Emergency Lighting Battery Market Synopsis:

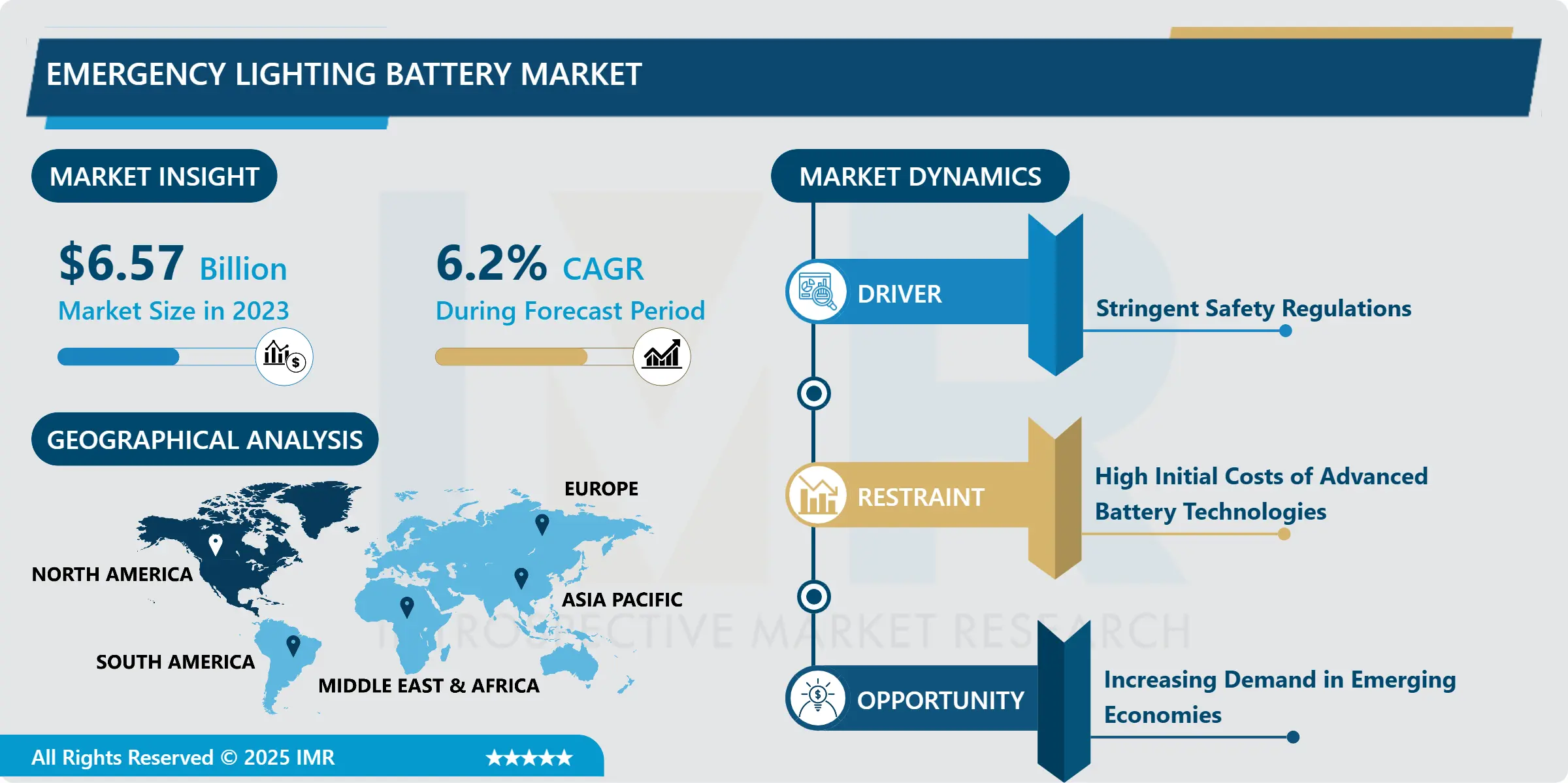

Emergency Lighting Battery Market Size Was Valued at USD 6.57 Billion in 2023, and is Projected to Reach USD 11.29 Billion by 2032, Growing at a CAGR of 6.2% From 2024-2032.

The Emergency Lighting Battery Market embraces the production and sale of batteries that are utilised to power emergency lighting fixtures and installations across commercial, civil, and industrial areas. These batteries allow continued operation of lighting systems during blackouts that make it possible to provide safety and emergency illumination. The popular battery kinds in the emergency lighting system are the lead-acid battery, lithium-ion battery, and the nickel-cadmium (Ni-Cd) battery.

The oldest and also the cheapest are lead-acid batteries, but lithium-ion batteries are gradually gaining increased attention because of their greater efficiency, longer service life, and lower environmental impact. Nickel-cadmium batteries are chiefly used in various complex applications that require high performance and high reliability. These batteries are normally intended for use where the environmental conditions are high. In addition, it also gives the details of various developments in the battery technologies like lithium-ion battery, which is gradually increasing its market share, and is likely to propel the growth of the Emergency Lighting Battery Market.

In developed economies, laws covering fire and evacuation also exert pressure to increase the use of the emergency lighting system, benefiting the battery market. The market finds the best opportunities for growth in the emergency lighting battery market in the commercial construction industry, which is fueled by urbanization and infrastructural development. Furthermore, the developing regions of the world are requiring energy effective and long-life cycle lighting solutions that also help in the growth of the market.

Emergency Lighting Battery Market Trend Analysis:

Shift Towards Lithium-Ion Batteries

-

Lithium-ion battery packs have been introduced to emergency lighting market due to their higher energy density, longer cycle life and advantage in terms of environmental protection as compared to lead-acid batteries. For this reason, the change towards lithium-ion technology is poised to ramp up as industries look to reduce turbine prices and make improvements to practicality. Lithium-ion batteries have more efficiency than lead-acid batteries, have low rates of maintenance requirement and take less space as compared to lead-acid batteries, and therefore, are suitable for emergency lighting applications in residential and commercial sectors.

-

The chance that they call for frequent replacement is low as compared to lead-acid batteries that offer less reliability during power failure. They are also preferred by most contemporary emergency lighting applications due to their compactness as well as low weight, especially in complex structures. This trend is going to remain as the innovation in lithium ion battery technology improves and lowers the cost per energy density.

Increasing Demand in Emerging Economies

-

The Growth tactics implemented by leading organizations have resulted in the growth of Emergency Lighting Battery Market in emerging countries in Asia-Pacific, Latin America and the Middle East region. These regions are witnessing rapid growth in both, population and structures which include commercial, industrial and residential structures, development of infrastructures and thirdly increased concern on safety features of commercial industrial and residential buildings. Thus, as infrastructures of these regions expand and renew as well the demand for emergency lighting systems with fairly efficient and reliable batteries will be high. Moreover, evolving clients’ concerns regarding occupational health and fire protection standards have evolved emergency lighting system into mandatory installations in most public structures which also forms a favorable market environment.

-

Rising middle income populace in developing economies is escalating the demand for living and working spaces that will complies with the modern safety standards such as emergency lighting. This population increase has created a demand for excellent lighting systems that fulfils the requirements of safety and security in case of blackouts. Due to the commitment of these regions for energy efficient technologies and the preference for sustainable solutions, manufacturers of emergency lighting batteries specialising in lithium-ion technology have the opportunity to grow the relevant market.

Emergency Lighting Battery Market Segment Analysis:

Emergency Lighting Battery Market is Segmented based on Battery Type, Technology, Application, End User, and Region

By Battery Type, Lead-acid Batteries segment is expected to dominate the market during the forecast period

-

Lead-acid batteries have been perhaps the most common type of batteries used in emergency lighting for most of the time due to factors such as cost. They are best used in applications that experience loads that are high for the brief durations and not for long periods. Solar powered lead acid batteries are cheaper for residential and small commercial buildings because the main function is to provide an adequate amount of light for a short duration of time in the event of a power outage. However, some of these batteries have short cycle life compared to new generation ones and often need to be checked and refilled with fluids. Nevertheless, the lead-acid batteries continue being popular in the market due to effectiveness in availability and cost.

-

With the developmental advantages of Multiple lithium-ion batteries such as higher energy density, longer service life and lower maintenance compared to lead-acid batteries, lithium-ion batteries have been widely used in the market of emergency lighting. These batteries come as a smaller size than their flooded counterparts making them suitable for use in ELT where space is a limiting factor. Lithium ion also has a faster charge time and is more efficient, these are other advantages that results to the effectiveness of emergency lighting solutions. They suggest that due to rising interest in cleaner and less expensive forms of energy storage, lithium-ion batteries are scheduled to gain more prominence in new applications and as replacements.

By Application, Exit Signs segment expected to held the largest share

-

These signs are very important while in the buildings to enable the inhabitants to evacuate during the disasters. Emergency lighting batteries keep exit signs lit during blackouts; they indicate where people can go, i.e. exits. Such signs are popular primarily when identifying evacuation paths in commercial and industrial complex structures, which require clear designation. Demand for exit signs has continued to rise due to the safety measures being embraced the world over and the need to adhere to the set fire and safety laws in every organization.

-

A pathway lighting system is a valuable source of illumination in emergencies and therefore the battery used must be dependable as well as durable to last through emergencies. Due to growth in areas like LED-based pathway lights that call for high performance batteries, the market has been forced to advance as well. These systems need batteries capable of providing constant power for say 10-15mins not to mention the larger buildings could take longer to evacuate. Lithium-ion and nickel-cadmium batteries will likely experience growth as the preferable pathways in lighting because they last longer and have a higher energy storage capacity than the lead-acid battery.

Emergency Lighting Battery Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is at present the most influential region in the overall Emergency Lighting Battery Market owing to strict safety codes and sound construction sector. The requirement imposed by local authorities on the general reputable and acceptable safety specifications and regulation in various business and residential structures across the region has made Emergency Lighting Systems very popular thus creating the need for high performance batteries. On the same note, and because of the region’s mature status, emergency lighting systems are common and easily accessible with the several regulatory bodies in North America making sure that buildings in health-care facilities, educational establishments and industrial complexes, among others, have the systems in place and well-maintained.

-

The availability of several leading players in the North American ESC and battery manufacturing sector, along with the technological improvement constantly going on, has consistently strengthened North American market dominance. The safety and energy efficiency are the major concerns in the region, especially given natural disasters and weaknesses in the power supply system. There is expected demand for more sophisticated emergency lighting batteries. The rising use of lithium-ion batteries in emergency lighting systems adds deeper strength to the region’s market dominance.

Active Key Players in the Emergency Lighting Battery Market

- Johnson Controls (Ireland)

- Schneider Electric (France)

- Eaton Corporation (Ireland)

- Lumenpulse (Canada)

- American Electric Lighting (USA)

- Chloride (India)

- Philips Lighting (Netherlands)

- Emerson Electric (USA)

- VARTA AG (Germany)

- Syska LED Lights (India)

- Vertiv (USA)

- Hubbell Incorporated (USA)

- Other Active Players

|

Global Emergency Lighting Battery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.57 Billion |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 11.29 Billion |

|

Segments Covered: |

By Battery Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Emergency Lighting Battery Market by Battery Type

4.1 Emergency Lighting Battery Market Snapshot and Growth Engine

4.2 Emergency Lighting Battery Market Overview

4.3 Lead-acid Batteries

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Lead-acid Batteries: Geographic Segmentation Analysis

4.4 Lithium-ion Batteries

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Lithium-ion Batteries: Geographic Segmentation Analysis

4.5 Nickel-cadmium (Ni-Cd) Batteries

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Nickel-cadmium (Ni-Cd) Batteries: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Emergency Lighting Battery Market by End-User

5.1 Emergency Lighting Battery Market Snapshot and Growth Engine

5.2 Emergency Lighting Battery Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Residential: Geographic Segmentation Analysis

5.4 Commercial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial: Geographic Segmentation Analysis

5.5 Industrial

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Industrial: Geographic Segmentation Analysis

5.6 Healthcare

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Healthcare: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Emergency Lighting Battery Market by Technology

6.1 Emergency Lighting Battery Market Snapshot and Growth Engine

6.2 Emergency Lighting Battery Market Overview

6.3 Centralized Power System

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Centralized Power System: Geographic Segmentation Analysis

6.4 Decentralized Power System

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Decentralized Power System: Geographic Segmentation Analysis

Chapter 7: Emergency Lighting Battery Market by Application

7.1 Emergency Lighting Battery Market Snapshot and Growth Engine

7.2 Emergency Lighting Battery Market Overview

7.3 Exit Signs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Exit Signs: Geographic Segmentation Analysis

7.4 Pathway Lighting

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pathway Lighting: Geographic Segmentation Analysis

7.5 Area Lighting

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Area Lighting: Geographic Segmentation Analysis

7.6 High Intensity Discharge Lighting

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 High Intensity Discharge Lighting: Geographic Segmentation Analysis

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Emergency Lighting Battery Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 JOHNSON CONTROLS (IRELAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SCHNEIDER ELECTRIC (FRANCE)

8.4 EATON CORPORATION (IRELAND)

8.5 LUMENPULSE (CANADA)

8.6 AMERICAN ELECTRIC LIGHTING (USA)

8.7 CHLORIDE (INDIA)

8.8 PHILIPS LIGHTING (NETHERLANDS)

8.9 EMERSON ELECTRIC (USA)

8.10 VARTA AG (GERMANY)

8.11 SYSKA LED LIGHTS (INDIA)

8.12 VERTIV (USA)

8.13 HUBBELL INCORPORATED (USA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Emergency Lighting Battery Market By Region

9.1 Overview

9.2. North America Emergency Lighting Battery Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Battery Type

9.2.4.1 Lead-acid Batteries

9.2.4.2 Lithium-ion Batteries

9.2.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size By End-User

9.2.5.1 Residential

9.2.5.2 Commercial

9.2.5.3 Industrial

9.2.5.4 Healthcare

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size By Technology

9.2.6.1 Centralized Power System

9.2.6.2 Decentralized Power System

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Exit Signs

9.2.7.2 Pathway Lighting

9.2.7.3 Area Lighting

9.2.7.4 High Intensity Discharge Lighting

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Emergency Lighting Battery Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Battery Type

9.3.4.1 Lead-acid Batteries

9.3.4.2 Lithium-ion Batteries

9.3.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size By End-User

9.3.5.1 Residential

9.3.5.2 Commercial

9.3.5.3 Industrial

9.3.5.4 Healthcare

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size By Technology

9.3.6.1 Centralized Power System

9.3.6.2 Decentralized Power System

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Exit Signs

9.3.7.2 Pathway Lighting

9.3.7.3 Area Lighting

9.3.7.4 High Intensity Discharge Lighting

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Emergency Lighting Battery Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Battery Type

9.4.4.1 Lead-acid Batteries

9.4.4.2 Lithium-ion Batteries

9.4.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size By End-User

9.4.5.1 Residential

9.4.5.2 Commercial

9.4.5.3 Industrial

9.4.5.4 Healthcare

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size By Technology

9.4.6.1 Centralized Power System

9.4.6.2 Decentralized Power System

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Exit Signs

9.4.7.2 Pathway Lighting

9.4.7.3 Area Lighting

9.4.7.4 High Intensity Discharge Lighting

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Emergency Lighting Battery Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Battery Type

9.5.4.1 Lead-acid Batteries

9.5.4.2 Lithium-ion Batteries

9.5.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size By End-User

9.5.5.1 Residential

9.5.5.2 Commercial

9.5.5.3 Industrial

9.5.5.4 Healthcare

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size By Technology

9.5.6.1 Centralized Power System

9.5.6.2 Decentralized Power System

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Exit Signs

9.5.7.2 Pathway Lighting

9.5.7.3 Area Lighting

9.5.7.4 High Intensity Discharge Lighting

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Emergency Lighting Battery Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Battery Type

9.6.4.1 Lead-acid Batteries

9.6.4.2 Lithium-ion Batteries

9.6.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size By End-User

9.6.5.1 Residential

9.6.5.2 Commercial

9.6.5.3 Industrial

9.6.5.4 Healthcare

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size By Technology

9.6.6.1 Centralized Power System

9.6.6.2 Decentralized Power System

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Exit Signs

9.6.7.2 Pathway Lighting

9.6.7.3 Area Lighting

9.6.7.4 High Intensity Discharge Lighting

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Emergency Lighting Battery Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Battery Type

9.7.4.1 Lead-acid Batteries

9.7.4.2 Lithium-ion Batteries

9.7.4.3 Nickel-cadmium (Ni-Cd) Batteries

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size By End-User

9.7.5.1 Residential

9.7.5.2 Commercial

9.7.5.3 Industrial

9.7.5.4 Healthcare

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size By Technology

9.7.6.1 Centralized Power System

9.7.6.2 Decentralized Power System

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Exit Signs

9.7.7.2 Pathway Lighting

9.7.7.3 Area Lighting

9.7.7.4 High Intensity Discharge Lighting

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Emergency Lighting Battery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.57 Billion |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 11.29 Billion |

|

Segments Covered: |

By Battery Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||