N-Butyllithium Market Synopsis

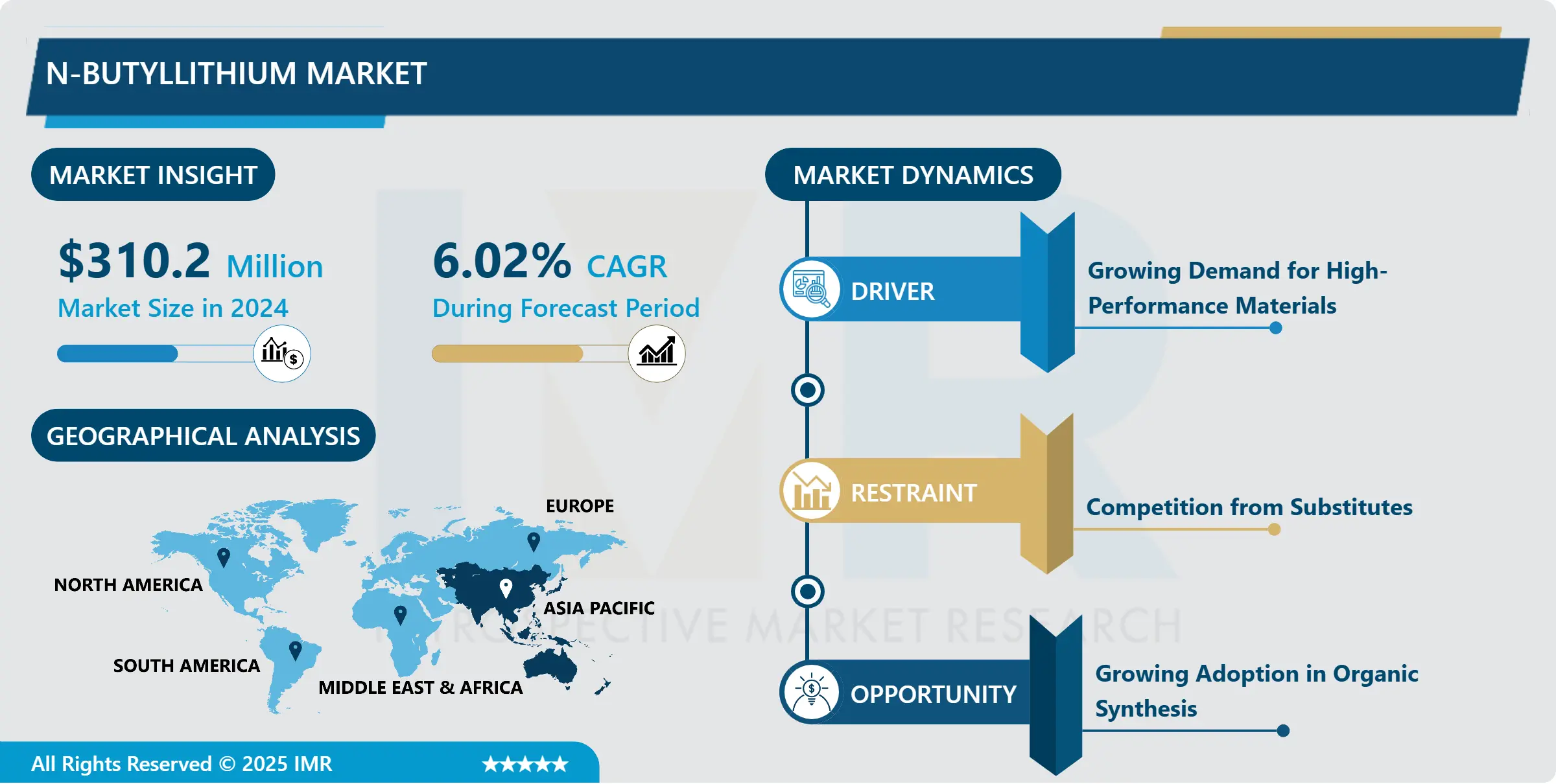

N-Butyllithium Market Size Was Valued at USD 310.2 Million in 2024, and is Projected to Reach USD 590.08 Million by 2035, Growing at a CAGR of 6.02% From 2025-2035.

N-Butyllithium is a highly reactive chemical compound used in organic synthesis and as a strong base in laboratory settings. It exists as a colorless to yellowish liquid and is composed of lithium atoms bonded to four butyl groups. Due to its extreme reactivity with air and moisture, it must be handled with extreme caution, often stored under inert atmospheres. It is primarily utilized in the synthesis of organic compounds and as a polymerization initiator in the production of polymers like rubber.

The n-butyllithium market is a crucial segment within the global lithium compounds industry. N-butyllithium, a highly reactive organolithium compound, is primarily used as a strong base and as an initiator in polymerization reactions, particularly in the production of synthetic rubber and elastomers. Its properties make it indispensable in various industrial processes, including pharmaceuticals, agrochemicals, and electronics.

The market for n-butyllithium is influenced by several factors. Growth in the automotive and construction industries, particularly in emerging economies, drives demand for synthetic rubber, thereby boosting the market for n-butyllithium. Additionally, advancements in polymer science and technology continue to create new applications, further stimulating market growth.

Geographically, Asia Pacific dominates the n-butyllithium market, led by countries like China and India, owing to their burgeoning industrial sectors and increasing investments in infrastructure. North America and Europe also hold significant shares due to the presence of well-established automotive and electronics industries.

The n-butyllithium market is poised for steady growth, driven by expanding industrial applications and technological advancements, albeit with challenges related to regulations and market competition.

N-Butyllithium Market Trend Analysis

Growing Demand for High-Performance Materials

- N-Butyllithium, a versatile organometallic compound, finds extensive applications in polymerization reactions, pharmaceuticals, and chemical synthesis processes. Its unique properties, including high reactivity and excellent solubility in non-polar solvents, make it indispensable in the production of specialty chemicals and advanced materials.

- The rising need for high-performance materials in sectors such as automotive, electronics, and healthcare is a key driving force behind the increasing demand for N-Butyllithium. In the automotive industry, for instance, N-Butyllithium is utilized in the manufacturing of specialty elastomers and plastics, enhancing the performance and durability of automotive components. Similarly, in electronics, it facilitates the synthesis of conductive polymers and advanced coatings, crucial for electronic devices' efficiency and longevity.

- The growing emphasis on sustainable and eco-friendly materials is further propelling the adoption of N-Butyllithium, as it enables the development of innovative, energy-efficient products with reduced environmental impact. As industries continue to prioritize performance and sustainability, the N-Butyllithium market is poised for continuous expansion, driving innovation and advancement in materials science and technology.

Growing Adoption in Organic Synthesis

- N-butyllithium, a strong base and nucleophile, is widely utilized in various organic synthesis processes due to its exceptional reactivity and versatility. Its ability to efficiently initiate polymerization reactions, such as anionic polymerization of monomers like styrene and butadiene, makes it indispensable in the production of synthetic rubbers and elastomers.

- The N-butyllithium plays a crucial role as a substance in the synthesis of complex organic molecules, including pharmaceuticals, agrochemicals, and specialty chemicals. Its unique properties enable chemists to carry out reactions that would otherwise be challenging or impossible to achieve, leading to the development of novel compounds and materials.

- The increasing demand for custom-designed molecules in industries such as pharmaceuticals and electronics fuels the need for advanced synthetic methodologies, where N-butyllithium stands out as a key reagent. Its effectiveness in facilitating selective transformations and its compatibility with a wide range of functional groups make it an indispensable tool for chemists striving for efficient and sustainable synthetic routes.

- The growing adoption of N-butyllithium in organic synthesis not only enhances process efficiency and product quality but also drives innovation and expands the scope of chemical synthesis, thereby creating lucrative opportunities for the N-butyllithium market.

N-Butyllithium Market Segment Analysis:

N-Butyllithium Market Segmented on the basis of Application, End-Users, and Distribution Channel.

By Application, Polymerization segment is expected to dominate the market during the forecast period

- N-Butyllithium, a strong base and powerful reducing agent, initiates polymerization reactions by reacting with monomers, leading to the formation of polymers with desired properties.

- In the Polymerization segment, N-Butyllithium is extensively used in the production of polymers such as synthetic rubbers, plastics, and elastomers. Its ability to efficiently initiate polymerization reactions makes it indispensable in industries ranging from automotive to healthcare. For instance, in the automotive sector, N-Butyllithium-initiated polymerization processes contribute to the production of high-performance tires and other rubber components, enhancing vehicle safety and performance.

- Furthermore, in the healthcare sector, N-Butyllithium finds application in the synthesis of specialized polymers used in medical devices and drug delivery systems. The versatility and reliability of N-Butyllithium in initiating polymerization reactions underscore its pivotal role in driving innovation and meeting the diverse demands of industries reliant on advanced polymer materials.

By End-User, Pharmaceutical industry segment held the largest share of xx% in 2023

- N-Butyllithium (NBL) is a crucial mixture in the pharmaceutical industry, primarily used for synthesis of complex molecules and pharmaceutical intermediates, and is widely used in the production of active pharmaceutical ingredients and drug formulations.

- Within the pharmaceutical segment, NBL is utilized in the synthesis of compounds for drugs targeting a range of therapeutic areas, including oncology, cardiovascular diseases, central nervous system disorders, and others. Its unique chemical properties make it indispensable for pharmaceutical research and development, enabling the creation of novel drug candidates and improving the efficiency of synthetic processes.

- The market for N-Butyllithium in the pharmaceutical sector is driven by the continual demand for innovative drugs, stringent quality standards, and the need for efficient synthetic methodologies. With pharmaceutical companies focusing on expanding their product pipelines and enhancing manufacturing capabilities, the demand for NBL is expected to remain robust in the foreseeable future, driving growth and innovation within the pharmaceutical industry.

N-Butyllithium Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific's industrial infrastructure and chemical manufacturing sector, backed by countries like China, Japan, and South Korea, are crucial for the production and distribution of n-butyllithium, fostering innovation and global competitiveness.

- Furthermore, the region boasts abundant reserves of raw materials essential for n-butyllithium production, ensuring a stable and cost-effective supply chain. This strategic advantage enhances the region's attractiveness as a manufacturing hub for n-butyllithium and related products.

- The Asia Pacific's rapidly expanding automotive and electronics industries are driving significant demand for n-butyllithium, which serves as a crucial catalyst in the production of polymers, elastomers, and specialty chemicals used in these sectors. As the region continues to experience economic growth and urbanization, the demand for n-butyllithium is expected to surge further, consolidating Asia Pacific's position as a dominant player in the global market.

- Additionally, favorable government policies and initiatives aimed at promoting industrial growth and innovation provide further impetus to the n-butyllithium market in the region. These policies incentivize investment in research and development, fostering technological advancements and ensuring the continued competitiveness of Asia Pacific's chemical industry on the world stage.

N-Butyllithium Market Top Key Players:

- FMC (United States)

- Rockwood (United States)

- JIANGXI GANFENG LITHIUM (China)

- Triveni Chemicals (India)

- Yixing City Changjili Chemicals (China)

- Quzhou Aokai Chemical (China)

- Shangyu Lucky Chemical Co., Ltd.

- Jiangsu Yangnong Chemical Technology Group Co., Ltd.

- Changmao Biochemical Engineering Co., Ltd.

- Jiangsu Jufeng Chemical Co., Ltd.

- Albemarle Corporation

- Hangzhou Zhonghuafuxing Chemistry Pharmacy Co., Ltd.

- Dalian Fuweite Chemical Co., Ltd.

- Tianjin Kewei Chemical Technology Development Co., Ltd.

- BASF SE

- Chengdu Shengnuo Chemical Technology Co., Ltd.

- Zhejiang Jiaxing Yamei New Material Science Co., Ltd.

- Sichuan Xinjin Chemical Co., Ltd.

- Chengdu Kewei Chemical Technology Co., Ltd.

- Sichuan Tiancheng Chemical Technology Co., Ltd. and Other Major Players.

Key Industry Developments in the N-Butyllithium Market:

- In May 2024, FMC Corporation (NYSE: FMC), a global leader in agricultural sciences, announced a multi-year research collaboration with biotechnology firm AgroSpheres to accelerate the development of novel bioinsecticides. This partnership combines AgroSpheres’ RNA production and formulation technologies with FMC's testing and market expertise. The collaboration aims to enhance crop protection and sustainability through RNA interference (RNAi) technology. FMC Ventures previously invested in AgroSpheres in 2023 to support biodegradable micro-encapsulation advancements, bolstering both companies' efforts in addressing resistance and advancing sustainable agriculture.

|

N-Butyllithium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 310.2 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.02 % |

Market Size in 2035: |

USD 590.08 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: N-Butyllithium Market by Application (2018-2035)

4.1 N-Butyllithium Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polymerization

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical synthesis

4.5 Chemical synthesis

Chapter 5: N-Butyllithium Market by End-User (2018-2035)

5.1 N-Butyllithium Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Polymer manufacturing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical industry

5.5 Chemical manufacturing

5.6 Agrochemicals

Chapter 6: N-Butyllithium Market by Distribution Channel (2018-2035)

6.1 N-Butyllithium Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Distributors

6.5 Online sales

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 N-Butyllithium Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 WEST PHARMACEUTICAL SERVICES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WESTROCK (UNITED STATES)

7.4 APTAR GROUP INC (UNITED STATES)

7.5 BEMIS COMPANY (UNITED STATES)

7.6 BERRY GLOBAL (UNITED STATES)

7.7 DRUG PLASTICS GROUP (UNITED STATES)

7.8 DS SMITH (UNITED KINGDOM)

7.9 MONDI GROUP(UNITED KINGDOM)

7.10 GERRESHEIMER AG (GERMANY)

7.11 SCHOTT AG (GERMANY)

7.12 SMURFIT KAPPA (IRELAND)

7.13 AMCOR (AUSTRALIA)

7.14 RENGO (JAPAN)

7.15

Chapter 8: Global N-Butyllithium Market By Region

8.1 Overview

8.2. North America N-Butyllithium Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Application

8.2.4.1 Polymerization

8.2.4.2 Pharmaceutical synthesis

8.2.4.3 Chemical synthesis

8.2.5 Historic and Forecasted Market Size by End-User

8.2.5.1 Polymer manufacturing

8.2.5.2 Pharmaceutical industry

8.2.5.3 Chemical manufacturing

8.2.5.4 Agrochemicals

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Direct sales

8.2.6.2 Distributors

8.2.6.3 Online sales

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe N-Butyllithium Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Application

8.3.4.1 Polymerization

8.3.4.2 Pharmaceutical synthesis

8.3.4.3 Chemical synthesis

8.3.5 Historic and Forecasted Market Size by End-User

8.3.5.1 Polymer manufacturing

8.3.5.2 Pharmaceutical industry

8.3.5.3 Chemical manufacturing

8.3.5.4 Agrochemicals

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Direct sales

8.3.6.2 Distributors

8.3.6.3 Online sales

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe N-Butyllithium Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Application

8.4.4.1 Polymerization

8.4.4.2 Pharmaceutical synthesis

8.4.4.3 Chemical synthesis

8.4.5 Historic and Forecasted Market Size by End-User

8.4.5.1 Polymer manufacturing

8.4.5.2 Pharmaceutical industry

8.4.5.3 Chemical manufacturing

8.4.5.4 Agrochemicals

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Direct sales

8.4.6.2 Distributors

8.4.6.3 Online sales

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific N-Butyllithium Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Application

8.5.4.1 Polymerization

8.5.4.2 Pharmaceutical synthesis

8.5.4.3 Chemical synthesis

8.5.5 Historic and Forecasted Market Size by End-User

8.5.5.1 Polymer manufacturing

8.5.5.2 Pharmaceutical industry

8.5.5.3 Chemical manufacturing

8.5.5.4 Agrochemicals

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Direct sales

8.5.6.2 Distributors

8.5.6.3 Online sales

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa N-Butyllithium Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Application

8.6.4.1 Polymerization

8.6.4.2 Pharmaceutical synthesis

8.6.4.3 Chemical synthesis

8.6.5 Historic and Forecasted Market Size by End-User

8.6.5.1 Polymer manufacturing

8.6.5.2 Pharmaceutical industry

8.6.5.3 Chemical manufacturing

8.6.5.4 Agrochemicals

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Direct sales

8.6.6.2 Distributors

8.6.6.3 Online sales

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America N-Butyllithium Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Application

8.7.4.1 Polymerization

8.7.4.2 Pharmaceutical synthesis

8.7.4.3 Chemical synthesis

8.7.5 Historic and Forecasted Market Size by End-User

8.7.5.1 Polymer manufacturing

8.7.5.2 Pharmaceutical industry

8.7.5.3 Chemical manufacturing

8.7.5.4 Agrochemicals

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Direct sales

8.7.6.2 Distributors

8.7.6.3 Online sales

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

N-Butyllithium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 310.2 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.02 % |

Market Size in 2035: |

USD 590.08 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||