Next Generation Memory Market Synopsis

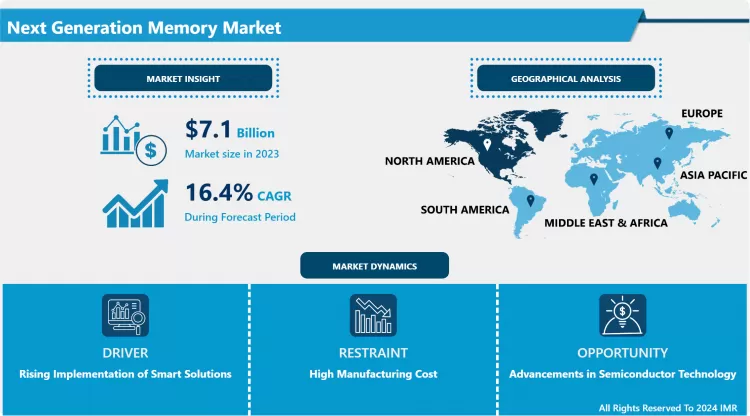

Next Generation Memory Market Size Was Valued at USD 7.1 Billion in 2023, and is Projected to Reach USD 27.9 Billion by 2032, Growing at a CAGR of 16.4% From 2024-2032.

Next generation memory also means a memory system which can perform data storage much faster, cheaper and can hold more information than silicon chips. It has therefore its uses widely in the telecommunication industries, information technology industries, and the banking, financial service, and insurance (BFSI) sectors throughout the world. Currently, there is more focus on the development and significant demand of high-bandwidth, low-power, and highly-scalable memories that used the art of artificial intelligence (AI), Internet of things (IoT), big data, and various other applications. This is in turn, fueling the requirements for the next generation memory.

- The next-generation memory technologies market has grown substantially over the past few years owing to the rise in demand for improved, faster as well as cost-efficient memory solutions, which are the factors boosting the market development.

- Next-generation memory is a category of ultra-fast computer memory technology that is under development at the present moment. These innovations suppress the drawbacks of the classical memory kinds of both DRAM and NAND Flash kinds. The key objective is to provide significant improvements in the major factors defining company’s operations, such as velocity, robustness, efficiency, and capacity. These technologies also usually convey a greater density of data, thus making it possible for organizations to get more information stored in less physical space. Implementation of these superior approaches can offer competitive advantage to a business especially in data processing a key factor in today’s market economy.

- New technologies such as artificial intelligence and machine learning and edge computing depend on memories that enable fast freeing of large amounts of data. These are critical in the advancement to set up and foster the innovative applications and services. A benefit of next-generation memory technologies is their non-volatile characteristic. It means they hold information such as program and applications even when there is a power outage. This characteristic leads that ATX has shorter amounts of time required while booting up the PC and this carries a very important role in increasing the stability of the data, which is key to every business that involves heavy use of data that must be readily available.

Next Generation Memory Market Trend Analysis

Rise in the traction of universal memory worldwide

- Currently, there is a tremendous increase in pull of universal memory across the globe. This, along with the electronics industry of the country being in a growing phase, can be considered one of the prominent forces that are driving the growth of the market. Besides this, with the increasing use of smarter facilities like mobile phones, tablets, USB, SSD, there is a demand for NOT AND (NAND) flash memory; which is non-volatile storage technique that does not require power to store the information. In addition to this, High Bandwidth Memory or HBM, that is the next generation of memory for graphics is gradually being employed in advanced graphics, networking, HPC, and AI devices.

- For example, it is used in decoders, fully self-driving cars, neural network structures, etc. , these are applications that need low power consumption and high bandwidth. Combined with the trend of increasing the usage of wearable devices, this is stimulating the development of the market. Such factors as the rise in the use of connected cars where the eMarketing is likely to be adopted and also the tremendous growth that is expected in IT industries is expected to foster the positive prospects of the market in the future years.

Increaseng the demand for storage applications to boost the market growth

- The overall demand of all types of enterprises to enhance demand for storage applications in the global market is active. BFSI which is one of the next-generation memory industry end-users are gradually upping their investment quantum on IoT technology, besides realizing the financial returns. The increasing RAT of next-generation memories, such as 3D Xpoint, provides the opportunity of much higher speed compared to the existing SSDs. This is further working as a major factor stimulating the Next-Generation Memory Market growth in an effective way.

- The enterprises are growing and with the IT sector companies, the use of storage technologies has become very common. This is mainly due to the increased demand of new generation storage services as well as devices on a large scale. This will also prescribe the management of the computer power between the noted institutions. Therefore, such factors that are associated with Next-Generation Memory have helped in elevating the Next-Generation Memory market CAGR in the last few years globally.

Next Generation Memory Market Segment Analysis:

- Next Generation Memory Market Segmented based on Technology, Wafer Size, and Application.

By Technology, non-volatile segment is expected to dominate the market during the forecast period

- It is predicted that the non-volatile segment will continue to hold the largest share in the market. A massive number of data generation in the industries results in high demand for effective, economical, and swift memory solutions. In the same way, wearables, High-Performance Computing, and solutions in place of flash memory require memory. It is imperative that these factors are driving the notion of the non-volatile memory technologies’ sales.

- The non-volatile memory is of two types, namely Hybrid Memory Cube or HMC, and High-bandwidth Memory or HBM. The non-volatile phenomena indeed comes with a package of benefits that are essential in today’s world of competing businesses. Still another noteworthy character is that they can preserve data even in the absence of power. Their non-volatile technology results in faster boot up times, and since they are able to maintain data and provide quick access to it the data integrity is also very high, something that is very important for instance when handling financial transaction or storage of other critical data.

- Furthermore, non-volatile memory plays a crucial role in the improvement of power consumption and battery life of portable devices as well as data centers energy costs optimization. With sustainability and low costs being always essential to company’s plans and strategies, non-volatile technology has its undeniable advantages in terms of saving energy. Moreover, due to the ability to withstand many more read and write operations before their performance detoriates, these technologies have longevity and economic sustainability unlike other technologies used in setting where data maybe frequently accessed or generated.

By Wafer Size, 300 mm segment held the largest share in 2023

- On the basis of wafer size, the market is classified into 200 mm and 300mm category out of which 300 mm category dominated the market in 2023. The use of 300 mm size wafers has the following strategic benefits in this market. These aspects give a large wafer a competitive edge that enhances production efficiency thus achieving economies of scale. Since the companies are looking forward to fulfilling the need of the higher memory technologies, working with the 300 mm wafers gives a higher volume and hence, reduced cost per piece. This scalability is particularly useful in large production applications, particularly in internet data centers and consumer products mainly because of the optimization of costs and enhanced yields. These wafers are well suited with the trends seen in the current industry where there is increased wafers size due to the complex design and manufacturing profile of the modern memory components.

Next Generation Memory Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American region is experiencing a fast growth of next-generation memory and this is due to the following factors. The continuous need for enhancement of data processing speed in finance, health, and clouds is forcing organizations towards development. Managers finally comprehend the fact that these productivity increases are the key to sustaining competition and serving customers with higher demands as time goes by. Secondly, North America has a strong IT and Semiconductor industry which helps in driving innovation and research in memory solutions. These creative strategies are a work in progress, and the region’s major corporations and university research laboratories are driving the process. Furthermore, increased importance of data protection and accountability of compliance, makes non-volatile memory crucial in the protection of such information.

Active Key Players in the Next Generation Memory Market

- Samsung

- Micron Technology, Inc.

- Fujitsu

- SK HYNIX INC.

- Honeywell International Inc.

- Microchip Technology Inc.

- Everspin Technologies Inc.

- Infineon Technologies AG

- Kingston Technology Europe Co LLP

- KIOXIA Singapore Pte. Ltd., Other Key Players.

Key Industry Developments in the Next Generation Memory Market:

- In June 2022, the South Korean tech giant, SK Hynix, Inc. , came up with a twelve-layer hi-bonded memory system type 3 (HBM3) product which has a memory capacity of 24GB 2. This is the globe’s speediest DRAM.

- November 2022, SAMSUNG gears up to start mass production of a 1-terabit (Tb) triple-level cell (TLC) eighth-generation Vertical NAND (V-NAND) with the company’s highest bit density.

- In June 6, 2022, Weebit Nano Limited revealed that the newest type of the prototype chip combines the element of an embedded Resistive Random-Access Memory (ReRAM) module and SkyWater Technology’s foundry. The internal industry name for this is “130nm CMOS process” and it will be ready with SkyWater’s when the technology is available: ideal for power management, automotive, analog, IoT, and medical applications.

|

Global Next Generation Memory Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.4 % |

Market Size in 2032: |

USD 27.9 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Wafer Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Next Generation Memory Market by Technology (2018-2032)

4.1 Next Generation Memory Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Volatile

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 SRAM

4.5 Magneto-Resistive Random-Access Memory (MRAM)

4.6 Ferroelectric RAM (FRAM)

4.7 Resistive Random-Access Memory (ReRAM)

4.8 Nano RAM

4.9 Other

4.10 Non-volatile

4.11 Hybrid Memory Cube (HMC)

4.12 High-bandwidth Memory (HBM)

Chapter 5: Next Generation Memory Market by Wafer Size (2018-2032)

5.1 Next Generation Memory Market Snapshot and Growth Engine

5.2 Market Overview

5.3 200 mm

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 300 mm

Chapter 6: Next Generation Memory Market by Application (2018-2032)

6.1 Next Generation Memory Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Consumer Electronics

6.5 Government

6.6 Telecommunications

6.7 Information Technology

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Next Generation Memory Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SAMSUNG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICRON TECHNOLOGY INCFUJITSU

7.4 SK HYNIX INCHONEYWELL INTERNATIONAL INCMICROCHIP TECHNOLOGY INCEVERSPIN TECHNOLOGIES INCINFINEON TECHNOLOGIES AG

7.5 KINGSTON TECHNOLOGY EUROPE CO LLP

7.6 KIOXIA SINGAPORE PTE. LTDOTHER KEY PLAYERS.

Chapter 8: Global Next Generation Memory Market By Region

8.1 Overview

8.2. North America Next Generation Memory Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Technology

8.2.4.1 Volatile

8.2.4.2 SRAM

8.2.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.2.4.4 Ferroelectric RAM (FRAM)

8.2.4.5 Resistive Random-Access Memory (ReRAM)

8.2.4.6 Nano RAM

8.2.4.7 Other

8.2.4.8 Non-volatile

8.2.4.9 Hybrid Memory Cube (HMC)

8.2.4.10 High-bandwidth Memory (HBM)

8.2.5 Historic and Forecasted Market Size by Wafer Size

8.2.5.1 200 mm

8.2.5.2 300 mm

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 BFSI

8.2.6.2 Consumer Electronics

8.2.6.3 Government

8.2.6.4 Telecommunications

8.2.6.5 Information Technology

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Next Generation Memory Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Technology

8.3.4.1 Volatile

8.3.4.2 SRAM

8.3.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.3.4.4 Ferroelectric RAM (FRAM)

8.3.4.5 Resistive Random-Access Memory (ReRAM)

8.3.4.6 Nano RAM

8.3.4.7 Other

8.3.4.8 Non-volatile

8.3.4.9 Hybrid Memory Cube (HMC)

8.3.4.10 High-bandwidth Memory (HBM)

8.3.5 Historic and Forecasted Market Size by Wafer Size

8.3.5.1 200 mm

8.3.5.2 300 mm

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 BFSI

8.3.6.2 Consumer Electronics

8.3.6.3 Government

8.3.6.4 Telecommunications

8.3.6.5 Information Technology

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Next Generation Memory Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Technology

8.4.4.1 Volatile

8.4.4.2 SRAM

8.4.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.4.4.4 Ferroelectric RAM (FRAM)

8.4.4.5 Resistive Random-Access Memory (ReRAM)

8.4.4.6 Nano RAM

8.4.4.7 Other

8.4.4.8 Non-volatile

8.4.4.9 Hybrid Memory Cube (HMC)

8.4.4.10 High-bandwidth Memory (HBM)

8.4.5 Historic and Forecasted Market Size by Wafer Size

8.4.5.1 200 mm

8.4.5.2 300 mm

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 BFSI

8.4.6.2 Consumer Electronics

8.4.6.3 Government

8.4.6.4 Telecommunications

8.4.6.5 Information Technology

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Next Generation Memory Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Technology

8.5.4.1 Volatile

8.5.4.2 SRAM

8.5.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.5.4.4 Ferroelectric RAM (FRAM)

8.5.4.5 Resistive Random-Access Memory (ReRAM)

8.5.4.6 Nano RAM

8.5.4.7 Other

8.5.4.8 Non-volatile

8.5.4.9 Hybrid Memory Cube (HMC)

8.5.4.10 High-bandwidth Memory (HBM)

8.5.5 Historic and Forecasted Market Size by Wafer Size

8.5.5.1 200 mm

8.5.5.2 300 mm

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 BFSI

8.5.6.2 Consumer Electronics

8.5.6.3 Government

8.5.6.4 Telecommunications

8.5.6.5 Information Technology

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Next Generation Memory Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Technology

8.6.4.1 Volatile

8.6.4.2 SRAM

8.6.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.6.4.4 Ferroelectric RAM (FRAM)

8.6.4.5 Resistive Random-Access Memory (ReRAM)

8.6.4.6 Nano RAM

8.6.4.7 Other

8.6.4.8 Non-volatile

8.6.4.9 Hybrid Memory Cube (HMC)

8.6.4.10 High-bandwidth Memory (HBM)

8.6.5 Historic and Forecasted Market Size by Wafer Size

8.6.5.1 200 mm

8.6.5.2 300 mm

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 BFSI

8.6.6.2 Consumer Electronics

8.6.6.3 Government

8.6.6.4 Telecommunications

8.6.6.5 Information Technology

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Next Generation Memory Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Technology

8.7.4.1 Volatile

8.7.4.2 SRAM

8.7.4.3 Magneto-Resistive Random-Access Memory (MRAM)

8.7.4.4 Ferroelectric RAM (FRAM)

8.7.4.5 Resistive Random-Access Memory (ReRAM)

8.7.4.6 Nano RAM

8.7.4.7 Other

8.7.4.8 Non-volatile

8.7.4.9 Hybrid Memory Cube (HMC)

8.7.4.10 High-bandwidth Memory (HBM)

8.7.5 Historic and Forecasted Market Size by Wafer Size

8.7.5.1 200 mm

8.7.5.2 300 mm

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 BFSI

8.7.6.2 Consumer Electronics

8.7.6.3 Government

8.7.6.4 Telecommunications

8.7.6.5 Information Technology

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Next Generation Memory Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.4 % |

Market Size in 2032: |

USD 27.9 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Wafer Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Next Generation Memory Market research report is 2024-2032.

Samsung; Micron Technology, Inc.; Fujitsu; SK HYNIX INC.; Honeywell International Inc.; Microchip Technology Inc.; Everspin Technologies Inc.; Infineon Technologies AG; Kingston Technology Europe Co LLP; KIOXIA Singapore Pte. Ltd, and Other Major Players.

The Next Generation Memory Market is segmented into technology, wafer size, application, and region. By technology, the market is categorized into volatile and non-volatile. By wafer size, the market is categorized into 200 mm and 300 mm. By application, the market is categorized into BFSI, consumer electronics, government, telecommunications, IT, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Next-generation memory involves superior forms of nonvolatile memory technologies that offer superior performance compared to DRAM and NAND flash memories and consume far less power, and also have better reliability. These new generation memory technologies including RRAM, PCM, MRAM are in the process of providing improved memory access speed, higher density and superior reliability than the currently existing memory technologies. Modern memory technology has a prospect of application in various industries such as consumer electronics, data centers, automobile industry, and IoT gadgets.

Next Generation Memory Market Size Was Valued at USD 7.1 Billion in 2023, and is Projected to Reach USD 27.9 Billion by 2032, Growing at a CAGR of 16.4% From 2024-2032.