Industrial Services Market Synopsis

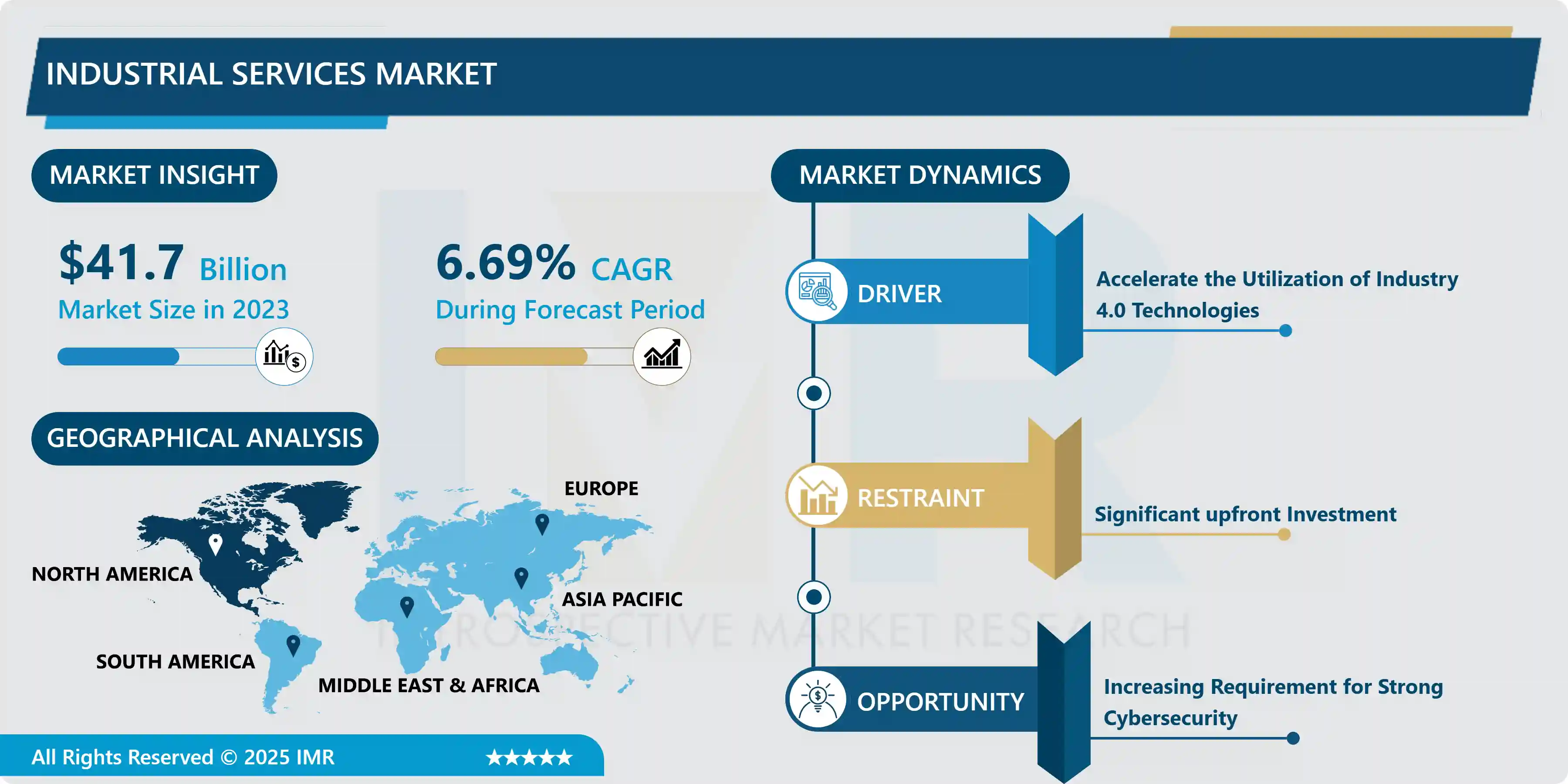

Industrial Services Market Size Was Valued at USD 41.7 Billion in 2023 and is Projected to Reach USD 74.69 Billion by 2032, Growing at a CAGR of 6.69% From 2024-2032.

Industrial services market is an economic sector that includes a wide range of services for companies operating in various industries. Specialized services are commonly provided to industrial companies. The market includes both specialized service providers and internal services of industrial organizations.

Industrial service applications span a wide range of industries, from manufacturing and logistics to energy and construction. These services play a key role in operational efficiency, maintenance, and safety in all industries. Benefits of industrial services include smoother operations, reduced downtime through preventative maintenance, improved safety protocols, and access to specialist expertise. This means cost savings, improved productivity, and better overall performance for businesses.

Industrial service demand is expected to grow significantly in the future due to various factors. These include advances such as the Internet of Things, artificial intelligence, and automation that enable predictive maintenance and real-time monitoring. Additionally, industrial processes are becoming more complex, and sustainable practices require the assistance of specialists. As the industry evolves, reliance on outsourcing non-core functions to specialists increases, increasing demand for industrial service providers.

The industrial services sector is expected to experience continued growth as industries prioritize efficiency, sustainability and safety. Emerging trends such as digitization, remote monitoring and data analytics continue to shape the landscape and create new opportunities for service providers. With its focus on innovation and customized solutions, the industrial services sector is well-positioned to meet the changing needs of modern businesses in various sectors.

Industrial Services Market Trend Analysis

Accelerate the Utilization of Industry 4.0 Technologies

- The widespread adoption of Industry 4.0 technologies stands out as an important catalyst that accelerates the growth of the industrial service market. These advanced technologies, including IoT, artificial intelligence, big data analytics, and robotics, are revolutionizing industrial operations and asset maintenance. For instance, predictive maintenance powered by IoT sensors allows companies to identify equipment problems before they escalate, reducing downtime and improving overall efficiency.

- The growing adoption of Industry 4.0 technologies is an effort to improve operations. Enterprises use data-driven insights from connected devices to optimize their processes, streamline workflows, and make informed decisions. This leads to better productivity, cost savings, and competitive advantages in the market.

- In addition, Industry 4.0 technologies enable a move towards proactive and predictive maintenance strategies, moving away from traditional reactive approaches. By leveraging real-time data and analytics, industrial service providers can provide more efficient and customized maintenance solutions to their customers. This not only improves equipment reliability but also reduces unplanned downtime, increasing customer satisfaction and loyalty.

Increasing Requirement for Strong Cybersecurity

- The growing need for robust cyber security offers a significant opportunity for expansion of industrial services. With the rise of digitization and interconnected systems in industries, cyber security has become a primary concern. Industry service providers are uniquely positioned to take advantage of this demand by offering comprehensive cybersecurity solutions tailored to the specific needs of different sectors. For example, companies that specialize in industrial cyber security can provide services such as network security assessments, vulnerability management, and incident response planning to protect critical infrastructure and data.

- As cyber threats become increasingly sophisticated and frequent, businesses across industries are realizing the importance of proactive cyber security measures. Industry service providers can seize this opportunity by integrating advanced technologies such as AI-based threat detection, blockchain for secure data transactions, and cloud-based security solutions into their offerings. Faced with new threats and compliance requirements, these service providers can provide added value to their customers and foster long-term partnerships.

- The ever-increasing emphasis on regulatory compliance and data protection is increasing the demand for robust cybersecurity services in the industry. Service providers can use their expertise to help clients navigate complex regulatory environments, implement data protection best practices, and achieve compliance with industry standards such as GDPR or the NIST Cybersecurity Framework. Such a comprehensive approach not only reduces risks, but also improves the overall sustainability of industrial operations in an increasingly digitized environment.

Industrial Services Market Segment Analysis:

Industrial Services Market is segmented on the basis of Type, Application, and End-User.

By Type, Installation & Commissioning segment is expected to dominate the market during the forecast period

- The installation and commission segment are poised to lead the growth of the industrial services market. Included in this category are the types of work required for the establishment of new equipment, systems, or facilities in various industries. As companies invest in modernizing their infrastructure and using new technologies, the demand for professional installation and application services is increasing. Industrial service providers play an important role in this area to ensure smooth integration, optimal performance, and compliance with regulatory standards.

- The main factors driving the dominance of the installation and commissioning sector are the increasing complexity of industrial systems, the need for precision engineering, and a focus on operational efficiency. Companies rely on skilled professionals to operate complex and demanding equipment, from machines in manufacturing plants to operating systems in power plants. Growth in this sector will be driven by industries such as renewable energy, automotive, and pharmaceuticals, which require integrated processes to ensure regulatory compliance and compliance.

By End-User, Oil & Gas segment held the largest share of 28.12% in 2023

- The oil and gas sector has emerged as one of the major contributors to the growth of the industrial services market. This segment includes a range of services tailored to the unique needs of the oil and gas industry, including maintenance, inspection, engineering, and project management. Demand for industrial services in this sector is driven by ongoing operations and maintenance requirements for machinery, pipelines, offshore platforms and petrochemical plants.

- The global energy demand, continued investments in infrastructure, and increased oil and gas operations. Companies rely heavily on specialized industrial service providers as they work to optimize production, ensure safety, and meet environmental regulations. These providers contribute significantly to the overall growth and sustainability of the oil and gas sector by providing expertise in areas such as asset management, risk assessment, and compliance with industry standards.

Industrial Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to take the lead as the dominant region for the growth of the industrial services market. This region boasts a diverse industrial landscape spanning sectors such as manufacturing, energy, aerospace, automotive, and healthcare. The demand for industrial services in North America is driven by factors like technological advancements, stringent regulatory standards, and the need for efficient maintenance and optimization of industrial assets.

- The region's strong emphasis on innovation, research, and development. Industries in North America prioritize leveraging cutting-edge technologies such as IoT, AI, automation, and data analytics to enhance productivity, reduce downtime, and improve overall operational performance. Additionally, the region's proactive approach to sustainability and environmental compliance further fuels the demand for specialized industrial services tailored to eco-friendly practices. These factors collectively position North America as a key market for industrial service providers looking to capitalize on emerging opportunities and meet evolving client demands.

Industrial Services Market Top Key Players:

- Honeywell International Inc. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Cognizant Technology Solutions Corp. (U.S.)

- General Electric Company (GE) (U.S.)

- Emerson Electric Co. (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- SKF AB (Sweden)

- ABB Ltd. (Switzerland)

- SGS SA (Switzerland)

- Johnson Controls International plc (Ireland)

- Eaton Corporation plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Daikin Industries, Ltd. (Japan)

- Yokogawa Electric Corporation (Japan), and Other Major Players

Key Industry Developments in the Industrial Services Market:

- In January 2024, Honeywell and Analog Devices, Inc. announced at CES 2024 that they have entered into a Memorandum of Understanding to explore the digitization of commercial buildings by upgrading to digital connectivity technologies without replacing existing wiring, which will help reduce cost, waste, and downtime. The strategic alliance would bring this new technology to building management systems for the first time.

- In August 2023, Schneider Electric, the leader in the digital transformation of energy management and industrial automation, today launched a Managed Security Services (MSS) offering to help customers in operational technology (OT) environments address the increased cyber risk associated with the demand for remote access and connectivity technologies.

|

Global Industrial Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.69% |

Market Size in 2032: |

USD 74.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industrial Services Market by Type (2018-2032)

4.1 Industrial Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Engineering & Consulting

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Installation & Commissioning

4.5 Improvement & Maintenance

Chapter 5: Industrial Services Market by Application (2018-2032)

5.1 Industrial Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Motor & Drives

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Distribution Control System

5.5 Programmable Logic Controller

5.6 Supervisory Control & Data Acquisition

5.7 Human Machine Interface

5.8 Others

Chapter 6: Industrial Services Market by End-User (2018-2032)

6.1 Industrial Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aerospace

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Chemicals

6.6 Oil & Gas

6.7 Food & Beverages

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industrial Services Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CERNER CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AIRSTRIP TECHNOLOGIES INC (UNITED STATES)

7.4 BIONET AMERICA INC (UNITED STATES)

7.5 CLINICAL COMPUTER SYSTEMS (UNITED STATES)

7.6 CLINICOMP

7.7 INTL (UNITED STATES)

7.8 COGNITIVE MEDICAL SYSTEMS (UNITED STATES)

7.9 COOPERSURGICAL INC. (UNITED STATES)

7.10 GAUMARD SCIENTIFIC COMPANY INC. (UNITED STATES)

7.11 GENERAL ELECTRIC COMPANY (UNITED STATES)

7.12 HARMONY HEALTHCARE IT (UNITED STATES)

7.13 ILLUMINA INC. (UNITED STATES)

7.14 MEDICAL INFORMATION TECHNOLOGY INC. (UNITED STATES)

7.15 PERIGEN INC. (UNITED STATES)

7.16 K2 MEDICAL SYSTEMS LTD (UNITED KINGDOM)

7.17 HUNTLEIGH HEALTHCARE LIMITED (UNITED KINGDOM)

7.18 KONINKLIJKE PHILIPS N.V (NETHERLANDS)

7.19 QIAGEN GMBH (GERMANY)

7.20 TRIUM ANALYSIS ONLINE GMBH (GERMANY)

7.21 EDAN INSTRUMENTS INC. (CHINA)

7.22 BIONET COLTD (SOUTH KOREA)

7.23 MERIDIAN HEALTH INFORMATICS PTY LTD (AUSTRALIA)

7.24 MOCDOC.IN (INDIA)

Chapter 8: Global Industrial Services Market By Region

8.1 Overview

8.2. North America Industrial Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Engineering & Consulting

8.2.4.2 Installation & Commissioning

8.2.4.3 Improvement & Maintenance

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Motor & Drives

8.2.5.2 Distribution Control System

8.2.5.3 Programmable Logic Controller

8.2.5.4 Supervisory Control & Data Acquisition

8.2.5.5 Human Machine Interface

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Aerospace

8.2.6.2 Automotive

8.2.6.3 Chemicals

8.2.6.4 Oil & Gas

8.2.6.5 Food & Beverages

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industrial Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Engineering & Consulting

8.3.4.2 Installation & Commissioning

8.3.4.3 Improvement & Maintenance

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Motor & Drives

8.3.5.2 Distribution Control System

8.3.5.3 Programmable Logic Controller

8.3.5.4 Supervisory Control & Data Acquisition

8.3.5.5 Human Machine Interface

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Aerospace

8.3.6.2 Automotive

8.3.6.3 Chemicals

8.3.6.4 Oil & Gas

8.3.6.5 Food & Beverages

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industrial Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Engineering & Consulting

8.4.4.2 Installation & Commissioning

8.4.4.3 Improvement & Maintenance

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Motor & Drives

8.4.5.2 Distribution Control System

8.4.5.3 Programmable Logic Controller

8.4.5.4 Supervisory Control & Data Acquisition

8.4.5.5 Human Machine Interface

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Aerospace

8.4.6.2 Automotive

8.4.6.3 Chemicals

8.4.6.4 Oil & Gas

8.4.6.5 Food & Beverages

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industrial Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Engineering & Consulting

8.5.4.2 Installation & Commissioning

8.5.4.3 Improvement & Maintenance

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Motor & Drives

8.5.5.2 Distribution Control System

8.5.5.3 Programmable Logic Controller

8.5.5.4 Supervisory Control & Data Acquisition

8.5.5.5 Human Machine Interface

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Aerospace

8.5.6.2 Automotive

8.5.6.3 Chemicals

8.5.6.4 Oil & Gas

8.5.6.5 Food & Beverages

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industrial Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Engineering & Consulting

8.6.4.2 Installation & Commissioning

8.6.4.3 Improvement & Maintenance

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Motor & Drives

8.6.5.2 Distribution Control System

8.6.5.3 Programmable Logic Controller

8.6.5.4 Supervisory Control & Data Acquisition

8.6.5.5 Human Machine Interface

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Aerospace

8.6.6.2 Automotive

8.6.6.3 Chemicals

8.6.6.4 Oil & Gas

8.6.6.5 Food & Beverages

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industrial Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Engineering & Consulting

8.7.4.2 Installation & Commissioning

8.7.4.3 Improvement & Maintenance

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Motor & Drives

8.7.5.2 Distribution Control System

8.7.5.3 Programmable Logic Controller

8.7.5.4 Supervisory Control & Data Acquisition

8.7.5.5 Human Machine Interface

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Aerospace

8.7.6.2 Automotive

8.7.6.3 Chemicals

8.7.6.4 Oil & Gas

8.7.6.5 Food & Beverages

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Industrial Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.69% |

Market Size in 2032: |

USD 74.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||