Digital Transformation Spending in Logistics Market Overview

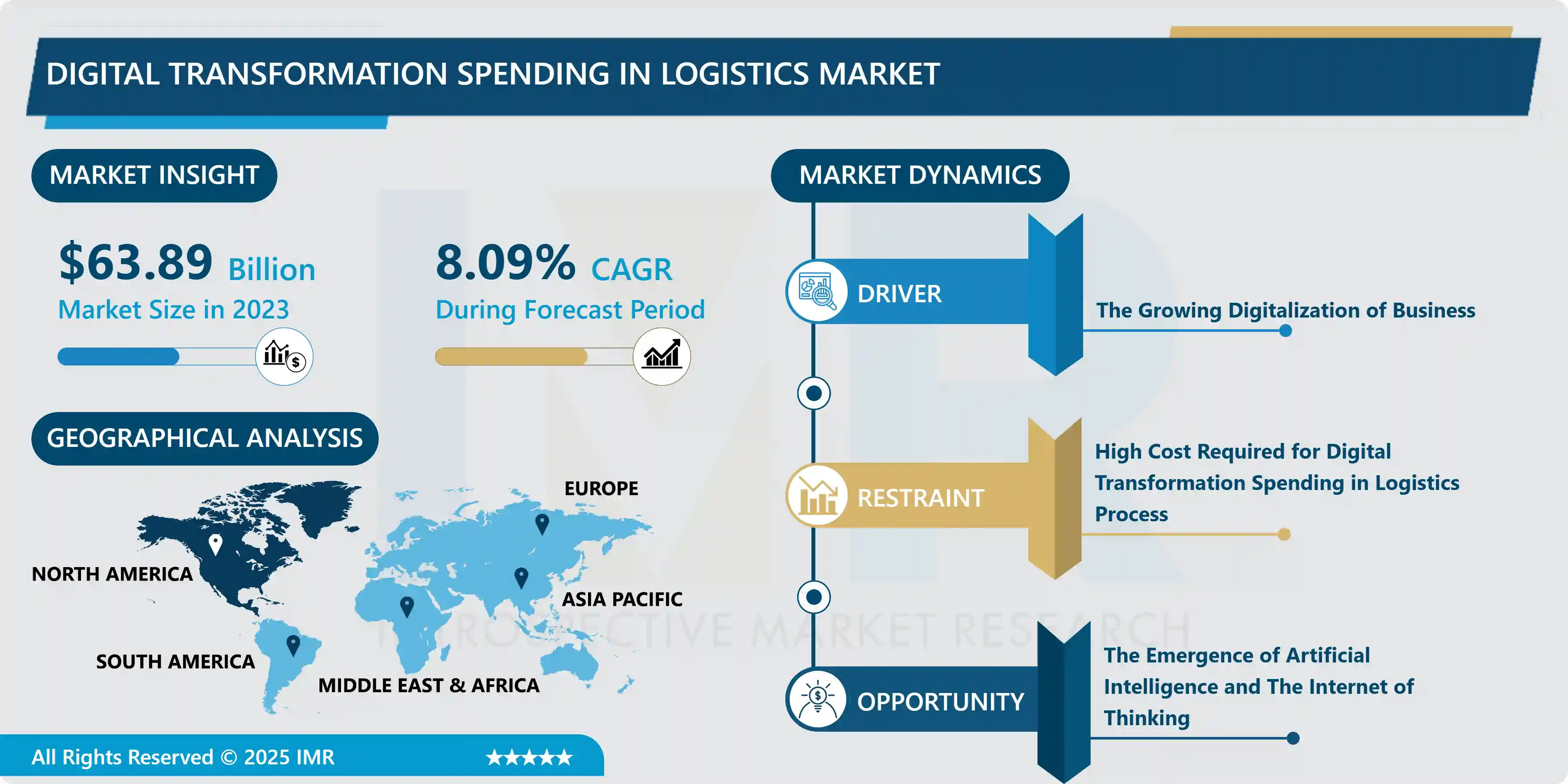

The Global Digital Transformation Spending in Logistics Market size is expected to grow from USD 63.89 billion in 2023 to USD 128.68 billion by 2032, at a CAGR of 8.09% during the forecast period (2024-2032).

Digital Transformation Spending in Logistics is the process of reshaping products services and entire business models by adopting digital technologies. Due to the high cost of building the whole IT department, only large and international organizations can afford to build a whole internal IT department. The spending in logistics are quite expensive and hence can hamper the growth of Digital Transformation Spending in Logistics market.

According to the analyst, the emergence of Artificial Intelligence and the Internet of Thinking has escalated Digital Transformation Spending in Logistics market growth for digital transformation in multinational companies. The logistics industries have adopted the Digital Transformation Spending in Logistics at a moderate pace than every other industry. The major driver for this market is the digitalization of business. The higher business models and innovative solutions with excellent reach to consumers are happening because of the digitalization all across the globe which is impacting the growth of Digital Transformation Spending in Logistics market positively.

By the end of 2027, the Digital Transformation Spending in Logistics market size is estimated to be USD 86.63 billion. Increasing and excessive use of artificial intelligence in multinational corporates are going to drive Digital Transformation Spending in Logistics market in the forecast period.

The Digital Transformation Spending in Logistics market is segmented by Solutions (Hardware, Software, and Services), by Hardware Solutions (Systems, Devices, and IT Equipment), by Systems (Conveyors, Automated Storage and Retrieval Systems (ASRS), Automatic Sorters, Automated guided vehicle (AGV), Robotic Picking System, Automatic Palletizer, Peripheral & Supporting Components BFSI), by Devices (RFID Readers, Real-time Location System, Barcode Scanners, Barcode Printers, Barcode Stickers, RFID Tags, GPS), by IT Equipment (Enterprise Servers, and Client Machines), by Deployment (Cloud-Based and On-Premise), by End-User (3PL and Warehouse).

Market Trend Analysis

Digital Transformation Spending in the Logistics Market

- The rapid growth of e-commerce and the increasing demand for faster delivery of goods have emerged as pivotal drivers for digital transformation in the logistics market. Businesses are striving to gain a competitive edge by adopting advanced systems like Warehouse Management Systems (WMS) and Transport Management Systems (TMS). This surge in digital adoption is further bolstered by the exponential rise in Internet users and the growing influence of social media platforms, which have amplified awareness about innovative digital solutions.

- Companies like Vinculum Solutions in India exemplify this trend, offering specialized solutions such as Vin eRetail WMS tailored to the retail industry. The complexity of online sales channels has compelled manufacturers and retailers to transition from in-house order fulfillment to third-party logistics providers (3PLs). These 3PLs are equipped with advanced warehouse management capabilities to address the growing online retail demands. This shift has accelerated the growth of the WMS industry, fostering efficiency and scalability.

- Collaboration among logistics players also plays a crucial role. Established companies and startups are increasingly sharing digital platforms, enabling mutual benefitsnew entrants gain market access, while incumbents enhance operational efficiency and explore shared network models. These developments underscore the critical role of digital transformation in shaping the logistics industry's future.

Leveraging E-Commerce Growth and Internet Proliferation for Market Expansion

- The explosive growth of the e-commerce industry, fueled by increasing online shopping and the proliferation of internet users, presents significant opportunities for market expansion. Businesses can capitalize on this trend by investing in innovative solutions to enhance operational efficiency and customer satisfaction.

- Digitization of logistics operations offers a transformative approach to managing supply chains, enabling real-time tracking, improved inventory management, and faster delivery times. Automation of material handling systems and warehouse management systems can reduce operational costs while increasing throughput, providing a competitive edge in a fast-paced market. Furthermore, integrating artificial intelligence and predictive analytics into e-commerce logistics allows businesses to anticipate consumer demand and optimize inventory levels.

- The emphasis on transparency, convenience, and speed in e-commerce aligns with consumer expectations, encouraging the adoption of new business models. Companies that proactively adapt to these demands by implementing digital tools and automation are positioned to strengthen customer loyalty and boost profitability. This opportunity underscores the critical role of technology in shaping the future of commerce and driving sustainable growth in a competitive landscape.

Market Segmentation

Solutions Insights:

- By Solutions, Digital Transformation Spending in Logistics market can be segmented into Hardware, Software, and Services. The segment Services held the largest market share of 77.28% with market size of USD 61.29 billion in the year 2026. But, Digital Transformation Spending in Logistics segment, software holds the highest CAGR of 8.51% for the year 2020..

Deployment type Insights:

- By Deployment Type, Digital Transformation Spending in Logistics market is segmented into Cloud-Based and On-Premise. The Cloud-based segment held the largest market share of 76.35% in the year 2019. The increasing investment for this segment by the IT sector to increase the productivity and efficiency of the businesses is improving the market share for this segment. It held Digital Transformation Spending in Logistics largest market size of USD 36.54 billion in the year 2019 and is anticipated to increase more in Digital Transformation Spending in Logistics forecast period to be at USD 62.58 billion in the year 2026 with a CAGR of 8.07%.

Salient Features of the Digital Transformation Spending in Logistics Market

- In 2019, Companies have spent around USD 2 trillion on Digital Transformation Spending in Logistics for digital tracking, efficiency, and due to competitive pressure.

- Digital Transformation Spending in Logistics estimated market share for the North-American region was 38.21% with market size of USD 17.95 billion in the year 2019 and is expected to be at USD 30.56 billion in the year 2026 with a high CAGR value.

- Digital Transformation Spending in Logistics Improved economic conditions, especially in emerging economies like India and China will support industry growth. Also, extensive investments in R&D programs by the international corporates are further responsible for the dominance of Digital Transformation Spending in Logistics market in this region which is the major driver for the market.

- Asia-Pacific is expected to be the fastest-growing region and hold the largest CAGR in the forecast period of 8.88% and has Digital Transformation Spending in Logistics estimated market size of USD 20.94 billion in the year 2026.

Major Key Players Considered in the Market

- JDA Software WMS

- Logitech

- Unisys Corporation

- Sanco Software

- Advantech

- Partner Tech

- Oracle

- Hexaware Technologies

- S2K warehouse management

- Samsung

- Mindtree

- 3GTMS

- XPO Logistics

- IBM

- APL Logistics Ltd.

- Digital Logistics Group

- Syntel

- 4Flow AG

- SAP

- Tech Mahindra

Key Industry Development in the Digital Transformation Spending in Logistics Market:

- In October 2023, UPS announced the acquisition of Happy Returns, a reverse logistics company specializing in seamless, box-free, and label-free return solutions for consumers and merchants. This strategic move aimed to expand UPS's digital logistics capabilities, offering enhanced convenience and efficiency in returns processing. The acquisition reinforced UPS's commitment to innovative solutions that streamline the logistics experience for businesses and their customers.

- In August 2023, Seedcom Logistics successfully transformed its warehouse environment through the implementation of Blue Yonder’s Warehouse Management System (WMS). This digital upgrade, completed in collaboration with Seedcom and Blue Yonder, significantly enhanced the capabilities of Seedcom Logistics. The new WMS has streamlined operations, improved efficiency, and set a benchmark for advanced logistics solutions, underscoring the company’s commitment to innovation and excellence in supply chain management.

|

Global Digital Transformation Spending in Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 63.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.09% |

Market Size in 2032: |

USD 128.68 Bn. |

|

Segments Covered: |

By Solutions |

|

|

|

By System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Transformation Spending in Logistics Market by Solutions (2018-2032)

4.1 Digital Transformation Spending in Logistics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Digital Transformation Spending in Logistics Market by System (2018-2032)

5.1 Digital Transformation Spending in Logistics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Conveyors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Automated Storage and Retrieval Systems (ASRS)

5.5 Automatic Sorters

5.6 Automated guided vehicle (AGV)

5.7 Robotic Picking System

5.8 Automatic Palletizer

5.9 Peripheral & Supporting Components BFSI

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Digital Transformation Spending in Logistics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AGILENT TECHNOLOGIES (CALIFORNIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EUROFINS MEDIGENOMIX GMBH (GERMANY)

6.4 FORENSIC FLUIDS LABORATORIES (UNITED STATES)

6.5 FORENSIC PATHWAYS (UK)

6.6 GE HEALTHCARE (CHICAGO

6.7 ILLINOIS)

6.8 LGC FORENSICS (LONDON)

6.9 NMS LABS (USA)

6.10 SPEX FORENSICS (USA)

6.11 THERMO FISHER SCIENTIFIC INC. (USA)

6.12 AND OTHER KEY PLAYERS

Chapter 7: Global Digital Transformation Spending in Logistics Market By Region

7.1 Overview

7.2. North America Digital Transformation Spending in Logistics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Solutions

7.2.4.1 Hardware

7.2.4.2 Software

7.2.4.3 Services

7.2.5 Historic and Forecasted Market Size by System

7.2.5.1 Conveyors

7.2.5.2 Automated Storage and Retrieval Systems (ASRS)

7.2.5.3 Automatic Sorters

7.2.5.4 Automated guided vehicle (AGV)

7.2.5.5 Robotic Picking System

7.2.5.6 Automatic Palletizer

7.2.5.7 Peripheral & Supporting Components BFSI

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Digital Transformation Spending in Logistics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Solutions

7.3.4.1 Hardware

7.3.4.2 Software

7.3.4.3 Services

7.3.5 Historic and Forecasted Market Size by System

7.3.5.1 Conveyors

7.3.5.2 Automated Storage and Retrieval Systems (ASRS)

7.3.5.3 Automatic Sorters

7.3.5.4 Automated guided vehicle (AGV)

7.3.5.5 Robotic Picking System

7.3.5.6 Automatic Palletizer

7.3.5.7 Peripheral & Supporting Components BFSI

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Digital Transformation Spending in Logistics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Solutions

7.4.4.1 Hardware

7.4.4.2 Software

7.4.4.3 Services

7.4.5 Historic and Forecasted Market Size by System

7.4.5.1 Conveyors

7.4.5.2 Automated Storage and Retrieval Systems (ASRS)

7.4.5.3 Automatic Sorters

7.4.5.4 Automated guided vehicle (AGV)

7.4.5.5 Robotic Picking System

7.4.5.6 Automatic Palletizer

7.4.5.7 Peripheral & Supporting Components BFSI

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Digital Transformation Spending in Logistics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Solutions

7.5.4.1 Hardware

7.5.4.2 Software

7.5.4.3 Services

7.5.5 Historic and Forecasted Market Size by System

7.5.5.1 Conveyors

7.5.5.2 Automated Storage and Retrieval Systems (ASRS)

7.5.5.3 Automatic Sorters

7.5.5.4 Automated guided vehicle (AGV)

7.5.5.5 Robotic Picking System

7.5.5.6 Automatic Palletizer

7.5.5.7 Peripheral & Supporting Components BFSI

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Digital Transformation Spending in Logistics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Solutions

7.6.4.1 Hardware

7.6.4.2 Software

7.6.4.3 Services

7.6.5 Historic and Forecasted Market Size by System

7.6.5.1 Conveyors

7.6.5.2 Automated Storage and Retrieval Systems (ASRS)

7.6.5.3 Automatic Sorters

7.6.5.4 Automated guided vehicle (AGV)

7.6.5.5 Robotic Picking System

7.6.5.6 Automatic Palletizer

7.6.5.7 Peripheral & Supporting Components BFSI

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Digital Transformation Spending in Logistics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Solutions

7.7.4.1 Hardware

7.7.4.2 Software

7.7.4.3 Services

7.7.5 Historic and Forecasted Market Size by System

7.7.5.1 Conveyors

7.7.5.2 Automated Storage and Retrieval Systems (ASRS)

7.7.5.3 Automatic Sorters

7.7.5.4 Automated guided vehicle (AGV)

7.7.5.5 Robotic Picking System

7.7.5.6 Automatic Palletizer

7.7.5.7 Peripheral & Supporting Components BFSI

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Digital Transformation Spending in Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 63.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.09% |

Market Size in 2032: |

USD 128.68 Bn. |

|

Segments Covered: |

By Solutions |

|

|

|

By System |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||