Processed Egg Market Synopsis

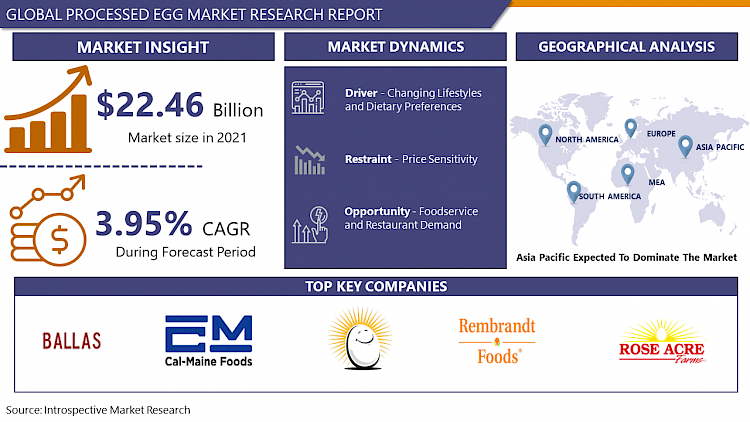

The Global Processed Egg Market size is expected to grow from USD 22.46 billion in 2022 to USD 30.62 billion by 2030, at a CAGR of 3.95% during the forecast period (2023-2030).

Processed eggs refer to eggs that have undergone various treatments or alterations from their natural state, typically for convenience, preservation, or specific culinary applications. These treatments include pasteurization, freezing, drying, or mixing with other ingredients to create products like liquid eggs, powdered eggs, or pre-cooked egg products. These processed forms offer extended shelf life, ease of handling, and versatility in various food preparations.

- The applications of processed eggs are widespread across the food industry. Liquid eggs, for instance, are commonly used in bakeries, restaurants, and food manufacturing for convenience and consistency in recipes. Powdered eggs find utility in emergency food supplies, camping foods, and commercial baking due to their longer shelf life and ease of storage. Pre-cooked egg products cater to the ready-to-eat market, featuring items like scrambled eggs, omelettes, or egg patties used in fast-food chains or foodservice settings.

- In recent years, the market for processed eggs has seen growth due to increased demand for convenient and ready-to-use food products. With changing consumer lifestyles and a focus on convenience without compromising quality, there's a rising trend toward these processed egg products. Moreover, health-conscious consumers seeking safer options have contributed to the popularity of pasteurized and pre-cooked egg products, as they minimize the risk of foodborne illnesses associated with raw eggs. Additionally, the incorporation of processed eggs in various cuisines, coupled with their longer shelf life, has led to their steady market expansion across the globe.

Processed Egg Market Trend Analysis

Changing Lifestyles and Dietary Preferences

- Modern lifestyles, characterized by busier schedules and an increased emphasis on convenience, have led consumers to seek quick and easy meal solutions. Processed eggs perfectly align with this trend, offering pre-prepared, easy-to-use options like liquid eggs or pre-cooked egg products. These cater to consumers who value time efficiency without compromising on nutrition or taste. Whether for breakfast at home or in foodservice settings, the demand for ready-to-cook or ready-to-eat egg products mirrors the shift towards more convenient food choices.

- Moreover, evolving dietary preferences also contribute to the rising demand for processed eggs. With more individuals opting for high-protein diets, eggs, being a rich source of protein, are gaining popularity. Processed egg products offer versatility and convenience in incorporating protein-rich ingredients into various dishes, attracting health-conscious consumers. Additionally, dietary restrictions or concerns about food safety drive the preference for pasteurized or pre-cooked egg products, addressing concerns about consuming raw eggs and providing a safer alternative.

- As consumer priorities continue to prioritize convenience, health, and dietary preferences, the processed egg market is positioned to expand further. Manufacturers and foodservice industries adapt by offering a diverse range of processed egg products that cater to these changing lifestyle needs and dietary choices, ensuring continued growth and relevance in the market.

Foodservice and Restaurant Demand

- As the foodservice industry continues to grow and diversify, there's a rising need for convenient, high-quality ingredients that meet specific culinary requirements. Processed egg products, such as liquid eggs or pre-cooked egg patties, offer consistency, convenience, and versatility to restaurants, catering services, and other food establishments.

- These establishments often face challenges related to efficiency and consistency in food preparation. Processed eggs address these concerns by providing ready-to-use solutions, reducing prep time, and ensuring consistent quality across various dishes. From breakfast joints requiring quick and uniform egg servings to high-end restaurants seeking premium pre-cooked egg products, the demand for processed eggs in the foodservice sector remains robust.

- Moreover, processed egg manufacturers have an opportunity to collaborate closely with restaurants and food chains to develop tailor-made egg products. Customizing formulations or creating specialty egg blends to suit specific recipes or menu items allows for unique offerings and strengthens partnerships within the foodservice industry. Such collaborations enable processed egg suppliers to stay responsive to evolving culinary trends while meeting the high standards and demands of foodservice establishments, thereby solidifying their position in this growing market segment.

Processed Egg Market Segment Analysis:

Processed Egg Market Segmented on the basis of type and application.

By Type, Liquid Egg segment is expected to dominate the market during the forecast period

- During the forecast period, the Liquid Egg segment is anticipated to spearhead the processed egg market. This dominance is attributed to various factors, including its widespread applications across diverse culinary sectors such as bakeries, food processing, and foodservice industries. Liquid eggs offer unparalleled convenience, streamlining preparation processes by eliminating the need for cracking and separating eggs while ensuring consistency in quality and taste. Their longer shelf life compared to fresh eggs further boosts their appeal to both consumers and commercial establishments, reducing waste and ensuring extended usability.

- Moreover, the versatility of liquid eggs in creating a wide array of dishes, from omelettes to baked goods, positions this segment at the forefront of the processed egg market, catering to the evolving demands of modern consumers seeking convenient, ready-to-use ingredients without compromising on quality.

By Application, Bakery segment held the largest market share of 37% in 2022

- The Bakery segment has emerged as a frontrunner in the processed egg market, holding the largest market share due to its extensive utilization of egg-based products. Eggs serve as fundamental ingredients in various baked goods, including cakes, pastries, bread, and cookies, owing to their functionalities such as emulsification, leavening, and moisture retention. Processed egg products like liquid eggs and powdered eggs offer convenience and consistency in baking applications, facilitating smoother production processes for bakeries, patisseries, and industrial baking units. Liquid eggs, for instance, provide ease of incorporation into batters and doughs, ensuring uniform texture and rising in baked goods.

- The demand for ready-to-use egg products in the bakery industry aligns with the need for efficient and standardized ingredients that maintain product quality. With these processed egg variants offering longer shelf life and convenience in handling, the bakery segment remains a key driver in the processed egg market, catering to the demands of consumers for a wide array of delectable baked treats.

Processed Egg Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Over the forecast period, Asia Pacific is poised to assert its dominance in the processed egg market. This region's projected leadership is fueled by several factors, including the burgeoning population, rising disposable incomes, and evolving dietary preferences. As consumers increasingly seek convenient and nutritious food options, processed egg products align perfectly with this demand, offering ready-to-use solutions that cater to varied culinary needs.

- Moreover, the expanding foodservice industry and the prevalence of bakery and confectionery businesses in countries such as China, India, and Japan contribute significantly to the market's growth. These industries heavily rely on processed egg products for their convenience and efficiency in large-scale food preparation. Additionally, increased urbanization and changing lifestyles in the region further boost the demand for processed eggs due to their versatility in quick and easy meal preparations. With the market continuously innovating and diversifying its product offerings, Asia Pacific is positioned to maintain its dominance in the processed egg market during the forecast period.

Processed Egg Market Top Key Players:

- Ballas Egg (U.S.)

- Browns Mill Farm (U.S.)

- Buckeye Egg Farm Lp (U.S.)

- Cal-Maine Foods (U.S.)

- Dakota Layers (U.S.)

- Daybreak Foods, Inc. (U.S.)

- Debel Food Products (U.S.)

- Rembrandt Enterprises, Inc. (U.S.)

- Rose Acre Farms, Inc. (U.S.)

- Michael Foods Inc. (U.S.)

- Nabati Foods Global Inc. (U.S.)

- Eat Just Inc. (U.S.)

- Global Eggs Corporation (Canada)

- Ovo-Tech (Poland)

- Dwise Ltd (U.K.)

- Noble Foods Ltd. (U.K.)

- Actini Group (France)

- Glon Group (France)

- Igreca S.A. (France)

- Interovo Egg Group B.V.(Netherland)

- Moba B.V. (Netherland)

- Bouwhuis Enthovan B.V. (Netherlands)

- Gruppo Eurovo (Italy)

- Pelbo S.P.A.(Italy)

- Sanovo Technology Group (Denmark) and Other Major Players

Key Industry Developments in the Processed Egg Market:

- In September 2023, Cal-Maine Foods, Inc., the largest producer and distributor of fresh shell eggs in the United States, announced a definitive agreement to acquire substantially all the assets of Fassio Egg Farms, Inc. (“Fassio”), related to its commercial shell egg production and processing business.

- In May 2023, LA PAZ COUNTY, Arizona-based Becker Development and Consulting LLC and its client, Rose Acre Farms, held a ground-breaking ceremony for the second egg farm, to be called Desert Valley Egg Farm. Rose Acre Farms will begin building the Desert Valley Egg Farm in the fall of 2023. The farm is anticipated to be finished by 2026 and will cost more than $100 million to build.

|

Global Processed Egg Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.46 Bn. |

|

Forecast Period 2023-32 CAGR: |

3.95 % |

Market Size in 2032: |

USD 30.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROCESSED EGG MARKET BY TYPE (2016-2030)

- PROCESSED EGG MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FROZEN EGG

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DRIED EGG

- LIQUID EGG

- PROCESSED EGG MARKET BY APPLICATION (2016-2030)

- PROCESSED EGG MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BAKERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONFECTIONERY

- DAIRY PRODUCTS

- READY-TO-EAT MEALS

- NUTRITIONAL SUPPLEMENTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PROCESSED EGG Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BALLAS EGG (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BROWNS MILL FARM (U.S.)

- BUCKEYE EGG FARM LP (U.S.)

- CAL-MAINE FOODS (U.S.)

- DAKOTA LAYERS (U.S.)

- DAYBREAK FOODS, INC. (U.S.)

- DEBEL FOOD PRODUCTS (U.S.)

- REMBRANDT ENTERPRISES, INC. (U.S.)

- ROSE ACRE FARMS, INC. (U.S.)

- MICHAEL FOODS INC. (U.S.)

- NABATI FOODS GLOBAL INC. (U.S.)

- EAT JUST INC. (U.S.)

- GLOBAL EGGS CORPORATION (CANADA)

- OVO-TECH (POLAND)

- DWISE LTD (U.K.)

- NOBLE FOODS LTD. (U.K.)

- ACTINI GROUP (FRANCE)

- GLON GROUP (FRANCE)

- IGRECA S.A. (FRANCE)

- INTEROVO EGG GROUP B.V.(NETHERLAND)

- MOBA B.V. (NETHERLAND)

- BOUWHUIS ENTHOVAN B.V. (NETHERLANDS)

- GRUPPO EUROVO (ITALY)

- PELBO S.P.A.(ITALY)

- SANOVO TECHNOLOGY GROUP (DENMARK)

- COMPETITIVE LANDSCAPE

- GLOBAL PROCESSED EGG MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Processed Egg Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 22.46 Bn. |

|

Forecast Period 2023-32 CAGR: |

3.95 % |

Market Size in 2032: |

USD 30.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROCESSED EGG MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROCESSED EGG MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROCESSED EGG MARKET COMPETITIVE RIVALRY

TABLE 005. PROCESSED EGG MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROCESSED EGG MARKET THREAT OF SUBSTITUTES

TABLE 007. PROCESSED EGG MARKET BY TYPE

TABLE 008. FROZEN EGG MARKET OVERVIEW (2016-2028)

TABLE 009. DRIED EGG MARKET OVERVIEW (2016-2028)

TABLE 010. LIQUID EGG MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. PROCESSED EGG MARKET BY APPLICATION

TABLE 013. BAKERY MARKET OVERVIEW (2016-2028)

TABLE 014. CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 015. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 016. READY-TO-EAT MEALS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. PROCESSED EGG MARKET BY END USERS

TABLE 019. RAW MATERIAL SUPPLIERS MARKET OVERVIEW (2016-2028)

TABLE 020. MANUFACTURERS & SUPPLIERS TRADERS MARKET OVERVIEW (2016-2028)

TABLE 021. DISTRIBUTORS & RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 022. FOOD & BEVERAGE MANUFACTURERS MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA PROCESSED EGG MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA PROCESSED EGG MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA PROCESSED EGG MARKET, BY END USERS (2016-2028)

TABLE 027. N PROCESSED EGG MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE PROCESSED EGG MARKET, BY TYPE (2016-2028)

TABLE 029. EUROPE PROCESSED EGG MARKET, BY APPLICATION (2016-2028)

TABLE 030. EUROPE PROCESSED EGG MARKET, BY END USERS (2016-2028)

TABLE 031. PROCESSED EGG MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC PROCESSED EGG MARKET, BY TYPE (2016-2028)

TABLE 033. ASIA PACIFIC PROCESSED EGG MARKET, BY APPLICATION (2016-2028)

TABLE 034. ASIA PACIFIC PROCESSED EGG MARKET, BY END USERS (2016-2028)

TABLE 035. PROCESSED EGG MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA PROCESSED EGG MARKET, BY TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA PROCESSED EGG MARKET, BY APPLICATION (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA PROCESSED EGG MARKET, BY END USERS (2016-2028)

TABLE 039. PROCESSED EGG MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA PROCESSED EGG MARKET, BY TYPE (2016-2028)

TABLE 041. SOUTH AMERICA PROCESSED EGG MARKET, BY APPLICATION (2016-2028)

TABLE 042. SOUTH AMERICA PROCESSED EGG MARKET, BY END USERS (2016-2028)

TABLE 043. PROCESSED EGG MARKET, BY COUNTRY (2016-2028)

TABLE 044. INTEROVO EGG GROUP B.V.: SNAPSHOT

TABLE 045. INTEROVO EGG GROUP B.V.: BUSINESS PERFORMANCE

TABLE 046. INTEROVO EGG GROUP B.V.: PRODUCT PORTFOLIO

TABLE 047. INTEROVO EGG GROUP B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. BROWNS MILL FARM: SNAPSHOT

TABLE 048. BROWNS MILL FARM: BUSINESS PERFORMANCE

TABLE 049. BROWNS MILL FARM: PRODUCT PORTFOLIO

TABLE 050. BROWNS MILL FARM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DAKOTA LAYERS: SNAPSHOT

TABLE 051. DAKOTA LAYERS: BUSINESS PERFORMANCE

TABLE 052. DAKOTA LAYERS: PRODUCT PORTFOLIO

TABLE 053. DAKOTA LAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. PELBO S.P.A.: SNAPSHOT

TABLE 054. PELBO S.P.A.: BUSINESS PERFORMANCE

TABLE 055. PELBO S.P.A.: PRODUCT PORTFOLIO

TABLE 056. PELBO S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. OVO-TECH: SNAPSHOT

TABLE 057. OVO-TECH: BUSINESS PERFORMANCE

TABLE 058. OVO-TECH: PRODUCT PORTFOLIO

TABLE 059. OVO-TECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. DEBEL FOOD PRODUCTS: SNAPSHOT

TABLE 060. DEBEL FOOD PRODUCTS: BUSINESS PERFORMANCE

TABLE 061. DEBEL FOOD PRODUCTS: PRODUCT PORTFOLIO

TABLE 062. DEBEL FOOD PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SANOVO TECHNOLOGY GROUP: SNAPSHOT

TABLE 063. SANOVO TECHNOLOGY GROUP: BUSINESS PERFORMANCE

TABLE 064. SANOVO TECHNOLOGY GROUP: PRODUCT PORTFOLIO

TABLE 065. SANOVO TECHNOLOGY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DWISE LTD: SNAPSHOT

TABLE 066. DWISE LTD: BUSINESS PERFORMANCE

TABLE 067. DWISE LTD: PRODUCT PORTFOLIO

TABLE 068. DWISE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GLON GROUP: SNAPSHOT

TABLE 069. GLON GROUP: BUSINESS PERFORMANCE

TABLE 070. GLON GROUP: PRODUCT PORTFOLIO

TABLE 071. GLON GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. GRUPPO EUROVO: SNAPSHOT

TABLE 072. GRUPPO EUROVO: BUSINESS PERFORMANCE

TABLE 073. GRUPPO EUROVO: PRODUCT PORTFOLIO

TABLE 074. GRUPPO EUROVO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. BOUWHUIS ENTHOVAN B.V.: SNAPSHOT

TABLE 075. BOUWHUIS ENTHOVAN B.V.: BUSINESS PERFORMANCE

TABLE 076. BOUWHUIS ENTHOVAN B.V.: PRODUCT PORTFOLIO

TABLE 077. BOUWHUIS ENTHOVAN B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. IGRECA S.A.: SNAPSHOT

TABLE 078. IGRECA S.A.: BUSINESS PERFORMANCE

TABLE 079. IGRECA S.A.: PRODUCT PORTFOLIO

TABLE 080. IGRECA S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. MOBA B.V.: SNAPSHOT

TABLE 081. MOBA B.V.: BUSINESS PERFORMANCE

TABLE 082. MOBA B.V.: PRODUCT PORTFOLIO

TABLE 083. MOBA B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. NABATI FOODS GLOBAL INC.: SNAPSHOT

TABLE 084. NABATI FOODS GLOBAL INC.: BUSINESS PERFORMANCE

TABLE 085. NABATI FOODS GLOBAL INC.: PRODUCT PORTFOLIO

TABLE 086. NABATI FOODS GLOBAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ACTINI GROUP: SNAPSHOT

TABLE 087. ACTINI GROUP: BUSINESS PERFORMANCE

TABLE 088. ACTINI GROUP: PRODUCT PORTFOLIO

TABLE 089. ACTINI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. BUCKEYE EGG FARM LP: SNAPSHOT

TABLE 090. BUCKEYE EGG FARM LP: BUSINESS PERFORMANCE

TABLE 091. BUCKEYE EGG FARM LP: PRODUCT PORTFOLIO

TABLE 092. BUCKEYE EGG FARM LP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. EAT JUST INC.: SNAPSHOT

TABLE 093. EAT JUST INC.: BUSINESS PERFORMANCE

TABLE 094. EAT JUST INC.: PRODUCT PORTFOLIO

TABLE 095. EAT JUST INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 096. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 097. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 098. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROCESSED EGG MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROCESSED EGG MARKET OVERVIEW BY TYPE

FIGURE 012. FROZEN EGG MARKET OVERVIEW (2016-2028)

FIGURE 013. DRIED EGG MARKET OVERVIEW (2016-2028)

FIGURE 014. LIQUID EGG MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. PROCESSED EGG MARKET OVERVIEW BY APPLICATION

FIGURE 017. BAKERY MARKET OVERVIEW (2016-2028)

FIGURE 018. CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 019. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 020. READY-TO-EAT MEALS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. PROCESSED EGG MARKET OVERVIEW BY END USERS

FIGURE 023. RAW MATERIAL SUPPLIERS MARKET OVERVIEW (2016-2028)

FIGURE 024. MANUFACTURERS & SUPPLIERS TRADERS MARKET OVERVIEW (2016-2028)

FIGURE 025. DISTRIBUTORS & RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 026. FOOD & BEVERAGE MANUFACTURERS MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA PROCESSED EGG MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE PROCESSED EGG MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC PROCESSED EGG MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA PROCESSED EGG MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA PROCESSED EGG MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Processed Egg Market research report is 2023-2030.

Ballas Egg (U.S.), Browns Mill Farm (U.S.), Buckeye Egg Farm LP (U.S.), Cal-Maine Foods (U.S.), Dakota Layers (U.S.), Daybreak Foods, Inc. (U.S.), Debel Food Products (U.S.), Rembrandt Enterprises, Inc. (U.S.), Rose Acre Farms, Inc. (U.S.), Michael Foods Inc. (U.S.), Nabati Foods Global Inc. (U.S.), Eat JUST Inc. (U.S.), Global Eggs Corporation (Canada), OVO-Tech (Poland), Dwise Ltd (U.K.), Noble Foods Ltd. (U.K.), Actini Group (France), Glon Group (France), Igreca S.A. (France), Interovo Egg Group B.V.(Netherland), MOBA B.V. (Netherland), Bouwhuis Enthovan B.V. (Netherlands), Gruppo Eurovo (Italy), Pelbo S.P.A.(Italy), Sanovo Technology Group (Denmark) and Other Major Players.

The Processed Egg Market is segmented into Type, Application, and region. By Type, the market is categorized into Frozen Egg, Dried Egg and Liquid Egg. By Application, the market is categorized into Bakery, Confectionery, Dairy Products, Ready-To-Eat Meals and Nutritional Supplements. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Processed eggs refer to eggs that have undergone various treatments or alterations from their natural state, typically for convenience, preservation, or specific culinary applications. These treatments include pasteurization, freezing, drying, or mixing with other ingredients to create products like liquid eggs, powdered eggs, or pre-cooked egg products. These processed forms offer extended shelf life, ease of handling, and versatility in various food preparations.

The Global Processed Egg Market size is expected to grow from USD 22.46 billion in 2022 to USD 30.62 billion by 2030, at a CAGR of 3.95% during the forecast period (2023-2030).