Lithium Compounds Market Synopsis

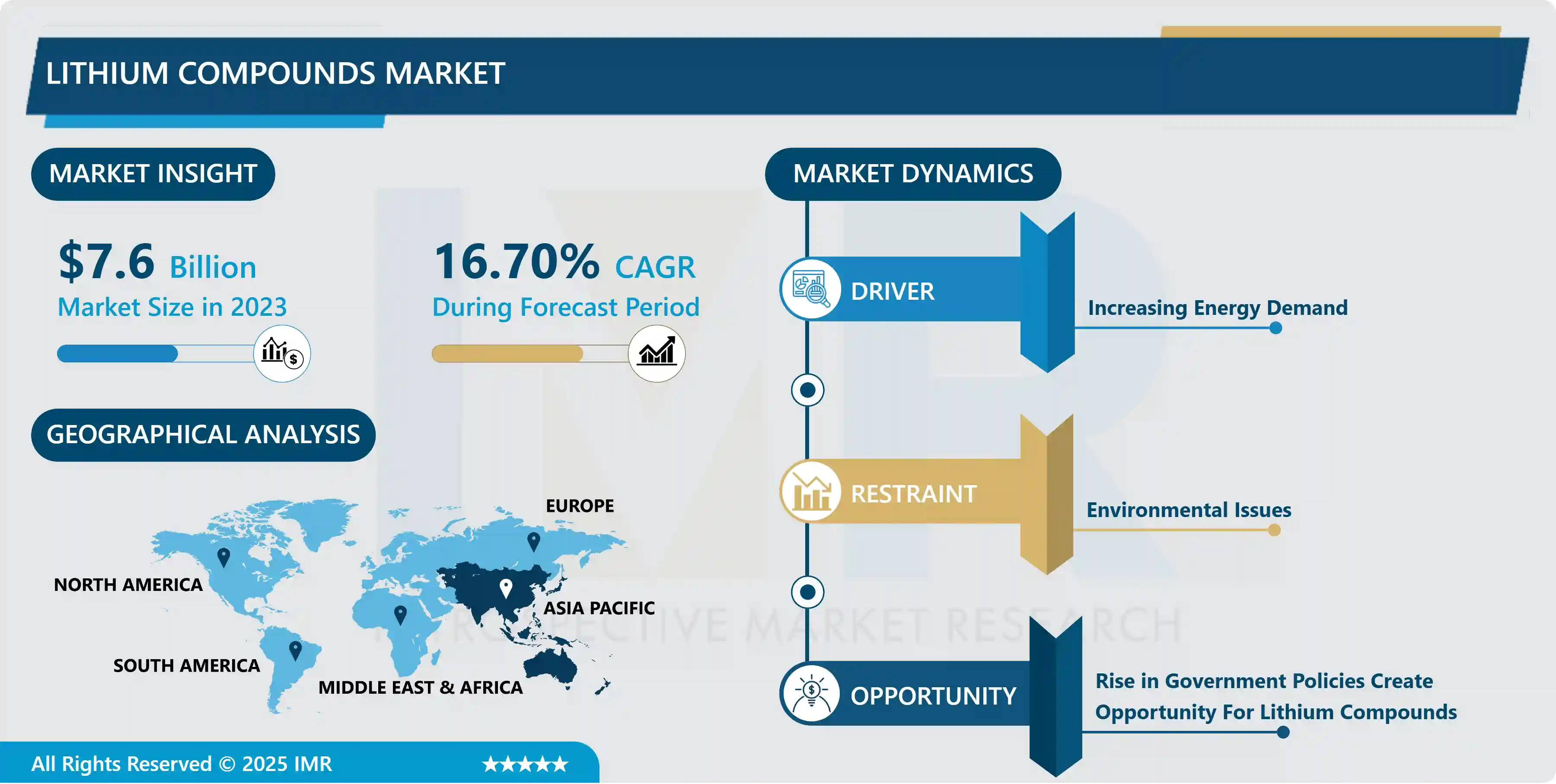

Lithium Compounds Market Size Was Valued at USD 7.6 Billion in 2023, and is Projected to Reach USD 30.51 Billion by 2032, Growing at a CAGR of 16.7% From 2024-2032.

Although lithium markets vary by location, global end-use markets were estimated as follows: batteries, 80%; ceramics and glass, 7%; lubricating greases, 4%; continuous casting mold flux powders, 2%; air treatment, 1%; medical, 1%; and other uses, 5%. Lithium consumption for batteries increased significantly in recent years because rechargeable lithium batteries have been used extensively in the growing market for electric vehicles and portable electronic devices, and increasingly have been used in electric tools, and grid storage applications. Lithium minerals were used directly as ore concentrates in ceramics and glass applications.

Lithium-strengthened glass and ceramics have become essential to the convenience modern life demands. Lithium and its compounds are now key to manufacturing glass-ceramic cooktops, stove windows, tough glass, fiberglass, ceramic frits, and ceramic dentures. These combined markets represent the second largest use for lithium after lithium-ion batteries, accounting for an estimated 5% of the market in 2021, down from 12% in 2011.

Lithium fluxes are used in the manufacture of ceramic glazes to coat ceramic bodies, in porcelain enamels to coat white goods, water heaters, grills, flue pipes, architectural panels, and in sanitary ware, tableware, cookware, and many other types of ceramic ware. The addition of lithium during the glass and glass ceramics manufacturing process brings many benefits. It lowers the firing (melting) temperature and reduces thermal expansion, which increases the strength of the final product and improves its color, strength, and luster. The lower firing temperature translates into lower energy input, reduced emissions output, and higher throughput.

Lithium Compounds Market Trend Analysis

Increasing Applications in the Automotive Industry especially electric vehicles (EVs)

- The increasing need for the electric vehicle (EV) sector is fueling expansion in the lithium compounds market. Lithium carbonate and lithium hydroxide are essential ingredients utilized in lithium-ion batteries for electric vehicles. Moreover, the growing need for lithium-ion batteries, especially for grid-scale applications, to guarantee a steady energy supply globally is driven by the rise of energy storage systems (ESS) incorporating renewable sources such as solar and wind.

- Innovations in battery technology involve adapting high-nickel cathodes in lithium-ion batteries to increase energy density, leading to a greater need for lithium hydroxide. Solid-state batteries have better energy density and safety but are still in the process of being commercialized. Geopolitical factors impact the worldwide lithium supply chain, raising worries about resource nationalism. To minimize risks, companies are expanding their lithium supply sources through different strategies.

- Fluctuations in lithium compounds market prices are caused by changes in supply and demand, influenced by factors such as overproduction and government regulations. Long-term agreements assist battery manufacturers in controlling fluctuations. The environmental demands promote sustainable mining methods and recycling programs. Asia-Pacific, particularly China, leads the market, with Europe and North America seeing an increase in demand.

- Efforts to boost lithium production worldwide are focused on investing in new mining ventures and expanding refining capabilities. The increasing need for lithium hydroxide is causing investments to be made in its production. Consolidation in the market and forming partnerships are fueling advancements in battery technology.

Rise in Eco-Friendly Lithium Tech Drives Interest In Recycling Batteries

- Increased attention towards sustainable and environmentally friendly technologies is driving the development of eco-conscious lithium extraction techniques such as DLE and the recycling of batteries. Enterprises have the opportunity to differentiate themselves in the market by providing eco-friendly lithium options. The growing popularity of the circular economy concept is also fueling interest in lithium recycling, providing opportunities for companies to profit from extracting lithium from old batteries.

- Allocating resources towards Research & Development (R&D) is essential for enhancing lithium compound manufacturing methods and creating novel uses, particularly in battery technology. Investors are pouring money into lithium and lithium-related technologies due to high demand. Offering chances for suppliers to broaden their local presence, emerging markets in Asia, Africa, and Latin America are fueling market growth.

- Ensuring the lithium supply chain is increasingly vital with strategic stockpiling and vertical integration. Government regulations that promote renewable energy and electric vehicles contribute to a positive regulatory atmosphere and encourage investment in local lithium production. Identifying lithium as a crucial mineral opens up more chances for exploration and development.

- The integration of renewable energy has created a need for effective Energy Storage Systems (ESS) to handle fluctuations in solar and wind power. Lithium compound suppliers are benefiting from the preference for lithium-ion batteries for grid-scale storage. The growth of decentralized energy systems also boosts the need for lithium batteries. Growth opportunities are presented by technological advancements such as solid-state batteries and battery recycling. Exploring new territories for untapped resources and expanding the use of lithium beyond batteries can bring in more revenue.

Lithium Compounds Market Segment Analysis:

The lithium Compounds Market is Segmented Based on Product Types, Applications, End-User, Grade, and Production Processes.

By Product Types, Lithium Carbonate Segment Is Expected to Dominate the Market During the Forecast Period

- Lithium carbonate is essential in the manufacturing of lithium-ion batteries for consumer electronics, electric vehicles, and energy storage systems. With the rising popularity of EVs, the demand for lithium-ion batteries has increased, leading to the growing importance of lithium carbonate in the industry. Moreover, lithium carbonate serves as a precursor for important lithium compounds such as lithium hydroxide, underscoring its crucial role in the battery industry.

- Lithium carbonate can be readily manufactured from spodumene and lithium-rich brine deposits located in areas like South America and Australia. Its plentiful availability makes it an economical option in comparison to other lithium substances. Its cheaper production compared to lithium hydroxide comes from being directly extracted from lithium brine, making it more available for use in applications that do not require extremely high levels of purity.

- Lithium carbonate is used in glass, ceramics, and pharmaceutical sectors to improve product characteristics such as reduced melting points and enhanced strength. Its importance in the pharmaceutical treatment of bipolar disorder is substantial yet lesser in comparison to other uses. It acts as a fluxing agent and assists in the production of aluminum in different industrial processes. The demand for lithium carbonate is on the rise as a result of the growing market for electric vehicles and energy storage systems, fueled by the transition towards renewable energy sources. Investments made to increase production capacity in nations such as Australia and Chile have enhanced its market position even more.

- Lithium carbonate holds the largest market share of lithium compounds worldwide because of its essential role in the manufacturing of batteries. Lithium carbonate continues to be the primary choice in many battery technologies and sectors, even as lithium hydroxide gains more traction. The demand for it is predicted to stay high as the world moves towards renewable energy and electric cars.

By Application, Batteries Segment Held the Largest Share

- Li-ion batteries possess a higher energy density in comparison to NiCd or lead-acid batteries, allowing for storage of a greater amount of energy in a lighter bundle. This leads to extended operational durations for gadgets such as smartphones and laptops, enhancing user satisfaction.

- Li-ion batteries are extensively utilized in consumer electronics such as smartphones and laptops because of their compact size, lightweight, and extended battery durability. These batteries play a crucial role in electric vehicles such as cars, buses, and e-bikes due to the increasing demand driven by the global emphasis on clean energy. Moreover, Li-ion batteries are essential for energy storage systems, aiding the grid in utilizing renewable energy sources. For tools, medical devices, and aerospace and defense uses, these batteries are dependable and effective in industrial settings.

- Ongoing advancements in Li-ion battery technology have enhanced energy density, charging rate, safety, and longevity. Advancements such as solid-state batteries provide higher energy capacities and enhanced safety characteristics. Decreases in production costs have increased the availability of Li-ion batteries for a wide range of uses. Li-ion batteries emit less and are better for the environment compared to conventional batteries. Efforts are ongoing to recycle batteries to lessen their environmental impact and preserve important resources.

- Governments worldwide are boosting the demand for Li-ion batteries by implementing stricter emissions laws, offering incentives for electric vehicle usage, and helping with the incorporation of renewable energy sources. Having production facilities in Asia, a dependable worldwide supply chain, and continuous advancements, Li-ion batteries are poised to enter new sectors and continue leading the industry.

Lithium Compounds Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Currently the great majority of spodumene is mined in Australia and refined in China, although this is now changing as new mines and new refineries are being built around the world. Owing to continuing exploration, identified lithium resources have increased substantially worldwide and total about 98 million tons. Identified lithium resources in the United States—from continental brines, claystone, geothermal brines, hectorite, oilfield brines, and pegmatites—are 12 million tons.

- China has a strong advantage in the lithium compound market due to its abundant spodumene deposits and lithium-rich brine resources. Australia, the leading lithium producer in the Asia-Pacific area, sends the majority of its lithium exports to China for further processing. China leads in the worldwide production of lithium-ion batteries, boasting a fully integrated supply chain from sourcing materials to producing batteries. The demand for lithium compounds is being pushed by the country's strong growth in electric vehicles and investments in renewable energy. Moreover, Chinese firms are pioneering battery technology with backing from the government for R&D.

- China has acknowledged the strategic significance of lithium and classified it as a critical mineral. China holds a dominant position in the lithium compound market due to policies promoting domestic production and stockpiling. Controlling the worldwide lithium supply chain allows China to impact prices and availability through trade policies. China's dominance is enhanced by economies of scale in processing and infrastructure development, along with strategic partnerships and global investments. The demand for lithium in Asia-Pacific, especially in China, is set to keep growing.

- Identified lithium resources in other countries have been revised to 86 million tons. Identified lithium resources are distributed as follows: Bolivia, 21 million tons; Argentina, 20 million tons; Chile, 11 million tons; Australia, 7.9 million tons; China, 6.8 million tons; Germany, 3.2 million tons; Congo (Kinshasa), 3 million tons; Canada, 2.9 million tons; Mexico, 1.7 million tons; Czechia, 1.3 million tons; Serbia, 1.2 million tons; Russia, 1 million tons; Peru, 880,000 tons; Mali, 840,000 tons; Brazil, 730,000 tons; Zimbabwe, 690,000 tons; Spain, 320,000 tons; Portugal, 270,000 tons; Namibia; 230,000 tons; Ghana, 180,000 tons; Finland, 68,000 tons; Austria, 60,000 tons; and Kazakhstan, 50,000 tons.

Lithium Compounds Market Active Players

- Albemarle Corporation (USA)

- Ganfeng Lithium Co., Ltd. (China)

- Sociedad Química y Minera de Chile (SQM) (Chile)

- Tianqi Lithium Corporation (China)

- Livent Corporation (USA)

- FMC Corporation (USA)

- Orocobre Limited (Australia)

- Mineral Resources Limited (Australia)

- Lithium Americas Corp. (Canada)

- Nemaska Lithium Inc. (Canada)

- Jiangxi Special Electric Motor Co., Ltd. (Jiangte) (China)

- Galaxy Resources Limited (Australia)

- Sichuan Yahua Industrial Group Co., Ltd. (China)

- Pilbara Minerals Limited (Australia)

- Kidman Resources Limited (Australia)

- Altura Mining Limited (Australia)

- Bacanora Lithium (UK)

- Neo Lithium Corp. (Canada)

- Millennial Lithium Corp. (Canada)

- Critical Elements Corporation (Canada)

- Global Lithium Resources Limited (Australia)

- Lithium Power International Limited (Australia)

Lithium Compounds Market Scope:

|

Lithium Compounds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.7 % |

Market Size in 2032: |

USD 30.51 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Grade |

|

||

|

By Production Process |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lithium Compounds Market by Product Types (2018-2032)

4.1 Lithium Compounds Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lithium Carbonate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lithium Hydroxide

4.5 Lithium Chloride

4.6 Lithium Metal

4.7 Lithium Bromide

4.8 Lithium Fluoride

Chapter 5: Lithium Compounds Market by Application (2018-2032)

5.1 Lithium Compounds Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Batteries

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Glass & Ceramics

5.5 Lubricants

5.6 Pharmaceuticals

5.7 Air Treatment Systems

Chapter 6: Lithium Compounds Market by End-User (2018-2032)

6.1 Lithium Compounds Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electronics

6.5 Energy Storage

6.6 Industrial

6.7 Healthcare

Chapter 7: Lithium Compounds Market by Grade (2018-2032)

7.1 Lithium Compounds Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Battery Grade

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Technical Grade

7.5 Pharmaceutical Grade

Chapter 8: Lithium Compounds Market by Production Process (2018-2032)

8.1 Lithium Compounds Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Natural Brine Extraction

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Mineral Extraction

8.5 Recycling

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Lithium Compounds Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ALBEMARLE CORPORATION (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 GANFENG LITHIUM COLTD. (CHINA)

9.4 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM) (CHILE)

9.5 TIANQI LITHIUM CORPORATION (CHINA)

9.6 LIVENT CORPORATION (USA)

9.7 FMC CORPORATION (USA)

9.8 OROCOBRE LIMITED (AUSTRALIA)

9.9 MINERAL RESOURCES LIMITED (AUSTRALIA)

9.10 LITHIUM AMERICAS CORP. (CANADA)

9.11 NEMASKA LITHIUM INC. (CANADA)

9.12 JIANGXI SPECIAL ELECTRIC MOTOR COLTD. (JIANGTE) (CHINA)

9.13 GALAXY RESOURCES LIMITED (AUSTRALIA)

9.14 SICHUAN YAHUA INDUSTRIAL GROUP COLTD. (CHINA)

9.15 PILBARA MINERALS LIMITED (AUSTRALIA)

9.16 KIDMAN RESOURCES LIMITED (AUSTRALIA)

9.17 ALTURA MINING LIMITED (AUSTRALIA)

9.18 BACANORA LITHIUM (UK)

9.19 NEO LITHIUM CORP. (CANADA)

9.20 MILLENNIAL LITHIUM CORP. (CANADA)

9.21 CRITICAL ELEMENTS CORPORATION (CANADA)

9.22 GLOBAL LITHIUM RESOURCES LIMITED (AUSTRALIA)

9.23 LITHIUM POWER INTERNATIONAL LIMITED (AUSTRALIA)

9.24 CYPRESS DEVELOPMENT CORP. (CANADA)

9.25 SAYONA MINING LIMITED (AUSTRALIA)

9.26 AVZ MINERALS LIMITED (AUSTRALIA)

9.27 EUROPEAN LITHIUM LTD. (AUSTRIA)

9.28 SIGMA LITHIUM RESOURCES CORPORATION (CANADA)

9.29 PIEDMONT LITHIUM LIMITED (USA)

9.30 IONEER LTD. (AUSTRALIA)

9.31 POWER METALS CORP. (CANADA)

9.32 AND

Chapter 10: Global Lithium Compounds Market By Region

10.1 Overview

10.2. North America Lithium Compounds Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Types

10.2.4.1 Lithium Carbonate

10.2.4.2 Lithium Hydroxide

10.2.4.3 Lithium Chloride

10.2.4.4 Lithium Metal

10.2.4.5 Lithium Bromide

10.2.4.6 Lithium Fluoride

10.2.5 Historic and Forecasted Market Size by Application

10.2.5.1 Batteries

10.2.5.2 Glass & Ceramics

10.2.5.3 Lubricants

10.2.5.4 Pharmaceuticals

10.2.5.5 Air Treatment Systems

10.2.6 Historic and Forecasted Market Size by End-User

10.2.6.1 Automotive

10.2.6.2 Electronics

10.2.6.3 Energy Storage

10.2.6.4 Industrial

10.2.6.5 Healthcare

10.2.7 Historic and Forecasted Market Size by Grade

10.2.7.1 Battery Grade

10.2.7.2 Technical Grade

10.2.7.3 Pharmaceutical Grade

10.2.8 Historic and Forecasted Market Size by Production Process

10.2.8.1 Natural Brine Extraction

10.2.8.2 Mineral Extraction

10.2.8.3 Recycling

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Lithium Compounds Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Types

10.3.4.1 Lithium Carbonate

10.3.4.2 Lithium Hydroxide

10.3.4.3 Lithium Chloride

10.3.4.4 Lithium Metal

10.3.4.5 Lithium Bromide

10.3.4.6 Lithium Fluoride

10.3.5 Historic and Forecasted Market Size by Application

10.3.5.1 Batteries

10.3.5.2 Glass & Ceramics

10.3.5.3 Lubricants

10.3.5.4 Pharmaceuticals

10.3.5.5 Air Treatment Systems

10.3.6 Historic and Forecasted Market Size by End-User

10.3.6.1 Automotive

10.3.6.2 Electronics

10.3.6.3 Energy Storage

10.3.6.4 Industrial

10.3.6.5 Healthcare

10.3.7 Historic and Forecasted Market Size by Grade

10.3.7.1 Battery Grade

10.3.7.2 Technical Grade

10.3.7.3 Pharmaceutical Grade

10.3.8 Historic and Forecasted Market Size by Production Process

10.3.8.1 Natural Brine Extraction

10.3.8.2 Mineral Extraction

10.3.8.3 Recycling

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Lithium Compounds Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Types

10.4.4.1 Lithium Carbonate

10.4.4.2 Lithium Hydroxide

10.4.4.3 Lithium Chloride

10.4.4.4 Lithium Metal

10.4.4.5 Lithium Bromide

10.4.4.6 Lithium Fluoride

10.4.5 Historic and Forecasted Market Size by Application

10.4.5.1 Batteries

10.4.5.2 Glass & Ceramics

10.4.5.3 Lubricants

10.4.5.4 Pharmaceuticals

10.4.5.5 Air Treatment Systems

10.4.6 Historic and Forecasted Market Size by End-User

10.4.6.1 Automotive

10.4.6.2 Electronics

10.4.6.3 Energy Storage

10.4.6.4 Industrial

10.4.6.5 Healthcare

10.4.7 Historic and Forecasted Market Size by Grade

10.4.7.1 Battery Grade

10.4.7.2 Technical Grade

10.4.7.3 Pharmaceutical Grade

10.4.8 Historic and Forecasted Market Size by Production Process

10.4.8.1 Natural Brine Extraction

10.4.8.2 Mineral Extraction

10.4.8.3 Recycling

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Lithium Compounds Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Types

10.5.4.1 Lithium Carbonate

10.5.4.2 Lithium Hydroxide

10.5.4.3 Lithium Chloride

10.5.4.4 Lithium Metal

10.5.4.5 Lithium Bromide

10.5.4.6 Lithium Fluoride

10.5.5 Historic and Forecasted Market Size by Application

10.5.5.1 Batteries

10.5.5.2 Glass & Ceramics

10.5.5.3 Lubricants

10.5.5.4 Pharmaceuticals

10.5.5.5 Air Treatment Systems

10.5.6 Historic and Forecasted Market Size by End-User

10.5.6.1 Automotive

10.5.6.2 Electronics

10.5.6.3 Energy Storage

10.5.6.4 Industrial

10.5.6.5 Healthcare

10.5.7 Historic and Forecasted Market Size by Grade

10.5.7.1 Battery Grade

10.5.7.2 Technical Grade

10.5.7.3 Pharmaceutical Grade

10.5.8 Historic and Forecasted Market Size by Production Process

10.5.8.1 Natural Brine Extraction

10.5.8.2 Mineral Extraction

10.5.8.3 Recycling

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Lithium Compounds Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Types

10.6.4.1 Lithium Carbonate

10.6.4.2 Lithium Hydroxide

10.6.4.3 Lithium Chloride

10.6.4.4 Lithium Metal

10.6.4.5 Lithium Bromide

10.6.4.6 Lithium Fluoride

10.6.5 Historic and Forecasted Market Size by Application

10.6.5.1 Batteries

10.6.5.2 Glass & Ceramics

10.6.5.3 Lubricants

10.6.5.4 Pharmaceuticals

10.6.5.5 Air Treatment Systems

10.6.6 Historic and Forecasted Market Size by End-User

10.6.6.1 Automotive

10.6.6.2 Electronics

10.6.6.3 Energy Storage

10.6.6.4 Industrial

10.6.6.5 Healthcare

10.6.7 Historic and Forecasted Market Size by Grade

10.6.7.1 Battery Grade

10.6.7.2 Technical Grade

10.6.7.3 Pharmaceutical Grade

10.6.8 Historic and Forecasted Market Size by Production Process

10.6.8.1 Natural Brine Extraction

10.6.8.2 Mineral Extraction

10.6.8.3 Recycling

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Lithium Compounds Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Types

10.7.4.1 Lithium Carbonate

10.7.4.2 Lithium Hydroxide

10.7.4.3 Lithium Chloride

10.7.4.4 Lithium Metal

10.7.4.5 Lithium Bromide

10.7.4.6 Lithium Fluoride

10.7.5 Historic and Forecasted Market Size by Application

10.7.5.1 Batteries

10.7.5.2 Glass & Ceramics

10.7.5.3 Lubricants

10.7.5.4 Pharmaceuticals

10.7.5.5 Air Treatment Systems

10.7.6 Historic and Forecasted Market Size by End-User

10.7.6.1 Automotive

10.7.6.2 Electronics

10.7.6.3 Energy Storage

10.7.6.4 Industrial

10.7.6.5 Healthcare

10.7.7 Historic and Forecasted Market Size by Grade

10.7.7.1 Battery Grade

10.7.7.2 Technical Grade

10.7.7.3 Pharmaceutical Grade

10.7.8 Historic and Forecasted Market Size by Production Process

10.7.8.1 Natural Brine Extraction

10.7.8.2 Mineral Extraction

10.7.8.3 Recycling

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Lithium Compounds Market Scope:

|

Lithium Compounds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.7 % |

Market Size in 2032: |

USD 30.51 Bn. |

|

Segments Covered: |

By Product Types |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Grade |

|

||

|

By Production Process |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||