Green Tea Market Synopsis

Green Tea Market Size Was Valued at USD 16.72 Billion in 2022, and is Projected to Reach USD 27.67 Billion by 2030, Growing at a CAGR of 6.5 % From 2023-2030.

Green tea is a pale green beverage or dietary supplement made from the unoxidized leaves of Camellia sinensis and has a slightly bitter taste.

- Green tea is a type of tea that is least processed and is employed as a medicine in India and China for easing digestion, improving heart and mental health, regulating body temperature, healing wounds as well as controlling bleeding problems.

- Green tea is also used as a raw material in the production of dietary supplements, cosmetic products, beverages, and dental care items widely. Regular consumption of green tea helps maintain an ideal weight within desired limits, boosts the immune system, relieves physical and mental stress, and keeps check on skin redness.

- Consumers all across the world prefer such beverages that offer functional benefits, encouraging them to opt for green tea products as a healthy alternative to sugar-laden beverages, thereby supporting the development of the green tea market over the analysis period.

Green Tea Market Trend Analysis

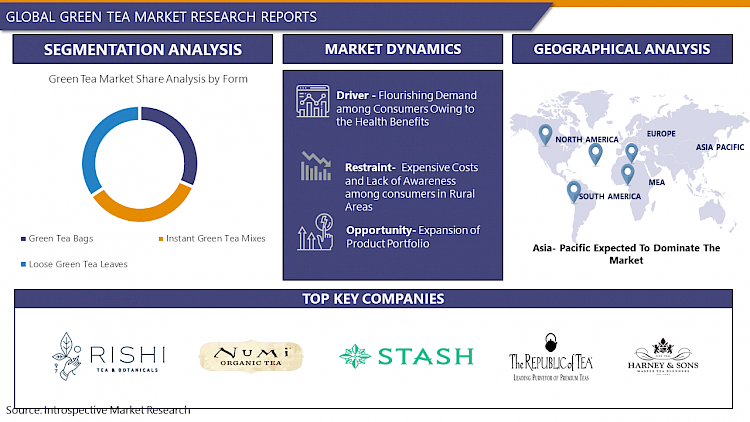

Flourishing Demand among Consumers Owing to the Health Benefits

- Green tea has several restorative and antioxidant characteristics that help to treat and prevent diseases such as diabetes, tooth decay, and heart disease. The antioxidant properties present in green tea play a vital role in maintaining blood pressure and cholesterol levels in the body. It further helps in detoxifying the body and healing scars. The rising obesity problem all over the world has also contributed in driving the growth of the green tea market worldwide. Owing to the major characteristics of reducing extra fat and maintaining weight, the green tea market is estimated to gain a significant traction in coming years.

- Due to the growing weight gain and obesity problems, the Food & Drug Administration stated that green tea production is anticipated to increase by 7.5% each year and witness a huge demand further. Also, several clinical studies have mentioned that the consumption of antioxidants and flavonoids boosts the mental stress response and cardiovascular health. Green tea is also known for its purifying and healing properties and is used widely to treat serious illnesses like cancer and reduce the effects of cancer cells. Owing to the varied health benefits of regular consumption, the green tea market is gaining immense popularity worldwide thereby, driving the growth of the green tea market over the analysis period.

Expansion of Product Portfolio creates an

- Green tea is known to be quite effective against anxiety, stress, depression, and various types of cancers such as liver cancer, lung cancer, gastric cancer, and colon cancer. Major scientific studies have also proven that regular consumption of green tea boosts the immune system, helps enhance thinking skills as well as lowers cholesterol and triglycerides levels in the body.

- Henceforth, due to these health benefits, there is a huge demand for green tea all over the world. Further, to meet this demand, major manufacturers bring innovations in the flavours and expand their product portfolio.

- With the extensive improvement in the product range of green tea, as well as the introduction of attractive packaging of green tea products, many consumers can be attracted which will further create a lucrative opportunity for the green tea market.

Green Tea Market Segment Analysis:

Green Tea Market Segmented on the basis of type, Form and distribution channel.

By Type, the flavoured green tea segment is expected to dominate the market during the forecast period

- By type, the flavoured green tea segment is expected to dominate the market growth of global green tea. The immense growth of this segment is due to the consumer interest in varied flavoured tea products and the availability of different flavours in the green tea market.

- Green tea is found in various flavours such as cinnamon, basil, lemon, aloe vera, vanilla, and many others, which attracts more consumers to purchase and consume green tea regularly. Also, due to the rising health benefits, consumers opt for healthy beverages like green tea, and the flavoured varieties boost the consumer interest for healthy beverages thereby, driving the development of the segment.

By Form, green tea bags segment held the largest share of 48.5% in 2022

- By form, green tea bags segment is anticipated to lead the growth of the green tea market in the studied period. Green tea bags are easy and convenient to use and making tea from them is quick and simple than any other method.

- Also, they are hassle-free, portable, and lightweight which makes them easier to carry during traveling. Apart from that, green tea bags are used to treat various skin conditions such as dark circles, acne, itching, and rashes by young people and millennials worldwide, driving the demand for the green tea bags.

Green Tea Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to dominate the growth of the green tea market over the analysis period. The existence of major green tea-producing nations such as Pakistan, China, India, and Sri Lanka in the world, is most likely to drive the growth of this region. Additionally, various natural features, such as temperature, soil texture as well as humidity in the Asia Pacific region are conducive to tea growth, which thereby contributes to a rapid rise in demand for green tea in this region.

- Various countries, including China and India, have further focused on planting tea plants across vast swathes of territory thus, increasing the production of green tea. Furthermore, China is considered to be the biggest consumer and producer of tea in the Asia Pacific region and has the largest consumption of functional beverages such as green tea, matcha tea, and specialty teas that are a rich source of nutrition.

Green Tea Market Top Key Players:

- Rishi Tea (United States)

- Numi Organic Tea (United States)

- Stash Tea (United States)

- Republic of Tea (United States)

- Harney & Sons (United States)

- Celestial Seasonings (United States)

- PepsiCo (United States)

- Coca-Cola Company (United States)

- Nestlé(Switzerland)

- Unilever (United Kingdom)

- James Finlay (United Kingdom)

- Twinings (United Kingdom)

- Twinings of London (United Kingdom)

- Tetley (United Kingdom)

- Yorkshire Tea (United Kingdom)

- Typhoo (United Kingdom)

- Associated British Foods (United Kingdom)

- Ito En (Japan)

- Kirin Holdings (Japan)

- Suntory Beverage & Food (Japan)

- Tata Global Beverages (India)

- Dilmah (Sri Lanka)

- Yutaka (Japan)

- OSulloc (South Korea)

- Ten Ren's Tea (Taiwan)

Key Industry Developments in the Green Tea Market:

- In February 2023, Unilever, the consumer goods giant, acquired Pukka Herbs, a leading UK-based organic herbal tea brand, for an undisclosed amount. This move strengthens Unilever's position in the growing organic tea market and expands its green tea offerings.

- In May 2023, Tata Global Beverages, the Indian tea giant, acquired Tetley, a British tea brand known for its green tea offerings, for £315 million. This acquisition gives Tata Global Beverages a strong foothold in the European green tea market.

- In August 2023, Ito En, the Japanese green tea giant, acquired Matcha.com, an online retailer of matcha, for an undisclosed amount. This move reflects the growing popularity of matcha, a type of green tea powder.

|

Global Green Tea Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.72 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5 % |

Market Size in 2030: |

USD 27.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GREEN TEA MARKET BY TYPE (2016-2030)

- GREEN TEA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FLAVOURED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- UNFLAVOURED

- GREEN TEA MARKET BY FORM (2016-2030)

- GREEN TEA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GREEN TEA BAGS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSTANT GREEN TEA MIXES

- LOOSE GREEN TEA LEAVES

- GREEN TEA MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- GREEN TEA MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- CONVENIENCE STORES

- ONLINE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- GREEN TEA Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- RISHI TEA (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NUMI ORGANIC TEA (UNITED STATES)

- STASH TEA (UNITED STATES)

- REPUBLIC OF TEA (UNITED STATES)

- HARNEY & SONS (UNITED STATES)

- CELESTIAL SEASONINGS (UNITED STATES)

- PEPSICO (UNITED STATES)

- COCA-COLA COMPANY (UNITED STATES)

- NESTLÉ (SWITZERLAND)

- UNILEVER (UNITED KINGDOM)

- JAMES FINLAY (UNITED KINGDOM)

- TWININGS (UNITED KINGDOM)

- TWININGS OF LONDON (UNITED KINGDOM)

- TETLEY (UNITED KINGDOM)

- YORKSHIRE TEA (UNITED KINGDOM)

- TYPHOO (UNITED KINGDOM)

- ASSOCIATED BRITISH FOODS (UNITED KINGDOM)

- ITO EN (JAPAN)

- KIRIN HOLDINGS (JAPAN)

- SUNTORY BEVERAGE & FOOD (JAPAN)

- TATA GLOBAL BEVERAGES (INDIA)

- DILMAH (SRI LANKA)

- YUTAKA (JAPAN)

- OSULLOC (SOUTH KOREA)

- TEN REN'S TEA (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL GREEN TEA MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Green Tea Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.72 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5 % |

Market Size in 2030: |

USD 27.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GREEN TEA MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GREEN TEA MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GREEN TEA MARKET COMPETITIVE RIVALRY

TABLE 005. GREEN TEA MARKET THREAT OF NEW ENTRANTS

TABLE 006. GREEN TEA MARKET THREAT OF SUBSTITUTES

TABLE 007. GREEN TEA MARKET BY TYPE

TABLE 008. FLAVOURED MARKET OVERVIEW (2016-2028)

TABLE 009. UNFLAVOURED MARKET OVERVIEW (2016-2028)

TABLE 010. GREEN TEA MARKET BY FORM

TABLE 011. GREEN TEA BAGS MARKET OVERVIEW (2016-2028)

TABLE 012. INSTANT GREEN TEA MIXES MARKET OVERVIEW (2016-2028)

TABLE 013. LOOSE GREEN TEA LEAVES MARKET OVERVIEW (2016-2028)

TABLE 014. GREEN TEA MARKET BY DISTRIBUTION CHANNEL

TABLE 015. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 016. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 017. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 018. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA GREEN TEA MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA GREEN TEA MARKET, BY FORM (2016-2028)

TABLE 021. NORTH AMERICA GREEN TEA MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 022. N GREEN TEA MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE GREEN TEA MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE GREEN TEA MARKET, BY FORM (2016-2028)

TABLE 025. EUROPE GREEN TEA MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 026. GREEN TEA MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC GREEN TEA MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC GREEN TEA MARKET, BY FORM (2016-2028)

TABLE 029. ASIA PACIFIC GREEN TEA MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 030. GREEN TEA MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA GREEN TEA MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA GREEN TEA MARKET, BY FORM (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA GREEN TEA MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 034. GREEN TEA MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA GREEN TEA MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA GREEN TEA MARKET, BY FORM (2016-2028)

TABLE 037. SOUTH AMERICA GREEN TEA MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 038. GREEN TEA MARKET, BY COUNTRY (2016-2028)

TABLE 039. ARIZONA BEVERAGE COMPANY (U.S): SNAPSHOT

TABLE 040. ARIZONA BEVERAGE COMPANY (U.S): BUSINESS PERFORMANCE

TABLE 041. ARIZONA BEVERAGE COMPANY (U.S): PRODUCT PORTFOLIO

TABLE 042. ARIZONA BEVERAGE COMPANY (U.S): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ASSOCIATED BRITISH FOODS LLC (UK): SNAPSHOT

TABLE 043. ASSOCIATED BRITISH FOODS LLC (UK): BUSINESS PERFORMANCE

TABLE 044. ASSOCIATED BRITISH FOODS LLC (UK): PRODUCT PORTFOLIO

TABLE 045. ASSOCIATED BRITISH FOODS LLC (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. TATA GLOBAL BEVERAGES (INDIA): SNAPSHOT

TABLE 046. TATA GLOBAL BEVERAGES (INDIA): BUSINESS PERFORMANCE

TABLE 047. TATA GLOBAL BEVERAGES (INDIA): PRODUCT PORTFOLIO

TABLE 048. TATA GLOBAL BEVERAGES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. UNILEVER (UK): SNAPSHOT

TABLE 049. UNILEVER (UK): BUSINESS PERFORMANCE

TABLE 050. UNILEVER (UK): PRODUCT PORTFOLIO

TABLE 051. UNILEVER (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CAPE NATURAL TEA PRODUCTS (SOUTH AFRICA): SNAPSHOT

TABLE 052. CAPE NATURAL TEA PRODUCTS (SOUTH AFRICA): BUSINESS PERFORMANCE

TABLE 053. CAPE NATURAL TEA PRODUCTS (SOUTH AFRICA): PRODUCT PORTFOLIO

TABLE 054. CAPE NATURAL TEA PRODUCTS (SOUTH AFRICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CELESTIAL SEASONINGS (US): SNAPSHOT

TABLE 055. CELESTIAL SEASONINGS (US): BUSINESS PERFORMANCE

TABLE 056. CELESTIAL SEASONINGS (US): PRODUCT PORTFOLIO

TABLE 057. CELESTIAL SEASONINGS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. FINLAYS BEVERAGES LTD (US): SNAPSHOT

TABLE 058. FINLAYS BEVERAGES LTD (US): BUSINESS PERFORMANCE

TABLE 059. FINLAYS BEVERAGES LTD (US): PRODUCT PORTFOLIO

TABLE 060. FINLAYS BEVERAGES LTD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FRONTIER NATURAL PRODUCTS CO-OP (US): SNAPSHOT

TABLE 061. FRONTIER NATURAL PRODUCTS CO-OP (US): BUSINESS PERFORMANCE

TABLE 062. FRONTIER NATURAL PRODUCTS CO-OP (US): PRODUCT PORTFOLIO

TABLE 063. FRONTIER NATURAL PRODUCTS CO-OP (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. HAMBLEDEN HERBS (CAMBRIDGESHIRE): SNAPSHOT

TABLE 064. HAMBLEDEN HERBS (CAMBRIDGESHIRE): BUSINESS PERFORMANCE

TABLE 065. HAMBLEDEN HERBS (CAMBRIDGESHIRE): PRODUCT PORTFOLIO

TABLE 066. HAMBLEDEN HERBS (CAMBRIDGESHIRE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. HANKOOK TEA (USA): SNAPSHOT

TABLE 067. HANKOOK TEA (USA): BUSINESS PERFORMANCE

TABLE 068. HANKOOK TEA (USA): PRODUCT PORTFOLIO

TABLE 069. HANKOOK TEA (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HONEST TEA INC (US): SNAPSHOT

TABLE 070. HONEST TEA INC (US): BUSINESS PERFORMANCE

TABLE 071. HONEST TEA INC (US): PRODUCT PORTFOLIO

TABLE 072. HONEST TEA INC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. KIRIN BEVERAGE CORP (TOKYO): SNAPSHOT

TABLE 073. KIRIN BEVERAGE CORP (TOKYO): BUSINESS PERFORMANCE

TABLE 074. KIRIN BEVERAGE CORP (TOKYO): PRODUCT PORTFOLIO

TABLE 075. KIRIN BEVERAGE CORP (TOKYO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. METROPOLITAN TEA COMPANY (ONTARIO): SNAPSHOT

TABLE 076. METROPOLITAN TEA COMPANY (ONTARIO): BUSINESS PERFORMANCE

TABLE 077. METROPOLITAN TEA COMPANY (ONTARIO): PRODUCT PORTFOLIO

TABLE 078. METROPOLITAN TEA COMPANY (ONTARIO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NORTHERN TEA MERCHANTS LTD (UK): SNAPSHOT

TABLE 079. NORTHERN TEA MERCHANTS LTD (UK): BUSINESS PERFORMANCE

TABLE 080. NORTHERN TEA MERCHANTS LTD (UK): PRODUCT PORTFOLIO

TABLE 081. NORTHERN TEA MERCHANTS LTD (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NUMI ORGANIC TEA (US): SNAPSHOT

TABLE 082. NUMI ORGANIC TEA (US): BUSINESS PERFORMANCE

TABLE 083. NUMI ORGANIC TEA (US): PRODUCT PORTFOLIO

TABLE 084. NUMI ORGANIC TEA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GREEN TEA MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GREEN TEA MARKET OVERVIEW BY TYPE

FIGURE 012. FLAVOURED MARKET OVERVIEW (2016-2028)

FIGURE 013. UNFLAVOURED MARKET OVERVIEW (2016-2028)

FIGURE 014. GREEN TEA MARKET OVERVIEW BY FORM

FIGURE 015. GREEN TEA BAGS MARKET OVERVIEW (2016-2028)

FIGURE 016. INSTANT GREEN TEA MIXES MARKET OVERVIEW (2016-2028)

FIGURE 017. LOOSE GREEN TEA LEAVES MARKET OVERVIEW (2016-2028)

FIGURE 018. GREEN TEA MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 019. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 020. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 021. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 022. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA GREEN TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE GREEN TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC GREEN TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA GREEN TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA GREEN TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Green Tea Market research report is 2023-2030.

Rishi Tea (United States), Numi Organic Tea (United States), Stash Tea (United States), Republic of Tea (United States), Harney & Sons (United States), Celestial Seasonings (United States), PepsiCo (United States), Coca-Cola Company (United States), Nestlé (Switzerland), Unilever (United Kingdom), James Finlay (United Kingdom), Twinings (United Kingdom), Twinings of London (United Kingdom), Tetley (United Kingdom), Yorkshire Tea (United Kingdom), Typhoo (United Kingdom), Associated British Foods (United Kingdom), Ito En (Japan), Kirin Holdings (Japan), Suntory Beverage & Food (Japan), Tata Global Beverages (India), Dilmah (Sri Lanka), Yutaka (Japan), OSulloc (South Korea), Ten Ren's Tea (Taiwan) and Other Major Players.

The Green Tea Market is segmented into Type, Form, Distribution Channel, and region. By Type, the market is categorized into Flavoured and Unflavoured. By Form, the market is categorized into Green Tea Bags, Instant Green Tea Mixes, and Loose Green Tea Leaves. By Distribution channel, the market is categorized into Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Online Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Green tea is a pale green beverage or dietary supplement made from the unoxidized leaves of Camellia sinensis and has a slightly bitter taste, and various health benefits and applications of green tea drive the market growth.

Green Tea Market Size Was Valued at USD 16.72 Billion in 2022, and is Projected to Reach USD 27.67 Billion by 2030, Growing at a CAGR of 6.5 % From 2023-2030.