Global Feed Packaging Market Synopsis

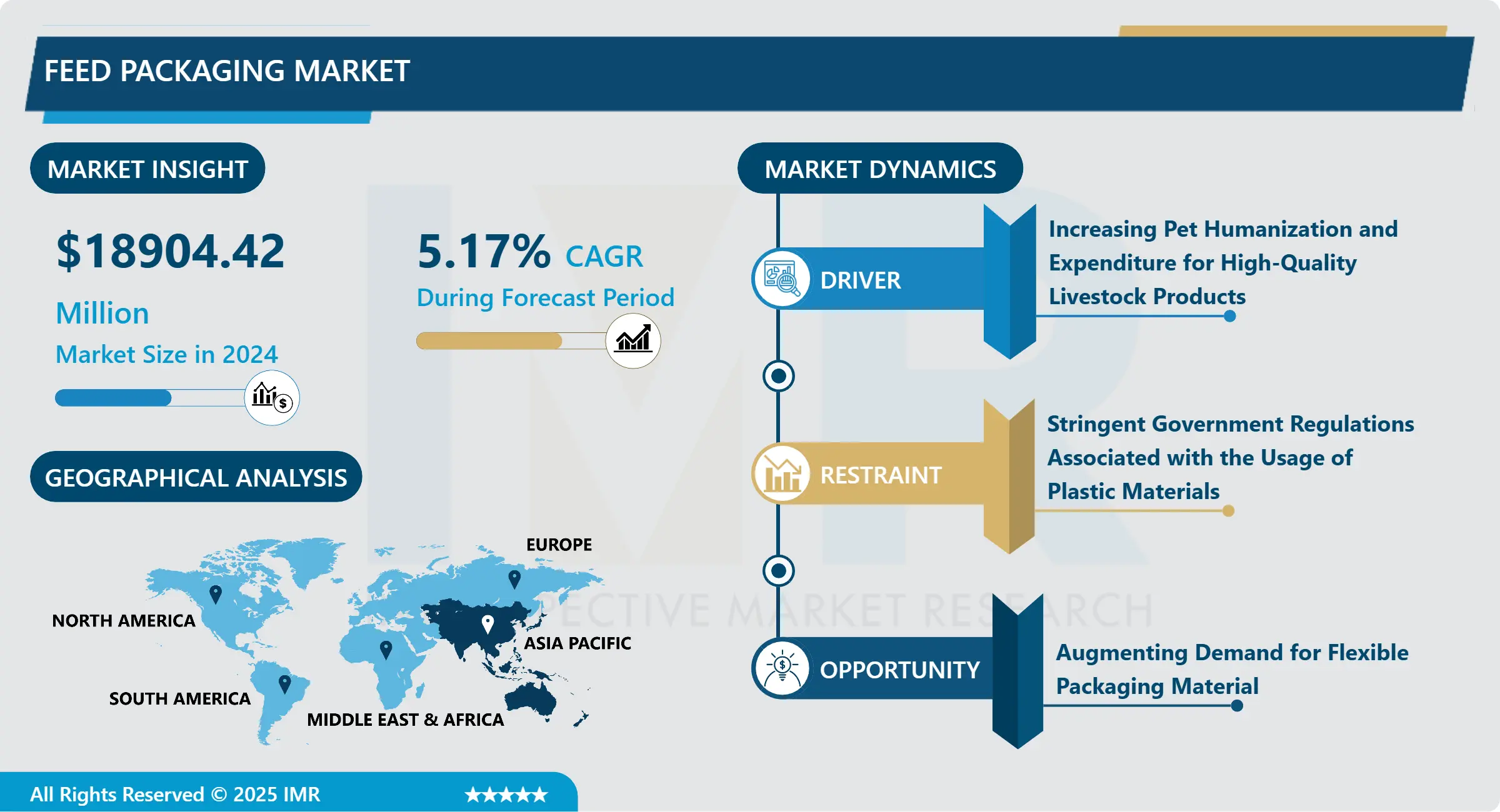

Feed Packaging Market Size Was Valued at USD 18904.42 Million in 2024 and is Projected to Reach USD 28294.27 Million by 2032, Growing at a CAGR of 5.17% From 2025-2032.

Feed Packaging involves enclosing and safeguarding products like pellets, granules, or powders in an appropriate container or wrapping material to maintain their quality, safety, and nutritional content while stored, transported, and handled.

Effective packaging of animal feed is crucial to maintain its nutrient content and overall quality, safeguarding it from pollutants, prolonging its storage time, and providing convenience for both farmers and distributors.

It can aid in cutting expenses, distinguishing brands, adhering to regulations, and enhancing supply chain effectiveness. Choosing environmentally friendly packaging can help reduce environmental impact, and tamper-proof features offer added security and reassurance.

Tailored solutions to meet specific customer needs are possible with customization options, making inventory management easier through efficient packaging. Packaging can help distinguish a product and emphasize its special features, improving the overall customer experience.

Packaging enables easy inventory management, reducing stockouts and overstocking, and ensuring that products are always available. Packaging can be used to differentiate products, such as premium or organic feed, and to communicate unique selling points.

Market Dynamics And Factors For Feed Packaging Market

Feed Packaging Market Growth Drivers- Increasing Pet Humanization and Expenditure for High-Quality Livestock Products

The Feed Packaging market is anticipated to register tremendous growth in the forthcoming years, due to increasing demand from pet and livestock owners to fulfill the nutritional and food requirement of their livestock and pet animals. Further, to fulfill this requirement, the feed packaging material is made available with different materials and served in a single pack or bulk packaging as per the demand from the customers. The ongoing and increasing humanization of pets is set to consistently drive the sales of all pet services and products, thereby increasing the growth of feed packaging for pet animals. Customers spend an additional amount on their pets for their betterment and to provide essential nutrients through the feed. Additionally, the fast-growing demand from middle and small-scale livestock fosters for stock extension of feed is one of the major factors expected to augment the growth of the feed packaging market. Moreover, the feeding of livestock has increased majorly in developing countries owing to the rising demand for high-quality livestock products. In addition, there has also been observed an increase in demand for premium livestock products and growing production of feed and feed additives, which further propels the growth of the feed packaging market.

Feed Packaging Market Limiting Factors- Stringent Government Regulations Associated with the Usage of Plastic Materials

Feed for animals such as pets and livestock are packed into different types of materials for immediate and future use. However, each material that is being used is not safe for the environment which further limits the use of such material. Various types of plastics are used in a greater quantity for feed packaging as compared to other materials, and strict government regulations are imposed for plastic use in many countries. Owing to these strict regulations associated with the usage of plastic packaging, the growth of the feed packaging market is hindered. Additionally, due to the rising environmental concern among the customers, demand for eco-friendly packaging material has increased rapidly. The increasing demand for materials such as compostable packaging, recycled packaging, and many others is estimated to restrict the feed packaging market growth in the forecasted years.

Feed Packaging Market Opportunities- Rising Demand for Flexible Packaging Material

Customers across the world are now demanding flexible packaging materials for feed packaging. Packaging for animal feed has to be highly flexible as different forms and types of products are filled in different bags. This rise in demand for flexible packaging is expected to generate a profitable growth opportunity for the feed packaging market in the upcoming years. Flexible packaging ensures high flexibility, reliability, and quality which attracts more customers around the world. Flexible packaging has also witnessed an upscale demand from the food & beverage, personal care & cosmetics, and pharmaceutical industry owing to their graphic impact, durability, lightweight, convenience & easy supply chain benefits. These benefits and features further create growth opportunities and are estimated to enhance the productivity and demand in the feed packaging market. In addition to this, with the increasing consumer disposable incomes and the arrival of omnichannel retailing, the demand for flexible packaging is expected to rise rapidly, thereby creating growth opportunities for the feed packaging market over the forecasted years.

Segmentation Analysis Of Feed Packaging Market

By Animal type, the livestock segment is the most dominating segment in the feed packaging market. The dominance of this segment can be attributed to the vast livestock population across the world and increasing awareness regarding animal nutrition. For instance, India had the largest cattle inventory in the world, and it accounted for almost 535.78 Million of livestock population in 2019. Livestock is an important asset for the vulnerable communities and rural livelihoods, and to protect them from any harm, essential feed and nutrition are high in demand. The demand for dairy and meat products has increased enormously in recent years. To meet the growing demand livestock growers are adopting innovative solutions to increase the yield thereby, supporting the development of the segment.

By Feed type, the dry feed segment holds the largest market share and is estimated to register significant growth over the forecast period. Feed packaging is majorly used for the dry type of feed across the world. Dry feed is highly available in the form of cubes, crumbles, powder, pellets, and cakes which further escalates the high demand from pet and livestock owners. Also, the affordable and easy-to-handle feature of the dry feed segment attracts more consumers, thereby driving the growth of this segment.

By Material, the BOPP segment dominates the market growth of feed packaging. BOPP bags are a strong and stable packaging option for any type of animal feed. The characteristics such as resistance to oil, moisture, grease to prevent contamination, high tensile strength to avoid tears and punctures, durability, and versatile nature of BOPP packaging makes it more suitable for feed packaging and thereby drive the growth of this segment.

Regional Analysis Of Feed Packaging Market

The Asia Pacific region is anticipated to dominate the feed packaging market over the analysis period attributed majorly to the high development in the production of feed and packaging in this region. The rising demand for meat and dairy products as well as the rapid economic growth in countries such as Thailand, China, India, and Japan have led to the dominance of this region. Also, feed is produced more in this region for domestic consumption and for export purposes. Furthermore, the R&D initiatives to support revenue growth is another factor that boosts the feed packaging market in the Asia Pacific region. The feed packaging is also witnessing huge demand owing to the variations in packaging size, marketing strategies as well as labeling of detailed contents present in the boxes. In addition to this, the small-sized pouches and woven bags are expected to witness a huge rise in demand as the growers in this region hold low infrastructure and poor storage, and using such small pouches can prevent the feed from spoilage.

Top Key Players Covered In The Feed Packaging Market

- LC Packaging (Netherlands)

- El Dorado Packaging Inc. (US)

- NPP Group Limited (Ireland)

- Plasteuropa Group (UK)

- NYP Corp. (US)

- ABC Packaging Direct (US)

- Shenzhen Longma Industrial Co., Limited (China)

- Amcor Limited (Australia)

- Mondi Group (Austria)

- ProAmpac (US)

- Sonoco Products Company (US)

- Winpak Ltd., (Canada)

- NNZ Group (the Netherlands)

- Constantia Flexible Group (Austria)

- Huhtamäki Oyj (Finland), and other active players.

Key Industry Development In The Feed Packaging Market

- In February 2024, LC Packaging has achieved QA-CER certification for using recycled polypropylene in non-food FIBCs. This European certification verifies recycled content and shows compliance with quality standards. It recognizes LC as an approved rPP recycled materials supplier.

- In August 2023, Mondi and Fressnapf are working together to introduce recyclable mono-material packaging for dry pet food using innovative printing technology. The packaging will include FlexiBag Recyclable, BarrierPack Recyclable, and Recyclable StandUp Pouches for Fressnapf | Maxi Zoo's SELECT GOLD range in various sizes. The pouches are certified as recyclable and offer strong barrier properties.

|

Global Feed Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 18904.42 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.17 % |

Market Size in 2032: |

USD 28294.27 Mn. |

|

Segments Covered: |

By Animal Type |

|

|

|

By Feed Type |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Feed Packaging Market by Animal Type (2018-2032)

4.1 Feed Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Livestock

Chapter 5: Feed Packaging Market by Feed Type (2018-2032)

5.1 Feed Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wet

5.5 Pet treats

5.6 Chilled & frozen

5.7 Others

Chapter 6: Feed Packaging Market by Material (2018-2032)

6.1 Feed Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets/ Hypermarkets

6.5 Online sales channel

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Feed Packaging Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALBEMARLE CORPORATION(UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHEMOURS (UNITED STATES)

7.4 DOW (UNITED STATES)

7.5 MILLIKEN & COMPANY (UNITED STATES)

7.6 NALCO WATER (UNITED STATES)

7.7 EASTMAN (UNITED STATES)

7.8 HUNTSMAN INTERNATIONAL LLC (UNITED STATES)

7.9 CHEMTURA CORPORATION (UNITED STATES)

7.10 SOUTHERN SPECIALTIES (UNITED STATES)

7.11 PERFORMANCE MATERIALS GROUP (UNITED STATES)

7.12 3M (UNITED STATES)

7.13 ASHLAND (UNITED STATES)

7.14 RHODIA (FRANCE)

7.15 BASF (GERMANY)

7.16 LANXESS (GERMANY)

7.17 EVONIK INDUSTRIES (GERMANY)

7.18 CRODA INTERNATIONAL PLC (UNITED KINGDOM)

7.19 CLARIANT (SWITZERLAND)

7.20 LONZA GROUP (SWITZERLAND)

7.21 SOLVAY (BELGIUM)

7.22 AKZO NOBEL (NETHERLANDS)

7.23 NIPPON SHOKUBAI (JAPAN)

7.24 NOURYON (NETHERLANDS)

7.25 QUANTUM HITECH (CHINA)

7.26 SANITIZED GROUP (CZECH REPUBLIC)

Chapter 8: Global Feed Packaging Market By Region

8.1 Overview

8.2. North America Feed Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Animal Type

8.2.4.1 Pets

8.2.4.2 Livestock

8.2.5 Historic and Forecasted Market Size by Feed Type

8.2.5.1 Dry

8.2.5.2 Wet

8.2.5.3 Pet treats

8.2.5.4 Chilled & frozen

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Material

8.2.6.1 Retail stores

8.2.6.2 Supermarkets/ Hypermarkets

8.2.6.3 Online sales channel

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Feed Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Animal Type

8.3.4.1 Pets

8.3.4.2 Livestock

8.3.5 Historic and Forecasted Market Size by Feed Type

8.3.5.1 Dry

8.3.5.2 Wet

8.3.5.3 Pet treats

8.3.5.4 Chilled & frozen

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Material

8.3.6.1 Retail stores

8.3.6.2 Supermarkets/ Hypermarkets

8.3.6.3 Online sales channel

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Feed Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Animal Type

8.4.4.1 Pets

8.4.4.2 Livestock

8.4.5 Historic and Forecasted Market Size by Feed Type

8.4.5.1 Dry

8.4.5.2 Wet

8.4.5.3 Pet treats

8.4.5.4 Chilled & frozen

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Material

8.4.6.1 Retail stores

8.4.6.2 Supermarkets/ Hypermarkets

8.4.6.3 Online sales channel

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Feed Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Animal Type

8.5.4.1 Pets

8.5.4.2 Livestock

8.5.5 Historic and Forecasted Market Size by Feed Type

8.5.5.1 Dry

8.5.5.2 Wet

8.5.5.3 Pet treats

8.5.5.4 Chilled & frozen

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Material

8.5.6.1 Retail stores

8.5.6.2 Supermarkets/ Hypermarkets

8.5.6.3 Online sales channel

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Feed Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Animal Type

8.6.4.1 Pets

8.6.4.2 Livestock

8.6.5 Historic and Forecasted Market Size by Feed Type

8.6.5.1 Dry

8.6.5.2 Wet

8.6.5.3 Pet treats

8.6.5.4 Chilled & frozen

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Material

8.6.6.1 Retail stores

8.6.6.2 Supermarkets/ Hypermarkets

8.6.6.3 Online sales channel

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Feed Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Animal Type

8.7.4.1 Pets

8.7.4.2 Livestock

8.7.5 Historic and Forecasted Market Size by Feed Type

8.7.5.1 Dry

8.7.5.2 Wet

8.7.5.3 Pet treats

8.7.5.4 Chilled & frozen

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Material

8.7.6.1 Retail stores

8.7.6.2 Supermarkets/ Hypermarkets

8.7.6.3 Online sales channel

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Feed Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 18904.42 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.17 % |

Market Size in 2032: |

USD 28294.27 Mn. |

|

Segments Covered: |

By Animal Type |

|

|

|

By Feed Type |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :