Carrageenan Market Synopsis

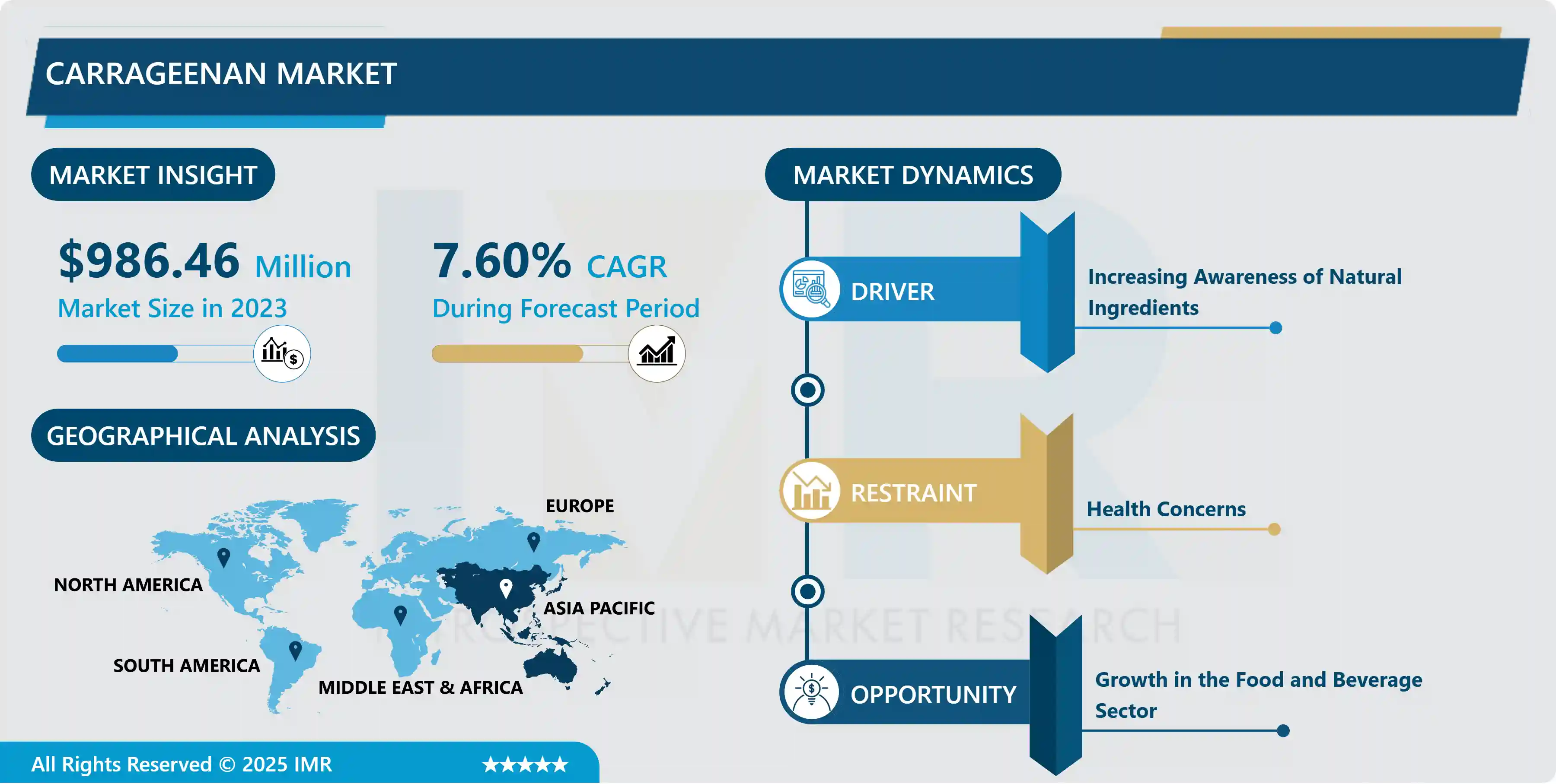

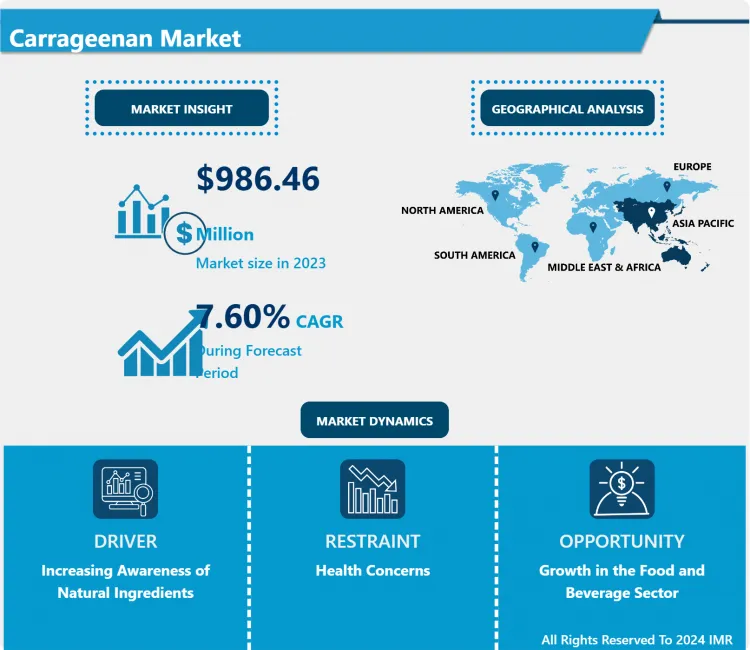

Carrageenan Market Size Was Valued at USD 986.46 Million in 2023 and is Projected to Reach USD 1,907.17 Million by 2032, Growing at a CAGR of 7.60% From 2024-2032.

Carrageenan is a polysaccharide extracted from red seaweed which also finds application as a thickening, gelling, and stabilizing agent in food industry. This property of gelation makes it useful particularly in dairy and meat products, and plant-protein based products. Carrageenan functions by when mixed with water it gels to enhance texture and viscosity of food products. The same is used in the production of drugs and cosmetics for similar purposes as well. However, although it is widely used, there has been some controversy regarding its health effects although due to its functional benefits it is still used.

Carrageenan is a natural polysaccharide derived from red seal weeds employed as gelling, thickening, and stabilising agents in the food and beverages. They include uses in the dairy products and meat processing industries, through to the chemical, pharmaceutical, and cosmetic industries. The general market for carrageenan has expanded particularly because of the multiple applications of the ingredient and the fact that consumers are paying more attention to natural and clean-label products. Organic and natural food products are increasingly being favoured in the market and this is supporting this growth. The division of the carrageenan market is in terms of type, application and the region.

There are primarily three types of carrageenan used in the industry: These are Kappa, iota, and lambda. Kappa carrageenan is the most preferred carrageenan for gelation and is widely used in dairy as well as meat products. Iota carrageenan has gel strength and application in dairy and bakery products as a texturant. Lambda carrageenan chiefly supplies thickness and is employed in products such as sauces and dressings. Thus, the type of carrageenan to be used depends with the given application and the texture or consistencies that are desirable in the final product. Although carrageenan has many uses, few of the most common are presented below. In the foods and beverages area , it is employed in commodities including yogurt, ice cream, meat products through enhancing texture and shelf stability. In pharma ceuticals, carrageenan finds uses in gel and suspension preparation for medication and drugs. This is because populations’ increase consumption of processed foods and beverages is supplemented by improved technologies in carrageenan production.

Regionally, the carrageenan market is growing in the areas of North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Thus, Asia-Pacific constitutes a large demand for carrageenan as it is the region that consists of some of the largest seaweed producers like Indonesia, the Philippines, and China. Another factor that is helping carrageenan market growth is better uptake of the carrageenan product by emerging nations.

However, the market of carrageenan has challenges like fluctuating price of the seaweed and controversy relating to health impacts of carrageenan. There are several issues regarding the safety of carrageenan: Some specific studies have made humans more aware of the health risks incurred from its consumption, regulatory actions and the banning or limitation of carrageenan in some countries. These challenges are being addressed through factors such as sustainable sourcing and enhancing production methods among others. Thus, the market of carrageenan is expected to grow because of the availability of numerous applications and the constantly increasing need for natural products in food industry. Since consumers’ preferences are increasingly transformed to natural and organic products, the demand for carrageenan is believed to grow. Nevertheless, it could be stated that the handling of the issues that are connected with the presence of certain health concerns, as well as the solidity of the actions proposed for making the practices sustainable, would appear to be defining for the creation of a consistent market drive.

Carrageenan Market Trend Analysis

Growing Demand in Plant-Based Products

- New trends for plant-based products have shifted the carrageenan market since consumers search for products that are beneficial to health and do not harm the environment and animals. Carrageenan is a natural polysaccharide used as a thickener or gelling and stabilizer particularly in plant-based products such as almond milk, soy milk, and coconut yogurt. Increasing veganism, lactose intolerance, and sustainability across the global population that ups the take of plant-based products has steered up the demand for carrageenan due to its plant sourced and functional properties.

- Companies are leveraging on this by including carrageenan in their formulation hence pointing to a shift of consumers want clean-label ingredients in their plant-based products. Furthermore, as the consumption of plant based food increases the growth of the plant based food industry will cause carrageenan to grow more and uncover new applications creating a further importance of carrageenan as an ingredient for formulation of other plant based foods.

Growth in the Food and Beverage Sector

- Market in the Food and beverages sector has been changing and further Carrageenan market has shown a great growth due to the growing demand of natural and organic food products. Seaweed derived carrageenan has been labelled as an effective texturant and stabiliser which has replaced synthetic thicknessers in the market. This growth is attributed to its versatility in use it in food products such as, dairy productos, processed meat products and sauces to enhance the texture and mouthfeel of the product. The increase in consumers’ interest in improved diets and clean-label food products has also increased demand as carrageenan is friendly to consumers’ demands on natural products.

- Furthermore, the increase in the food and beverage market around the world as well as advancement in the carrageenan processing and uses are other drivers of the market. Other factors that boost the sector include regulatory clearances and carrageenan use in the growth markets. Thus, as the food and beverage segment undergoes constant changes, carrageenan will remain an essential ingredient that defines product development and adapts to consumers’ demand for higher quality dinners and their environmental impact.

Carrageenan Market Segment Analysis:

Carrageenan Market Segmented based on Processing Technology, Function , Product Type, and Application .

By Processing Technology , Semi-refined segment is expected to dominate the market during the forecast period

- The carrageenan market is segmented based on processing technology into three primary categories: According to the category of the process involved, three main methods of gel production include alcohol precipitation, gel press and, semi refined. Regarding the extraction of carrageenan, this is accomplished by using alcohol precipitation, to be followed by filtration and drying to generate a pure product. This method is appreciated for its concerns to achieve the high quality of carrageenan with low contaminants. The other type of process is the gel press process where the gelling of seaweed is carried out and followed by mechanical pressing that minimises the differ-entiation of carrageenan and leads to a more standard product on the basis of their mechanical properties. This method is preferred for carrageenan of a certain functional characteristic to meet certain application requirements.

- Partial carrageenan is manufactured by a comparatively milder procedure which retains certain constituents of the seaweed fiber; it is cheaper though slightly inferior in quality to the fully refined carrageenan and finds a wide use in both the food and the industrial sectors. Each processing technology applied has its own merits and demerits of the carrageenan market taking into consideration the quality needed, requirement of the application to be used and cost factor.

By Function , Thickening Agent segment held the largest share in 2023

- The carrageenan market can be segmented by functions where it used, the segments being thickening agents, gelling agents, stabilizers and others. Carrageenan is the extract derived from red seaweed, and due to its functional properties, Carrageenan finds application in different sectors. In this case, carrageenan works as a thickening agent that is used in increasing the viscosity of such commodities like sauces, dressings, and dairy products. Stable and essential in gelling which makes it applicable in gellation of products such as puddings, jellies and some of the confectionaries to achieve the right texture and consistency.

- It also serves the purpose of stabilizer, mostly used in the separation prevention of dairy products as well as in the beverages. The functions “others” are essential for the food product where carrageenan’s chemical characteristic is useful for product formation and stability, besides emulsification and water holding capacity or water retention. The respective category’s need for carrageenan stimulates the market’s growth due to factors such as the consumer inclination toward natural materials and improvements in the techniques for carrageenan extraction and application.

Carrageenan Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Concerning the carrageenan market, analysts forecast considerable domination of the Asia Pacific region during the forecast period due to several factors. This region’s output is attributed to its strong agriculture sector that offer steady supply of seaweed, the raw material used in carrageenan production. Also, the new and expanding food and beverages market in Asia Pacific region due to increased consumers’ preference for processed food and convenience foods has instigate growth of carrageenan applications chiefly as a thickener and gelling agent.

- Pharmaceuticals and personal care products industries in such nations as China and India are also on the rise, and so is the consumption of carrageenan in various products. In addition, policies from a supporting government to invest in research and development of new products, as well as the expansion of many manufacturers” and suppliers’ companies in the area will also contribute significantly to the growth of the market. With these factors it can be concluded that Asia Pacific is likely to dominate the carrageenan market throughout the rest of the world making it a strategic region for this ever growing sector.

Active Key Players in the Carrageenan Market

- DSM Nutritional Products (Netherlands)

- CP Kelco (USA)

- Ingredion Incorporated (USA)

- FMC Corporation (USA)

- Gelymar (Chile)

- Cargill, Incorporated (USA)

- DuPont de Nemours, Inc. (USA)

- Nippon Paper Industries Co., Ltd. (Japan)

- Marine Ingredients (Norway)

- Gum Technology Corporation (USA) and Other Active Player

Key Industry Developments in the Carrageenan Market

- In November 2022, Biolchim Group was acquired by J.M Huber Corporation, which is one of the major manufacturers and distributors of a diverse selection of specialized plant nutrition and biostimulants. The West Coast Marine-Bio Processing Corp, one of the organizations of Biolchim, supplied with seaweeds like carrageenan, is also part of J.M. Huber Corporation.

- In October 2022, NoriZite Nasal Spray with carrageenan was developed by Birmingham Biotech Ltd. Norizite with carrageenan acts as an anti-viral agent known to prevent infection from several respiratory viruses.

|

Carrageenan Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 986.46 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.60%

|

Market Size in 2032: |

USD 1,907.17 Mn. |

|

Segments Covered: |

By Processing Technology |

|

|

|

By Function |

|

||

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Carrageenan Market by Processing Technology (2018-2032)

4.1 Carrageenan Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alcohol Precipitation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gel Press

4.5 Semi-refined

Chapter 5: Carrageenan Market by Function (2018-2032)

5.1 Carrageenan Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Thickening Agent

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gelling Agent

5.5 Stabilizer

5.6 Others

Chapter 6: Carrageenan Market by Product Type (2018-2032)

6.1 Carrageenan Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Kappa

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Iota

6.5 Lambda

Chapter 7: Carrageenan Market by Application (2018-2032)

7.1 Carrageenan Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical

7.5 Personal Care & Cosmetics

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Carrageenan Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DSM NUTRITIONAL PRODUCTS (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CP KELCO (USA)

8.4 INGREDION INCORPORATED (USA)

8.5 FMC CORPORATION (USA)

8.6 GELYMAR (CHILE)

8.7 CARGILL INCORPORATED (USA)

8.8 DUPONT DE NEMOURS INC. (USA)

8.9 NIPPON PAPER INDUSTRIES COLTD. (JAPAN)

8.10 MARINE INGREDIENTS (NORWAY)

8.11 GUM TECHNOLOGY CORPORATION (USA) OTHER ACTIVE PLAYER

Chapter 9: Global Carrageenan Market By Region

9.1 Overview

9.2. North America Carrageenan Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Processing Technology

9.2.4.1 Alcohol Precipitation

9.2.4.2 Gel Press

9.2.4.3 Semi-refined

9.2.5 Historic and Forecasted Market Size by Function

9.2.5.1 Thickening Agent

9.2.5.2 Gelling Agent

9.2.5.3 Stabilizer

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Product Type

9.2.6.1 Kappa

9.2.6.2 Iota

9.2.6.3 Lambda

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Food & Beverage

9.2.7.2 Pharmaceutical

9.2.7.3 Personal Care & Cosmetics

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Carrageenan Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Processing Technology

9.3.4.1 Alcohol Precipitation

9.3.4.2 Gel Press

9.3.4.3 Semi-refined

9.3.5 Historic and Forecasted Market Size by Function

9.3.5.1 Thickening Agent

9.3.5.2 Gelling Agent

9.3.5.3 Stabilizer

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Product Type

9.3.6.1 Kappa

9.3.6.2 Iota

9.3.6.3 Lambda

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Food & Beverage

9.3.7.2 Pharmaceutical

9.3.7.3 Personal Care & Cosmetics

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Carrageenan Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Processing Technology

9.4.4.1 Alcohol Precipitation

9.4.4.2 Gel Press

9.4.4.3 Semi-refined

9.4.5 Historic and Forecasted Market Size by Function

9.4.5.1 Thickening Agent

9.4.5.2 Gelling Agent

9.4.5.3 Stabilizer

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Product Type

9.4.6.1 Kappa

9.4.6.2 Iota

9.4.6.3 Lambda

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Food & Beverage

9.4.7.2 Pharmaceutical

9.4.7.3 Personal Care & Cosmetics

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Carrageenan Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Processing Technology

9.5.4.1 Alcohol Precipitation

9.5.4.2 Gel Press

9.5.4.3 Semi-refined

9.5.5 Historic and Forecasted Market Size by Function

9.5.5.1 Thickening Agent

9.5.5.2 Gelling Agent

9.5.5.3 Stabilizer

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Product Type

9.5.6.1 Kappa

9.5.6.2 Iota

9.5.6.3 Lambda

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Food & Beverage

9.5.7.2 Pharmaceutical

9.5.7.3 Personal Care & Cosmetics

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Carrageenan Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Processing Technology

9.6.4.1 Alcohol Precipitation

9.6.4.2 Gel Press

9.6.4.3 Semi-refined

9.6.5 Historic and Forecasted Market Size by Function

9.6.5.1 Thickening Agent

9.6.5.2 Gelling Agent

9.6.5.3 Stabilizer

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Product Type

9.6.6.1 Kappa

9.6.6.2 Iota

9.6.6.3 Lambda

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Food & Beverage

9.6.7.2 Pharmaceutical

9.6.7.3 Personal Care & Cosmetics

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Carrageenan Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Processing Technology

9.7.4.1 Alcohol Precipitation

9.7.4.2 Gel Press

9.7.4.3 Semi-refined

9.7.5 Historic and Forecasted Market Size by Function

9.7.5.1 Thickening Agent

9.7.5.2 Gelling Agent

9.7.5.3 Stabilizer

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Product Type

9.7.6.1 Kappa

9.7.6.2 Iota

9.7.6.3 Lambda

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Food & Beverage

9.7.7.2 Pharmaceutical

9.7.7.3 Personal Care & Cosmetics

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Carrageenan Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 986.46 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.60%

|

Market Size in 2032: |

USD 1,907.17 Mn. |

|

Segments Covered: |

By Processing Technology |

|

|

|

By Function |

|

||

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||