Global Cloud Based Drug Discovery Platforms Market Overview

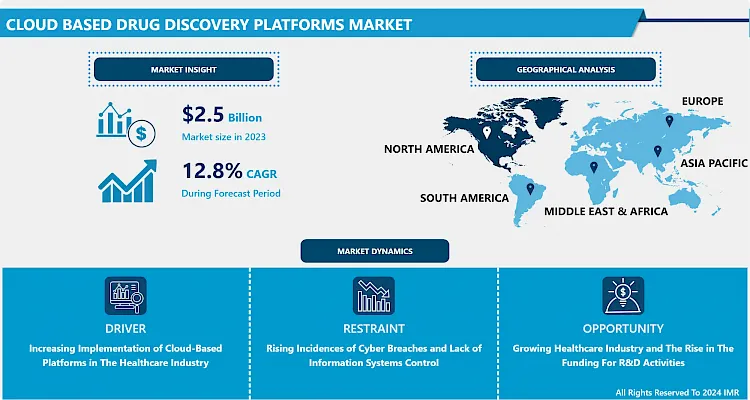

The Global Cloud-Based Drug Discovery Platforms Market size is expected to grow from USD 2.82 Billion in 2024 to USD 7.39 Billion by 2032, at a CAGR of 12.8% during the forecast period (2025-2032).

Cloud computing technology gives customers access to storage, files, software, and servers through internet-connected devices such as computers, smartphones, tablets, and wearables. Cloud computing solution providers store and process data in a location that's separate from end-users. Moreover, cloud computing provides the ability to store and access data and programs over the internet instead of on a hard drive. The usage of cloud-based drug discovery platforms in pharmaceutical and biotechnology firms allows collaboration with scientists and companies around the world. Furthermore, cloud-based drug discovery platforms reduce the risk and accelerate the drug development process by utilizing cost-effective, high-performance computing power and Artificial Intelligence/Machine Learning capabilities on the extensive cloud infrastructure. Additionally, cloud-based platforms assure secure research collaborations between different global teams and simplify data movement from lab equipment to integrate research environments. Cloud-based platforms provide the user with large storage options that aid in optimizing costs and performance. According to a study published in the Journal of the American Medical Association, the median cost of bringing a new drug to market is estimated to be $985 million, and the average cost is $1.3 billion. With the incorporation of cloud-based drug discovery platforms, the cost of drug discovery can be reduced thus, supporting the expansion of the market during the forecast period.

Market Dynamics And Key Factors In Cloud Based Drug Discovery Platforms Market

Drivers:

With cloud-based drug discovery platforms, an individual with an internet connection and proper security codes can participate in the drug discovery process irrespective of its geographic location. Additionally, it enables researchers globally, not only from different departments but also different companies with different processes and cultures, to collaborate and exchange data and function as a team in the drug discovery process. Moreover, with the adoption of cloud-based platforms, it became effortless for research institutions to organize several different drug discovery projects without having to upload all the information repeatedly. The data generated by the pharmaceutical companies is enormous and its management is a critical issue. Additionally, pharmaceutical companies are utilizing cloud-based drug discovery platforms to bolster their drug development process and to manage the huge data generated. Furthermore, storing data on clouds not only offers cost-saving but also improves accessibility thus, strengthening the development of cloud-based drug discovery platforms in the forecast period.

Zero lag time is the unique feature offered by the cloud-based drug discovery platform, which saves time and gives real-time access to users. Moreover, by employing cloud computing, the collection of data from appropriate individuals participating in clinical trials, across the globe can be done in real-time thereby, reducing the complexity of data collection. Furthermore, global pharma companies can leverage cloud solutions from any remote locations to suit a localized workforce, and the cost incurred in conducting clinical trials by developing exclusive data centers can be eliminated. Cloud-based high-performance computing aids Research and Development teams to access computational resources and along with Artificial and Machine Learning technologies, the cloud can accelerate the processes leading to faster release of the drug. Researchers will benefit from the automation of data processes coupled with other digital technologies like biosensors thus, driving the growth of the cloud-based drug discovery platforms in the estimated period.

Restraints:

The main concern while deploying a cloud-based system in research organizations is the security of the data. Moreover, the rising incidences of cyber breaches and lack of information systems control are the main factors hampering the expansion of cloud-based drug discovery platforms growth in the forecast period. Furthermore, to access the data stored in the cloud, research institutions or individuals require reliable internet connectivity. Without a secure internet connection, the data stored on the cloud is not accessed. Vendor lock-in is the main disadvantage of cloud computing. Pharma industries may face problems while transferring services from one vendor to another. As different vendors provide different platforms, that can cause difficulty moving from one cloud to another thus, hindering the development of cloud-based drug discovery platforms during the projected period.

Opportunities:

The growing healthcare industry and the rise in the fundings for R&D activities to develop new drugs to treat diseases efficiently are creating better opportunities for software vendors. In recent years there has been a significant increase in the price of bringing new drugs to market, with estimates putting the cost as high as $1bn. This situation has forced R&D laboratories to turn to new laboratory informatics technologies, to reduce spending and launch essential drugs in the market, faster. With the adoption of cloud-based drug discovery platforms, institutions can cut down the time required to discover new drugs. Moreover, the rise in the number of research institutions and the growing biotechnology industry is generating lucrative opportunities for market players to develop robust software and meet all the requirements of the users.

Market Segmentation

Segmentation Analysis of Cloud-Based Drug Discovery Platforms Market:

Depending on the type, Software as a service (SaaS) segment is expected to dominate the cloud-based drug discovery platforms market in the projected period. SaaS reduced the time spent on the installation and configuration of software. The maintenance cost of SaaS is low as compared to other types thus, allowing access to small research organizations for cloud-based. SaaS can quickly and efficiently deliver the principal value of the clinical research application with the ability to capture, manage, share efficiently and effectively across thousands of investigators around the globe and among all stakeholders will help decrease the time for the whole clinical research cycle thus, driving the growth of this segment.

Depending on deployment mode, the hybrid segment is projected to lead the market over the estimated period attributed to the increase in the number of users, and resource mobility. In addition, the rapid migration of applications over the cloud, and the emergence of more sophisticated threats are prompting businesses to adopt hybrid cloud-based solutions. Pharmaceutical industries are adopting hybrid cloud solutions to support the migration of on-premise data and application workloads into the cloud, with objectives such as reducing costs, increasing IT efficiency, and reducing time-to-market for new drugs thus, driving the growth of this segment in the forecast period.

Depending on the end-user, the pharmaceutical vendor segment is expected to dominate the cloud-based drug discovery platforms market in the estimated period. The rise in the number of software vendors providing cloud-based drug discovery platforms to facilitate research and development processes is the main driving force for the growth of this segment. Moreover, to tackle new strains of viruses, bacteria, and to find appropriate medications on these outbreaks cloud-based platforms are aiding research organizations to develop drugs in a short time. Furthermore, the cost involved in traditional clinical trials can be reduced and the data generated while conducting clinical trials can be efficiently managed through cloud-based solutions thus, strengthening the expansion of the cloud-based drug discovery platforms market in the projected period.

Regional Analysis of Cloud Based Drug Discovery Platforms Market:

The North American region is expected to have the highest share of cloud-based drug discovery platforms in the forecast period. The growing number of pharmaceutical firms and a need to manage the huge data generated by this industry is the main factor driving the expansion of cloud-based drug discovery platforms in this region. Moreover, countries such as US and Canada have a wide presence of prominent cloud computing service providers. The growing prevalence of diseases and to find effective drugs quicker is stimulating pharmaceutical and biotechnology vendors to adopt cloud-based drug discovery platforms.

The European region is anticipated to have the second-highest share of the market during the projected period. The technological advancements in this region are promoting research institutes in this region to incorporate cloud-based drug discovery platforms to accelerate the drug development process. Key players in this region are offering flexible, cost-effective, and highly secure cloud-based storage options to users thereby, fueling the development of cloud-based drug discovery platforms.

The Asia-Pacific region is forecasted to expand at the highest growth rate. The rise in collaborations with a top western research organization and the growing inclination towards solutions offered by cloud-based services is promoting the progress of cloud-based drug discovery platforms in this region. China, Japan, and India are the major countries contributing to the growth of cloud-based drug discovery platforms in this region.

Players Covered in Cloud Based Drug Discovery Platforms Market are:

- Accenture PLC (Ireland)

- Acelot Inc (US)

- Cloud Pharmaceuticals Inc. (US)

- Dassault Systemes (France)

- IBM Corporation (US)

- SAS Institute Inc. (the US)

- Tata Consultancy Services Ltd. (India)

- WuXi AppTec (China)

- Collaborative Drug Discovery (CDD)

- SCYNEXIS Inc. (the US)

- Medidata (US)

- Certara (US)

- Google (US)

- Cloudpharm

- Amazon Web Services Inc. (US) and other Active players.

COVID-19 Impact on Cloud Based Drug Discovery Platforms Market

With the outbreak of the COVID-19 pandemic, several industry verticals were forced to shut down their operational activities. Moreover, to constraint the spread of the virus the number of workers, working in the pharmaceutical and biotechnology industry were reduced. In addition, the restrictions on transportation disrupted the supply chain of various pharmaceutical drugs. To overcome the financial losses incurred by the COVID-19 pandemic, many industry verticals started fundamentally leveraging cloud computing for their digital transformation process, pharmaceutical and biotechnology organizations started utilizing it for drug discovery and other critical processes. Furthermore, the pandemic has accelerated the adoption rate of cloud computing solutions by the pharma sector, which was slow in transitioning to the cloud earlier. According to a survey report published by Healthcare Information and Management Systems Society, more than 83 percent of pharma companies are already leveraging cloud services. With the Covid-19 pandemic driving innovation, the pharmaceutical industry is making headway in developing vaccines, repurposing drugs, and new drug discoveries to curb the spread of the virus. Huge investments are being made in Research and Development with the cloud becoming a key solution to streamline all IT expenses by reducing costs and increasing efficiency. In addition, to Research and Development activities, the subsequent development of the COVID-19 vaccine in a short period of one and half year demonstrated the vital contribution of cloud technology in advancing the process. Apart from drug development, big data is being leveraged to determine the effective dosage of various drugs through collating and interpreting scores of data points collected on a real-time basis.

Key Industry Developments In Cloud Based Drug Discovery Platforms Market

- In January 2023, BioNTech announced the acquisition of InstaDeep, a leading AI and machine learning company, for £362 million in cash and shares, plus potential milestone payments of £200 million. The deal strengthens BioNTech’s position in AI-powered drug discovery and development, adding 240 skilled professionals and advanced platforms like InstaDeep’s DeepChain™ to enable high-throughput design of next-generation immunotherapies and vaccines. InstaDeep will operate as a BioNTech company from its London headquarters, enhancing BioNTech’s global research capabilities and AI-driven innovation.

- In May 2023, Google Cloud unveiled two AI-powered solutions at the Bio-IT World Conference to accelerate drug discovery and precision medicine. The Target and Lead Identification Suite leverages tools like AlphaFold2 and Vertex AI to predict protein structures, optimize leads, and streamline in silico drug design, while the Multiomics Suite aids genomic data analysis for precision treatments. Early adopters, including Pfizer and Cerevel, are leveraging these cloud-based platforms to expedite drug development and enhance therapeutic innovations.

- In December 2023, MilliporeSigma, the U.S. and Canada Life Science arm of Merck KGaA, Darmstadt Germany, introduced AIDDISON™, an AI-powered SaaS platform integrating generative AI, machine learning, and computer-aided drug design with Synthia™ retrosynthesis API. This innovation screens over 60 billion chemical targets, identifies optimal drug candidates, and recommends cost-effective, sustainable synthesis routes, revolutionizing cloud-based drug discovery platforms to accelerate the development of safer and more effective therapies.

|

Global Cloud Based Drug Discovery Platforms Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.82 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 7.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud Based Drug Discovery Platforms Market by Type (2018-2032)

4.1 Cloud Based Drug Discovery Platforms Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Infrastructure As A Service {IaaS}

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software As A Service {SaaS}

4.5 Platform As A Service {PaaS}

Chapter 5: Cloud Based Drug Discovery Platforms Market by Deployment Mode (2018-2032)

5.1 Cloud Based Drug Discovery Platforms Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private

5.5 Hybrid

Chapter 6: Cloud Based Drug Discovery Platforms Market by End User (2018-2032)

6.1 Cloud Based Drug Discovery Platforms Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pharmaceutical Vendors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Biotech Vendors

6.5 Contract Research Organizations

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud Based Drug Discovery Platforms Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EQUIVANT (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DAILY JOURNAL CORPORATION (US)

7.4 MICROPACT (US)

7.5 MICROSOFT (US)

7.6 RELATIVITY (US)

7.7 HYLAND SOFTWARE (US)

7.8 WELLIGENT INC (US)

7.9 JAYHAWK SOFTWARE (US)

7.10 TYLER TECHNOLOGIES (US)

7.11 OTHER KEY PLAYERS

7.12

Chapter 8: Global Cloud Based Drug Discovery Platforms Market By Region

8.1 Overview

8.2. North America Cloud Based Drug Discovery Platforms Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Infrastructure As A Service {IaaS}

8.2.4.2 Software As A Service {SaaS}

8.2.4.3 Platform As A Service {PaaS}

8.2.5 Historic and Forecasted Market Size by Deployment Mode

8.2.5.1 Public

8.2.5.2 Private

8.2.5.3 Hybrid

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Pharmaceutical Vendors

8.2.6.2 Biotech Vendors

8.2.6.3 Contract Research Organizations

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud Based Drug Discovery Platforms Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Infrastructure As A Service {IaaS}

8.3.4.2 Software As A Service {SaaS}

8.3.4.3 Platform As A Service {PaaS}

8.3.5 Historic and Forecasted Market Size by Deployment Mode

8.3.5.1 Public

8.3.5.2 Private

8.3.5.3 Hybrid

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Pharmaceutical Vendors

8.3.6.2 Biotech Vendors

8.3.6.3 Contract Research Organizations

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud Based Drug Discovery Platforms Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Infrastructure As A Service {IaaS}

8.4.4.2 Software As A Service {SaaS}

8.4.4.3 Platform As A Service {PaaS}

8.4.5 Historic and Forecasted Market Size by Deployment Mode

8.4.5.1 Public

8.4.5.2 Private

8.4.5.3 Hybrid

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Pharmaceutical Vendors

8.4.6.2 Biotech Vendors

8.4.6.3 Contract Research Organizations

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud Based Drug Discovery Platforms Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Infrastructure As A Service {IaaS}

8.5.4.2 Software As A Service {SaaS}

8.5.4.3 Platform As A Service {PaaS}

8.5.5 Historic and Forecasted Market Size by Deployment Mode

8.5.5.1 Public

8.5.5.2 Private

8.5.5.3 Hybrid

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Pharmaceutical Vendors

8.5.6.2 Biotech Vendors

8.5.6.3 Contract Research Organizations

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud Based Drug Discovery Platforms Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Infrastructure As A Service {IaaS}

8.6.4.2 Software As A Service {SaaS}

8.6.4.3 Platform As A Service {PaaS}

8.6.5 Historic and Forecasted Market Size by Deployment Mode

8.6.5.1 Public

8.6.5.2 Private

8.6.5.3 Hybrid

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Pharmaceutical Vendors

8.6.6.2 Biotech Vendors

8.6.6.3 Contract Research Organizations

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud Based Drug Discovery Platforms Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Infrastructure As A Service {IaaS}

8.7.4.2 Software As A Service {SaaS}

8.7.4.3 Platform As A Service {PaaS}

8.7.5 Historic and Forecasted Market Size by Deployment Mode

8.7.5.1 Public

8.7.5.2 Private

8.7.5.3 Hybrid

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Pharmaceutical Vendors

8.7.6.2 Biotech Vendors

8.7.6.3 Contract Research Organizations

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cloud Based Drug Discovery Platforms Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.82 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 7.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||