General Motion Control (GMC) Market Synopsis

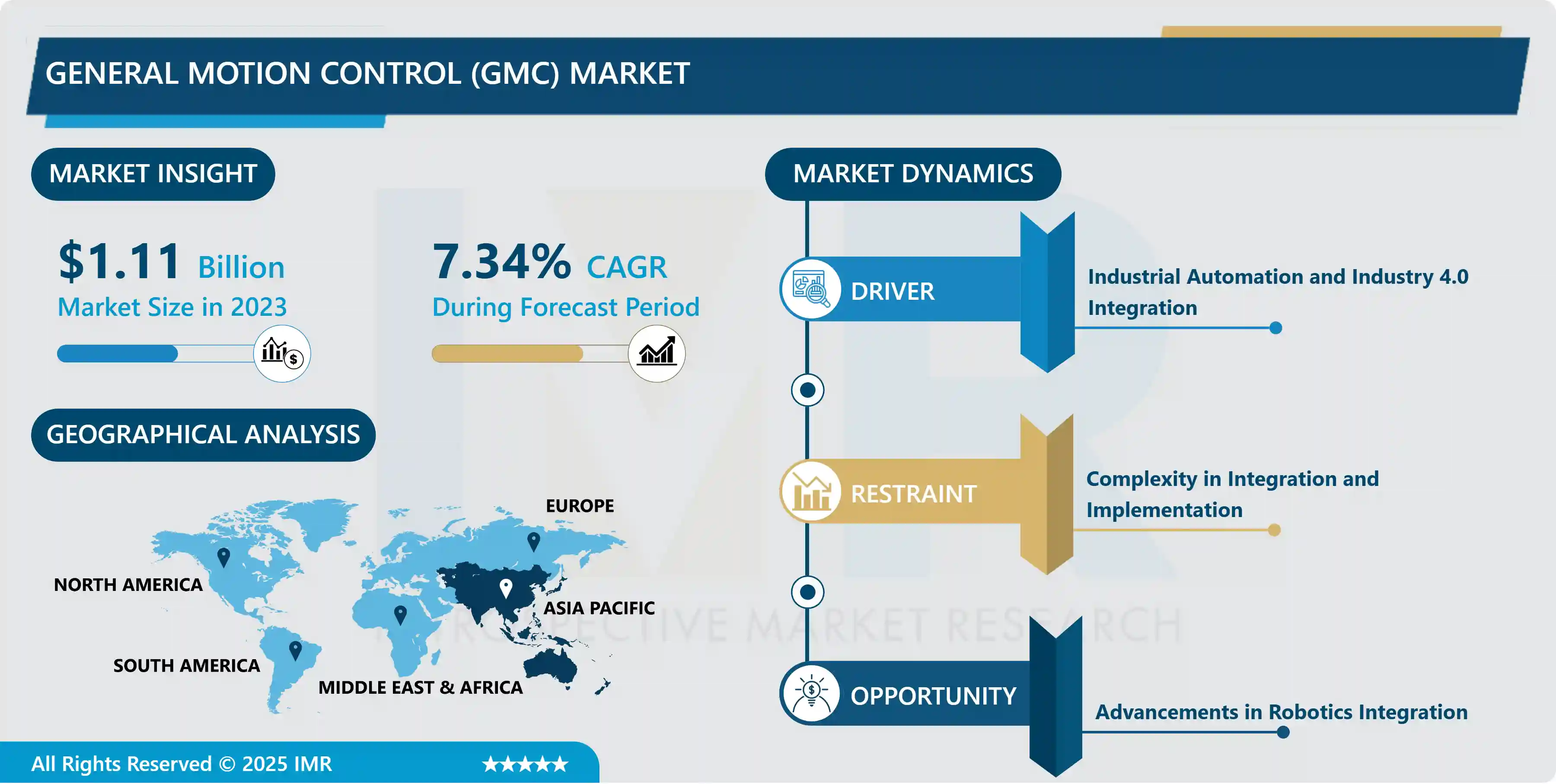

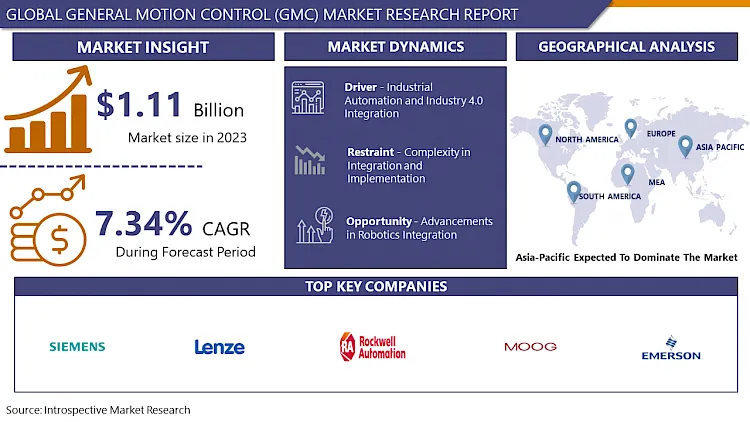

General Motion Control (GMC) Market Size Was Valued at USD 1.11 Billion in 2023, and is Projected to Reach USD 2.09 Billion by 2032, Growing at a CAGR of 7.34% From 2024-2032.

General Motion Control (GMC) refers to the systematic management and regulation of movement in various mechanical systems, such as robotics, manufacturing equipment, and vehicles. It involves the precise coordination of position, velocity, and acceleration of components to achieve desired motions. GMC systems typically utilize sensors, actuators, and controllers to monitor and adjust motion parameters, ensuring accuracy, efficiency, and safety in diverse applications. From simple tasks like conveyor belt operation to complex maneuvers in robotic arms, GMC plays a crucial role in optimizing performance and enhancing automation in modern industries.

The General Motion Control (GMC) market encompasses a wide array of technologies and applications aimed at precise movement and control in various industries. From robotics and automation to aerospace and automotive sectors, GMC solutions play a pivotal role in enhancing efficiency, productivity, and safety. Key components such as servo drives, motors, actuators, and controllers are integrated to facilitate seamless motion control across diverse applications. With the rapid advancements in sensor technology, artificial intelligence, and connectivity, GMC systems are evolving to offer higher precision, faster response times, and greater adaptability to changing environments. the increasing demand for smart manufacturing processes and the adoption of Industrial Internet of Things (IIoT) are driving the growth of the GMC market, as companies strive to optimize operations and stay competitive in today's dynamic business landscape.

the General Motion Control (GMC) market is expanding into new sectors such as healthcare, consumer electronics, and entertainment. In healthcare, GMC technologies are revolutionizing surgical procedures with precise robotic systems, improving patient outcomes and reducing recovery times. In consumer electronics, GMC enables the development of advanced gadgets like smartphones with gyroscopic sensors for motion detection and virtual reality headsets for immersive experiences. Furthermore, in the entertainment industry, GMC is utilized in theme park rides, simulators, and motion-controlled gaming consoles, enhancing the thrill and realism of virtual environments.

The GMC market is also witnessing significant innovation in software solutions, with the emergence of sophisticated algorithms for motion planning, trajectory optimization, and predictive maintenance. Machine learning and AI-powered analytics are being integrated into GMC systems to enable predictive maintenance, fault detection, and performance optimization, thereby minimizing downtime and maximizing operational efficiency. Additionally, the shift towards electrification and renewable energy sources is driving the demand for electric actuators and servo drives in automotive and renewable energy applications, further fueling the growth of the GMC market.

General Motion Control (GMC) Market Trend Analysis

Adoption of Collaborative and Autonomous Robotics

- The adoption of Collaborative and Autonomous Robotics in the General Motion Control (GMC) market is witnessing significant growth driven by advancements in technology, increased demand for automation, and the need for efficient and flexible manufacturing processes. Collaborative robotics, which work alongside humans in shared workspaces, are increasingly being deployed in various industries such as manufacturing, healthcare, and logistics, enhancing productivity and safety. These robots are equipped with advanced sensors and AI algorithms enabling them to collaborate with human workers effectively. On the other hand, Autonomous Robotics are gaining traction due to their ability to operate without human intervention, optimizing processes in industries like warehousing, agriculture, and transportation. The integration of GMC technologies further enhances the capabilities of these robots, enabling precise motion control and coordination for seamless operations. As the adoption of collaborative and autonomous robotics continues to expand, the GMC market is poised for substantial growth, offering opportunities for innovation and efficiency across diverse industries.

- The adoption of Collaborative and Autonomous Robotics in the General Motion Control (GMC) market is not only driven by technological advancements but also by evolving market dynamics such as the increasing need for agility and adaptability in manufacturing and logistics. Collaborative robotics, with their ability to work alongside human operators, facilitate a more flexible and responsive production environment, enabling quick reconfiguration and setup for diverse tasks. This versatility is particularly valuable in industries with high product variability and short production cycles. Furthermore, the rise of e-commerce and the growing demand for personalized products have spurred the adoption of Autonomous Robotics in warehousing and fulfillment centers. These robots can autonomously navigate through dynamic environments, optimizing picking, packing, and shipping processes to meet the demands of modern supply chains.

- The integration of General Motion Control technologies enhances the precision and efficiency of robotic movements, enabling smoother operation and higher throughput. As industries continue to embrace collaborative and autonomous robotics, coupled with advanced motion control capabilities, the GMC market is poised to witness sustained growth, driving innovation and reshaping the future of manufacturing and logistics.

Advancements in Robotics Integration

- The advancements in robotics integration have significantly impacted the General Motion Control (GMC) market, revolutionizing various industries such as manufacturing, healthcare, logistics, and more. These advancements have been driven by innovations in sensor technologies, artificial intelligence, and machine learning algorithms, enabling robots to perform increasingly complex tasks with precision and efficiency. One notable trend is the integration of collaborative robots, or cobots, which work alongside humans in shared workspaces, enhancing productivity and safety. the emergence of cloud computing and Internet of Things (IoT) technologies has facilitated remote monitoring and control of robotic systems, allowing for real-time optimization and predictive maintenance.

- Furthermore, advancements in robotics integration have led to the development of modular and customizable robotic systems, offering flexibility and scalability to meet diverse application requirements. These systems can be easily reconfigured and adapted to perform various tasks, reducing the need for costly and time-consuming retooling processes.

- The integration of vision systems and machine learning algorithms has enabled robots to perceive and adapt to their environments autonomously, enhancing their capabilities in tasks such as object recognition, navigation, and manipulation. This convergence of technologies has fueled innovation in areas like autonomous mobile robots (AMRs) for warehouse automation, surgical robots for minimally invasive procedures, and unmanned aerial vehicles (UAVs) for aerial inspection and surveillance. As the demand for efficient and intelligent automation solutions continues to grow, the GMC market is poised for further expansion, driving continuous innovation and shaping the future of industries worldwide.

General Motion Control (GMC) Market Segment Analysis

General Motion Control (GMC) Market Segmented based on Type and Application.

By Type, Unprocessed General Motion Control (GMC) segment is expected to dominate the market during the forecast period

- The general motion control (GMC), there exists a dual landscape characterized by processed and unprocessed solutions, each catering to distinct industrial requirements. Processed GMC systems offer streamlined and pre-configured solutions, often preferred for their plug-and-play convenience and rapid deployment. Conversely, unprocessed GMC solutions provide greater flexibility and customization options, allowing for tailored configurations to meet specific operational needs. This dichotomy underscores the dynamic nature of the GMC market, where end-users navigate trade-offs between convenience and customization based on their application demands and operational objectives.

- The industries continue to evolve and diversify, Type Analysis General Motion Control (GMC) Market exhibits a trend towards hybrid solutions that blend the advantages of both processed and unprocessed offerings, fostering innovation and driving market growth.

By Application , Industrial segment held the largest share in 2023

- The General Motion Control (GMC) market spans across various applications, each playing a crucial role in driving its growth and evolution. In the industrial sector, GMC systems are integral for enhancing operational efficiency, enabling precise control over machinery and processes, thereby optimizing production outputs. In power generation, GMC technology facilitates the precise movement and positioning of components within power plants, ensuring seamless operations and maximizing energy output. In residential settings, GMC solutions are increasingly integrated into home automation systems, offering enhanced comfort, convenience, and energy savings through intelligent control of appliances and devices.

- Moreover, in commercial environments, GMC technology enables precise motion control in diverse applications such as robotics, material handling, and manufacturing, enhancing productivity and safety standards. In transportation, GMC systems are pivotal for optimizing vehicle performance, enhancing safety, and improving passenger comfort through precise control of vehicle dynamics and subsystems. Across these diverse applications, the General Motion Control market continues to witness significant growth driven by advancements in automation, robotics, and smart technologies, catering to the evolving needs of various industries and sectors.

General Motion Control (GMC) Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is poised to exert significant dominance over the General Motion Control (GMC) market throughout the forecast period. Several factors contribute to this projection. Firstly, the region's burgeoning industrial sector, especially in countries like China, Japan, and South Korea, drives the demand for advanced motion control systems across various applications, including manufacturing, automotive, electronics, and robotics.

- Additionally, rapid urbanization and infrastructure development in emerging economies fuel the need for automation technologies, further propelling the GMC market's growth. Moreover, favorable government initiatives promoting industrial automation, coupled with increasing investments in research and development, foster innovation and adoption of advanced motion control solutions in the region. the presence of key players and established manufacturing facilities in Asia-Pacific strengthens the market's foothold, ensuring a robust supply chain and technological advancements.

Active Key Players in the General Motion Control (GMC) Market

- Rockwell Automation, Inc. (U.S.)

- Parker Hannifin Corporation (U.S.)

- Emerson Electric Co. (U.S.)

- Kollmorgen Corporation (U.S.)

- Moog Inc. (U.S.)

- Wittenstein SE (Germany)

- Lenze SE (Germany)

- Siemens AG (Germany)

- Bosch Rexroth AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd (Switzerland)

- Hitachi, Ltd (Japan)

- Fanuc Corporation (Japan)

- SMC Corporation (Japan)

- Omron Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Delta Electronics, Inc. (Taiwan), and Other Key Players

Key Industry Developments in the General Motion Control (GMC) Market

- In March 2023, Regal Rexnord Corporation successfully finalized the acquisition of Altra Industrial Motion Corp. Through this acquisition, Regal Rexnord's Power Transmission Technologies business experienced a substantial augmentation of its existing power transmission portfolio, notably in the industrial powertrain sector. The addition of complementary motion control products such as brakes, gears, and clutches enhances the overall capabilities and offerings of the business.

- In May 2023, Mitsubishi Electric Corporation and MOVENSYS Inc. forged a strategic business alliance to enhance cooperation in their individual AC servo and motion control endeavors. This partnership is designed to enable Mitsubishi Electric to broaden its AC servo business, specifically focusing on semiconductor manufacturing equipment and other applications.

|

Global General Motion Control (GMC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.34% |

Market Size in 2032: |

USD 2.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: General Motion Control (GMC) Market by Type (2018-2032)

4.1 General Motion Control (GMC) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed General Motion Control (GMC)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed General Motion Control (GMC)

Chapter 5: General Motion Control (GMC) Market by Application (2018-2032)

5.1 General Motion Control (GMC) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Power Generation

5.5 Residential

5.6 Commercial

5.7 Transportation

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 General Motion Control (GMC) Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBYY

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ADOBE

6.4 ANYLINE GMBH

6.5 ATAPY SOFTWARE

6.6 CAPTRICITY INC CREACEED S.P.R.L CVISION TECHNOLOGIES INC EXPER-OCR INC GOOGLE LLC

6.7 INTERNATIONAL BUSINESS MACHINES CORPORATION

6.8 INTSIG INFORMATION COLTD. CORPORATION

6.9 IRIS S.A LEAD TECHNOLOGIES INC MICROSOFT

6.10 NAVER CORP NUANCE COMMUNICATIONS INC OPEN TEXT CORPORATION

6.11 OTHER KEY PLAYERS

Chapter 7: Global General Motion Control (GMC) Market By Region

7.1 Overview

7.2. North America General Motion Control (GMC) Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Processed General Motion Control (GMC)

7.2.4.2 Unprocessed General Motion Control (GMC)

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Industrial

7.2.5.2 Power Generation

7.2.5.3 Residential

7.2.5.4 Commercial

7.2.5.5 Transportation

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe General Motion Control (GMC) Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Processed General Motion Control (GMC)

7.3.4.2 Unprocessed General Motion Control (GMC)

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Industrial

7.3.5.2 Power Generation

7.3.5.3 Residential

7.3.5.4 Commercial

7.3.5.5 Transportation

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe General Motion Control (GMC) Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Processed General Motion Control (GMC)

7.4.4.2 Unprocessed General Motion Control (GMC)

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Industrial

7.4.5.2 Power Generation

7.4.5.3 Residential

7.4.5.4 Commercial

7.4.5.5 Transportation

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific General Motion Control (GMC) Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Processed General Motion Control (GMC)

7.5.4.2 Unprocessed General Motion Control (GMC)

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Industrial

7.5.5.2 Power Generation

7.5.5.3 Residential

7.5.5.4 Commercial

7.5.5.5 Transportation

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa General Motion Control (GMC) Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Processed General Motion Control (GMC)

7.6.4.2 Unprocessed General Motion Control (GMC)

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Industrial

7.6.5.2 Power Generation

7.6.5.3 Residential

7.6.5.4 Commercial

7.6.5.5 Transportation

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America General Motion Control (GMC) Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Processed General Motion Control (GMC)

7.7.4.2 Unprocessed General Motion Control (GMC)

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Industrial

7.7.5.2 Power Generation

7.7.5.3 Residential

7.7.5.4 Commercial

7.7.5.5 Transportation

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global General Motion Control (GMC) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.11 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.34% |

Market Size in 2032: |

USD 2.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||