Tea PolyPhenols Market Synopsis

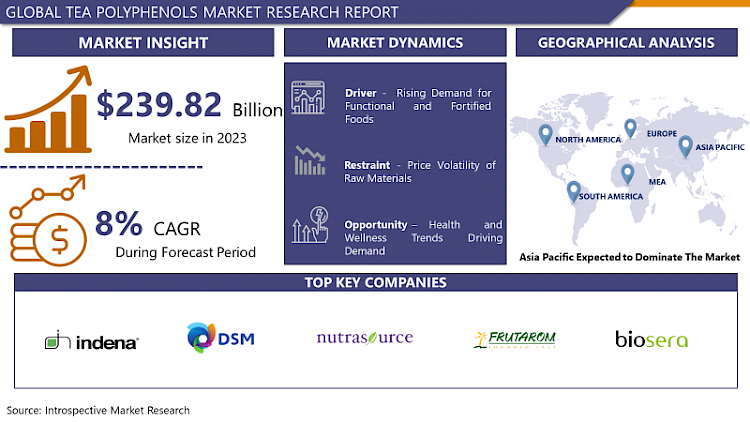

Tea PolyPhenols MarketSize Was Valued at USD 239.82 Million in 2023, and is Projected to Reach USD 479.40 Million by 2032, Growing at a CAGR of 8 % From 2024-2032.

Free radicals are highly reactive unstable molecules that circulate in the human body; these molecules can cause diseases and infections in the body due to their instability. There are catechins, theaflavins, tannins, and flavonoids which play role in the quality of tea in terms of colour and taste not forgetting the health aspect of it. These polyphenols have antioxidant effects on cells thereby preventing oxidation by free radicals, are beneficial to the heart, and may also have anti-cancer properties. Some of the prevalent categories of tea polyphenols are the flavan-3-ols especially the EGCG in green tea or theaflavins in black tea.

- The Tea Polyphenols Market has shown spectacular growth in recent years and it is likely to experience more robust growth in the years to come because of the increasing health consciousness among people the world over and the use of polyphenols in so many industries. The bioactive compounds are Tea polyphenols which mainly include Catechins, Theaflavins and Tannins present in tea leaves that are powerful antioxidants. They have received a lot of attention longitudinally in relation to the reduction of chronic diseases like cardiovascular diseases diabetes and some forms of cancer. Due to the growing trend of consumers shifting more of their focus toward natural products, including organics, tea polyphenols are also expected to be safe and offered as health beneficial supplements.

- Food and beverages is the largest industry thus far in the tea polyphenols market. These compounds are gradually being formulated into functional foods, drinks, and nutraceuticals due to the clinically-associated health benefits. The demand is especially high in regions like the Operations within North America and even Europe where customers are willing to go deeper into their pockets to purchase products that are associated with additional health benefits. Also the demand for the use of tea polyphenols as healthy products together with the increased use of nutraceuticals and cosmeceuticals have occasioned the increased market of the tea polyphenols. Cosmetics with tea polyphenol contents are being introduced in the market as it is known to help reduce aging and protect skin; these aspects are expected to drive the market.

- The Asia-Pacific Desk has the largest market for tea polyphenols since the location has the oldest drinking tea custom and contains main tea producers including China, India, and Japan. The tea products consumption trend in the region has been high due the region’s tea culture meaning a high use of tea polyphenol products. On the same note, improved standard of living and the change of attitude that has seen people adopt healthier lifestyle has also seen market growth in these nations. Another factor is the changing diversification of new product formulations and novel tea polyphenol added products lined in the market.

- This is mainly due to factors such as inherent price vulnerability of the raw materials used in production of tea polyphenols and the governing policies regarding the approval and use of polyphenols in food and medicine. Nevertheless, challenges such as fluctuating tea prices and volatility of other dynamics such as exchange rate values could be countered by improved extraction technologies and research and development evidence on the proven health benefits of tea polyphenols in today’s world. The continuing research, production and further developments in bioavailability and efficiency of the tea polyphenols are predicted to create future growth rates for the market.

- Therefore, the tea polyphenols market is in a position to maintain the positive growth curve over the forecast period due to increased health consciousness, rising demand for natural products globally, and new applications across the different industries. Despite the current and projected slowdown in the growth rates of the market, there are prospects for development due to the creation of new attractive products, catering to today’s global trends and the increasing demand for healthier and more natural products.

Tea PolyPhenols Market Trend Analysis

Increasing Demand for Functional Beverages

- The functional beverages product segment has experienced tremendous growth in popularity due to the shift of consumer concerns to healthier segments. This trend has fuelled the rise of the tea polyphenols market, since these compunds are well known for their antioxidant effects and possible medicinal uses. Tea polyphenols obtainable from green tea, black tea, oolong tea, and others are now being added to energy drink, sports drinks, and flavored water since they assist in adding nutritional value to the foods, particularly in the energy and sports drinks that are becoming popular among people who are more conscious of health issues. People are slowly beginning to understand the possible health benefits associated with tea polyphenols given by continuing studies, some of which include the health of the heart, management of body weight and support of the immune system, hence there is expected to be an increase in the demand for functional beverages with these compounds in the near future.

- Also, emphasis on consumption of healthy foods and engaging in healthy lifestyles through functional and fortified food and beverages has encouraged consumption of functional beverages containing tea polyphenols. There has been a trend where consumers are now opting to consume water reliant food products that will be accompanied by several other health benefits. Thus, the beverage producers developed their products based on natural ingredients containing tea polyphenols for particular aims and purposes like combating stress, enhancing learning abilities, or improving digestion. Additionally, the global market for functional drinks experience growth due to the now trending towards natural ingredients and clean label products, where, the tea polyphenols perfectly fall in this aspect due to their plant origin and perceived health benefits. Thus, the market share within functional beverages segment for tea polyphenols is expected to show further increase in the future due to the growing popularity of such beverages that provide not only the basic need of refreshment but also several health benefits.

Health and Wellness Trends Driving Demand

-

Tea polyphenols, renowned for their antioxidant properties, are riding the wave of health and wellness trends shaping consumer behavior. As individuals increasingly prioritize preventive healthcare, they are turning to natural remedies like tea polyphenols to support their well-being. With growing concerns about chronic diseases and aging, consumers are seeking products that offer holistic benefits, including improved immune function, cardiovascular health, and skin rejuvenation—all of which tea polyphenols are believed to promote. This demand is further fueled by the rising interest in functional foods and beverages, where tea polyphenols find extensive application due to their ability to enhance the nutritional profile of products without compromising taste or convenience.

- Moreover, as awareness of the environmental and social impacts of consumption grows, there's a shift towards sustainable and ethically sourced ingredients, which aligns well with the production processes of tea polyphenols. Consumers are not only looking for products that benefit their health but also ones that are produced in an environmentally responsible manner, fostering biodiversity and supporting local communities. This emphasis on sustainability adds another layer of appeal to tea polyphenols, positioning them as not just a health-promoting ingredient but also as a conscious choice for individuals mindful of their impact on the planet and society.

Tea PolyPhenols Market Segment Analysis:

Tea PolyPhenols Market is Segmented based on Type, Application and Distribution Channels.

By Type, Green Tea segment is expected to dominate the market during the forecast period

- Tea polyphenols, known for their potent antioxidant properties, are key constituents that contribute to the health benefits associated with various types of tea. Green tea, particularly abundant in catechins such as epigallocatechin gallate (EGCG), has garnered attention for its potential in combating oxidative stress and inflammation. The rising consumer inclination towards healthier lifestyles has propelled the demand for green tea polyphenols, especially in regions where traditional tea consumption is prevalent. Black tea, though fermented and possessing a different polyphenol profile compared to green tea, still contains significant levels of these compounds, particularly theaflavins and thearubigins, contributing to its antioxidant activity. However, Oolong tea, undergoing partial oxidation, presents a unique polyphenol composition with varying degrees of catechins and polymerized polyphenols, offering a distinct flavor profile and potential health benefits.

- The "Others" category encompasses a diverse range of teas such as white tea, herbal infusions, and blends, each with its own polyphenolic composition and health implications. White tea, minimally processed and rich in catechins and flavonoids, is gaining traction for its delicate flavor and purported health-promoting properties. Herbal teas, derived from various plant parts, offer a plethora of polyphenols with potential medicinal effects, contributing to their growing popularity among health-conscious consumers. Blends, combining different types of teas and botanicals, provide a multifaceted approach to polyphenol consumption, catering to diverse taste preferences and wellness goals. Overall, the by-type analysis of the tea polyphenols market underscores the significance of polyphenol-rich teas in meeting consumer demand for functional beverages with antioxidant benefits and diverse flavor profiles.

By Application , Food & Beverages segment held the largest share in 2023

- The tea polyphenols are innovative food additives and functional diets in the food and beverages category that are associated with numerous health benefits and antioxidant characteristics. They are widely used as a component for foods like teas, juices and energy drinks to boost the quality and to appeal to the nutritional and diabetic conscious market. Increasing trend towards natural and functional ingredients for the consumption in food and beverages is a major factor triggering the growth of tea polyphenols in this segment and manufacturers are now proving more valuable by adding these compounds to their products portfolio as the consumers are more conscious about their health.

- Global interest has recently been directed towards the potentials of tea polyphenols that have started to be used in cosmetics, particularly for anti-aging effects, UV protectiveness, and anti-inflammatory characteristics. Since the consumers are getting more sensitive towards the damages that are caused to the skin by the environmental pollutants as well as the ultraviolet related radiation, there is a good market demand for skincare products that contains natural elements like the tea polyphenols. Consequently, cosmetics producers are developing all sorts of skin care products such as creams, serums, and sunscreens containing tea polyphenols to fit in this niche market and accelerate the industry’s shift to clean-label and sustainable cosmetics.

Tea PolyPhenols Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- One of the critical trends expecting in the Tea PolyPhenols market over the years is growing domination of Asia Pacific region. The assumptions for the above projection are as follows. Firstly, Asia Pacific region represents some of the most significant tea producing countries including China, India and Japan to name a few which contribute to the key percentage of the global tea manufacture. Since tea polyphenols are derived from tea leaves, availability of infrastructure for tea cultivation in this region means a good source of supply for its extraction thus enabling market growth. In addition, as the overall awareness of the health effects of tea polyphenols including antioxidant and disease fighting or preventing substances, increases in the region, it also augments the market for Tea Powder and consolidates the region’s hold on the global market.

- Also, evolving consumer preference for natural and organic is in harmony with traditional characteristics of tea polyphenols, which are considered natural bioactive compounds. This is especially the case in China/India which are some of the largest users of traditional/indigenous systems that encourage the use of natural products. Additionally, global consumers’ inclination toward healthier diet due to the prevailing life style diseases, along with improved disposable income in the emerging Asia Pacific nations, is expected to lead towards higher spending on functional food and beverages including the products containing tea polyphenols. Therefore, Asia Pacific is forecasted to remain dominant and may even increase its market share of Tea PolyPolyphenols within the global domain over the forecast period.

Active Key Players in the Tea PolyPhenols Market

- Indena (Italy)

- DSM (Netherlands)

- Amax NutraSource (USA)

- Frutarom (Israel)

- Bioserae (France)

- Layn Natural Ingredients ( USA)

- DuPont-Danisco ( USA)

- FutureCeuticals ( USA)

- HERZA Schokolade (Germany)

- Martin Bauer Group(Germany)

- Naturex (France)

- Prinova ( USA)

- Sabinsa (India)

- Seppic (France)

- Other Key Players

|

Global Tea PolyPhenols Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 239.82 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.00% |

Market Size in 2032: |

USD 479.40 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TEA POLYPHENOLS MARKET BY TYPE (2017-2032)

- TEA POLYPHENOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GREEN TEA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BLACK TEA

- OOLONG TEA

- OTHERS

- TEA POLYPHENOLS MARKET BY APPLICATION (2017-2032)

- TEA POLYPHENOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIETARY SUPPLEMENTS

- FUNCTIONAL FOODS & BEVERAGES

- COSMETICS

- OTHERS

- TEA POLYPHENOLS MARKET BY DISTRIBUTION CHANNELS (2017-2032)

- TEA POLYPHENOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE RETAILING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MASS RETAILERS

- DIRECT SELLING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- TEA POLYPHENOLS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- INDENA (ITALY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DSM (NETHERLANDS)

- AMAX NUTRASOURCE (USA)

- FRUTAROM (ISRAEL)

- BIOSERAE (FRANCE)

- LAYN NATURAL INGREDIENTS (USA)

- DUPONT-DANISCO (USA)

- FUTURECEUTICALS (USA)

- HERZA SCHOKOLADE (GERMANY)

- MARTIN BAUER GROUP(GERMANY)

- NATUREX (FRANCE)

- PRINOVA (USA)

- SABINSA (INDIA)

- SEPPIC (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL TEA POLYPHENOLS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channels

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Tea PolyPhenols Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 239.82 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.00% |

Market Size in 2032: |

USD 479.40 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TEA POLYPHENOLS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TEA POLYPHENOLS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TEA POLYPHENOLS MARKET COMPETITIVE RIVALRY

TABLE 005. TEA POLYPHENOLS MARKET THREAT OF NEW ENTRANTS

TABLE 006. TEA POLYPHENOLS MARKET THREAT OF SUBSTITUTES

TABLE 007. TEA POLYPHENOLS MARKET BY TYPE

TABLE 008. GREEN TEA MARKET OVERVIEW (2016-2028)

TABLE 009. BLACK TEA MARKET OVERVIEW (2016-2028)

TABLE 010. OOLONG TEA MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. TEA POLYPHENOLS MARKET BY APPLICATION

TABLE 013. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 014. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

TABLE 015. FUNCTIONAL FOODS & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. TEA POLYPHENOLS MARKET BY DISTRIBUTION CHANNELS

TABLE 019. ONLINE RETAILING MARKET OVERVIEW (2016-2028)

TABLE 020. MASS RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 021. DIRECT SELLING MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA TEA POLYPHENOLS MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA TEA POLYPHENOLS MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA TEA POLYPHENOLS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 025. N TEA POLYPHENOLS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE TEA POLYPHENOLS MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE TEA POLYPHENOLS MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE TEA POLYPHENOLS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 029. TEA POLYPHENOLS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC TEA POLYPHENOLS MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC TEA POLYPHENOLS MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC TEA POLYPHENOLS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 033. TEA POLYPHENOLS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA TEA POLYPHENOLS MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA TEA POLYPHENOLS MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA TEA POLYPHENOLS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 037. TEA POLYPHENOLS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA TEA POLYPHENOLS MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA TEA POLYPHENOLS MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA TEA POLYPHENOLS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 041. TEA POLYPHENOLS MARKET, BY COUNTRY (2016-2028)

TABLE 042. INDENA: SNAPSHOT

TABLE 043. INDENA: BUSINESS PERFORMANCE

TABLE 044. INDENA: PRODUCT PORTFOLIO

TABLE 045. INDENA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. CHR. HANSEN: SNAPSHOT

TABLE 046. CHR. HANSEN: BUSINESS PERFORMANCE

TABLE 047. CHR. HANSEN: PRODUCT PORTFOLIO

TABLE 048. CHR. HANSEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DSM: SNAPSHOT

TABLE 049. DSM: BUSINESS PERFORMANCE

TABLE 050. DSM: PRODUCT PORTFOLIO

TABLE 051. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. AJINOMOTO OMNICHEM NATURAL SPECIALTY: SNAPSHOT

TABLE 052. AJINOMOTO OMNICHEM NATURAL SPECIALTY: BUSINESS PERFORMANCE

TABLE 053. AJINOMOTO OMNICHEM NATURAL SPECIALTY: PRODUCT PORTFOLIO

TABLE 054. AJINOMOTO OMNICHEM NATURAL SPECIALTY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. XIAN HAOTIAN BIO-ENGINEERING TECHNOLOGY: SNAPSHOT

TABLE 055. XIAN HAOTIAN BIO-ENGINEERING TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 056. XIAN HAOTIAN BIO-ENGINEERING TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 057. XIAN HAOTIAN BIO-ENGINEERING TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AMAX NUTRASOURCE: SNAPSHOT

TABLE 058. AMAX NUTRASOURCE: BUSINESS PERFORMANCE

TABLE 059. AMAX NUTRASOURCE: PRODUCT PORTFOLIO

TABLE 060. AMAX NUTRASOURCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FRUTAROM: SNAPSHOT

TABLE 061. FRUTAROM: BUSINESS PERFORMANCE

TABLE 062. FRUTAROM: PRODUCT PORTFOLIO

TABLE 063. FRUTAROM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. BIOSERAELAYN NATURAL INGREDIENTS: SNAPSHOT

TABLE 064. BIOSERAELAYN NATURAL INGREDIENTS: BUSINESS PERFORMANCE

TABLE 065. BIOSERAELAYN NATURAL INGREDIENTS: PRODUCT PORTFOLIO

TABLE 066. BIOSERAELAYN NATURAL INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. DUPONT-DANISCO: SNAPSHOT

TABLE 067. DUPONT-DANISCO: BUSINESS PERFORMANCE

TABLE 068. DUPONT-DANISCO: PRODUCT PORTFOLIO

TABLE 069. DUPONT-DANISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. FUTURECEUTICALS: SNAPSHOT

TABLE 070. FUTURECEUTICALS: BUSINESS PERFORMANCE

TABLE 071. FUTURECEUTICALS: PRODUCT PORTFOLIO

TABLE 072. FUTURECEUTICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HERZA SCHOKOLADE: SNAPSHOT

TABLE 073. HERZA SCHOKOLADE: BUSINESS PERFORMANCE

TABLE 074. HERZA SCHOKOLADE: PRODUCT PORTFOLIO

TABLE 075. HERZA SCHOKOLADE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. MARTIN BAUER GROUP: SNAPSHOT

TABLE 076. MARTIN BAUER GROUP: BUSINESS PERFORMANCE

TABLE 077. MARTIN BAUER GROUP: PRODUCT PORTFOLIO

TABLE 078. MARTIN BAUER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NATUREX: SNAPSHOT

TABLE 079. NATUREX: BUSINESS PERFORMANCE

TABLE 080. NATUREX: PRODUCT PORTFOLIO

TABLE 081. NATUREX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. PRINOVA: SNAPSHOT

TABLE 082. PRINOVA: BUSINESS PERFORMANCE

TABLE 083. PRINOVA: PRODUCT PORTFOLIO

TABLE 084. PRINOVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SABINSA: SNAPSHOT

TABLE 085. SABINSA: BUSINESS PERFORMANCE

TABLE 086. SABINSA: PRODUCT PORTFOLIO

TABLE 087. SABINSA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. SEPPIC: SNAPSHOT

TABLE 088. SEPPIC: BUSINESS PERFORMANCE

TABLE 089. SEPPIC: PRODUCT PORTFOLIO

TABLE 090. SEPPIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. TIANJIN JIANFENG NATURAL PRODUCTS: SNAPSHOT

TABLE 091. TIANJIN JIANFENG NATURAL PRODUCTS: BUSINESS PERFORMANCE

TABLE 092. TIANJIN JIANFENG NATURAL PRODUCTS: PRODUCT PORTFOLIO

TABLE 093. TIANJIN JIANFENG NATURAL PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. ARRY CALLEBAUT: SNAPSHOT

TABLE 094. ARRY CALLEBAUT: BUSINESS PERFORMANCE

TABLE 095. ARRY CALLEBAUT: PRODUCT PORTFOLIO

TABLE 096. ARRY CALLEBAUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 097. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 098. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 099. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TEA POLYPHENOLS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TEA POLYPHENOLS MARKET OVERVIEW BY TYPE

FIGURE 012. GREEN TEA MARKET OVERVIEW (2016-2028)

FIGURE 013. BLACK TEA MARKET OVERVIEW (2016-2028)

FIGURE 014. OOLONG TEA MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. TEA POLYPHENOLS MARKET OVERVIEW BY APPLICATION

FIGURE 017. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 018. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

FIGURE 019. FUNCTIONAL FOODS & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. TEA POLYPHENOLS MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 023. ONLINE RETAILING MARKET OVERVIEW (2016-2028)

FIGURE 024. MASS RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 025. DIRECT SELLING MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA TEA POLYPHENOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE TEA POLYPHENOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC TEA POLYPHENOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA TEA POLYPHENOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA TEA POLYPHENOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Tea PolyPhenols Market research report is 2024-2032.

Indena (Italy), DSM (Netherlands), Amax NutraSource (USA), Frutarom (Israel), Bioserae (France), Layn Natural Ingredients ( USA), DuPont-Danisco ( USA), FutureCeuticals ( USA), HERZA Schokolade (Germany), and Other Major Players.

The Tea PolyPhenols Market is segmented into By Type, By Application ,By Distribution Channels. and Region. By Type , the market is categorized into Green Tea, Black Tea, Oolong Tea, Others. By Application, the market is categorized into Food & Beverages, Dietary Supplements, Functional Foods & Beverages, Cosmetics, Others. By Distribution Channels, the market is categorized into Online Retailing, Mass Retailers, Direct Selling. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Free radicals are highly reactive unstable molecules that circulate in the human body; these molecules can cause diseases and infections in the body due to their instability. There are catechins, theaflavins, tannins, and flavonoids which play role in the quality of tea in terms of colour and taste not forgetting the health aspect of it. These polyphenols have antioxidant effects on cells thereby preventing oxidation by free radicals, are beneficial to the heart, and may also have anti-cancer properties. Some of the prevalent categories of tea polyphenols are the flavan-3-ols especially the EGCG in green tea or theaflavins in black tea.

Tea PolyPhenols MarketSize Was Valued at USD 239.82 Million in 2023, and is Projected to Reach USD 479.40 Million by 2032, Growing at a CAGR of 8 % From 2024-2032.