), Fres-co System USA Inc. (United States), and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Sachet Packaging Machines Market by Type (2018-2035)

4.1 Sachet Packaging Machines Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vertical Sachet Packaging Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Horizontal Sachet Packaging Machines

Chapter 5: Sachet Packaging Machines Market by End User (2018-2035)

5.1 Sachet Packaging Machines Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food and Beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical and Medical

5.5 Personal Care and Cosmetics

5.6 Agriculture

5.7 Animal Feed

5.8 Homecare

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sachet Packaging Machines Market Share by Manufacturer/Service Provider(2024)

6.1.3 Industry BCG Matrix

6.1.4 PArtnerships, Mergers & Acquisitions

6.2 ACCOLADE PACKAGING (NEW ZEALAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Recent News & Developments

6.2.10 SWOT Analysis

6.3 ALL-FILL INC. (UNITED STATES)

6.4 ARANOW PACKAGING MACHINERY (SPAIN)

6.5 BOSSAR PACKAGING (SPAIN)

6.6 FOSHAN CORETAMP PACKAGING MACHINERY CO. LTD. (CHINA)

6.7 FRES-CO SYSTEM USA INC. (UNITED STATES)

6.8 HASSIA-REDATRON (SOUTH KOREA)

6.9 HAYSSEN FLEXIBLE SYSTEMS (UNITED STATES)

6.10 HONOR PACK (CHINA)

6.11 IMA S.P.A. (ITALY)

6.12 MARCHESINI GROUP S.P.A (ITALY)

6.13 MATRIX PACKAGING MACHINERY

6.14 LLC (UNITED STATES)

6.15 MEDISEAL GMBH (GERMANY)

6.16 MENTPACK (GERMANY)

6.17 MESPACK (UNITED STATES)

6.18 NICHROME INDIA LTD. (INDIA)

6.19 OMAG S.R.L. (ITALY)

6.20 QUADROPACK (NETHERLANDS)

6.21 ROVEMA GMBH (GERMANY)

6.22 SANKO MACHINERY CO.

6.23 LTD. (JAPAN)

6.24 SIKRI PACKAGING CORPORATION LLP (INDIA)

6.25 SMARTPAC VERPACKUNGSMASCHINEN GMBH (GERMANY)

6.26 SPACK MACHINE (CHINA)

6.27 SYNTEGON TECHNOLOGY GMBH (GERMANY)

6.28 TURPACK MAKINE SANAYI VE TICARET LTD. STI. (TURKEY)

6.29 UNIVERSAL PACK S.R.L. (ITALY)

6.30 VIKING MASEK (UNITED STATES)

6.31 WINPAK LTD. (CANADA)

6.32 WOLF VERPACKUNGSMASCHINEN GMBH (GERMANY)

6.33 Y-FANG SEALING MACHINE LTD. (TAIWAN)

6.34 AND OTHER ACTIVE PLAYERS

Chapter 7: Global Sachet Packaging Machines Market By Region

7.1 Overview

7.2. North America Sachet Packaging Machines Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecast Market Size by Country

7.2.4.1 US

7.2.4.2 Canada

7.2.4.3 Mexico

7.3. Eastern Europe Sachet Packaging Machines Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecast Market Size by Country

7.3.4.1 Russia

7.3.4.2 Bulgaria

7.3.4.3 The Czech Republic

7.3.4.4 Hungary

7.3.4.5 Poland

7.3.4.6 Romania

7.3.4.7 Rest of Eastern Europe

7.4. Western Europe Sachet Packaging Machines Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecast Market Size by Country

7.4.4.1 Germany

7.4.4.2 UK

7.4.4.3 France

7.4.4.4 The Netherlands

7.4.4.5 Italy

7.4.4.6 Spain

7.4.4.7 Rest of Western Europe

7.5. Asia Pacific Sachet Packaging Machines Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecast Market Size by Country

7.5.4.1 China

7.5.4.2 India

7.5.4.3 Japan

7.5.4.4 South Korea

7.5.4.5 Malaysia

7.5.4.6 Thailand

7.5.4.7 Vietnam

7.5.4.8 The Philippines

7.5.4.9 Australia

7.5.4.10 New Zealand

7.5.4.11 Rest of APAC

7.6. Middle East & Africa Sachet Packaging Machines Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecast Market Size by Country

7.6.4.1 Turkiye

7.6.4.2 Bahrain

7.6.4.3 Kuwait

7.6.4.4 Saudi Arabia

7.6.4.5 Qatar

7.6.4.6 UAE

7.6.4.7 Israel

7.6.4.8 South Africa

7.7. South America Sachet Packaging Machines Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecast Market Size by Country

7.7.4.1 Brazil

7.7.4.2 Argentina

7.7.4.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 10 Case Study

Chapter 11 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Sachet Packaging Machines |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 57.2 Billion |

|

Forecast Period 2025-35 CAGR: |

6.14% |

Market Size in 2035: |

USD 110.17 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

Accolade Packaging (New Zealand),All-Fill Inc.(United States), Aranow Packaging Machinery(Spain), Bossar Packaging (Spain), Foshan Coretamp Packaging Machinery Co. Ltd. (China), Fres-co System USA Inc. (United States), and Other Active Players. |

||