Bean Ingredients Market Synopsis

The Global Bean Ingredients Market size was reasonably estimated to be approximately USD 2,524.00 Million in 2022 and is poised to generate revenue over USD 3,672.65 Million by the end of 2030, projecting a CAGR of around 4.80% from 2022 to 2030.

Bean ingredients are one of the most cost-effective and environmentally friendly sources of protein. It is regarded as a healthy food because of its high fiber, low fat, and nutrients like iron and folic acid.

- The minerals included in beans, such as calcium, potassium, magnesium, folate, and antioxidants, are important for overall health. Bean components are utilized in a variety of processes, including those that produce coffee flour, chocolate, and other organic foods. Many suppliers offer organic, gluten-free, and allergen-free beans, which are quite healthy. The industry that makes coffee is where materials from beans are most commonly used. The market for bean ingredients is expanding significantly and, it is expected to expand more.

- The most cost-effective and nutritious sources of protein are found in beans. Iron, folic acid, and low-fat, high-fiber nutrients are found in beans. The increased use of beans in the creation of various organic foods, chocolate, and coffee flour is driving the need for bean-based components. The production of gluten-free, allergen-free, and organic bean ingredients which are not only good for health but are also rich in nutritional value, including antioxidants, calcium, potassium, magnesium, and folate which has been made possible by consistent product improvements and moderations in response to consumer needs.

The Bean Ingredients Market Trend Analysis

Increasing Bean Ingredients Application in Various Food Production

- The increase in the application of beans due to their convenient consumption and high nutritional content is boosting the growth of the bean ingredients market. The increase in demand for coffee and cocoa products is supplementing the upsurge in the production of bean ingredients. This is attributed due to the easy availability, and affordability of the bean ingredients, thereby driving the growth of the market.

- The demand for bean ingredients is driven by their rise in application in various organic food production, chocolate, as well as coffee flour production. Consistent product improvements and moderations as per the consumer needs have given increase to the production of gluten-free, allergen-free, and organic bean ingredients, which are not just beneficial for health but are also rich in nutritional value, including antioxidants, potassium, magnesium, folate, and calcium which drives the growth of the market.

- Moreover, continuous technological advancements are remarkably replacing the conventional and high-cost methods of bean ingredient processing, which is emerging as an opportunity for manufacturers. With the rising demand for bean ingredients, the market is expected to boost in the coming years.

Opportunity in Cocoa and Coffee Bean Ingredients

- Most of the global bean raw material is collected from coffee and cocoa beans, which gives major market players the opportunity to increase production in them. Due to the growing global demand for coffee, the coffee powder was made from coffee beans. Cocoa beans are widely used in various products such as cocoa butter, cosmetics, soaps, moisturizing creams, and emulsions. Thus, the health and beauty benefits of coffee and cocoa encourage customers to develop strong demands for it.

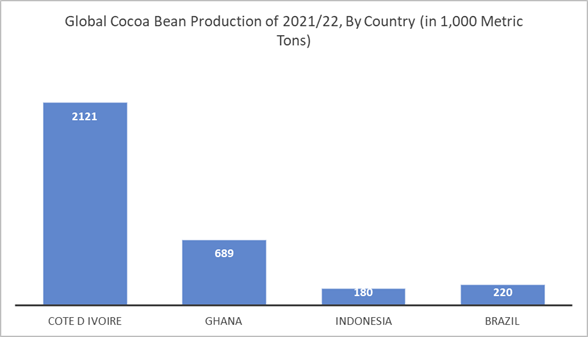

- These growing applications for coffee and cocoa beans are driving global bean ingredient production. For instance, according to Statista, the production of cocoa beans of by country in the crop year 2021/2022, about 2.1 million metric tons of cocoa beans were produced in Côte d'Ivoire.

Moreover, the presence of major key players in the dean ingredients market drives the growth of the market. The launch of the new product by manufacturers has penetrated the market in compliance with different consumer demands. The demand for beans has been significantly increasing, due to the nutritional benefits they offer, such factors create growth opportunities for the growth of the market.

Segmentation Analysis of The Bean Ingredients Market

Bean ingredients market segments cover the Type, Ingredient Type, End-Use Industry, and Distribution Channel. By Type, the Organic Bean Ingredients segment is anticipated to dominate the Market Over the Forecast period.

- Organic beans are produced and processed without the use of synthetic fertilizers and pesticides. Increasing consumer awareness of the health benefits of organic products and a preference for natural products with fewer chemicals and additives are rising the demand for organic bean ingredients products. Nowadays consumers are becoming more interested in organic and natural foods due to health issues such as diabetes, high blood pressure, obesity, and other diseases which are driving them to live healthier lifestyles. Henceforth, functional foods containing plant-based proteins, such as organic protein-based products, are more appealing to them which drives the demand for organic bean ingredients.

- The organic Bean Ingredients provide the same nutritional content as nonorganic beans; however, they are grown without the use of synthetic fertilizers or chemical pesticides. Additionally, organic farming is designed to promote soil fertility and reduce pollution as well as concern water and energy. This makes them an ideal choice for health-conscious individuals who wish to provide their bodies with nutrients free from chemicals or adulterants. Furthermore, consuming organic beans may help reduce exposure to certain toxins which can lead to long-term illnesses such as cancer or diabetes.

Regional Analysis of The Bean Ingredients Market

North America is Expected to Dominate the Bean Ingredients Market Over the Forecast Period.

- North America is known for its high consumption of beans, which is a major factor contributing to the dominance of this region. Beans are an important part of the North American diet, and their high protein and fiber content make them a popular ingredient in many foods. The North American population is becoming increasingly health conscious and the demand for healthy and natural foods is increasing. The bean is considered a healthy and natural ingredient, which increases the demand for beans in the region. Additionally, due to the growing trend of veganism and plant-based diets, the demand for plant-based ingredients in food is increasing. Beans are a popular ingredient in vegan and plant-based products, increasing the demand for beans in the region.

- North American governments have enacted favorable regulations to promote the use of natural and healthy ingredients in food. This led to increased production and consumption of beans in the region. Moreover, the North American region has a favorable climate for growing beans, and raw materials for the manufacture of beans are constantly ensured. This made it easier for manufacturers to produce bean ingredients in the region, leading to a dominant position in the market during the forecast period.

Covid-19 Impact Analysis On the Bean Ingredients Market

- During the covid-19 pandemic situation, most industries around the world have been negatively affected. This may be due to the significant disruptions their manufacturing and supply chain operations have experienced due to various precautionary restrictions, as well as other restrictions imposed by regulatory bodies around the world. It also affects the global market for bean ingredients. In addition, consumer demand has declined since then, as individuals are now more willing to cut non-essential expenses from their budgets, as the pandemic has severely affected most people's overall finances.

- The manufacturing and processing of bean ingredients have not been taking place in the industries, owing to the outbreak of COVID-19 and the implementation of the lockdown. This has strikingly reduced the amount of finished stock with the market, hampering revenue for the firm. The supply chains for raw materials have been disrupted amid lockdown situations, which hindered the production as well as supply of finished products in the market. This has declined the market growth.

Top Key Players Covered in The Bean Ingredients Market

- Archer Daniels Midland Company (US)

- Cargill Incorporated (US)

- Mara Global Foods (Australia)

- Olam International (Singapore)

- Vermont Bean Crafters (US)

- Inland Empire Foods (US)

- BENEO(Germany)

- Faribault Foods, Inc. (US)

- Better Bean (US)

- Globeways Canada Inc (Canada), and Other Major Players

Key Industry Developments in the Bean Ingredients Market

In November 2022, BENEO Showcases New Faba Bean Ingredients. The new faba bean protein concentrate and starch-rich flour at the IFT Food Expo. Themed “Rooted in Nature the Power of Plants,” visitors will learn how faba bean ingredients are providing food manufacturers with innovative opportunities for texture improvement in meat and dairy alternatives as well as protein enrichment in a vast array of foods.

In December 2019, Roquette, a global leader in plant-based ingredients and pioneer of new vegetal proteins launched two new plant-based textured proteins to better address the growing consumers’ demand for sensory, diversity, and sustainable nutritional improvement. To an existing range of two textured pea proteins, Roquette adds now two plant-based textured proteins, one from peas and one from fava beans

|

Global Bean Ingredients Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 2,524.00 Bn |

|

Forecast Period 2022-30 CAGR: |

4.80% |

Market Size in 2030: |

USD 3,672.65 Bn |

|

|

By Type |

|

|

|

By Ingredient Type |

|

||

|

|||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Ingredient Type

3.3 By End-Use Industry

3.4 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Bean Ingredients Market by Type

5.1 Bean Ingredients Market Overview Snapshot and Growth Engine

5.2 Bean Ingredients Market Overview

5.3 Organic Bean Ingredients

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2030F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Organic Bean Ingredients: Geographic Segmentation

5.4 Conventional Bean Ingredients

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2030F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Conventional Bean Ingredients: Geographic Segmentation

5.5 Gluten-free

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2030F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Gluten-free: Geographic Segmentation

5.6 Allergen-free

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2030F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Allergen-free: Geographic Segmentation

Chapter 6: Bean Ingredients Market by Ingredient Type

6.1 Bean Ingredients Market Overview Snapshot and Growth Engine

6.2 Bean Ingredients Market Overview

6.3 Flour

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2030F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Flour: Geographic Segmentation

6.4 Protein

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2030F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Protein: Geographic Segmentation

Chapter 7: Bean Ingredients Market by End-Use Industry

7.1 Bean Ingredients Market Overview Snapshot and Growth Engine

7.2 Bean Ingredients Market Overview

7.3 Processed Food Production

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2030F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Processed Food Production: Geographic Segmentation

7.4 Coffee-Based Products

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2030F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Coffee-Based Products: Geographic Segmentation

7.5 Cocoa-Based Products

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2030F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Cocoa-Based Products: Geographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2030F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation

Chapter 8: Bean Ingredients Market by Distribution Channel

8.1 Bean Ingredients Market Overview Snapshot and Growth Engine

8.2 Bean Ingredients Market Overview

8.3 Supermarket & Hypermarket

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2030F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Supermarket & Hypermarket: Geographic Segmentation

8.4 Convenience Store

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2030F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Convenience Store: Geographic Segmentation

8.5 Online Store

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2030F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Online Store: Geographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2030F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Bean Ingredients Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Bean Ingredients Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Bean Ingredients Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ARCHER DANIELS MIDLAND COMPANY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 CARGILL INCORPORATED

9.4 MARA GLOBAL FOODS

9.5 OLAM INTERNATIONAL

9.6 VERMONT BEAN CRAFTERS

9.7 INLAND EMPIRE FOODS

9.8 BENEO

9.9 FARIBAULT FOODS INC.

9.10 BETTER BEAN

9.11 GLOBEWAYS CANADA INC

9.12 OTHER MAJOR PLAYERS

Chapter 10: Global Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Organic Bean Ingredients

10.2.2 Conventional Bean Ingredients

10.2.3 Gluten-free

10.2.4 Allergen-free

10.3 Historic and Forecasted Market Size By Ingredient Type

10.3.1 Flour

10.3.2 Protein

10.4 Historic and Forecasted Market Size By End-Use Industry

10.4.1 Processed Food Production

10.4.2 Coffee-Based Products

10.4.3 Cocoa-Based Products

10.4.4 Others

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Supermarket & Hypermarket

10.5.2 Convenience Store

10.5.3 Online Store

10.5.4 Others

Chapter 11: North America Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Organic Bean Ingredients

11.4.2 Conventional Bean Ingredients

11.4.3 Gluten-free

11.4.4 Allergen-free

11.5 Historic and Forecasted Market Size By Ingredient Type

11.5.1 Flour

11.5.2 Protein

11.6 Historic and Forecasted Market Size By End-Use Industry

11.6.1 Processed Food Production

11.6.2 Coffee-Based Products

11.6.3 Cocoa-Based Products

11.6.4 Others

11.7 Historic and Forecasted Market Size By Distribution Channel

11.7.1 Supermarket & Hypermarket

11.7.2 Convenience Store

11.7.3 Online Store

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 US

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Eastern Europe Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Organic Bean Ingredients

12.4.2 Conventional Bean Ingredients

12.4.3 Gluten-free

12.4.4 Allergen-free

12.5 Historic and Forecasted Market Size By Ingredient Type

12.5.1 Flour

12.5.2 Protein

12.6 Historic and Forecasted Market Size By End-Use Industry

12.6.1 Processed Food Production

12.6.2 Coffee-Based Products

12.6.3 Cocoa-Based Products

12.6.4 Others

12.7 Historic and Forecasted Market Size By Distribution Channel

12.7.1 Supermarket & Hypermarket

12.7.2 Convenience Store

12.7.3 Online Store

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Bulgaria

12.8.2 The Czech Republic

12.8.3 Hungary

12.8.4 Poland

12.8.5 Romania

12.8.6 Rest of Eastern Europe

Chapter 13: Western Europe Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Organic Bean Ingredients

13.4.2 Conventional Bean Ingredients

13.4.3 Gluten-free

13.4.4 Allergen-free

13.5 Historic and Forecasted Market Size By Ingredient Type

13.5.1 Flour

13.5.2 Protein

13.6 Historic and Forecasted Market Size By End-Use Industry

13.6.1 Processed Food Production

13.6.2 Coffee-Based Products

13.6.3 Cocoa-Based Products

13.6.4 Others

13.7 Historic and Forecasted Market Size By Distribution Channel

13.7.1 Supermarket & Hypermarket

13.7.2 Convenience Store

13.7.3 Online Store

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 Germany

13.8.2 UK

13.8.3 France

13.8.4 Netherlands

13.8.5 Italy

13.8.6 Russia

13.8.7 Spain

13.8.8 Rest of Western Europe

Chapter 14: Asia Pacific Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Organic Bean Ingredients

14.4.2 Conventional Bean Ingredients

14.4.3 Gluten-free

14.4.4 Allergen-free

14.5 Historic and Forecasted Market Size By Ingredient Type

14.5.1 Flour

14.5.2 Protein

14.6 Historic and Forecasted Market Size By End-Use Industry

14.6.1 Processed Food Production

14.6.2 Coffee-Based Products

14.6.3 Cocoa-Based Products

14.6.4 Others

14.7 Historic and Forecasted Market Size By Distribution Channel

14.7.1 Supermarket & Hypermarket

14.7.2 Convenience Store

14.7.3 Online Store

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 China

14.8.2 India

14.8.3 Japan

14.8.4 South Korea

14.8.5 Malaysia

14.8.6 Thailand

14.8.7 Vietnam

14.8.8 The Philippines

14.8.9 Australia

14.8.10 New Zealand

14.8.11 Rest of APAC

Chapter 15: Middle East & Africa Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Organic Bean Ingredients

15.4.2 Conventional Bean Ingredients

15.4.3 Gluten-free

15.4.4 Allergen-free

15.5 Historic and Forecasted Market Size By Ingredient Type

15.5.1 Flour

15.5.2 Protein

15.6 Historic and Forecasted Market Size By End-Use Industry

15.6.1 Processed Food Production

15.6.2 Coffee-Based Products

15.6.3 Cocoa-Based Products

15.6.4 Others

15.7 Historic and Forecasted Market Size By Distribution Channel

15.7.1 Supermarket & Hypermarket

15.7.2 Convenience Store

15.7.3 Online Store

15.7.4 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Turkey

15.8.2 Bahrain

15.8.3 Kuwait

15.8.4 Saudi Arabia

15.8.5 Qatar

15.8.6 UAE

15.8.7 Israel

15.8.8 South Africa

Chapter 16: South America Bean Ingredients Market Analysis, Insights and Forecast, 2016-2030

16.1 Key Market Trends, Growth Factors and Opportunities

16.2 Impact of Covid-19

16.3 Key Players

16.4 Key Market Trends, Growth Factors and Opportunities

16.4 Historic and Forecasted Market Size By Type

16.4.1 Organic Bean Ingredients

16.4.2 Conventional Bean Ingredients

16.4.3 Gluten-free

16.4.4 Allergen-free

16.5 Historic and Forecasted Market Size By Ingredient Type

16.5.1 Flour

16.5.2 Protein

16.6 Historic and Forecasted Market Size By End-Use Industry

16.6.1 Processed Food Production

16.6.2 Coffee-Based Products

16.6.3 Cocoa-Based Products

16.6.4 Others

16.7 Historic and Forecasted Market Size By Distribution Channel

16.7.1 Supermarket & Hypermarket

16.7.2 Convenience Store

16.7.3 Online Store

16.7.4 Others

16.8 Historic and Forecast Market Size by Country

16.8.1 Brazil

16.8.2 Argentina

16.8.3 Rest of SA

Chapter 17 Investment Analysis

Chapter 18 Analyst Viewpoint and Conclusion

|

Global Bean Ingredients Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 2,524.00 Bn |

|

Forecast Period 2022-30 CAGR: |

4.80% |

Market Size in 2030: |

USD 3,672.65 Bn |

|

|

By Type |

|

|

|

By Ingredient Type |

|

||

|

|||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BEAN INGREDIENTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BEAN INGREDIENTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BEAN INGREDIENTS MARKET COMPETITIVE RIVALRY

TABLE 005. BEAN INGREDIENTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BEAN INGREDIENTS MARKET THREAT OF SUBSTITUTES

TABLE 007. BEAN INGREDIENTS MARKET BY TYPE

TABLE 008. ORGANIC BEAN INGREDIENTS MARKET OVERVIEW (2016-2030)

TABLE 009. CONVENTIONAL BEAN INGREDIENTS MARKET OVERVIEW (2016-2030)

TABLE 010. GLUTEN-FREE MARKET OVERVIEW (2016-2030)

TABLE 011. ALLERGEN-FREE MARKET OVERVIEW (2016-2030)

TABLE 012. BEAN INGREDIENTS MARKET BY INGREDIENT TYPE

TABLE 013. FLOUR MARKET OVERVIEW (2016-2030)

TABLE 014. PROTEIN MARKET OVERVIEW (2016-2030)

TABLE 015. BEAN INGREDIENTS MARKET BY END-USE INDUSTRY

TABLE 016. PROCESSED FOOD PRODUCTION MARKET OVERVIEW (2016-2030)

TABLE 017. COFFEE-BASED PRODUCTS MARKET OVERVIEW (2016-2030)

TABLE 018. COCOA-BASED PRODUCTS MARKET OVERVIEW (2016-2030)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 020. BEAN INGREDIENTS MARKET BY DISTRIBUTION CHANNEL

TABLE 021. SUPERMARKET & HYPERMARKET MARKET OVERVIEW (2016-2030)

TABLE 022. CONVENIENCE STORE MARKET OVERVIEW (2016-2030)

TABLE 023. ONLINE STORE MARKET OVERVIEW (2016-2030)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 025. NORTH AMERICA BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 026. NORTH AMERICA BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 027. NORTH AMERICA BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 028. NORTH AMERICA BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 029. N BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 030. EASTERN EUROPE BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 031. EASTERN EUROPE BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 032. EASTERN EUROPE BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 033. EASTERN EUROPE BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 034. BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 035. WESTERN EUROPE BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 036. WESTERN EUROPE BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 037. WESTERN EUROPE BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 038. WESTERN EUROPE BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 039. BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 040. ASIA PACIFIC BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 041. ASIA PACIFIC BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 042. ASIA PACIFIC BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 043. ASIA PACIFIC BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 044. BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 045. MIDDLE EAST & AFRICA BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 046. MIDDLE EAST & AFRICA BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 049. BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 050. SOUTH AMERICA BEAN INGREDIENTS MARKET, BY TYPE (2016-2030)

TABLE 051. SOUTH AMERICA BEAN INGREDIENTS MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 052. SOUTH AMERICA BEAN INGREDIENTS MARKET, BY END-USE INDUSTRY (2016-2030)

TABLE 053. SOUTH AMERICA BEAN INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 054. BEAN INGREDIENTS MARKET, BY COUNTRY (2016-2030)

TABLE 055. ARCHER DANIELS MIDLAND COMPANY: SNAPSHOT

TABLE 056. ARCHER DANIELS MIDLAND COMPANY: BUSINESS PERFORMANCE

TABLE 057. ARCHER DANIELS MIDLAND COMPANY: PRODUCT PORTFOLIO

TABLE 058. ARCHER DANIELS MIDLAND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CARGILL INCORPORATED: SNAPSHOT

TABLE 059. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 060. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 061. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MARA GLOBAL FOODS: SNAPSHOT

TABLE 062. MARA GLOBAL FOODS: BUSINESS PERFORMANCE

TABLE 063. MARA GLOBAL FOODS: PRODUCT PORTFOLIO

TABLE 064. MARA GLOBAL FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OLAM INTERNATIONAL: SNAPSHOT

TABLE 065. OLAM INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 066. OLAM INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 067. OLAM INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. VERMONT BEAN CRAFTERS: SNAPSHOT

TABLE 068. VERMONT BEAN CRAFTERS: BUSINESS PERFORMANCE

TABLE 069. VERMONT BEAN CRAFTERS: PRODUCT PORTFOLIO

TABLE 070. VERMONT BEAN CRAFTERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. INLAND EMPIRE FOODS: SNAPSHOT

TABLE 071. INLAND EMPIRE FOODS: BUSINESS PERFORMANCE

TABLE 072. INLAND EMPIRE FOODS: PRODUCT PORTFOLIO

TABLE 073. INLAND EMPIRE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. BENEO: SNAPSHOT

TABLE 074. BENEO: BUSINESS PERFORMANCE

TABLE 075. BENEO: PRODUCT PORTFOLIO

TABLE 076. BENEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. FARIBAULT FOODS INC.: SNAPSHOT

TABLE 077. FARIBAULT FOODS INC.: BUSINESS PERFORMANCE

TABLE 078. FARIBAULT FOODS INC.: PRODUCT PORTFOLIO

TABLE 079. FARIBAULT FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. BETTER BEAN: SNAPSHOT

TABLE 080. BETTER BEAN: BUSINESS PERFORMANCE

TABLE 081. BETTER BEAN: PRODUCT PORTFOLIO

TABLE 082. BETTER BEAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. GLOBEWAYS CANADA INC: SNAPSHOT

TABLE 083. GLOBEWAYS CANADA INC: BUSINESS PERFORMANCE

TABLE 084. GLOBEWAYS CANADA INC: PRODUCT PORTFOLIO

TABLE 085. GLOBEWAYS CANADA INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 086. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 087. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 088. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BEAN INGREDIENTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BEAN INGREDIENTS MARKET OVERVIEW BY TYPE

FIGURE 012. ORGANIC BEAN INGREDIENTS MARKET OVERVIEW (2016-2030)

FIGURE 013. CONVENTIONAL BEAN INGREDIENTS MARKET OVERVIEW (2016-2030)

FIGURE 014. GLUTEN-FREE MARKET OVERVIEW (2016-2030)

FIGURE 015. ALLERGEN-FREE MARKET OVERVIEW (2016-2030)

FIGURE 016. BEAN INGREDIENTS MARKET OVERVIEW BY INGREDIENT TYPE

FIGURE 017. FLOUR MARKET OVERVIEW (2016-2030)

FIGURE 018. PROTEIN MARKET OVERVIEW (2016-2030)

FIGURE 019. BEAN INGREDIENTS MARKET OVERVIEW BY END-USE INDUSTRY

FIGURE 020. PROCESSED FOOD PRODUCTION MARKET OVERVIEW (2016-2030)

FIGURE 021. COFFEE-BASED PRODUCTS MARKET OVERVIEW (2016-2030)

FIGURE 022. COCOA-BASED PRODUCTS MARKET OVERVIEW (2016-2030)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 024. BEAN INGREDIENTS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 025. SUPERMARKET & HYPERMARKET MARKET OVERVIEW (2016-2030)

FIGURE 026. CONVENIENCE STORE MARKET OVERVIEW (2016-2030)

FIGURE 027. ONLINE STORE MARKET OVERVIEW (2016-2030)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 029. NORTH AMERICA BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. EASTERN EUROPE BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. WESTERN EUROPE BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. ASIA PACIFIC BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. MIDDLE EAST & AFRICA BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. SOUTH AMERICA BEAN INGREDIENTS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Bean Ingredients Market research report is 2023-2030.

Archer Daniels Midland Company (US), Cargill Incorporated (US), Mara Global Foods (Australia), Olam International (Singapore), Vermont Bean Crafters (US), Inland Empire Foods (US), BENEO (Germany), Faribault Foods, Inc. (US), Better Bean (US), Globeways Canada Inc (Canada), and Other Major Players

The Bean Ingredients Market is segmented into Type, Ingredient Type, End-Use Industry Distribution Channel, and regions. By Type, the market is categorized into Organic Bean Ingredients, Conventional Bean Ingredients, Gluten-free, and Allergen-free. By Ingredient Type, the market is categorized into Flour, Protein. By End-Use Industry, the market is categorized into Processed Food Production, Coffee-Based Products, Cocoa-Based Products, and Others. By Distribution Channel, the market is categorized into supermarkets and Hypermarkets, Convenience Stores, Online Stores, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bean ingredients are one of the most cost-effective and environmentally friendly sources of protein. It is regarded as a healthy food because of its high fiber, low fat, and nutrients like iron and folic acid. The minerals included in beans, such as calcium, potassium, magnesium, folate, and antioxidants, are important for overall health. Bean components are utilized in a variety of processes, including those that produce coffee flour, chocolate, and other organic foods.

The Global Bean Ingredients Market size was reasonably estimated to be approximately USD 2,524.00 Million in 2022 and is poised to generate revenue over USD 3,672.65 Million by the end of 2030, projecting a CAGR of around 4.80% from 2022 to 2030.