Instant Coffee Market Synopsis

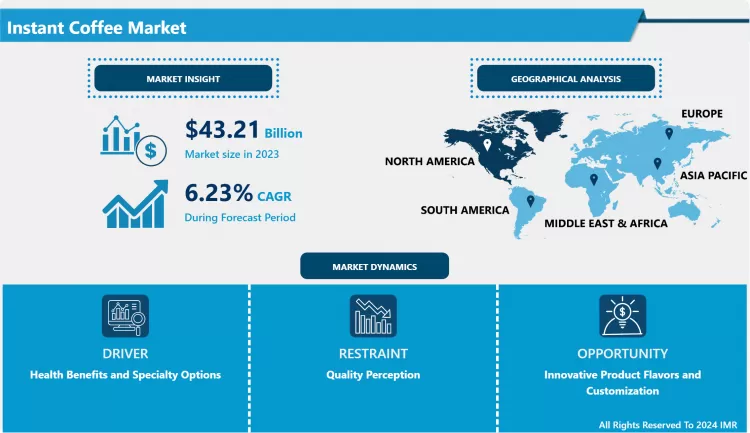

Instant Coffee Market Size Was Valued at USD 43.21 Billion in 2023, and is Projected to Reach USD 74.44 Billion by 2032, Growing at a CAGR of 6.23% From 2024-2032.

Instigate coffee is the category of coffee beverages prepared from dry specimens of roasted coffee that have been brewed as powder or granules. Usually manufactured by mixing it with hot water, Instant coffee gives the same taste of brewed coffee without the process of brewing. Suspended coffee is favorite due to its convenience of preparation and long shelf life of the product.

- The Instant Coffee Market has had growth on global scale owing to convenience, affordability and shift in consumption patterns in the world. Instant coffee is another termed as soluble coffee is one of the simplest and quickest way to brew coffee that friendly suits modern fast running lives. Innovations in freeze-drying and spray-drying have enhanced the taste of instant coffee and has brought more quality to consumers. Also, Urbanization and growth of the mid-income consumers across developed and the emerging economy such as China, India & Brazil has also led to better demand of instant coffee. Increase in the usage of the internet also helps the market as the various brands can be accessed an purchased through e-commerce sites. Likewise, issues of environment has forced manufacturers into practicing sustainable procurement and packaging of coffee for environmentally conscious consumers.

- Geographical factors have an influential factor in the instant coffee market seen from the regions. In particular, Europe is the largest consumer of instant coffee, which is confirmed by the example of the UK and Russia’s instant coffee market shares. Nonetheless, the Asia Pacific region has become one of the most promising areas due to the rising consumption in China, Japan, and South Korea. Here, instant coffee is viewed as a fashionable beverages associated with the western culture, for the drinking public that is now made up of a larger working class and users of modern commodities including urban life. Alternative higher quality specialty products of instant coffee have also been observed as consumers migrate from basic tradition instant coffee types to the premium varieties. Manufacturers are compensating for this shift by introducing new subtypes, such as single origin and organic, which appeals to the contemporary approach to more ethically and higher quality specializing coffee.

- To the same effect, the market for the instant coffee products is also threatened due to the new shifts, fresh ground coffee, and coffee pods, which are perceived to be better quality. This competition has made brands under the instant coffee category to transform themselves into new flavors and packaging to counter top these newer brewing systems. The same trend has extended to juices and other beverages becoming conscious of what they consume; they look for low acid, low caffeine or products with caffeine removed, Decaffeinated. To address this need, a majority of instant coffee producers have now begun adding functional ingredients like adaptogens, collagen, or even probiotics into their products. Furthermore, the constantly increasing number of people who prefer to consume food and beverages at home, especially during the COVID-19 period, has contributed to the proliferation of instant coffee consumption so that they can get an espresso-style coffee drinks at home.

- Segmentation in relation to the market is divided into freeze-dried instant coffee, spray-dried instant coffee and instant coffee that is made from chicory. Of these, Freezing Trade Coffee powdering is becoming popular because of its quality that preserves the real taste of coffee. Furthermore, single-serve product formats, especially in terms of portions in sachets or pods, are also regularly consumed more since such products offer convenience in use. Private labels have equally contributed to the market since they provide cheaper versions of the market incumbant brands. Supermarkets and hypermarkets, as well as online sales continue to dominate the distribution channels with rising prominence of online sales platforms.

- Thus, the further development of the instant coffee market is expected to be increasingly associated with the concept of sustainability. Lifestyle and sustainability trends have shifted consumers’ preferences away from the conventional coffee and towards Fair Trade and Rainforest Alliance certificates. Which is why businesses are now incorporating sustainability strategies into every aspect of their supply chain – from sourcing the coffee beans to the containers that can be recycled or biodegradable. Plant-based coffee substitutes, including oat or almond-based instant coffee, are also driving the future market because of the growing vegan and lactose intolerance population. More so, with the constantly growing demand for convenience as seen in the current market, indexes the instant coffee market to grow in the coming years with such innovations.

Instant Coffee Market Trend Analysis

Growing Demand for Premium Instant Coffee

- The major growth drivers of premium instant coffee change in customer preferences, with more focus on the quality of coffee products, convenience, and an enhanced experience in terms of how to consume. More often than not, it pushes consumers in the direction of seeking premium instant coffee offerings that can bring richer flavors, enhanced aroma, and superior ingredients into the home environment. This trend is fueled by a rapidly growing number of coffee lovers- more and more millennials and Gen Z consumers are making quality and convenience their top priorities in their cups. Also, freeze-drying as well as spray-drying technology has improved the quality of instant coffees so much that premium options have finally become within easy reach of the masses. Brands are capitalizing on this trend with new introductions in blends, single-origin types, and sustainably sourced coffee; all of these resonate with consumer desires for ethical and gourmet products.

- Premium instant coffee is further gaining traction as disposable incomes rise and the middle-class population grows in emerging markets. Consumers within the Asia-Pacific and Latin America regions are increasingly willing to pay for quality instant coffee products. This has also spurred the demand for instant coffee because more and more people work from home and will look for a convenient beverage. As it stands, eco-friendly packaging and sustainability in sourcing are premium differentiators among instant coffee brands, which aligns well with consumers' new focus on sustainability and responsibility to the environment. In fact, premium product offerings globally for the instant coffee market are increasing steadily, indicating an expectation of a boost in market expansion in the years to come.

Innovative Product Flavors and Customization

- Instant coffee has been witnessing changes in product variety and diversification on the basis of an enhanced consumer taste for many different flavors in their beverage products. Here, manufacturers are shifting from standard props like vanilla or hazelnut to experimenting with coffee flavors made from spices, fruit essences, and the like. This trend responds to the increasing need for specialty coffee consumption and the young generation to whom it is easy to offer diverse choices for experimentation. Also, regional specialties are becoming popular lately with companies releasing products for a specific geographical area and region’s preferences such as spicy coffee flavors in Middle East or fruit flavors in South East Asia. Flavor is another critical area that product makers have had to focus on in order to increase the level of product differentiation in the market.

- In the instant coffee sector another sign of increasing differentiation is present through the adapted packaging and individualized offerings. The current flow of products in the market was presented in a way that they can be special and adjusted in strength, sweetness, and creaminess depending on the customer’s taste preference. Backing it up with the growing trend of subscription services where the customer can choose their preferred coffee kits and have it delivered to their doorsteps at their desired frequencies. While customization serves to improve the perceived value of the product, it also reinforces the perceived attachment of consumers to the brand associated with their choice of coffee. In addition, there is increasing importance given to the concept of flavours and that increase in the possibilities of the range and customisation is another major way brands are hoping to gain more market share within this realm of products.

Instant Coffee Market Segment Analysis:

Instant Coffee Market Segmented based on lavoring, Packaging Type, Production Technology, And Distribution Channel.

By Flavoring ,Flavored segment is expected to dominate the market during the forecast period

- A primary way through which the global instant coffee market is slowly segmenting is by flavoring; flavored and unflavored segment. Malt beverage based flavoured instant coffee has also received high acceptance due toincreasing customer demand for varied tastes. A number of flavored coffee types, including vanilla, hazelnut, as well as mocha, can be attributed to increasing tendency towards individuation of food and beverages. This segment grows with the young people ages, millennials, and others who may opt to try new products instead of regular brands, meaning that the manufacturers need to develop new products. New product development of gourmet and premium flavored instant coffee has added more strength to this segment due to escalating trends towards quality packaged coffee products with time convenience.

- On the other hand there still are people who prefer unflavoured instant coffee due to purposes of simple, pure coffee taste. It is suitable to describe this segment as more popular among the older population and people with a preference to classic products without any additives. While flavoured instant products are putting up impressive shows, unflavoured products still enjoy a huge market share mainly because they come cheaper and are what many are used to. While the trends in coffee drink consumption continue to change, manufacturers are now challenged to develop more flavored products while maintaining the basic unflavored instant coffee needed to satisfy consumers and facilitate improvements in the overall market growth.

By Production Technology , Freeze-Dried Instant Coffee segment held the largest share in 2023

- This market of instant coffee, based on production technology, is divided into freeze-dried and spray-dried methods. Each of these has characteristics, advantages, and a distinct difference from the others. Free-dried instant coffee is made by freezing brewed coffee at very fast speed and then, through its sublimation under a vacuum, retaining the aroma and flavor compounds much better than other methods. This technology leads to a better product, tasting richer with a more aromatic profile, appealing to consumers who want premium experiences from their coffee. Freeze-drying is more costly, but it accommodates the growing interest in quality instant coffee in specialty coffee lovers and premium brands.

- In contrast, spray-dried instant coffee is manufactured when fine liquid coffee mist is sprayed into a hot chamber where quick evaporation of water gives rise to coffee particles. Freeze-dried tends to be more costly and suited more to smaller production volume whereas the latter actually commands a higher price point that would be enough to appeal to mass-market consumers. Spray-dried products become prevalent with economy brands and are convenient because they keep longer. Freeze-dried coffee has more intense flavor profiles, although changing consumer preferences are for high quality, freeze-dried, where the market still sways towards better quality but spray-dried is prevalent because of convenience and cost.

Instant Coffee Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The major factors to boost the north American region instant coffee market in the coming years are the change in consumers’ preference and the growing need for convenience in beverages. Due to increasing demand of convenience driven by factors such as time constraint among the consumers, instant coffee products have recorded high market acceptance due to their preparation convenience. Also, an increased number of people is buying groceries online which has helped customers access and purchase preferred instant coffee brands and flavors depending on their age, gender and other demographics. Time constraints and increased mobility have seen ready to drink coffee creeping into most households as a necessity.

- Similarly, new product development that includes premium and special instant coffee brands are also being attributed to market growth. Customer demand for differentiated categories with quality and sustainability – particularly incoffee – are becoming more pronounced with appeal towards specialty coffee. To meet such demands, brands are introducing instant coffee products that contain gourmet blends in addition to organic compounds that are require by the new generation and environmentally conscious people. Moreover, marketing trends relating to instant coffee convenience, flavor choice, and superior quality are believed to strengthen this segment’s standing in North America and support it being a leading segment of the overall coffee market.

Active Key Players in the Instant Coffee Market

- Nestlé SA (Switzerland)

- Starbucks Corporation (US)

- Jacobs Douwe Egberts BV (Netherlands)

- Strauss Group Ltd (Israel)

- Matthew Algie & Company Ltd (Scotland)

- Kraft Foods Group Inc. (US)

- Tata Beverages Ltd (India)

- Tchibo Coffee International Ltd (US)

- Unilever Plc (UK)

- Keurig Dr. Pepper (US)

- Others Key Player

Key Industry Developments in the Instant Coffee Market

- 8 January 2023: Tata Consumer Products announced the launch of its premium instant coffee ‘Tata Coffee Grand Premium’, a 100% coffee blend with flavor-locked decoction crystals. The product was launched keeping in mind the taste preference of consumers in non-South markets who tend to prefer a 100% coffee blend over a coffee ‘chicory blend’.

- 7 May 2024: Nescafé launched its new ‘Nescafé Espresso Concentrate’. The product is designed to capture the out of home cold coffee experience. This premium liquid coffee concentrate brings barista-style personalized iced coffees to consumers’ homes. Consumers can simply add a small shot of Espresso Concentrate to milk to have a creamy iced Latte or in water for a robust Americano, or even mix it in a refreshing twist with lemonade or juice.

- 24 July 2023: illycaffè signed a new partnership with Hangzhou Onechance Tech to its increase e-commerce sales in China.

|

Global Instant Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 43.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.23% |

Market Size in 2032: |

USD 74.44 Bn. |

|

Segments Covered: |

By Flavoring |

|

|

|

By Packaging Type |

|

||

|

By Production Technology |

|

||

|

By Distribution Channe |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Instant Coffee Market by Flavoring (2018-2032)

4.1 Instant Coffee Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Flavored

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unflavored Instant Coffee

Chapter 5: Instant Coffee Market by Packaging Type (2018-2032)

5.1 Instant Coffee Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sachets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pouches

5.5 Jars

Chapter 6: Instant Coffee Market by Production Technology (2018-2032)

6.1 Instant Coffee Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Freeze-Dried Instant Coffee

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Spray-Dried Instant Coffee

Chapter 7: Instant Coffee Market by Distribution Channe (2018-2032)

7.1 Instant Coffee Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience/Grocery Stores

7.5 Specialist Retailers

7.6 Online Channels

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Instant Coffee Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NESTLÉ SA (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 STARBUCKS CORPORATION (US)

8.4 JACOBS DOUWE EGBERTS BV (NETHERLANDS)

8.5 STRAUSS GROUP LTD (ISRAEL)

8.6 MATTHEW ALGIE & COMPANY LTD (SCOTLAND)

8.7 KRAFT FOODS GROUP INC. (US)

8.8 TATA BEVERAGES LTD (INDIA)

8.9 TCHIBO COFFEE INTERNATIONAL LTD (US)

8.10 UNILEVER PLC (UK)

8.11 KEURIG DR. PEPPER (US)

8.12 OTHERS KEY PLAYER

Chapter 9: Global Instant Coffee Market By Region

9.1 Overview

9.2. North America Instant Coffee Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Flavoring

9.2.4.1 Flavored

9.2.4.2 Unflavored Instant Coffee

9.2.5 Historic and Forecasted Market Size by Packaging Type

9.2.5.1 Sachets

9.2.5.2 Pouches

9.2.5.3 Jars

9.2.6 Historic and Forecasted Market Size by Production Technology

9.2.6.1 Freeze-Dried Instant Coffee

9.2.6.2 Spray-Dried Instant Coffee

9.2.7 Historic and Forecasted Market Size by Distribution Channe

9.2.7.1 Supermarkets/Hypermarkets

9.2.7.2 Convenience/Grocery Stores

9.2.7.3 Specialist Retailers

9.2.7.4 Online Channels

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Instant Coffee Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Flavoring

9.3.4.1 Flavored

9.3.4.2 Unflavored Instant Coffee

9.3.5 Historic and Forecasted Market Size by Packaging Type

9.3.5.1 Sachets

9.3.5.2 Pouches

9.3.5.3 Jars

9.3.6 Historic and Forecasted Market Size by Production Technology

9.3.6.1 Freeze-Dried Instant Coffee

9.3.6.2 Spray-Dried Instant Coffee

9.3.7 Historic and Forecasted Market Size by Distribution Channe

9.3.7.1 Supermarkets/Hypermarkets

9.3.7.2 Convenience/Grocery Stores

9.3.7.3 Specialist Retailers

9.3.7.4 Online Channels

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Instant Coffee Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Flavoring

9.4.4.1 Flavored

9.4.4.2 Unflavored Instant Coffee

9.4.5 Historic and Forecasted Market Size by Packaging Type

9.4.5.1 Sachets

9.4.5.2 Pouches

9.4.5.3 Jars

9.4.6 Historic and Forecasted Market Size by Production Technology

9.4.6.1 Freeze-Dried Instant Coffee

9.4.6.2 Spray-Dried Instant Coffee

9.4.7 Historic and Forecasted Market Size by Distribution Channe

9.4.7.1 Supermarkets/Hypermarkets

9.4.7.2 Convenience/Grocery Stores

9.4.7.3 Specialist Retailers

9.4.7.4 Online Channels

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Instant Coffee Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Flavoring

9.5.4.1 Flavored

9.5.4.2 Unflavored Instant Coffee

9.5.5 Historic and Forecasted Market Size by Packaging Type

9.5.5.1 Sachets

9.5.5.2 Pouches

9.5.5.3 Jars

9.5.6 Historic and Forecasted Market Size by Production Technology

9.5.6.1 Freeze-Dried Instant Coffee

9.5.6.2 Spray-Dried Instant Coffee

9.5.7 Historic and Forecasted Market Size by Distribution Channe

9.5.7.1 Supermarkets/Hypermarkets

9.5.7.2 Convenience/Grocery Stores

9.5.7.3 Specialist Retailers

9.5.7.4 Online Channels

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Instant Coffee Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Flavoring

9.6.4.1 Flavored

9.6.4.2 Unflavored Instant Coffee

9.6.5 Historic and Forecasted Market Size by Packaging Type

9.6.5.1 Sachets

9.6.5.2 Pouches

9.6.5.3 Jars

9.6.6 Historic and Forecasted Market Size by Production Technology

9.6.6.1 Freeze-Dried Instant Coffee

9.6.6.2 Spray-Dried Instant Coffee

9.6.7 Historic and Forecasted Market Size by Distribution Channe

9.6.7.1 Supermarkets/Hypermarkets

9.6.7.2 Convenience/Grocery Stores

9.6.7.3 Specialist Retailers

9.6.7.4 Online Channels

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Instant Coffee Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Flavoring

9.7.4.1 Flavored

9.7.4.2 Unflavored Instant Coffee

9.7.5 Historic and Forecasted Market Size by Packaging Type

9.7.5.1 Sachets

9.7.5.2 Pouches

9.7.5.3 Jars

9.7.6 Historic and Forecasted Market Size by Production Technology

9.7.6.1 Freeze-Dried Instant Coffee

9.7.6.2 Spray-Dried Instant Coffee

9.7.7 Historic and Forecasted Market Size by Distribution Channe

9.7.7.1 Supermarkets/Hypermarkets

9.7.7.2 Convenience/Grocery Stores

9.7.7.3 Specialist Retailers

9.7.7.4 Online Channels

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Instant Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 43.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.23% |

Market Size in 2032: |

USD 74.44 Bn. |

|

Segments Covered: |

By Flavoring |

|

|

|

By Packaging Type |

|

||

|

By Production Technology |

|

||

|

By Distribution Channe |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Instant Coffee Market research report is 2024-2032.

Nestlé SA (Switzerland),Starbucks Corporation (US),Jacobs Douwe Egberts BV (Netherlands),Strauss Group Ltd (Israel),Matthew Algie & Company Ltd (Scotland),Kraft Foods Group Inc. (US),and Other Major Players.

The Instant Coffee Market is segmented into Flavoring, Packaging Type, Production Technology, Distribution Channel and Region. By Flavoring , the market is categorized into Flavored and Unflavored Instant Coffee. By Packaging Type , the market is categorized into Sachets, Pouches, and Jars. By Production Technology , the market is categorized into Freeze-Dried Instant Coffee and Spray-Dried Instant Coffee.By Distribution Channel , the market is categorized into Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialist Retailers, Online Channels, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Instigate coffee is the category of coffee beverages prepared from dry specimens of roasted coffee that have been brewed as powder or granules. Usually manufactured by mixing it with hot water, Instant coffee gives the same taste of brewed coffee without the process of brewing. Suspended coffee is favorite due to its convenience of preparation and long shelf life of the product.

Instant Coffee Market Size Was Valued at USD 43.21 Billion in 2023, and is Projected to Reach USD 74.44 Billion by 2032, Growing at a CAGR of 6.23% From 2024-2032.