Chemical Logistics Market Overview:

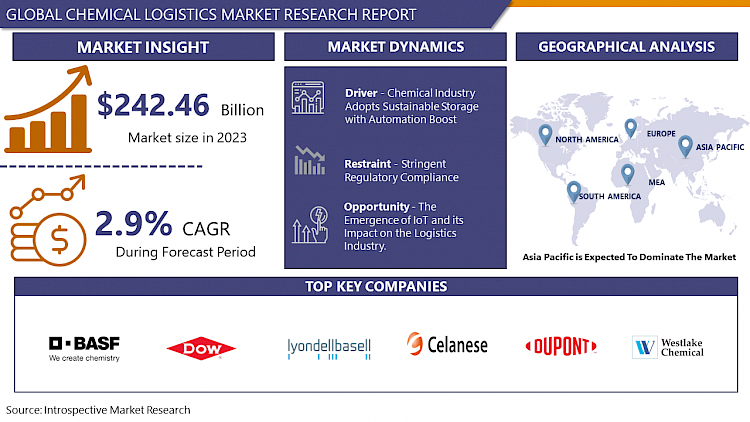

Global Chemical Logistics Market Size Was Valued at USD 242.46 Billion in 2023 and is Projected to Reach USD 304.76 Billion by 2032, Growing at a CAGR of 2.9% From 2024-2032.

Chemical Logistics refers to the systematic management and coordination of the transportation, storage, inventory, and security of chemicals and related materials from suppliers to manufacturers and consumers. The primary objective of chemical logistics is to ensure the timely delivery of the right chemicals to the right destinations while maintaining high levels of safety and security throughout the supply chain.

- The chemical industry is a crucial sector that plays a vital role in various industries such as pharmaceuticals, food production, the automotive industry, and plastic processing. Many industries depend on chemical products as chemical substances form a vital base. The transportation of chemicals in the supply chain, along with storage and shipping services, is known as chemical logistics. Sustainable, efficient, and competitive logistics are crucial in the chemical industry as consumption and production areas are generally separated. Moreover, logistics is typically adjustable, agile, and flexible, allowing the market to respond efficiently and quickly to changes.

- The production of various chemicals has been steadily increasing in recent years, driven largely by the growing utilization of shale gas as a primary feedstock in the energy sector. This trend has significantly heightened the demand for transporting shale gas within the industry. For example, data from the American Chemistry Council (ACC) in August 2020 revealed that the U.S. chemical industry experienced a notable 0.8% increase in chemical production compared to 2016, with expectations of further growth amounting to a 3% rise by the end of 2020.

- With the surge in chemical production comes the imperative need for safe transportation of these manufactured chemicals. This necessity is poised to fuel the demand for logistics services specialized in handling chemical cargo on a global scale in the foreseeable future. Consequently, the expansion of chemical production across various end-use industries is projected to serve as a significant catalyst for the growth of the chemical logistics market.

Chemical Industry Adopts Sustainable Storage with Automation Boost

- The logistics industry is seeing a growing trend towards adopting automatic warehousing systems, a type of green technology. This advancement towards sustainable storage solutions is significant. In the past, chemical storage facilities relied on traditional methods, often posing environmental risks due to potential leaks, spills, or contamination. However, thanks to technological advancements, the market now offers a range of storage options that aim to minimize environmental impact. These solutions include state-of-the-art protection systems like double wall tanks and advanced monitoring sensors.

- Chemical companies can use various automation technologies like robotics, AI, and data analytics to automate their processes, such as inventory control and transportation planning. For instance, automated storage systems can track chemical inventory accurately in real time, helping with proactive replenishment and reducing the risk of overstocks or stockouts. Additionally, automated logistics platforms can optimize vehicle usage and route planning, leading to reduced fuel consumption and greenhouse gas emissions.

- The chemical industry is making progress by integrating automation and sustainable practices into its operations. By giving priority to environmental protection and operational excellence, chemical companies can attain greater flexibility, competitiveness, and sustainability in today's dynamic market. With technological advancements, the industry must remain proactive in adopting innovative solutions that meet regulatory requirements and exceed stakeholder expectations for responsible and efficient chemical management.

The Emergence of IoT and its Impact on the Logistics Industry

- The chemical logistics industry has an opportunity for change with the emergence of the Internet of Things (IoT). IoT technologies such as connected devices and sensors provide improved visibility, efficiency, and safety in the transportation and storage of chemical products. One key benefit is enhancing supply chain visibility. By using IoT-compatible tracking devices, chemical companies can monitor their shipments' location, condition, and integrity in real time. This ensures greater transparency and security during the logistics process, minimizing the risk of theft, contamination, or damage.

- The Internet of Things (IoT) provides chemical logistics companies with a way to manage risks and maintenance proactively. By collecting and analyzing data from IoT sensors placed in storage containers, transport vehicles, and infrastructure, they can anticipate equipment failures or environmental hazards before they happen. This approach not only prevents costly disruptions but also improves operational security and compliance. Furthermore, IoT-based predictive analytics enables logistics service providers to optimize route planning, inventory management, and resource allocation, resulting in reduced costs and increased efficiency.

Global Chemical Logistics Market Segment Analysis:

Global Chemical Logistics Market Segmented on the basis of Service, Mode of Transportation, and end-users.

By Service,

The Transportation segment of the Chemical Logistics Market is experiencing growth due to globalization. Globalization has led to an increase in international trade of chemicals, necessitating efficient transportation networks to move products across borders. Additionally, the chemical industry itself is expanding, driven by demand from sectors such as manufacturing, agriculture, and healthcare, further fueling the need for reliable transportation services.

Moreover, stringent regulations regarding the handling and transportation of chemicals have prompted companies to outsource these operations to specialized logistics providers with expertise in compliance and safety measures. This outsourcing trend is particularly evident in regions where regulatory requirements are complex and continuously evolving.

Furthermore, advancements in technology have enabled transportation service providers to optimize routes, enhance tracking capabilities, and improve overall efficiency, thereby reducing costs and enhancing customer satisfaction.

By Mode of Transportation

The Waterways mode of transportation in the Chemical Logistics Market is experiencing growth due water transport offers a cost-effective solution for transporting bulk chemicals over long distances. Ships have large capacities and can carry substantial loads, leading to economies of scale and lower per-unit transportation costs compared to other modes like road or air.

Water transport is environmentally friendly relative to other modes of transportation, particularly air freight and road transport. It produces fewer emissions per ton-mile, making it an attractive option for chemical companies looking to reduce their carbon footprint and comply with increasingly stringent environmental regulations.

Additionally, water transport provides access to remote regions and inland destinations that may be inaccessible by road or rail. This accessibility expands market reach and opens up new opportunities for chemical producers to serve customers in diverse geographic locations.

Global Chemical Logistics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The chemical logistics industry is expected to be led by the Asia Pacific region. The presence of rising economies in the area, such as India and China, is a prominent driver of market expansion. The entire Southeast Asia region is emerging as an economy hotspot in the Asia Pacific. Additionally, India is a global leader in chemical exports and imports, ranking 14th in exports and eighth in imports. While the chemical industry is global, China is its biggest single market. Developing countries are focusing on the manufacturing sector and building strong warehouse infrastructure, which is expected to fuel the expansion of the chemical logistics industry.

Global Chemical Logistics Market Top Key Players:

- BASF Corporation (US)

- Dow Chemical Company (US)

- LyondellBasell Industries (US)

- Celanese Corporation (US)

- E.I. du Pont de Nemours (US)

- Westlake Chemical Corporation (US)

- Univar Solutions Inc (US)

- Praxair, Inc (US)

- A&R Logistics (US)

- Air Products and Chemicals, Inc (US)

- Nalco Holding Company (US)

- Evonik Industries AG(US)

- Invista S.à r.l (US)

- Solvay SA(Europe)

- Linde AG(Germany)

- Bayer AG(Germany)

- Merck KGaA (Germany)

- DSM (Netherlands)

- SABIC (Saudi Arabia)

- Sinopec Corp (China)

- China National Chemical Corporation (China)

- Mitsubishi Chemical Corporation (Japan)

- Toray Industries, Inc (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- LG Chem (South Korea), and Other Major Players

Key Industry Developments in the Global Chemical Logistics Market:

- In December, 2023: Quantix, a portfolio business of Wind Point Partners ("Wind Point") and North America's premier chemical industry supply chain services provider, announced the purchase of Mid-States Packaging. Mid-States is a full-service dry bulk transportation, warehousing, and export services provider with 11 facilities in Texas, the Northeast, and the Mid-Atlantic. Mid-States expands Quantix's regional footprint and expands its warehouse and trucking transportation activities.

- In April, 2022: C.H. Robinson and Waymo, an American autonomous driving technology company enter a strategic partnership to advance the development of autonomous trucking for supply chains. Waymo Via's autonomous trucks to haul C.H. Robinson customer freight in several pilots over the coming years. Expertise and knowledge sharing to spur the long-term development of autonomous freight transportation for customers and carriers.

|

Global Chemical Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 242.46 Bn. |

|

Forecast Period 2023-30 CAGR: |

2.9% |

Market Size in 2032: |

USD 304.76 Bn. |

|

Segments Covered: |

by Service |

|

|

|

By Mode of Transportation |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- CHEMICAL LOGISTICS MARKET BY SERVICE (2016-2030)

- CHEMICAL LOGISTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSPORTATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WAREHOUSING

- CUSTOMS & SECURITY

- GREEN LOGISTICS

- CONSULTING & MANAGEMENT SERVICES

- CHEMICAL LOGISTICS MARKET BY MODE OF TRANSPORTATION (2016-2030)

- CHEMICAL LOGISTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ROADWAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RAILWAYS

- AIRWAYS

- WATERWAYS

- PIPELINES

- CHEMICAL LOGISTICS MARKET BY END USER (2016-2030)

- CHEMICAL LOGISTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHARMACEUTICAL INDUSTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETIC INDUSTRY

- OIL AND GAS INDUSTRY

- SPECIALTY CHEMICALS INDUSTRY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Chemical Logistics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPETITIVE LANDSCAPE

BASF Corporation

-

-

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPANYB Dow Chemical Company

- LyondellBasell Industries

- Celanese Corporation

- E.I. du Pont de Nemours

- Westlake Chemical Corporation

- Univar Solutions Inc

- Praxair, Inc

- A&R Logistics

- Air Products and Chemicals, Inc

- Nalco Holding Company

- Evonik Industries AG

- Invista S.à r.l

- Solvay SA

- Linde AG

- Bayer AG

- Merck KGaA

- DSM

- SABIC

- Sinopec Corp

- China National Chemical Corporation

- Mitsubishi Chemical Corporation

- Toray Industries, Inc

- Sumitomo Chemical Co., Ltd.

- LG Chem

-

- GLOBAL CHEMICAL LOGISTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Mode of Transportation

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Chemical Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 242.46 Bn. |

|

Forecast Period 2023-30 CAGR: |

2.9% |

Market Size in 2032: |

USD 304.76 Bn. |

|

Segments Covered: |

by Service |

|

|

|

By Mode of Transportation |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Chemical Logistics Market research report is 2024-2032.

BASF Corporation, Dow Chemical Company, LyondellBasell Industries, Celanese Corporation ,E.I. du Pont de Nemours, Westlake Chemical Corporation, Univar Solutions Inc, Praxair, Inc, A&R Logistics, Air Products and Chemicals, Inc, Nalco Holding Company, Evonik Industries AG, Invista S.à r.l, Solvay SA, Linde AG, Bayer AG, Merck KGaA, DSM, SABIC, Sinopec Corp, China National Chemical Corporation, Mitsubishi Chemical Corporation, Toray Industries, Inc, Sumitomo Chemical Co., Ltd., LG Chem and Other Major Players.

The Global Chemical Logistics Market is segmented into Service, Nature, End User, and region. By Service, the market is categorized into Transportation, Warehousing, Customs & Security, Green Logistics, Consulting & Management Services), Mode of Transportation (. By Mode of Transportation the market is categorized into Roadways, Railways, Airways, Waterways, Pipelines. By End User, the market is categorized into Pharmaceutical Industry, Cosmetic Industry, Oil and Gas Industry, Specialty Chemicals Industry. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Chemical Logistics refers to the systematic management and coordination of the transportation, storage, inventory, and security of chemicals and related materials from suppliers to manufacturers and consumers. The primary objective of chemical logistics is to ensure the timely delivery of the right chemicals to the right destinations while maintaining high levels of safety and security throughout the supply chain.

Chemical Logistics Market Size Was Valued at USD 242.46 Billion in 2023, and is Projected to Reach USD 304.76 Billion by 2032, Growing at a CAGR of 2.9% From 2024-2032.