Micro Tube Box Market Synopsis

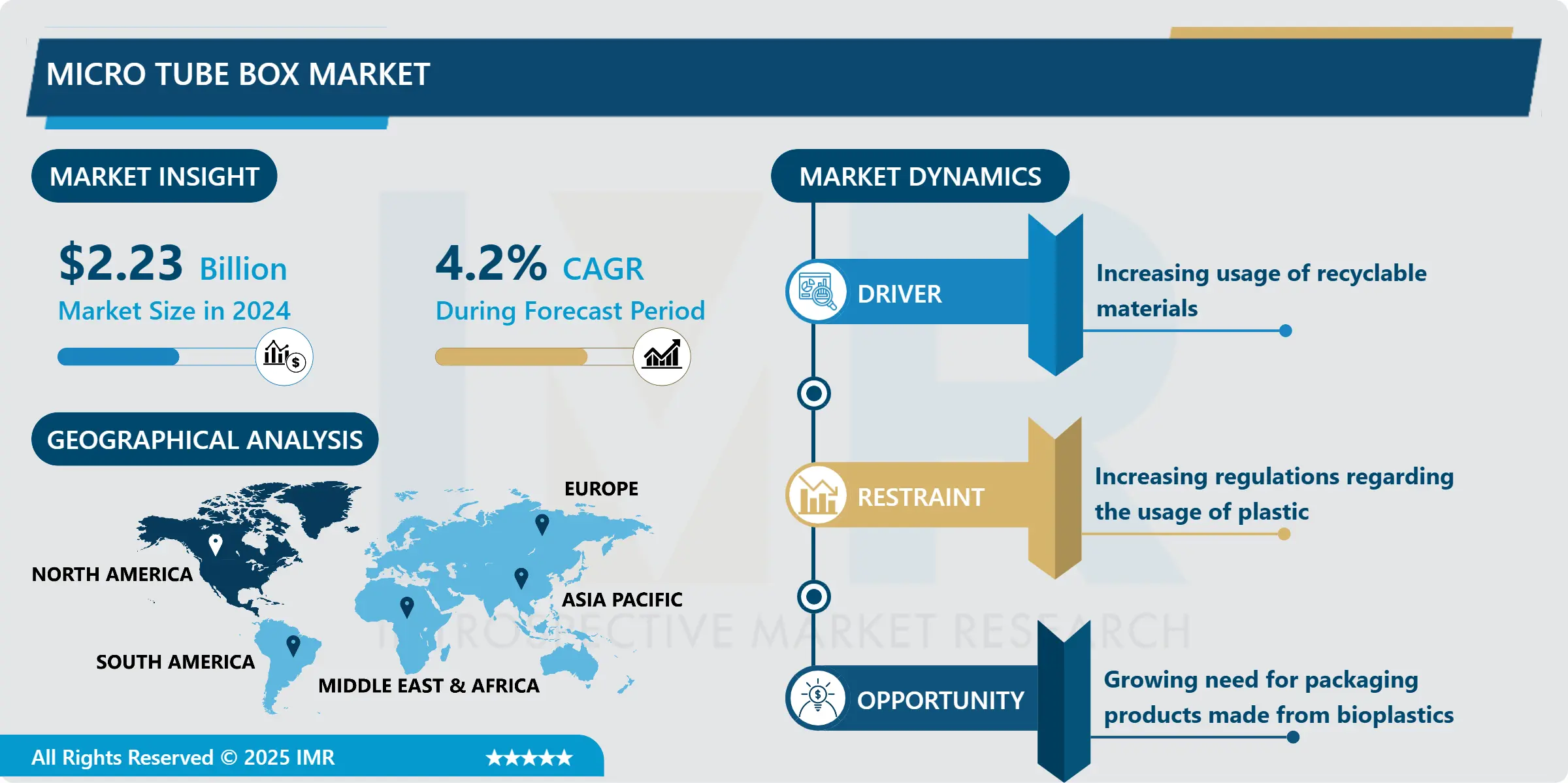

Micro Tube Box Market Size Was Valued at USD 2.23 Billion in 2024, and is Projected to Reach USD 3.51 Billion by 2035, Growing at a CAGR of 4.2% From 2025-2035.

Microtubes are frequently employed for sample storage and analysis in numerous environments. The Microtube Box Market provides various boxes specifically made to safely store and arrange microtubes, meeting the requirements of various scientific fields. The traditional microtube box has a grid design with spaces for storing microtubes, typically constructed from strong materials such as polypropylene. Screw-cap microtube boxes with enhanced sealing for sample safety are increasingly becoming popular, particularly for storing sensitive samples. Certain microtube boxes have integrated functionalities to simplify sample monitoring and recognition, such as color-coding, compatibility with barcodes, and the choice of alphanumeric labeling, which enhances sample handling efficiency and minimizes mistakes.

Progress in material science has resulted in the creation of recyclable materials that offer equal levels of protection and performance compared to conventional options. Advanced recycling techniques have simplified and made it affordable to recycle materials in small tube containers, which cuts costs and makes recycling options more attractive for producers. Utilizing recyclable materials in microtube boxes can help companies stand out in the market, giving them a competitive advantage. In spite of the increased upfront expenses, savings, in the long run, can be attained by cutting waste management costs and adhering to regulations. Changes in the supply chain are needed in order to adapt to the transition to recyclable materials, meaning manufacturers must find top-notch recyclable materials and may need to make investments in new equipment or procedures.

Micro Tube Box Market Trend Analysis

Increasing usage of recyclable materials

- Increased awareness of the environmental impact of plastic waste is driving a shift towards using recyclable materials for packaging, like micro tube boxes in laboratories and the medical field. Companies place importance on reducing their carbon footprint, and utilizing recyclable materials is crucial in cutting down on waste and safeguarding natural resources. It is essential to adopt sustainable strategies in order to address environmental problems effectively.

- Regulatory pressures, such as government regulations and circular economy efforts, are pushing manufacturers in the micro tube box industry to transition to recyclable materials. Numerous governments are enforcing stricter regulations on plastics that cannot be recycled, prompting companies to adopt more sustainable practices in order to comply with these rules and promote circular economy principles.

- Environmentally conscious consumers choose products with sustainable packaging as their top priority when making purchasing decisions. Producers in the micro tube box industry are satisfying this need by providing materials that can be recycled. Businesses are implementing corporate social responsibility initiatives that emphasize sustainability, showing dedication to environmental conservation with the use of recyclable packaging.

Opportunity

Growing need for packaging products made from bioplastics

- Traditional plastics contribute to environmental pollution by generating non-biodegradable waste that accumulates in both landfills and oceans. Bioplastics, derived from materials like corn starch and cellulose, can either break down naturally or be converted into compost, reducing the environmental impact of plastic waste. This shift aligns with efforts to reduce reliance on finite fossil fuels and promote sustainable resource management.

- Consumers are increasingly interested in eco-friendly packaging options like bioplastics. Businesses can attract customers who care about the environment and enhance their brand reputation by using environmentally friendly packaging materials. This can provide a competitive edge in a market that prioritizes sustainability. Advancements in bioplastic technology have enhanced performance, resulting in increased durability and protection.

- As production increases, bioplastics are becoming more cost-efficient compared to traditional plastics. This allows for broader usage in the micro tube box industry, offering unique features to safeguard delicate items. Incorporating bioplastics into the supply chain requires finding trustworthy materials and adjusting production methods. This might mean establishing new vendor partnerships or making investments in production capabilities. Adjustments may be necessary to machinery or techniques; however, the advantages of sustainability are greater.

Micro Tube Box Market Segment Analysis:

Micro Tube Box Market Segmented based on Capacity, Application, Material, End-User, And Region.

By Material, Polypropylene Segment Is Expected to Dominate the Market During the Forecast Period

- Polypropylene exhibits versatility and high performance, featuring superb chemical resistance that hinders contamination in laboratory environments. Its durability and toughness make it perfect for microtube boxes, keeping them safe and secure during frequent handling, storage, and transportation. Polypropylene exhibits thermal resistance, enduring elevated temperatures needed for sterilization methods such as autoclaving.

- It is essential for microtube containers in medical or laboratory environments to preserve the integrity of samples. It also possesses a low-temperature resistance, which is crucial for cryogenic storage to maintain samples at extremely cold temperatures. Polypropylene is more budget-friendly than materials such as polycarbonate or PET, which is why it is a popular choice for manufacturers of top-notch micro tube boxes. The effective manufacturing process enables the shaping of polypropylene micro tube boxes into different sizes and forms, ultimately cutting down on costs.

- The extensive global presence of polypropylene guarantees a dependable supply chain for producing micro tube boxes. Having suppliers who adhere to consistent quality standards ensures that the boxes meet required specifications, making polypropylene a favoured material for mass production. Polypropylene's light weight makes it easy to handle and transport micro tube boxes in laboratory environments. Its ability to be recycled meets the need for environmentally friendly packaging, although it is not as environmentally friendly as paperboard. This characteristic adds to its attractiveness in markets that prioritize reducing environmental impact.

By End-User, Research Institute Segment Held the Largest Share In 2024

- Research institutions engage in numerous research projects spanning genetics, molecular biology, biochemistry, and clinical research, each with unique requirements. In genomics and drug discovery, experiments on a large scale necessitate micro tube boxes for storing and organizing biological samples. Maintaining a steady stream of these containers is essential for precise and replicable outcomes.

- Research institutions obtain significant funding for research and innovation, enabling them to acquire premium laboratory equipment such as micro tube boxes. Government grants, private sector investments, and institutional funding all contribute to this financial support. Institutions prioritize innovation by utilizing trustworthy instruments to investigate novel technologies, treatments, and approaches in their state-of-the-art studies.

- Research institutions manage a variety of biological samples, including DNA, RNA, proteins, and cells. Specific micro tube containers are necessary to store and handle these samples in order to preserve their integrity and stability. Biobanks and other research facilities need to have well-organized and labelled sample libraries, leading to a high demand for micro tube boxes to effectively manage samples in different research settings.

Micro Tube Box Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is home to robust healthcare and biotechnology facilities, including advanced healthcare systems found in the United States and Canada. The area houses top biotech and pharma firms which rely on top-notch lab equipment such as micro tube boxes for handling, moving, and examining vital biological samples essential for drug research and development. North American companies are at the forefront of developing micro tube boxes using cutting-edge materials and eco-friendly methods, enhancing efficiency and customer attraction.

- The United States is at the forefront of global research and development spending, especially in life sciences, biotechnology, and pharmaceuticals, driving the need for products such as micro tube boxes in laboratories. Top research institutions and laboratories in North America need dependable micro tube boxes for their daily work, leading to increased demand in the area. The demand for standardized and reliable micro tube boxes for automated processes has been created by the early adoption of automation in laboratories.

- The stringent regulatory standards in North America guarantee safety and quality for medical and laboratory equipment such as micro tube boxes. This set of regulations encourages the production of high-quality products, helping the region maintain its market leadership. Moreover, sustainability is emphasized, promoting the utilization of environmentally-friendly materials in packaging and laboratory supplies, resulting in higher interest in sustainable micro tube boxes and expansion of the market.

Micro Tube Box Market Active Players

- Thermo Fisher Scientific Inc. (USA)

- Corning Incorporated (USA)

- Greiner Bio-One International GmbH (Austria)

- Eppendorf AG (Germany)

- VWR International, LLC(USA)

- Sigma-Aldrich Corporation (USA)

- Simport Scientific (Canada)

- BioCision LLC (USA)

- Micronic BV (Netherlands)

- Ratiolab GmbH (Germany)

- Capp ApS (Denmark)

- Sarstedt AG & Co. KG (Germany)

- Starlab International GmbH (Germany)

- Heathrow Scientific LLC (USA)

- Kartell S.p.A. (Italy)

- BrandTech Scientific, Inc. (USA)

- Bio-Rad Laboratories, Inc. (USA)

- DWK Life Sciences GmbH (Germany)

- Scilogex, LLC (USA)

- Nalgene (Thermo Fisher Scientific) (USA)

- Biotix, Inc. (USA)

- Biopointe Scientific (USA)

- Alpha Laboratories Ltd. (UK)

- Cytiva (Danaher Corporation) (USA)

- Grenova Inc. (USA)

Key Industry Developments in the Micro Tube Box Market:

- In Jan 2024, Galapagos entered into a strategic collaboration agreement with Thermo Fisher Scientific to further expand its decentralized CAR-T manufacturing network in the U.S.

- In May 2023, Thermo Fisher Scientific & Pfizer Partner to Expanded Localized Access to Next Generation Sequencing-Based Testing for Cancer Patients in International Markets.

|

Micro Tube Box Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 3.51 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Application |

|

||

|

By Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Micro Tube Box Market by Capacity (2018-2035)

4.1 Micro Tube Box Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Up to 50 Tubes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 51 to 100 Tubes

4.5 100 to 150 Tubes

4.6 Above 150 Tubes

Chapter 5: Micro Tube Box Market by Application (2018-2035)

5.1 Micro Tube Box Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Biological

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medicine

5.5 Chemical

Chapter 6: Micro Tube Box Market by Material (2018-2035)

6.1 Micro Tube Box Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Plastic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Polyethylene

6.5 Polycarbonate

6.6 Polyethylene Terephthalate

6.7 Polypropylene

6.8 Paperboard

Chapter 7: Micro Tube Box Market by End-User (2018-2035)

7.1 Micro Tube Box Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Biotechnology

7.5 Research Institute

7.6 Diagnostics Centre

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Micro Tube Box Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THERMO FISHER SCIENTIFIC INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CORNING INCORPORATED (USA)

8.4 GREINER BIO-ONE INTERNATIONAL GMBH (AUSTRIA)

8.5 EPPENDORF AG (GERMANY)

8.6 VWR INTERNATIONAL

8.7 LLC(USA)

8.8 SIGMA-ALDRICH CORPORATION (USA)

8.9 SIMPORT SCIENTIFIC (CANADA)

8.10 BIOCISION LLC (USA)

8.11 MICRONIC BV (NETHERLANDS)

8.12 RATIOLAB GMBH (GERMANY)

8.13 CAPP APS (DENMARK)

8.14 SARSTEDT AG & CO. KG (GERMANY)

8.15 STARLAB INTERNATIONAL GMBH (GERMANY)

8.16 HEATHROW SCIENTIFIC LLC (USA)

8.17 KARTELL S.P.A. (ITALY)

8.18 BRANDTECH SCIENTIFIC INC. (USA)

8.19 BIO-RAD LABORATORIES INC. (USA)

8.20 DWK LIFE SCIENCES GMBH (GERMANY)

8.21 SCILOGEX

8.22 LLC (USA)

8.23 NALGENE (THERMO FISHER SCIENTIFIC) (USA)

8.24 BIOTIX INC. (USA)

8.25 BIOPOINTE SCIENTIFIC (USA)

8.26 ALPHA LABORATORIES LTD. (UK)

8.27 CYTIVA (DANAHER CORPORATION) (USA)

8.28 GRENOVA INC. (USA)

Chapter 9: Global Micro Tube Box Market By Region

9.1 Overview

9.2. North America Micro Tube Box Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Capacity

9.2.4.1 Up to 50 Tubes

9.2.4.2 51 to 100 Tubes

9.2.4.3 100 to 150 Tubes

9.2.4.4 Above 150 Tubes

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Biological

9.2.5.2 Medicine

9.2.5.3 Chemical

9.2.6 Historic and Forecasted Market Size by Material

9.2.6.1 Plastic

9.2.6.2 Polyethylene

9.2.6.3 Polycarbonate

9.2.6.4 Polyethylene Terephthalate

9.2.6.5 Polypropylene

9.2.6.6 Paperboard

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Pharmaceutical

9.2.7.2 Biotechnology

9.2.7.3 Research Institute

9.2.7.4 Diagnostics Centre

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Micro Tube Box Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Capacity

9.3.4.1 Up to 50 Tubes

9.3.4.2 51 to 100 Tubes

9.3.4.3 100 to 150 Tubes

9.3.4.4 Above 150 Tubes

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Biological

9.3.5.2 Medicine

9.3.5.3 Chemical

9.3.6 Historic and Forecasted Market Size by Material

9.3.6.1 Plastic

9.3.6.2 Polyethylene

9.3.6.3 Polycarbonate

9.3.6.4 Polyethylene Terephthalate

9.3.6.5 Polypropylene

9.3.6.6 Paperboard

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Pharmaceutical

9.3.7.2 Biotechnology

9.3.7.3 Research Institute

9.3.7.4 Diagnostics Centre

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Micro Tube Box Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Capacity

9.4.4.1 Up to 50 Tubes

9.4.4.2 51 to 100 Tubes

9.4.4.3 100 to 150 Tubes

9.4.4.4 Above 150 Tubes

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Biological

9.4.5.2 Medicine

9.4.5.3 Chemical

9.4.6 Historic and Forecasted Market Size by Material

9.4.6.1 Plastic

9.4.6.2 Polyethylene

9.4.6.3 Polycarbonate

9.4.6.4 Polyethylene Terephthalate

9.4.6.5 Polypropylene

9.4.6.6 Paperboard

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Pharmaceutical

9.4.7.2 Biotechnology

9.4.7.3 Research Institute

9.4.7.4 Diagnostics Centre

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Micro Tube Box Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Capacity

9.5.4.1 Up to 50 Tubes

9.5.4.2 51 to 100 Tubes

9.5.4.3 100 to 150 Tubes

9.5.4.4 Above 150 Tubes

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Biological

9.5.5.2 Medicine

9.5.5.3 Chemical

9.5.6 Historic and Forecasted Market Size by Material

9.5.6.1 Plastic

9.5.6.2 Polyethylene

9.5.6.3 Polycarbonate

9.5.6.4 Polyethylene Terephthalate

9.5.6.5 Polypropylene

9.5.6.6 Paperboard

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Pharmaceutical

9.5.7.2 Biotechnology

9.5.7.3 Research Institute

9.5.7.4 Diagnostics Centre

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Micro Tube Box Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Capacity

9.6.4.1 Up to 50 Tubes

9.6.4.2 51 to 100 Tubes

9.6.4.3 100 to 150 Tubes

9.6.4.4 Above 150 Tubes

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Biological

9.6.5.2 Medicine

9.6.5.3 Chemical

9.6.6 Historic and Forecasted Market Size by Material

9.6.6.1 Plastic

9.6.6.2 Polyethylene

9.6.6.3 Polycarbonate

9.6.6.4 Polyethylene Terephthalate

9.6.6.5 Polypropylene

9.6.6.6 Paperboard

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Pharmaceutical

9.6.7.2 Biotechnology

9.6.7.3 Research Institute

9.6.7.4 Diagnostics Centre

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Micro Tube Box Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Capacity

9.7.4.1 Up to 50 Tubes

9.7.4.2 51 to 100 Tubes

9.7.4.3 100 to 150 Tubes

9.7.4.4 Above 150 Tubes

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Biological

9.7.5.2 Medicine

9.7.5.3 Chemical

9.7.6 Historic and Forecasted Market Size by Material

9.7.6.1 Plastic

9.7.6.2 Polyethylene

9.7.6.3 Polycarbonate

9.7.6.4 Polyethylene Terephthalate

9.7.6.5 Polypropylene

9.7.6.6 Paperboard

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Pharmaceutical

9.7.7.2 Biotechnology

9.7.7.3 Research Institute

9.7.7.4 Diagnostics Centre

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Micro Tube Box Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 3.51 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Application |

|

||

|

By Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||