Green Chemicals Market Synopsis

Green Chemicals Market Size Was Valued at USD 104.62 Billion in 2023, and is Projected to Reach USD 221.3 Billion by 2032, Growing at a CAGR of 9.8% From 2024-2032.

Green chemicals, also known as sustainable or environmentally friendly chemicals, refer to substances that are designed and produced with a focus on minimizing their impact on the environment and human health. These chemicals are developed through processes that reduce or eliminate the use of hazardous substances, energy consumption, and waste generation.

- The goal of green chemistry is to create products that are not only effective in their intended applications but also pose fewer risks to ecosystems and human well-being throughout their lifecycle. Green chemicals often involve innovations in the choice of raw materials, manufacturing processes, and end-of-life disposal, promoting a more sustainable and responsible approach to chemical production.

- Additionally, to reducing environmental impact, green chemicals strive to address issues such as resource depletion, climate change, and pollution. This approach involves considering the entire life cycle of a chemical, from its creation to its ultimate disposal or recycling.

- The development and adoption of green chemicals contribute to a more sustainable and circular economy, aligning with the global effort to transition towards greener practices and mitigate the ecological challenges associated with traditional chemical manufacturing. As industries increasingly recognize the importance of sustainability, the demand for green chemicals continues to grow, driving further research and innovation in the field of environmentally conscious chemistry.

- The Green Chemicals market is witnessing significant growth as industries increasingly prioritize environmentally friendly alternatives. With rising awareness of sustainability, the demand for eco-friendly chemicals is surging. Key drivers include stringent regulations, consumer preferences for eco-conscious products, and a growing emphasis on reducing carbon footprints, fostering a transition towards greener solutions.

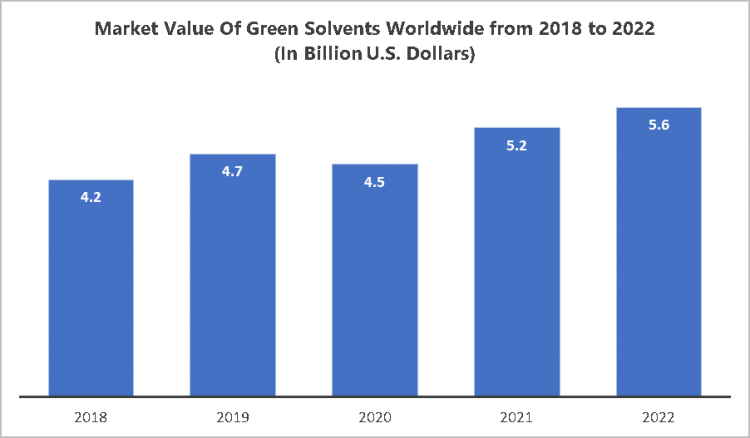

- The given graph shows that the green solvents are solvents that are environmentally friendly. They are derived from the processing of agricultural crops. The global market value of green solvents was 4.2 billion U.S. dollars in 2018 to nearly six billion U.S. dollars in 2023.

Green Chemicals Market Trend Analysis

Consumer Awareness and Preferences

- Consumer awareness and preferences play a pivotal role in steering the growth of the Green Chemicals market. With an increasing global focus on sustainable practices and environmental responsibility, consumers are becoming more conscientious about the products they choose. Green Chemicals, characterized by eco-friendly and sustainable manufacturing processes, align closely with these evolving consumer values.

- As consumers become more informed about the environmental impact of traditional chemical products, there is a growing demand for alternatives that are less harmful to the planet. Green Chemicals, which are derived from renewable resources and designed to minimize ecological footprints, resonate well with environmentally conscious consumers. This heightened awareness has prompted a shift in consumer preferences towards products that prioritize sustainability and contribute to a circular economy.

- Companies responsive to these consumer trends are investing in research and development to innovate and produce greener alternatives. The Green Chemicals market is expanding to meet the increasing demand for sustainable solutions. Ultimately, consumer awareness and preferences act as catalysts, driving the adoption of Green Chemicals and fostering a more sustainable future for the chemical industry.

Growing Demand for Sustainable Products creates Opportunity for Green Chemicals Market

- The growing demand for sustainable products has created significant opportunities for the Green Chemicals market. As consumers become more environmentally conscious, there is a heightened awareness of the impact of traditional chemical processes on the planet. Green Chemicals, also known as bio-based or renewable chemicals, offer a sustainable alternative by utilizing raw materials derived from renewable sources such as biomass, agricultural waste, or algae.

- One major opportunity in the shift towards eco-friendly alternatives across various industries, including agriculture, packaging, and manufacturing. Green Chemicals contribute to reduced carbon emissions and decreased reliance on fossil fuels, aligning with global sustainability goals. Additionally, stringent environmental regulations and policies aimed at reducing chemical pollution further drive the demand for eco-friendly solutions.

- Investments in research and development of innovative green technologies present another avenue for growth. Companies that focus on developing cost-effective and efficient green processes stand to gain a competitive edge. Collaborations between industries and government initiatives supporting sustainable practices further amplify the potential for market expansion.

Green Chemicals Market Segment Analysis:

Green Chemicals Market Segmented on the basis of Product type, Source, and end-users.

By Product Type, Bio Organic Acids segment is expected to dominate the market during the forecast period

- Bio Organic Acids segment is poised to assert its dominance. This ascendancy can be attributed to a confluence of factors that underscore the growing significance of sustainable and eco-friendly alternatives in various industries.

- Bio Organic Acids, derived from renewable resources such as biomass and agricultural by-products, epitomize the green revolution in chemical manufacturing. As businesses and consumers increasingly prioritize environmentally responsible practices, the demand for these bio-based acids has surged. Their inherent eco-friendly nature, coupled with their versatility and applicability across diverse sectors, positions them as frontrunners in the green chemicals space.

- The prominence of Bio Organic Acids is further accentuated by their role in mitigating environmental impact and reducing carbon footprints. Industries ranging from agriculture and food processing to pharmaceuticals and packaging are incorporating these acids as alternatives to traditional, petrochemical-derived counterparts. This transition aligns with global sustainability goals and regulatory frameworks, fostering the widespread adoption of Bio Organic Acids.

By Source, Plant-Based segment held the largest share of 60% in 2022

- The dominance of the plant-based segment in the Green Chemicals Market can be attributed to several factors. Plant-based chemicals, also known as bio-based chemicals, are derived from renewable resources such as crops, sugarcane, corn, and other plant materials. This segment has gained prominence due to the increasing global awareness of sustainability and environmental concerns.

- Consumers and industries alike are increasingly seeking alternatives to traditional petrochemical-based products, driven by the desire to reduce their carbon footprint and promote eco-friendly practices. Plant-based chemicals offer a viable solution, as they are derived from renewable sources, making them more sustainable and environmentally friendly. Additionally, the production of plant-based chemicals often involves lower greenhouse gas emissions compared to conventional chemical manufacturing processes.

Green Chemicals Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as a dominant force in the global Green Chemicals Market, exhibiting significant growth and influence. This projection is underpinned by several key factors that underscore the region's pivotal role in shaping the future of sustainable chemical production.

- The Asia Pacific region is home to a burgeoning population and rapidly expanding economies, driving an escalating demand for eco-friendly alternatives in various industries. Governments in the region are increasingly prioritizing environmental sustainability, prompting a shift towards green practices and policies.

- Moreover, the Asia Pacific region boasts a robust infrastructure for chemical manufacturing, research, and development. With a focus on innovation and technological advancement, the region is actively investing in green chemistry initiatives. This commitment positions Asia Pacific as a frontrunner in adopting and promoting the use of environmentally friendly chemicals.

Green Chemicals Market Top Key Players:

- Lubrizol (USA)

- Ashland Global Holdings (USA)

- DuPont (USA)

- Eastman Chemical Company (USA)

- Genomatica (USA)

- Ecolab (USA)

- Huntsman Corporation (USA)

- BioAmber (Canada)

- BASF SE (Germany)

- Covestro (Germany)

- Evonik Industries (Germany)

- Bayer CropScience (Germany)

- Croda International (United Kingdom)

- Ineos (United Kingdom)

- Solvay (Belgium)

- AkzoNobel (Netherlands)

- DSM (Netherlands)

- Clariant (Switzerland)

- Mitsubishi Chemical Holdings (Japan)

- Kuraray (Japan)

- Novozymes (Denmark)

- Borregaard (Norway)

- Borouge (United Arab Emirates)

- SABIC (Saudi Basic Industries Corporation) (Saudi Arabia)

- Indorama Ventures (Thailand)

Key Industry Developments in the Green Chemicals Market:

- In 2023, SABIC has finalized the acquisition of Clariant's stake in Scientific Design, thereby securing full ownership of the catalyst leader. This acquisition reinforces SABIC's presence in the Specialties market, aligning with their strategic shift to establish a standalone Specialties division to pursue diverse growth opportunities.

- In May 2023, NTPC Green Energy Limited (NGEL) and HPCL Mittal Energy Limited (HMEL) joined hands to explore opportunities in the green hydrogen business & its derivatives (Green Ammonia and green Methanol).

|

Green Chemicals Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 104.62 Bn. |

|

|

CAGR (2023-2030) : |

11.6% |

Market Size in 2032: |

USD 221.02 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Source |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GREEN CHEMICALS MARKET BY PRODUCT TYPE (2016-2030)

- GREEN CHEMICALS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BIO ALCOHOLS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIO ORGANIC ACIDS

- BIO KETONES

- BIO POLYMERS

- BIO SOLVENTS

- GREEN CHEMICALS MARKET BY SOURCE (2016-2030)

- GREEN CHEMICALS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLANT-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ALGAE-BASED

- BIO-WASTE

- GREEN CHEMICALS MARKET BY END-USERS (2016-2030)

- GREEN CHEMICALS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICALS

- FOOD & BEVERAGES

- PAINTS & COATINGS

- AGRICULTURE

- OTHERS (AUTOMOTIVE, TEXTILE)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- GREEN CHEMICALS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LUBRIZOL (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ASHLAND GLOBAL HOLDINGS (USA)

- DUPONT (USA)

- EASTMAN CHEMICAL COMPANY (USA)

- GENOMATICA (USA)

- ECOLAB (USA)

- HUNTSMAN CORPORATION (USA)

- BIOAMBER (CANADA)

- BASF SE (GERMANY)

- COVESTRO (GERMANY)

- EVONIK INDUSTRIES (GERMANY)

- BAYER CROPSCIENCE (GERMANY)

- CRODA INTERNATIONAL (UNITED KINGDOM)

- INEOS (UNITED KINGDOM)

- SOLVAY (BELGIUM)

- AKZONOBEL (NETHERLANDS)

- DSM (NETHERLANDS)

- CLARIANT (SWITZERLAND)

- MITSUBISHI CHEMICAL HOLDINGS (JAPAN)

- KURARAY (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL GREEN CHEMICALS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By End-Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Green Chemicals Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 104.62 Bn. |

|

|

CAGR (2023-2030) : |

11.6% |

Market Size in 2032: |

USD 221.02 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Source |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Green Chemicals Market research report is 2024-2032.

Lubrizol (USA), Ashland Global Holdings (USA), DuPont (USA), Eastman Chemical Company (USA), Genomatica (USA), Ecolab (USA), Huntsman Corporation (USA), BioAmber (Canada), BASF SE (Germany), Covestro (Germany), Evonik Industries (Germany), Bayer CropScience (Germany), Croda International (United Kingdom), Ineos (United Kingdom), Solvay (Belgium), AkzoNobel (Netherlands), DSM (Netherlands), Clariant (Switzerland), Mitsubishi Chemical Holdings (Japan), Kuraray (Japan), Novozymes (Denmark), Borregaard (Norway), Borouge (United Arab Emirates), SABIC (Saudi Basic Industries Corporation) (Saudi Arabia), Indorama Ventures (Thailand) and Other Major Players.

The Green Chemicals Market is segmented into Product Type, Source, End-Users, and region. By Product Type, the market is categorized into Bio Alcohols, Bio Organic Acids, Bio Ketones, Bio Polymers, Bio Solvents. By Source, the market is categorized into Plant-Based, Algae-Based, Bio-Waste. By End-users, the market is categorized into Construction, Pharmaceuticals, Food & Beverages, Paints & Coatings, Agriculture, Automotive, Textile. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Green chemicals, also known as sustainable or environmentally friendly chemicals, refer to substances that are designed and produced with a focus on minimizing their impact on the environment and human health. These chemicals are developed through processes that reduce or eliminate the use of hazardous substances, energy consumption, and waste generation.

Green Chemicals Market Size Was Valued at USD 104.62 Billion in 2023, and is Projected to Reach USD 221.3 Billion by 2032, Growing at a CAGR of 9.8% From 2024-2032.