Procurement Software Market Synopsis

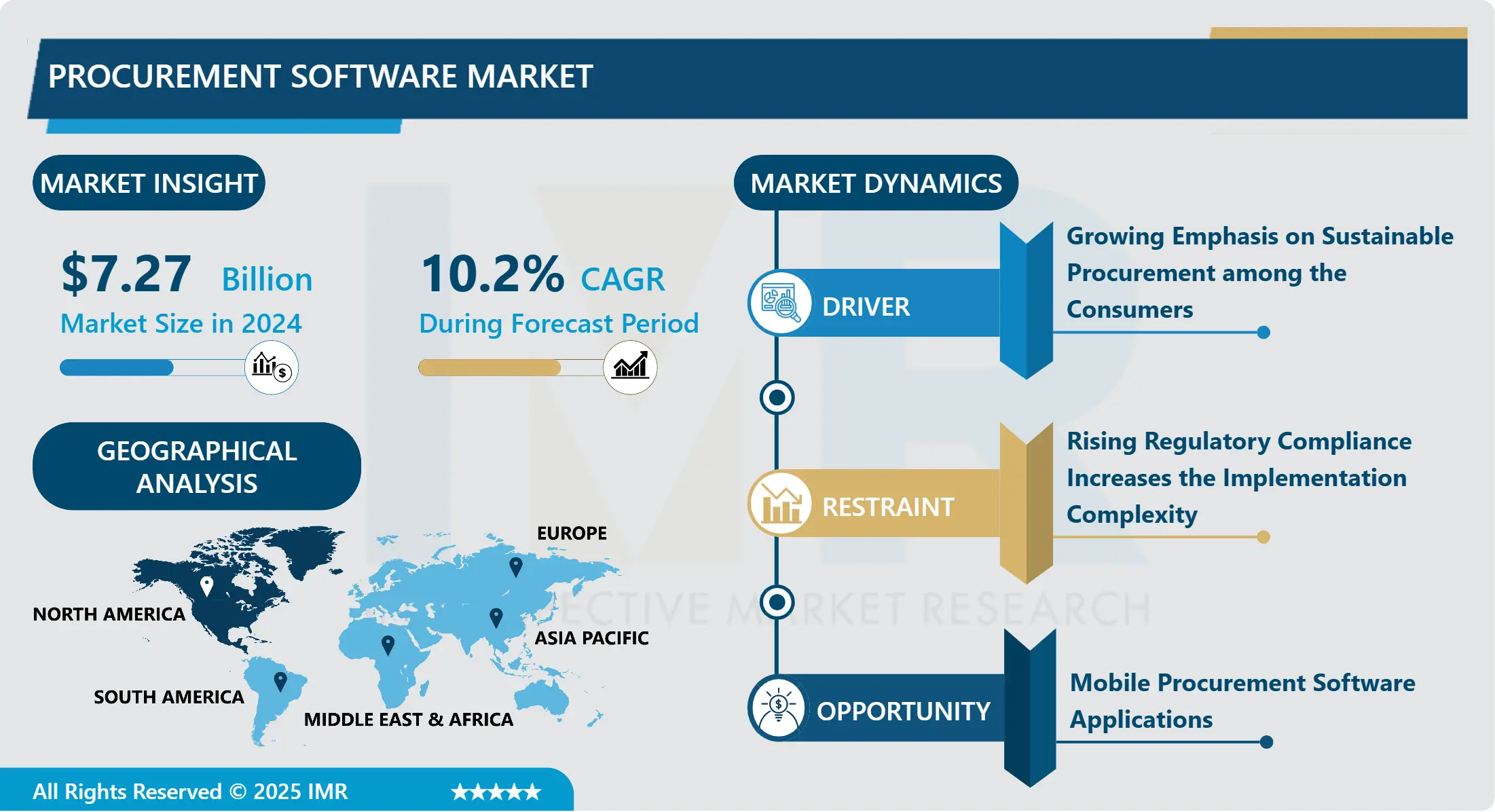

Procurement Software Market Size Was Valued at USD 7.27 Billion in 2024, and is Projected to Reach USD 15.81 Billion by 2032, Growing at a CAGR of 10.2% From 2025-2032.

Procurement software can be defined as the various technologies employed in the purchase process of an organization. Different types of software solutions enable sourcing of suppliers, contracting, issues related to procurement, purchase orders, and many kinds of inventory. Due to centralizing procurement activities, enhancing top supplier relationships, and improving the visibility of the purchasing data, it enables organizations in enhancing efficiency, decreasing total cost, managing risks, and making better decisions in the course of the whole procurement life cycle.

Several organisations have made sustainability in supply chain operations a top priority since they need to reduce their emission controls, find legitimate sources of raw materials, and abide by the rules and laws governing the business world. There is a way in which procurement software can be developed to incorporate sustainability tools that make it possible for organizations to evaluate the sustainability status of their suppliers, monitor sustainability performance, and effect sustainable sourcing. The need for sustainable procurement solutions means that there is a sub-market of the total procurement software market that only addresses this need, hence putting pressure on the procurement software companies to innovate and develop special solutions for sustainable procurement.

As the business grows more intricate, procurement becomes a central issue that has to cover aspects of supplier relations, sort of contracts, and sourcing strategy. Growth in consciousness of organizations to cut operating expenses so as to improve their profit margins and enhance their bargaining power for suppliers, buyers, and cost assessors. Incorporation of use of procurement software on supplier management, sourcing and procurement analysis

Another major challenge in the market is the integration of procurement software with other legacy systems and other enterprise procurement software. It results in wasted work time that is throughput-reducing, creation of disparate data sets, preventable that new procurement software returns cannot be attained as planned.

However, with the implementation of technology in the procurement process a key issue regarding security of data is elicited which poses a major challenge to the growth of technology procurement in organizations dealing with sensitive data hence experienced a slow market growth rate.

The need for real-time procurement data to be made available irrespective of where the user is located due to the current globalization of operations that has ensured that firms have teams located in different areas. Advancements in digital technologies and its continuous integration into the business function for procurement activities. The increasing awareness of environmentally friendly and corporate social responsibility which makes the leaders of the organizations to especially think of the supply chains impacts.

Procurement Software Market Trend Analysis

Procurement Software Market Growth Driver- Growing Technological Advancements Enhances the Efficiency of Operations

- Technology gives rise to better solutions that can proactively be used to improve, simplify, or more accurately and transparently perform procurement tasks. Technological developments like AI, machine learning, and Robotic Process Automation (RPA) enable procurement software to possession smart sourcing, predictive dearth, and robotic processing, which enhances the decision-making mechanism and resources. It is about technological capabilities that intensify market operation, reduce costs and risks as well as enhance supplier relations; all key factors for development of a market.

Procurement Software Market Expansion Opportunity- Increasing Adoption of Cloud-Based Solutions Provides Rapid Deployment Capabilities

- Some of the other benefits of cloud based procurement software include; • cloud based procurement software is easily scalable, flexible and can be accessed through the internet from any part of the world. Organizations are inclined toward such solutions since they do not have to build many infrastructures for the intended resources and can deploy these rapidly. Further, cloud-based procurement software permits real-time sharing and updating of the procurement software and process, hence, allowing organisations to access and implement new versions of the software and the enhancements made to it. This trend is part of the general trend in the establishment of cloud computing in organizations, as businesses look forward to optimize the flexibility associated with cloud technology in procurement operations.

Procurement Software Market Segment Analysis:

Procurement Software Market Segmented based on Deployment, Software Type, Organization Size, Vertical, and Region.

By Deployment, on-premise segment is expected to dominate the market during the forecast period

- The on-premise segment is long expected to remain dominant in the market, with the priority of organizations preferring an on-premise installation of the software. The software can also be used for training the staff of an organizations in how to use it in purchasing and pricing of the products in order to obtain bulk cheaply.

By Organization Size, SMEs segment held the largest share in 2024

- SMEs are expected to contribute heavily in the global procurement software market and it will grow at a rate of 10. It should be noted that the company’s compounded annual growth rate of the is expected to be at a paltry 3% per the forcast period. Increase in the utilisation of cloud deployments and attempt to gain a larger market share have the potential to push the segment’s demand for the software. Besides, the advantages such as simplification of contracts, new sources of supply, fewer mistakes in invoices, and better working capital make the SMEs attracted toward the software.

Procurement Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Used evaluation criteria, North America is likely to dominate in procurement software market owing to the positioning of leaders like IBM Corporation, Oracle Corporation and Coupa Software Incorporated. The region has good background, and there is a clear long-term tendency towards unification of purchasing processes owing to the need for optimization and cost reduction. With these identified market players and conditions, North America is well-geared towards sustaining its supremacy in the procurement software market which enables it to continue to address the changing needs of business entities in the region across industries.

Active Key Players in the Procurement Software Market

- Coupa Software Incorporated (U.S.)

- Epicor Software Corporation (U.S.)

- JDA Software Inc. (U.S.)

- Zycus Inc. (U.S.)

- SAP SE (Germany)

- Mercateo AG (Germany)

- Oracle Corporation (U.S.)

- Infor Inc. (U.S.)

- IBM Corporation (U.S.)

- Other Active Players

Key Industry Developments in the Procurement Software Market:

- In February 2024, Microsoft revealed new intelligent capabilities of Dynamics 365 procurement solutions to deliver more intelligent spend management and to enhance the processing.

- In January 2024, Coupa Software is one of the key players; it incorporated risk prediction by using machine learning on its platform and cost-saving areas. In a nutshell, AI is gradually becoming your best friend in procurement!

- In December 2023, The procurement innovator known as Ivalua Inc announced the ‘Autonomous Procurement’; the features include purchase order approval as well as invoice automation. Robots taking over procurement? No, not that much, but surely going out of their way to assist.

|

Global Procurement Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.6 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 15.81 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Software Type |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Procurement Software Market by Deployment (2018-2032)

4.1 Procurement Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-premise

Chapter 5: Procurement Software Market by Software Type (2018-2032)

5.1 Procurement Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supplier Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Contract Management

5.5 E-procurement

5.6 E-sourcing

5.7 Spend Analysis

Chapter 6: Procurement Software Market by Organization Size (2018-2032)

6.1 Procurement Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and medium size Enterprises (SME)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Procurement Software Market by Vertical (2018-2032)

7.1 Procurement Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Travel & Logistics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IT & Telecommunications

7.5 Electronics

7.6 Automotive

7.7 Retail

7.8 Mining

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Procurement Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 COUPA SOFTWARE INCORPORATED (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EPICOR SOFTWARE CORPORATION (U.S.)

8.4 JDA SOFTWARE INC. (U.S.)

8.5 ZYCUS INC. (U.S.)

8.6 SAP SE (GERMANY)

8.7 MERCATEO AG (GERMANY)

8.8 ORACLE CORPORATION (U.S.)

8.9 INFOR INC. (U.S.)

8.10 IBM CORPORATION (U.S.)

Chapter 9: Global Procurement Software Market By Region

9.1 Overview

9.2. North America Procurement Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment

9.2.4.1 On-cloud

9.2.4.2 On-premise

9.2.5 Historic and Forecasted Market Size by Software Type

9.2.5.1 Supplier Management

9.2.5.2 Contract Management

9.2.5.3 E-procurement

9.2.5.4 E-sourcing

9.2.5.5 Spend Analysis

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 Small and medium size Enterprises (SME)

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 Travel & Logistics

9.2.7.2 IT & Telecommunications

9.2.7.3 Electronics

9.2.7.4 Automotive

9.2.7.5 Retail

9.2.7.6 Mining

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Procurement Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment

9.3.4.1 On-cloud

9.3.4.2 On-premise

9.3.5 Historic and Forecasted Market Size by Software Type

9.3.5.1 Supplier Management

9.3.5.2 Contract Management

9.3.5.3 E-procurement

9.3.5.4 E-sourcing

9.3.5.5 Spend Analysis

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 Small and medium size Enterprises (SME)

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 Travel & Logistics

9.3.7.2 IT & Telecommunications

9.3.7.3 Electronics

9.3.7.4 Automotive

9.3.7.5 Retail

9.3.7.6 Mining

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Procurement Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment

9.4.4.1 On-cloud

9.4.4.2 On-premise

9.4.5 Historic and Forecasted Market Size by Software Type

9.4.5.1 Supplier Management

9.4.5.2 Contract Management

9.4.5.3 E-procurement

9.4.5.4 E-sourcing

9.4.5.5 Spend Analysis

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 Small and medium size Enterprises (SME)

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 Travel & Logistics

9.4.7.2 IT & Telecommunications

9.4.7.3 Electronics

9.4.7.4 Automotive

9.4.7.5 Retail

9.4.7.6 Mining

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Procurement Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment

9.5.4.1 On-cloud

9.5.4.2 On-premise

9.5.5 Historic and Forecasted Market Size by Software Type

9.5.5.1 Supplier Management

9.5.5.2 Contract Management

9.5.5.3 E-procurement

9.5.5.4 E-sourcing

9.5.5.5 Spend Analysis

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 Small and medium size Enterprises (SME)

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 Travel & Logistics

9.5.7.2 IT & Telecommunications

9.5.7.3 Electronics

9.5.7.4 Automotive

9.5.7.5 Retail

9.5.7.6 Mining

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Procurement Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment

9.6.4.1 On-cloud

9.6.4.2 On-premise

9.6.5 Historic and Forecasted Market Size by Software Type

9.6.5.1 Supplier Management

9.6.5.2 Contract Management

9.6.5.3 E-procurement

9.6.5.4 E-sourcing

9.6.5.5 Spend Analysis

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 Small and medium size Enterprises (SME)

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 Travel & Logistics

9.6.7.2 IT & Telecommunications

9.6.7.3 Electronics

9.6.7.4 Automotive

9.6.7.5 Retail

9.6.7.6 Mining

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Procurement Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment

9.7.4.1 On-cloud

9.7.4.2 On-premise

9.7.5 Historic and Forecasted Market Size by Software Type

9.7.5.1 Supplier Management

9.7.5.2 Contract Management

9.7.5.3 E-procurement

9.7.5.4 E-sourcing

9.7.5.5 Spend Analysis

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 Small and medium size Enterprises (SME)

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 Travel & Logistics

9.7.7.2 IT & Telecommunications

9.7.7.3 Electronics

9.7.7.4 Automotive

9.7.7.5 Retail

9.7.7.6 Mining

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Procurement Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.6 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.2 % |

Market Size in 2032: |

USD 15.81 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Software Type |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||