Global Medical Simulation Market Overview

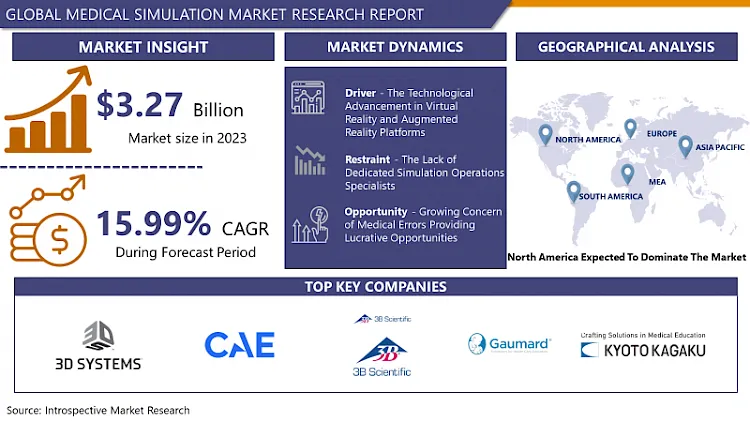

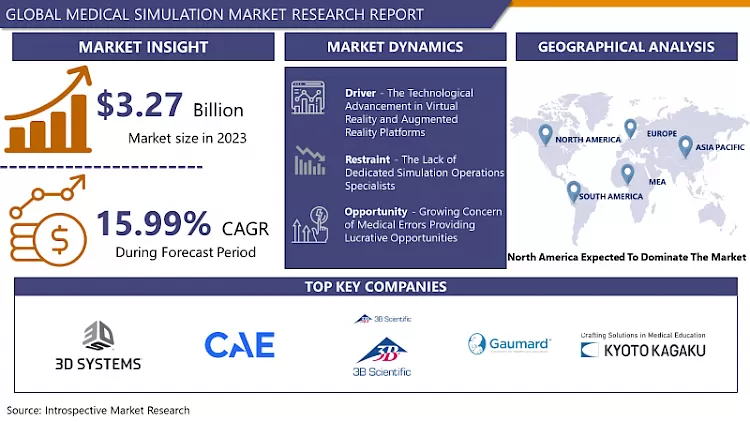

The Global Medical Simulation Market size is expected to grow from USD 3.27 Billion in 2023 to USD 12.43 Billion by 2032, at a CAGR of 15.99% during the forecast period (2024-2032)

The role of telematics and virtual simulations as a constructive educational method for both technical and non-technical skill have been already demonstrated throughout the years in several educational methods. Medical simulation in the healthcare system builds a safe learning environment, for practitioners and researchers to test new clinical processes and improve their teams' and individuals' skills. Most of the simulation methods are comprised of artificial patients, that display symptom, and also respond to the simulated treatment. This enables specialists to upgrade their clinical skills without risking patient lives. Additionally, a trainee can make mistakes and then learn from them without putting patients' lives at risk. Medical simulation techniques are utilized by academic institutes, hospitals, military organizations, and researchers. The growing number of healthcare professionals has escalated the demand for hands-on patient techniques. According to the article Medical Error Reduction and Prevention, medical errors cost approximately US$ 20 billion each year and roughly 100,000 people die due to medical errors in hospitals and clinics. Thus, to prevent medical errors, medical simulation procedures can be extensively utilized thereby, strengthening the expansion of the market over the projected period.

Market Dynamics and Key Factors in Medical Simulation Market:

Drivers:

The technological advancement in Virtual Reality and Augmented Reality platforms has created new methods to deliver health education while promoting safety. Medical simulation creates educational opportunities for multiple healthcare professionals to come together and improve the quality of patient care. It also helps in developing teamwork in a situation like medical crises, based on principles of structured communication, effective assertion, active information sharing, and a shared understanding of psychological safety, situational awareness, and effective leadership behaviors. Medical simulation provides scheduled, valuable learning experiences that cannot be achieved through traditional teaching methods. Medical simulation enhances learners' qualities such as hands-on and thinking skills, including knowledge-in-action, procedures, decision-making, and effective communication.

Moreover, critical teamwork behaviors such as managing high workload, trapping errors, and coordinating under stress can be taught and practiced through medical simulation methods. Training covers everything from preventive care to invasive surgery. Many clinical situations can be simulated at will, these learning opportunities can be planned at convenient times and locations and can be repeated as needed. Medical simulation techniques can be utilized to help distant students in performing surgeries and other processes together. Medical simulation is a well-known application to train and prepare healthcare workers for difficult and hazardous scenarios. In particular, simulation enhances healthcare workers' skills and can be utilized to validate protocols, identify threats and issues, and test solutions thus, helping the expansion of the medical simulation market during the analysis period.

Restraints:

The lack of dedicated simulation operations specialists (SimOps) is the major factor hindering the expansion of the medical simulation market in some regions. Moreover, most of the simulators utilized currently are expensive and require regular updates of the software. In developing regions, the medical simulation centers rely heavily on government and private fundings. Recently due to economic crises in some countries, the fundings for medical simulators have been diverted thus, the expansion of the medical simulator market in these countries is restricted.

Opportunities:

Faculty are beginning to get trained in simulators and are consequently understanding their importance, especially for patient safety and teaching diverse behavioral skills. Recently there has been an unprecedented rise in the adoption of medical simulators in developed economies and the developing countries are following their lead. Simulation societies are now actively educating teaching faculty across healthcare disciplines through faculty development programs and conferences. Furthermore, the growing concern of medical errors has promoted all the end-users to adopt medical simulators to reduce the cost generated due to medical errors and prevent people from dying thus, creating a profitable opportunity for the market players involved in the medical simulation market.

Market Segmentation

Depending on products and services, the healthcare anatomical models' segment is expected to dominate the medical simulation market during the projected period. Anatomical models help surgeons to plan and practice for operations. Cardiac and brain surgeries have been a vital challenge for surgeons owing to the complex nature of these surgeries and the need for highly skilled professionals thus, anatomical models can be utilized to promote patient safety in these complex operative procedures. Healthcare anatomical models can be used to simulate ultrasound, dental, endovascular, and eye operations and to teach common individuals about CPR techniques thus, supporting the growth of healthcare anatomical models' segment.

Depending on end-users, the academic institute's segment is forecasted to lead the medical simulation market over the forecast period. The increased awareness about patient safety and to produce the best healthcare professionals is stimulating academic institutes to adopt medical simulation methods. Moreover, to support the development of academic institutes there has been an increase in fundings from the government as well as from private entities. Academic institutes play a vital role in elevating the standard of learning thus, strengthening segments' growth.

Depending on fidelity, the high-fidelity segment is anticipated to have the highest CAGR in the analysis period. The high-fidelity simulation used in healthcare education methodology involves the usage of sophisticated life-like manikins in realistic patient environments. These high-fidelity simulators are similar to human anatomy and physiology. High-fidelity manikins can perform functions characterized by humans such as expanding chests to breathe, palpable pulses, variable heart rates and tones, and measurable blood pressure. Procedures such as bag-mask ventilation, intubation, defibrillation, chest tube placement, cricothyrotomy, and others can be performed on the manikins. Some high-fidelity simulators are specifically designed to portray clinical situations such as trauma manikins with severely damaged or missing limbs, newborn or premature babies, birthing manikins that mimic a woman during labor, and delivery and smaller pediatric manikins. High-fidelity manikins create more realistic clinical scenarios and thus help in enhancing the skills of learners thereby, fueling the growth of the high-fidelity segment.

Players Covered in Medical Simulation market are :

- 3D Systems (US)

- CAE (Canada)

- 3B Scientific (Germany)

- Gaumard Scientific Company (US)

- Kyoto Kagaku (Japan)

- Laerdal Medical (Norway)

- Limbs & Things (UK)

- IP Group plc (UK)

- Mentice AB (US)

- Operative Experience Inc. (US)

- Simulab Corporation (US)

- Simulaids (UK)

- SynBone AG (Switzerland)

- VirtaMed AG (Switzerland)

- VRMagic Holding AG (Germany)

- Surgical Science (Sweden) and other major players.

Regional Analysis of Medical Simulation Market:

The North American region is forecasted to have the highest share of the medical simulation market in the forecast period attributed to the presence of prominent service providers and the high adoption rate of emerging technologies. Moreover, to enhance patient safety, medical simulation is widely utilized by institutes and hospitals to raise the standard of teaching methods. The supportive government stands such as the USA simulation program which aims at delivering high-quality, realistic simulated clinical learning experiences for health/medical professions students and clinicians, to prepare them for an advancing healthcare system, is consolidating the expansion of the medical simulation market in this region.

The European region is anticipated to have the second-highest share of the medical simulation market during the projected period owing to the rapid technological advancements in the healthcare system, and the growing popularity of virtual and online training amid the COVID-19 pandemic. The academic institutes in this region are focused on preparing students and clinicians to provide the highest levels of healthcare facilities across populations and communities, thus, there has been a significant rise in the usage of simulation methods in the healthcare sector.

The Asia-Pacific region is expected to develop at the highest CAGR over the analysis period. The growing inclination towards simulation techniques to improve healthcare facilities and the increasing demand of healthcare professionals for hands-on patient training are the main factors supporting the development of the medical simulation market in this region. Recently, there has been an upsurge in the number of centers offering medical simulation services, and healthcare fundings. The strategic collaborations and agreements between companies are enhancing the technologies utilized in the medical simulation thus, strengthening the development of the market in this region.

Recent Industry Developments in Medical Simulation Market:

- In January 2024, GigXR Inc., a global provider of extended reality (XR) solutions for healthcare training, and CAE Healthcare announced their partnership to enhance the efficiency and effectiveness of clinical simulation. The collaboration between GigXR and CAE Healthcare streamlines the ability to implement and manage multimodal simulation for medical schools, nursing schools, hospital systems, first responders, and government – spanning analog, immersive, and digital modalities that can be used to create full curricula.

- In August 2023, 3B Scientific, a leading manufacturer and marketer of medical simulation products and anatomical models for healthcare education, announced that it has reached an agreement to acquire Lifecast Body Simulation.

|

Global Medical Simulation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 3.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.99% |

Market Size in 2032: |

USD 12.43 Bn. |

|

Segments Covered: |

By Fidelity |

|

|

|

By Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Simulation Market by Fidelity (2018-2032)

4.1 Medical Simulation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Low

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium

4.5 High

Chapter 5: Medical Simulation Market by Type (2018-2032)

5.1 Medical Simulation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Healthcare Anatomical Models

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Web-Based Simulators

5.5 Healthcare Simulation Software

5.6 Simulation Training Services

Chapter 6: Medical Simulation Market by End-User (2018-2032)

6.1 Medical Simulation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Academic Institutes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospitals

6.5 Military Organization

6.6 Research

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Simulation Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BIO-RAD LABORATORIES INC. (US) DIASORIN SPA (ITALY)BAG HEALTH CARE GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GRIFOLS INTERNATIONAL SA (SPAIN)

7.4 HOLOGIC INC. (THE US)

7.5 IMMUCOR INC. (THE US)

7.6 ABBOTT LABORATORIES (US)

7.7 ORTHO CLINICAL DIAGNOSTICS INC. (THE US)

7.8 QUOTIENT LTD (SWITZERLAND)

7.9 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

Chapter 8: Global Medical Simulation Market By Region

8.1 Overview

8.2. North America Medical Simulation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Fidelity

8.2.4.1 Low

8.2.4.2 Medium

8.2.4.3 High

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Healthcare Anatomical Models

8.2.5.2 Web-Based Simulators

8.2.5.3 Healthcare Simulation Software

8.2.5.4 Simulation Training Services

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Academic Institutes

8.2.6.2 Hospitals

8.2.6.3 Military Organization

8.2.6.4 Research

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medical Simulation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Fidelity

8.3.4.1 Low

8.3.4.2 Medium

8.3.4.3 High

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Healthcare Anatomical Models

8.3.5.2 Web-Based Simulators

8.3.5.3 Healthcare Simulation Software

8.3.5.4 Simulation Training Services

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Academic Institutes

8.3.6.2 Hospitals

8.3.6.3 Military Organization

8.3.6.4 Research

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medical Simulation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Fidelity

8.4.4.1 Low

8.4.4.2 Medium

8.4.4.3 High

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Healthcare Anatomical Models

8.4.5.2 Web-Based Simulators

8.4.5.3 Healthcare Simulation Software

8.4.5.4 Simulation Training Services

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Academic Institutes

8.4.6.2 Hospitals

8.4.6.3 Military Organization

8.4.6.4 Research

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medical Simulation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Fidelity

8.5.4.1 Low

8.5.4.2 Medium

8.5.4.3 High

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Healthcare Anatomical Models

8.5.5.2 Web-Based Simulators

8.5.5.3 Healthcare Simulation Software

8.5.5.4 Simulation Training Services

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Academic Institutes

8.5.6.2 Hospitals

8.5.6.3 Military Organization

8.5.6.4 Research

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medical Simulation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Fidelity

8.6.4.1 Low

8.6.4.2 Medium

8.6.4.3 High

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Healthcare Anatomical Models

8.6.5.2 Web-Based Simulators

8.6.5.3 Healthcare Simulation Software

8.6.5.4 Simulation Training Services

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Academic Institutes

8.6.6.2 Hospitals

8.6.6.3 Military Organization

8.6.6.4 Research

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medical Simulation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Fidelity

8.7.4.1 Low

8.7.4.2 Medium

8.7.4.3 High

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Healthcare Anatomical Models

8.7.5.2 Web-Based Simulators

8.7.5.3 Healthcare Simulation Software

8.7.5.4 Simulation Training Services

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Academic Institutes

8.7.6.2 Hospitals

8.7.6.3 Military Organization

8.7.6.4 Research

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Medical Simulation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 3.27 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.99% |

Market Size in 2032: |

USD 12.43 Bn. |

|

Segments Covered: |

By Fidelity |

|

|

|

By Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Medical Simulation Market research report is 2024-2032.

3D Systems (US),CAE (Canada), 3B Scientific (Germany), Gaumard Scientific Company (US), Kyoto Kagaku (Japan), Laerdal Medical (Norway), Limbs & Things (UK), IP Group plc (UK), Mentice AB (US), Operative Experience Inc. (US), Simulab Corporation (US), Simulaids (UK), SynBone AG (Switzerland), VirtaMed AG (Switzerland), VRMagic Holding AG (Germany), Surgical Science (Sweden), and Other Major Players.

Medical Simulation Market is segmented into Fidelity, Type, End-User and region. By Fidelity, the market is categorized into Low, Medium, and High. By Type, the market is categorized into Healthcare Anatomical Models, Web-Based Simulators, Healthcare Simulation Software, and Simulation Training Services. By End-User, the market is categorized into Academic Institutes, Hospitals, Military Organization, Research, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Medical simulation in the healthcare system builds a safe learning environment, for practitioners and researchers to test new clinical processes and improve their teams' and individuals' skills

The Global Medical Simulation Market size is expected to grow from USD 3.27 Billion in 2023 to USD 12.43 Billion by 2032, at a CAGR of 15.99% during the forecast period (2024-2032)