Explosion Isolation Valves Market Synopsis

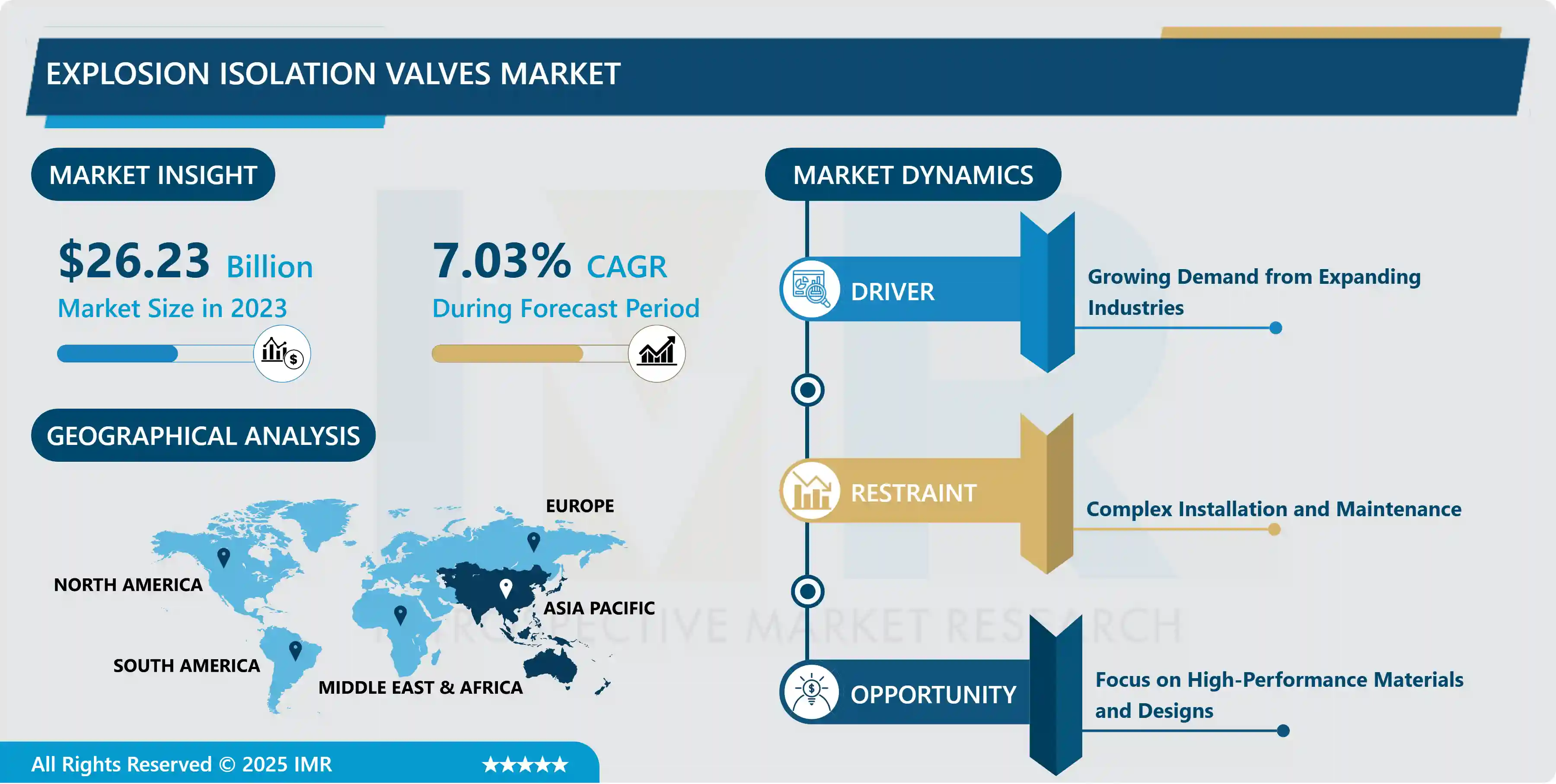

The Global Explosion Isolation Valves Market Size Was Valued at USD 26.23 Billion in 2023, and is Projected to Reach USD 48.34 Billion by 2032, Growing at a CAGR of 7.03 % From 2024-2032.

Explosion Isolation Valves serve as safety mechanisms specifically crafted to halt the spread of explosions in industrial environments. These valves rapidly identify and contain combustible dust or gas explosions, mitigating damage and safeguarding both personnel and equipment.

Explosion Isolation Valvesserve as safety mechanisms meticulously designed to halt the transmission of flames and pressure resulting from explosions in industrial systems. These valves act as a swift barrier, promptly detecting and isolating explosions to protect interconnected equipment, pipelines, and systems. Their pivotal role is evident in mitigating the severe consequences of combustible dust or gas explosions across various industries. Commonly installed in pipelines or ductwork, these valves provide a critical layer of protection in environments with explosive atmospheres, such as chemical processing plants, refineries, food manufacturing facilities, and power generation plants.

The utilization of Explosion Isolation Valves significantly contributes to enhancing industrial safety. By efficiently isolating explosions at their source, these valves safeguard personnel, equipment, and infrastructure from potential damage. Notable advantages of these valves include rapid response times, reliable operation, and the capability to prevent the spread of flames and pressure, thereby minimizing the risk of secondary explosions.

Moreover, the future demand for Explosion Isolation Valves is expected to surge in tandem with increased industrialization, stringent safety regulations, and a growing awareness of the imperative need for robust explosion protection measures. As industries prioritize worker safety and asset protection, the market for these valves is poised for sustained growth, with ongoing innovations anticipated to further augment their effectiveness and applicability across diverse industrial settings.

Explosion Isolation Valves Market Trend Analysis:

Explosion Isolation Valves Market Trend Analysis:

Growing Demand from Expanding Industries

- The rapid growth of the Explosion Isolation Valves Market is propelled by the increasing demand from expanding industries. As diverse sectors, including chemical processing, pharmaceuticals, and manufacturing, undergo significant expansion, there is a growing requirement for effective safety measures to mitigate the risks associated with explosive atmospheres. Addressing this need, explosion isolation valves play a crucial role in safeguarding critical infrastructure, pipelines, and interconnected systems from the potentially severe consequences of combustible dust or gas explosions.

- Explosion Isolation Valves becomes apparent in their widespread application across expanding industries, where the protection of personnel, equipment, and assets takes precedence. As manufacturing facilities and industrial processes undergo evolution, the demand for these valves rises, propelled by the need to ensure uninterrupted operations and adhere to stringent safety regulations. Moreover, the surge in demand is not confined to specific sectors but spans a wide range of industries, including energy production, food processing, and materials manufacturing. The versatility of explosion isolation valves positions them as indispensable safety components, actively contributing to the secure and efficient functioning of expanding industrial landscapes.

- The proactive adoption of explosion isolation valves is also driven by industries' increasing recognition of the potential consequences of industrial explosions. With a heightened emphasis on risk mitigation and operational resilience, these valves become integral components within the overall safety framework, ensuring that as industries expand, they do so with a commitment to maintaining the highest standards of safety and reliability. As global industrialization persists, the Explosion Isolation Valves Market is set for sustained growth, propelled by the necessity to secure burgeoning industrial landscapes against the hazards of explosive environments.

Focus on High-Performance Materials and Designs

- The Explosion Isolation Valves Market experiences significant growth opportunities driven by the emphasis on high-performance materials and innovative designs. With industries increasingly prioritizing safety and efficiency, there is a rising demand for explosion isolation valves that incorporate cutting-edge materials known for their durability and resilience in challenging industrial environments. Opportunities abound in the development of valves featuring advanced alloys, ceramics, and polymers, which not only withstand the challenges of explosive atmospheres but also contribute to extended service life and reduced maintenance needs.

- The adoption of innovative designs in explosion isolation valves provides opportunities for manufacturers to distinguish their products and meet evolving industry requirements. Prospects exist for compact designs that facilitate easy installation in confined spaces, enhancing the versatility and adaptability of these safety components across various industrial settings. Furthermore, the integration of user-friendly interfaces and smart technologies into the design of explosion isolation valves opens up new possibilities, offering real-time monitoring capabilities and improving operational efficiency.

- The market's opportunities extend to addressing specific industry needs by tailoring designs to meet the challenges of various applications. Customized solutions that account for factors such as pressure, temperature, and the type of combustible materials in a particular industry provide manufacturers with opportunities to serve niche markets and establish a competitive edge. As industries continue to seek advanced safety solutions, the focus on high-performance materials and designs emerges as a pivotal driver, providing manufacturers with a pathway to deliver innovative and reliable explosion isolation valves that elevate safety standards across diverse industrial landscapes.

Explosion Isolation Valves Market Segment Analysis:

Explosion Isolation Valves Market Segmented on the basis of Type, Operating Mechanism, Material, and Application

By Application, Chemical segment is expected to dominate the market during the forecast period

- The Chemical segment is positioned to lead the Explosion Isolation Valves Market, driven by its critical role in enhancing safety within chemical processing plants. Operating with a diverse range of combustible materials and volatile substances, the chemical industry necessitates robust explosion protection measures. Explosion isolation valves play a pivotal role in swiftly detecting and isolating potential explosions, preventing the spread of flames and pressure throughout interconnected systems.

- The global expansion of the chemical industry due to increased demand for various chemical products, the requirement for reliable and advanced explosion isolation solutions intensifies, establishing the dominance of this segment. Furthermore, stringent safety regulations within the chemical sector contribute to the high adoption rate of explosion isolation valves, positioning them as essential components in safeguarding personnel, assets, and critical infrastructure.

By Type, Butterfly Valves segment held the largest share of 44.56% in 2022

- The Butterfly Valves segment has emerged as the leader in the Explosion Isolation Valves Market, owing to its pivotal role in delivering efficient and reliable explosion protection. These valves are favored for their rapid response mechanisms, enabling swift isolation during potential explosive events. Butterfly valves actively contribute to preventing the propagation of flames and pressure by quickly closing in response to detected anomalies, thereby playing a crucial role in safeguarding industrial systems. Their versatility in diverse industrial applications, including chemical processing, power generation, and manufacturing, has further reinforced their dominant market position.

- Moreover, the prominence of the Butterfly Valves segment can be attributed to the simplicity and cost-effectiveness of these valves. Their straightforward design, coupled with easy maintenance, appeals to industries seeking practical and dependable explosion isolation solutions. As safety regulations become more stringent across industries, the demand for butterfly valves remains robust, underscoring their significant share in the Explosion Isolation Valves Market.

Explosion Isolation Valves Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- This prominence is attributed to the region's swift industrialization, with expanding manufacturing and processing industries requiring robust safety measures. The increasing awareness of the potential hazards associated with explosive atmospheres prompts industries in Asia Pacific to actively seek advanced explosion isolation solutions, leading to a substantial demand for these safety components. The region's critical role in global supply chains, particularly in sectors such as chemicals, electronics, and energy, further enhances the need for explosion protection, solidifying Asia Pacific's position as a key player in the market.

- Furthermore, the proactive adoption of advanced technologies and increased investments in industrial safety initiatives in Asia Pacific create favorable conditions for the proliferation of Explosion Isolation Valves. As governments and industries in the region prioritize safety standards and regulations, the market for these valves is expected to experience sustained growth. The expansive industrial landscape, coupled with a growing emphasis on risk mitigation, positions Asia Pacific at the forefront of driving innovation and demand in the global Explosion Isolation Valves Market.

Explosion Isolation Valves Market Top Key Players:

- Fike Corporation (US)

- CECO Environmental (US)

- Imperial Systems (US)

- US Tubing (US)

- CV Technology (US)

- ATEX Explosion Protection (US)

- Curtiss-Wright Corporation (US)

- Emerson Electric Co. (US)

- Omega Engineering Inc. (US)

- Parker Hannifin Corporation (US)

- RICO Sicherheitstechnik AG (Germany)

- Festo AG & Co. KG (Germany)

- Danfoss A/S (Denmark)

- Rotork plc (UK)

- Nederman Holding AB (Sweden)

- Camfil Air Pollution Control (Sweden)

- Euratex (Belgium)

- Avcon Controls Pvt. Ltd. (India)

- Burkert Contromatic Pvt. Ltd. (India)

- CKD Corporation (Japan)

- Ulpadust Industrial Dust Collection Systems (Turkey), and Other Major Players.

Key Industry Developments in the Explosion Isolation Valves Market:

- In January 2023, Emerson Electric Co. announced that it submitted a proposal to the Board of Directors of National Instruments to acquire NI for $53 per share in cash at an implied enterprise value of $7.6 billion.

|

Global Explosion Isolation Valves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.23 Billion. |

|

Forecast Period 2024-32 CAGR: |

7.03% |

Market Size in 2032: |

USD 48.34 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Operating Mechanism |

|

||

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Explosion Isolation Valves Market by Type (2018-2032)

4.1 Explosion Isolation Valves Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ball Valves

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Butterfly Valves

4.5 Diaphragm Valves

4.6 Check Valves

4.7 Gate valves

4.8 Others

Chapter 5: Explosion Isolation Valves Market by Operating Mechanism (2018-2032)

5.1 Explosion Isolation Valves Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pneumatic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hydraulic

5.5 Electric

5.6 Manual

Chapter 6: Explosion Isolation Valves Market by Material (2018-2032)

6.1 Explosion Isolation Valves Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Stainless steel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ductile iron

6.5 Aluminum

Chapter 7: Explosion Isolation Valves Market by Application (2018-2032)

7.1 Explosion Isolation Valves Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Chemical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Petrochemical

7.5 Food & beverage

7.6 Power generation

7.7 Mining

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Explosion Isolation Valves Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SCHUNK ELECTRONIC (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 LPKF LASER & ELECTRONICS (GERMANY)

8.4 JIELI (GERMANY)

8.5 CTI SYSTEMS (LUXEMBOURG)

8.6 OSAI (ITALY)

8.7 IPTE FACTORY AUTOMATION N.V.(BELGIUM)

8.8 GENITEC (UK)

8.9 CENCORP AUTOMATION (FINLAND)

8.10 MSTECH (KOREA)

8.11 AUROTEK CORPORATION (CHINA)

8.12 KELI (CHINA)

8.13 SAYAKA (JAPAN)

8.14 YUSH ELECTRONIC TECHNOLOGY (CHINA)

8.15 ASYS GROUP (SINGAPORE)

8.16 GETECH AUTOMATION (SINGAPORE)

8.17

Chapter 9: Global Explosion Isolation Valves Market By Region

9.1 Overview

9.2. North America Explosion Isolation Valves Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Ball Valves

9.2.4.2 Butterfly Valves

9.2.4.3 Diaphragm Valves

9.2.4.4 Check Valves

9.2.4.5 Gate valves

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size by Operating Mechanism

9.2.5.1 Pneumatic

9.2.5.2 Hydraulic

9.2.5.3 Electric

9.2.5.4 Manual

9.2.6 Historic and Forecasted Market Size by Material

9.2.6.1 Stainless steel

9.2.6.2 Ductile iron

9.2.6.3 Aluminum

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Chemical

9.2.7.2 Petrochemical

9.2.7.3 Food & beverage

9.2.7.4 Power generation

9.2.7.5 Mining

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Explosion Isolation Valves Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Ball Valves

9.3.4.2 Butterfly Valves

9.3.4.3 Diaphragm Valves

9.3.4.4 Check Valves

9.3.4.5 Gate valves

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size by Operating Mechanism

9.3.5.1 Pneumatic

9.3.5.2 Hydraulic

9.3.5.3 Electric

9.3.5.4 Manual

9.3.6 Historic and Forecasted Market Size by Material

9.3.6.1 Stainless steel

9.3.6.2 Ductile iron

9.3.6.3 Aluminum

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Chemical

9.3.7.2 Petrochemical

9.3.7.3 Food & beverage

9.3.7.4 Power generation

9.3.7.5 Mining

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Explosion Isolation Valves Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Ball Valves

9.4.4.2 Butterfly Valves

9.4.4.3 Diaphragm Valves

9.4.4.4 Check Valves

9.4.4.5 Gate valves

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size by Operating Mechanism

9.4.5.1 Pneumatic

9.4.5.2 Hydraulic

9.4.5.3 Electric

9.4.5.4 Manual

9.4.6 Historic and Forecasted Market Size by Material

9.4.6.1 Stainless steel

9.4.6.2 Ductile iron

9.4.6.3 Aluminum

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Chemical

9.4.7.2 Petrochemical

9.4.7.3 Food & beverage

9.4.7.4 Power generation

9.4.7.5 Mining

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Explosion Isolation Valves Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Ball Valves

9.5.4.2 Butterfly Valves

9.5.4.3 Diaphragm Valves

9.5.4.4 Check Valves

9.5.4.5 Gate valves

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size by Operating Mechanism

9.5.5.1 Pneumatic

9.5.5.2 Hydraulic

9.5.5.3 Electric

9.5.5.4 Manual

9.5.6 Historic and Forecasted Market Size by Material

9.5.6.1 Stainless steel

9.5.6.2 Ductile iron

9.5.6.3 Aluminum

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Chemical

9.5.7.2 Petrochemical

9.5.7.3 Food & beverage

9.5.7.4 Power generation

9.5.7.5 Mining

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Explosion Isolation Valves Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Ball Valves

9.6.4.2 Butterfly Valves

9.6.4.3 Diaphragm Valves

9.6.4.4 Check Valves

9.6.4.5 Gate valves

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size by Operating Mechanism

9.6.5.1 Pneumatic

9.6.5.2 Hydraulic

9.6.5.3 Electric

9.6.5.4 Manual

9.6.6 Historic and Forecasted Market Size by Material

9.6.6.1 Stainless steel

9.6.6.2 Ductile iron

9.6.6.3 Aluminum

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Chemical

9.6.7.2 Petrochemical

9.6.7.3 Food & beverage

9.6.7.4 Power generation

9.6.7.5 Mining

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Explosion Isolation Valves Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Ball Valves

9.7.4.2 Butterfly Valves

9.7.4.3 Diaphragm Valves

9.7.4.4 Check Valves

9.7.4.5 Gate valves

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size by Operating Mechanism

9.7.5.1 Pneumatic

9.7.5.2 Hydraulic

9.7.5.3 Electric

9.7.5.4 Manual

9.7.6 Historic and Forecasted Market Size by Material

9.7.6.1 Stainless steel

9.7.6.2 Ductile iron

9.7.6.3 Aluminum

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Chemical

9.7.7.2 Petrochemical

9.7.7.3 Food & beverage

9.7.7.4 Power generation

9.7.7.5 Mining

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Explosion Isolation Valves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.23 Billion. |

|

Forecast Period 2024-32 CAGR: |

7.03% |

Market Size in 2032: |

USD 48.34 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Operating Mechanism |

|

||

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||