Oral Care and Oral Hygiene Products Market Synopsis

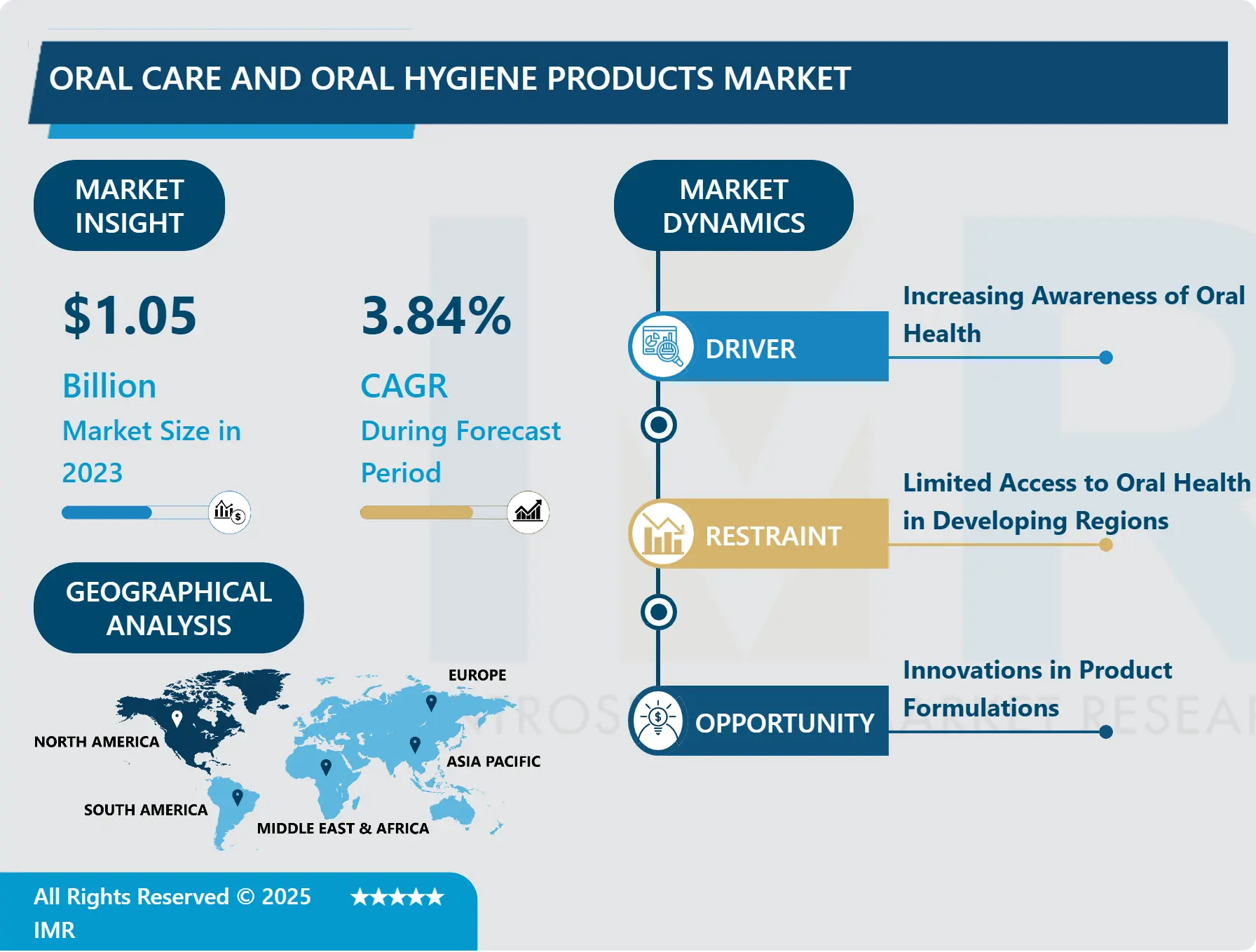

Oral Care and Oral Hygiene Products Market Size is Valued at USD 1.05 Billion in 2023, and is Projected to Reach USD 1.47 Billion by 2032, Growing at a CAGR of 3.84% From 2024-2032.

The products under Oral Care and Oral Hygiene Products Market are drawn to care for oral hygiene and enhance oral health. This market covers products like toothbrushes, toothpaste, and mouthwash, and flosses and other related products that can be used to prevent diseases that affect the teeth or gums or which enables control of those diseases or that ensures a healthy teeth and gum condition. This market continues to grow through the development of new products and the expansion of innovative and convenient dental care products due to higher awareness of dental health, increasing consumer demand for upgraded dental care products, and constantly growing incidence of dental diseases. Elements affecting this market are demographic changes, increase in disposable income per capita and development of technologies on the oral care market enhancing the market’s elasticity and creating more opportunities for its growth worldwide.

The Oral Care and Oral Hygiene Products Market is a growing market type that requires consistent developments and innovation due to the growing consumer consciousness of dental health and cleanliness. Products falling under these classes include toothpaste, mouthwash, dental floss, toothbrush, preventive and therapeutic oral care products. This has been accompanied by the increasing incidence of dental diseases thus creating a positive demand Fayette and Mccollough (2002). The market is also dynamised by changes in technology where latest gadgets like the electric toothbrushes, and new types of fluorides are common in the market. Furthermore, there is a trend to naturals and organic products for oral care related to more general tendencies towards nature and sustainability.

Regionally, they show different trends of growth, which mainly attributes to North America and Europe region due to they are more advanced healthcare systems and customers are more willing to pay for products. But the Asia-Pacific region presents a high growth which is fueled by a big population, growth in the urban areas, and rising purchasing power. The Oral care products markets within emerging economies of this region are being boosted by a growing public awareness on Oral health. In addition, there is a significant increase of people using e-commerce channels for the purchase of oral care products due to the advantages of the attached convenience and a greater number of products available. Distribution channel competition has many major global players and there are many regional brands making the competition complex and highly competitive. The personalization of oral care and the continual shift towards improved preventive care should continue to propel future market growth, thus the Oral Care and Oral Hygiene Products Market remains a complex, dynamic, and promising segment with major room for growth and development.

Oral Care and Oral Hygiene Products Market Trend Analysis

Rising Demand for Premium and Specialized Oral Care Products

- The increase in the use of high-end and niche oral care products is the new trend setting a new pace. Consumers today are willing to pay for more than traditional protection; they want better oral care in a more individualistic sense. People are displaying a preference for these superior products, including those without fluoride, naturally derived and clinically backed formulations. This shift is attributed to a knowledge of oral health and a tendency to adapt personal care products and solutions accordingly in accordance to health habits. For instance, there is specially made toothpaste with no fluoride for people who are apropos of dangers related to the usage of fluoride; natural and organically produced toothpaste are soothing to those who do not wish to use toothpaste with compounds.

- Therefore, in order to meet the new demands, food and beverages producers are ramping up research activities to develop products that affect certain oral conditions like sensitivity, discoloration and gums problems. Market for premium oral care solutions is growing as brand create products which can be marketed as effective solutions for these problems. They range from toothpaste with elements that build up the enamel, mouthwash that boosts gums’ health and whitening products that offer a higher degree of whiteness. This focus on specialization not only assists brands in positioning themselves in a competitive market creatively but also answers the changing needs of the consumers who are shifting towards the healthier lifestyle and want to get a personalised approach. Consequently, the premium segment is emerging as a key growth driver in the oral care market due to improving product formulations and heightened awareness of the population, as well as their needs.

Technological Advancements and Sustainability Trends in Oral Care Products

- The incorporation of technological advancement into oral hygiene products is a major revolution that is changing the consumer practices. Among technologies that have acted as game changers in this field, the smart toothbrush has many features that include real time feedback and personalized brushing suggestions as well as compatibility with mobile apps. These innovations give market consumers accurate data about their brushing activities as well as computing smart home devices and digital health solutions. These not only explain to the users the correct brushing techniques, but also track the users’ performance and ensure better oral hygiene. This technological feature not only enables better practices in oral care but also corresponds with trends observed with the general digitalisation of consumer products.

- Similarly, the current oral care market reveals a developing trend in the appliance of sustainable and ecological products. Environmental conservation has become a major concern to consumers, and therefore more customers are diverting towards products with lesser or no ecological footprint. Some examples for such initiatives are the toothbrushes manufactured from biodegradable materials like bamboo or those in recyclable or more minimalist packaging at the moment. This shift towards a green consumerism is an even larger global trend toward environmental conservation, forcing manufacturers to use environmentally friendly processes and components. Therefore, the role in oral care technology industry is rapidly changing by which technological and environmentally aspects play the most important role in the development of new products and services.

Oral Care and Oral Hygiene Products Market Segment Analysis:

Oral Care and Oral Hygiene Products Market Segmented based on By Product Type, By Form, By Ingredient Type, By Distribution Channel and By End-User.

By Product Type, Toothpastesegment is expected to dominate the market during the forecast period

- Toothpaste is an important part of oral care products used at least twice a day, it is produced very carefully and it must function in several ways. Its main function is to remove by far and clean your teeth, the layer of bacteria that is sticky that causes various diseases such as dental caries and periodontitis. To this effect, toothpaste includes such mild abrasives that that can act like scrubbers to the tooth surface hence removing any food particles and the plague. Also, most toothpastes available in the market contain fluoride that has the capability to help rebuild the tooth enamel through the process of remineralization after undue exposure to the acids that bacterial growth in the mouth produce. Fluoride content is a very sensitive factor that helps to protect teeth from caries and maintain dental health.

- In addition to the mechanical cleaning and coating of the teeth the toothpaste can be available in different types depending on certain oral ailments. The toothpastes for sensitive teeth are intended for people that experienced pain when eating cold or hot meals as they hinder the ways to sensitive nerves. Official toothpastes are especially designed for those that want to make their smile brighter, it contains ingredients that can help to clean the teeth surface and prevent discoloration. Further more, there are types of teeth cleanersolutions that are especially designed with substance that is effective for treating gums, containing compounds that alleviate gum irritation and fighting bacteria. This kind of diversity enables consumers to select a product that best serves his or her dental needs and wants or preferences.

By End user, Adult segment held the largest share in 2023

- Adult oriented products usually cater for several main dental concerns that develop with ageing including gum health, plaque control and whitening products. It is often including that when people grow old their oral health requirements may alter and as such require more than cleansing items. For instance, formulations of gums targeting oral care may contain ingredients such as antiseptic and anti-inflammatory to help cut short the disease and also inflammation respectively. These products are intended for the elimination of early stages of gums inflammation, namely gingivitis and periodontitis satisfactory treatments for which can halt the progression of severe oral health diseases. Also, there are enhanced anti bacterial agents and enzymes in the selected product so as to facilitate the breaking down of the plaques and hindrance of formation of tarter which causes both gum diseases and cavities.

- Besides the gum health and plaque control, there are many dental care products for the adults based on the sensitivity and enamel problems. Sensitivity-focused products are usually includes potassium nitrate or strontium chloride, which prevents stimulation of sensitive nerves in the teeth and cause painful sensation. Callous degradation another dental problem that adult products deal with is enamel erosion brought on by acidic foods and drinks. Such gels could contain fluoride or calcium phosphates which assist in the process of dog / hardening of reverted enamel that creates lesser problems like decay and sensitivity. There are also a variety of whitening products in this segment that aims at eradicating stains originating on the outer surfaces of teeth and giving back the inherent radiance of teeth through a method of cleaning, which caters to the aging group of people who requires cosmetic implants as well as functional requirements in the oral cavity.

Oral Care and Oral Hygiene Products Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The maturity and the level of professionalism within the North American oral care and oral hygiene products industry can be attributed to the region’s developed healthcare system and a constantly rising interest in the care of teeth among the population. Indeed, due to the effective increased customer health consciousness and insurance coverage in the United States, the market leans heavily towards preventive care that is encourages through regular dental check-ups. This early intervention has encouraged the use of novel oral care products including smart electric toothbrushes, enhanced fluoride pastes, and oral rinse that has targeted oral hygiene functions. The market is also growing more so due to awareness campaigns and effort put in sensitization exercises, as consumers engage more in purchase of premium products for dental care.

- Of the two, Canada is also emerging as a major market for the North American oral care market growth. The Canadian market also portrays a similar trend with the increasing reliance of consumers on a wider range of better quality and specialization oral conditioning products due to the increasing health conscience among consumers. This together with a growth in, the easy availability of dental care services and an increase in the healthcare activities. With the increasing population of seniors in Canada, customers are clamouring for products which appeal to seniors’ dental care including denture care products as well as toothpaste that repairs enamel. The trends taking shape through these factors is directing North America towards becoming one of the premier market in the global oral care related industries with increased innovations and consumer awareness as key drivers for the market growth in the future.

Active Key Players in the Oral Care and Oral Hygiene Products Market

- Procter & Gamble Co.

- Colgate-Palmolive Company

- Johnson & Johnson

- GlaxoSmithKline plc (GSK)

- Henkel AG & Co. KGaA

- Unilever plc

- Church & Dwight Co., Inc.

- Dr. Fresh, LLC

- Danaher Corporation

- Dabur India L

- Other Key Players

|

Global Oral Care and Oral Hygiene Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.05 Bn. |

|

Forecast Period 2024-32 CAGR: 3.84% |

3.84% |

Market Size in 2032: |

USD 1.47 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oral Care and Oral Hygiene Products Market by Product Type (2018-2032)

4.1 Oral Care and Oral Hygiene Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Toothpaste

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Toothbrushes

4.5 Mouthwash/Rinses

4.6 Dental Floss

4.7 Dental Sprays

4.8 Others

Chapter 5: Oral Care and Oral Hygiene Products Market by Form (2018-2032)

5.1 Oral Care and Oral Hygiene Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Gel-Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Paste-Based

5.5 Liquid

5.6 Powder

Chapter 6: Oral Care and Oral Hygiene Products Market by Ingredient Type (2018-2032)

6.1 Oral Care and Oral Hygiene Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Fluoride-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Herbal/Natural

6.5 Antibacterial

6.6 Whitening Agents

Chapter 7: Oral Care and Oral Hygiene Products Market by Distribution Channel (2018-2032)

7.1 Oral Care and Oral Hygiene Products Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmacies/Drug Stores

7.5 Online Retail

7.6 Convenience Stores

Chapter 8: Oral Care and Oral Hygiene Products Market by End-User (2018-2032)

8.1 Oral Care and Oral Hygiene Products Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Adults

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Children

8.5 Elderly

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Oral Care and Oral Hygiene Products Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PROCTER & GAMBLE COCOLGATE-PALMOLIVE COMPANY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 JOHNSON & JOHNSON

9.4 GLAXOSMITHKLINE PLC (GSK)

9.5 HENKEL AG & CO. KGAA

9.6 UNILEVER PLC

9.7 CHURCH & DWIGHT COINCDR. FRESH

9.8 LLC

9.9 DANAHER CORPORATION

9.10 DABUR INDIA L

9.11 OTHER KEY PLAYERS

9.12

Chapter 10: Global Oral Care and Oral Hygiene Products Market By Region

10.1 Overview

10.2. North America Oral Care and Oral Hygiene Products Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Toothpaste

10.2.4.2 Toothbrushes

10.2.4.3 Mouthwash/Rinses

10.2.4.4 Dental Floss

10.2.4.5 Dental Sprays

10.2.4.6 Others

10.2.5 Historic and Forecasted Market Size by Form

10.2.5.1 Gel-Based

10.2.5.2 Paste-Based

10.2.5.3 Liquid

10.2.5.4 Powder

10.2.6 Historic and Forecasted Market Size by Ingredient Type

10.2.6.1 Fluoride-Based

10.2.6.2 Herbal/Natural

10.2.6.3 Antibacterial

10.2.6.4 Whitening Agents

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 Supermarkets/Hypermarkets

10.2.7.2 Pharmacies/Drug Stores

10.2.7.3 Online Retail

10.2.7.4 Convenience Stores

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Adults

10.2.8.2 Children

10.2.8.3 Elderly

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Oral Care and Oral Hygiene Products Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Toothpaste

10.3.4.2 Toothbrushes

10.3.4.3 Mouthwash/Rinses

10.3.4.4 Dental Floss

10.3.4.5 Dental Sprays

10.3.4.6 Others

10.3.5 Historic and Forecasted Market Size by Form

10.3.5.1 Gel-Based

10.3.5.2 Paste-Based

10.3.5.3 Liquid

10.3.5.4 Powder

10.3.6 Historic and Forecasted Market Size by Ingredient Type

10.3.6.1 Fluoride-Based

10.3.6.2 Herbal/Natural

10.3.6.3 Antibacterial

10.3.6.4 Whitening Agents

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 Supermarkets/Hypermarkets

10.3.7.2 Pharmacies/Drug Stores

10.3.7.3 Online Retail

10.3.7.4 Convenience Stores

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Adults

10.3.8.2 Children

10.3.8.3 Elderly

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Oral Care and Oral Hygiene Products Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Toothpaste

10.4.4.2 Toothbrushes

10.4.4.3 Mouthwash/Rinses

10.4.4.4 Dental Floss

10.4.4.5 Dental Sprays

10.4.4.6 Others

10.4.5 Historic and Forecasted Market Size by Form

10.4.5.1 Gel-Based

10.4.5.2 Paste-Based

10.4.5.3 Liquid

10.4.5.4 Powder

10.4.6 Historic and Forecasted Market Size by Ingredient Type

10.4.6.1 Fluoride-Based

10.4.6.2 Herbal/Natural

10.4.6.3 Antibacterial

10.4.6.4 Whitening Agents

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 Supermarkets/Hypermarkets

10.4.7.2 Pharmacies/Drug Stores

10.4.7.3 Online Retail

10.4.7.4 Convenience Stores

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Adults

10.4.8.2 Children

10.4.8.3 Elderly

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Oral Care and Oral Hygiene Products Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Toothpaste

10.5.4.2 Toothbrushes

10.5.4.3 Mouthwash/Rinses

10.5.4.4 Dental Floss

10.5.4.5 Dental Sprays

10.5.4.6 Others

10.5.5 Historic and Forecasted Market Size by Form

10.5.5.1 Gel-Based

10.5.5.2 Paste-Based

10.5.5.3 Liquid

10.5.5.4 Powder

10.5.6 Historic and Forecasted Market Size by Ingredient Type

10.5.6.1 Fluoride-Based

10.5.6.2 Herbal/Natural

10.5.6.3 Antibacterial

10.5.6.4 Whitening Agents

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 Supermarkets/Hypermarkets

10.5.7.2 Pharmacies/Drug Stores

10.5.7.3 Online Retail

10.5.7.4 Convenience Stores

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Adults

10.5.8.2 Children

10.5.8.3 Elderly

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Oral Care and Oral Hygiene Products Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Toothpaste

10.6.4.2 Toothbrushes

10.6.4.3 Mouthwash/Rinses

10.6.4.4 Dental Floss

10.6.4.5 Dental Sprays

10.6.4.6 Others

10.6.5 Historic and Forecasted Market Size by Form

10.6.5.1 Gel-Based

10.6.5.2 Paste-Based

10.6.5.3 Liquid

10.6.5.4 Powder

10.6.6 Historic and Forecasted Market Size by Ingredient Type

10.6.6.1 Fluoride-Based

10.6.6.2 Herbal/Natural

10.6.6.3 Antibacterial

10.6.6.4 Whitening Agents

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 Supermarkets/Hypermarkets

10.6.7.2 Pharmacies/Drug Stores

10.6.7.3 Online Retail

10.6.7.4 Convenience Stores

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Adults

10.6.8.2 Children

10.6.8.3 Elderly

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Oral Care and Oral Hygiene Products Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Toothpaste

10.7.4.2 Toothbrushes

10.7.4.3 Mouthwash/Rinses

10.7.4.4 Dental Floss

10.7.4.5 Dental Sprays

10.7.4.6 Others

10.7.5 Historic and Forecasted Market Size by Form

10.7.5.1 Gel-Based

10.7.5.2 Paste-Based

10.7.5.3 Liquid

10.7.5.4 Powder

10.7.6 Historic and Forecasted Market Size by Ingredient Type

10.7.6.1 Fluoride-Based

10.7.6.2 Herbal/Natural

10.7.6.3 Antibacterial

10.7.6.4 Whitening Agents

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 Supermarkets/Hypermarkets

10.7.7.2 Pharmacies/Drug Stores

10.7.7.3 Online Retail

10.7.7.4 Convenience Stores

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Adults

10.7.8.2 Children

10.7.8.3 Elderly

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Oral Care and Oral Hygiene Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.05 Bn. |

|

Forecast Period 2024-32 CAGR: 3.84% |

3.84% |

Market Size in 2032: |

USD 1.47 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :