Business Software And Services Market Synopsis

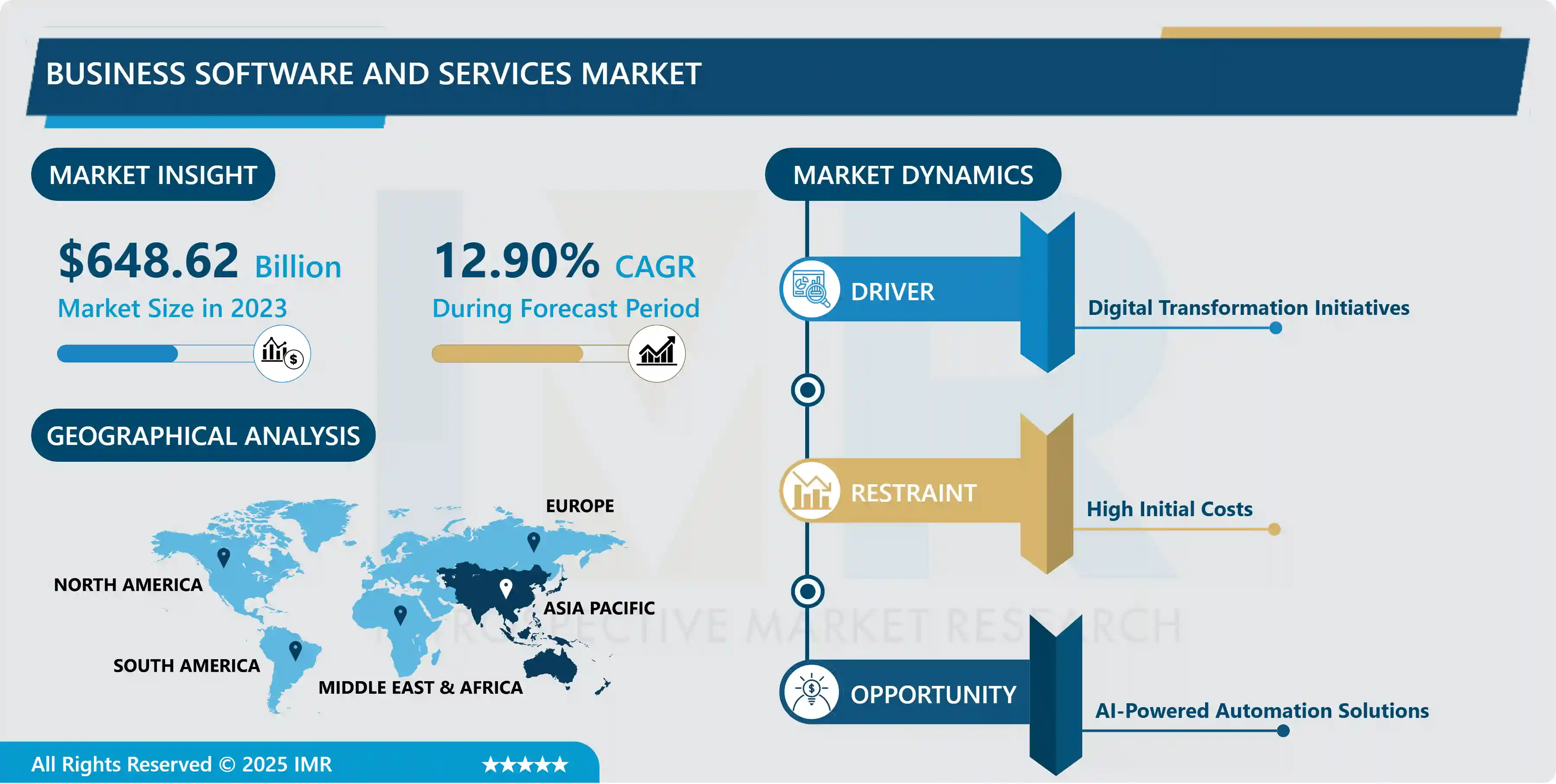

Business Software And Services Market Size Was Valued at USD 648.62 Billion in 2023, and is Projected to Reach USD 1,933.02 Billion by 2032, Growing at a CAGR of 12.90% From 2024-2032.

Business software and services entails applications, plus services and platforms, which are aimed at improving operational efficiency of businesses. Such technologies include those specific programs like accounting, CRM, ERP, project management and others that assist the companies in the organization of their processes, increase of effectiveness and the achievement of their objectives.

The business software and services market is a fast-moving segment originally covering everything related to computerization of business processes in an organization. The growth in this market can be attributed to the constant rise in digital business strategies, methods such as cloud computing, and the integration of multiple solutions with organizations.

The other main force that has been shown to be instrumental in the business software and services market is the fourth force that is speed of technological change. Businesses are always in the process of looking for technological solutions that would make their processes faster and more efficient, resulting in an emergence of numerous software products that address specific organizational requirements. These are; Enterprise Resource planning (ERP) systems, Customer Relation Management (CRM) solutions, Supply Chain Management (SCM) systems, and Business Intelligence (BI) tools. Each of these categories concerns particular aspects of business management, allowing the organisations to control the resources, enhance the relations with the customers and use the data.

Cloud computing technology has impacted the availability of business solutions by providing firms with versatile and cheap applications through web access. Such a transition has provided equal opportunity for the use of sophisticated business solutions, especially with the development of conduit cloud-based software-as-a-service (SaaS) that can be highly beneficial for SMEs, which may not afford the on-premise installation. In addition, cloud solutions are flexible, and can easily accommodate changes in the market, and hence providing a growing business with the means to expand rapidly.

Another evident and increasingly popular direction in the BSS market is the incorporation of AI & ML in business software solutions. People are seeking the use of AI in several aspects like predictive analysis, natural language processing, and business process automation. They help organisations to derive intelligence to analyse the high volume of data, to tailor the customer communications and interactions, and to manage the business processes effectively. In addition, the market is saturated with vendors ranging from global giants to specific niches among which it is possible to find an individual offer adapted to the specific maximum functionality, ease of use, and quality of the customer’s requests. The mentioned competitive environment leads to a constant search for improvements and growth in the capabilities of software and can be viewed as a positive factor for end users offering numerous options and constantly developing products.

Therefore, it can be stated that the business software and services market will continue to grow at a constant rate as the firms and companies of various industries are becoming aware of the significance of turning into the technological methods for attaining their organizational goals and business strategies. Thus, as a result of continuous developments in the field of cloud computing, AI and automation together with the growing need for effective, exhaustive and interlinked solutions for various problems, the market outlook is expected to be rather active and oversaturated. Entities that are able to effectively incorporate these technologies possess the capacity to improve their operation’s speed, flexibility and creativity to meet market demands.

Business Software And Services Market Trend Analysis

Shift Towards Cloud-Based Solutions

- It is apparent that change has been inevitable in business software and services market with emphasis been put on cloud solutions because of the following reasons. Cloud applications are becoming popular in organizations because of the benefits that come with it as compared the traditional on premise application. Outsourced solutions provide business with opportunities to run their data and applications from various sites, which favor both work from home and teamwork across organizations internationally. This transition has also resulted in quicker deployment and compatibility with other systems which in turn has cut down on IT burden and upkeep expenses.

- In addition, ?exible consumption models and the ability to perform computations in the cloud, and analytical capabilities based on machine learning open up opportunities for business to analyze their data and optimize business processes. Therefore, cloud-based business software and services are still making their steady growth in the market and vendors are trying to develop tools and solutions that will correspond to modern requirements of the organizations from different sectors.

AI-Powered Automation Solutions

- The automation solutions market for business software and services has been on the rise for the past several years mainly because of developments in artificial intelligence as well as machine learning. They are transforming different sectors by enabling better efficiency and making the management and decision-making processes easier. The market’s key stake holders are thus investing in developing complex software programs, incorporating them into software suites that provide customers with automation of a broad range of tasks, from managing client relations and performing marketing analysis to overseeing supply chains and forecasting financial outcomes.

- Application areas include healthcare, finance, retail, and manufacture industries are among the leading in implementing these technologies in a bid to cut on operational costs, enhance accuracy as well as achieve large scale company operations productivity. As the need for improved and more efficient business processes consulting rises, there are further trends in the growth of AI-powered automation solutions, and given the constant drive of new developments, there is a sense that the demand in global enterprises will perpetually progress.

Business Software And Services Market Segment Analysis:

Business Software And Services Market Segmented based on Software, Service, Deployment, Enterprise Size And End User.

By Solution , Sales & Marketing segment is expected to dominate the market during the forecast period

- The business software and services market is a broad field containing the finance, sales, marketing, human resource, supply chain, and many other fields. To an extent, every sector heavily depends on the software solutions that meet the requirements of the specific field. Irrespective of a business organization’s industry, software is paramount in its financial analysis, risk management, and regulation, increasing the speed and accuracy of all financial activities. CRM, lead collation and campaigns are some of the areas where sales and marketing software assist in delivery of efficient as well appropriately marketed products. The usage of the human resource software allows for the automation of the payroll, recruitment, performance management and even the engagement of the workforce hence the proper management of the employees.

- Supply chain management software enhances the status of inventory, logistics and purchasing hence creating the efficiency of offering services and products in a chain. Apart from such fields, business software and services also cover additional fields: healthcare, education, manufacturing, etc, providing tools for competent patient’s management, academic sector management, and production enhancement accordingly. The market is continuously evolving, and cloud computing, Artificial intelligence, and big data analytics are taking central stage in improving upon functionality, flexibility, and the ability to forecast trends in a number of industries. Increasingly, businesses aim for digital transformation and optimal functionality, thus, the call for complex, interlinked business applications helps fuel the growth and rivalry on the business software & services marketplace.

By Service , Managed Services segment held the largest share in 2023

- In the Business Software and Services market, consulting services are key change makers that guide the overall strategy, change management, and business improvements resulting from the efficient use of the solution for specific organizational needs. These consulting services include strategy formation for IT and planning for putting strategies into practice which aids organizations to relate technology back to the broader business mission. While, that on the other hand, are IT solutions where the provider offers comprehensive and regular maintenance and monitoring of client’s IT systems, applications, and security.

- Such a mandate guarantees that businesses depending on outside help obtain exemplary, efficient, and economical services from such a model. The last tier is the support and maintenance services which is the final component to sustain infrastructure to ensure that software solutions run in the marketplace with the least of hitch and are safe from any external threats. In combination, these services constitute a holistic paradigm of enabling organizational development by leveraging technology in today’s hyper-competitive environment.

Business Software And Services Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to dominate the business software and services market within the predicted time span. This expected leadership is due to several factors that are boosting development in the area. First of all, progressive digitization processes in various spheres and increased utilization of cloud technologies and SaaS, in turn, are engendering the necessity of sophisticated business software. Many Asian nations such as China, India, Japan and South Korea are experiencing a GDP growth, an increasing middle class population and the emergence of many start-ups, which has an impact on increased investments in business software and services.

- Also, recent efforts made by the governments to come up with smart city development, electronic business, and other digital platforms are also prompting the growth of the market even more. Technological advancement has been adopted enthusiastically in the Asia Pacific region; furthermore, this region has a massive and growing ardently digitally oriented population, making Asia Pacific one of the most promising territories for business software and services vendors interested in gripping new opportunities in the digital economy.

Active Key Players in the Business Software And Services Market

- Acumatica, Inc. (USA)

- Deltek, Inc. (USA)

- Epicor Software Corporation (USA)

- International Business Machines Corporation (USA)

- Infor (USA)

- NetSuite Inc. (USA)

- Microsoft Corporation (USA)

- SAP SE (Germany)

- Oracle Corporation (USA)

- TOTVS S.A. (Brazil)

- Unit4 (Netherlands)

- SYSPRO (South Africa) and Other Active Player

|

Business Software And Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 648.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.90% |

Market Size in 2032: |

USD 1,933.02 Bn. |

|

Segments Covered: |

By Software |

|

|

|

By Service |

|

||

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Software And Services Market by Software (2018-2032)

4.1 Business Software And Services Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Finance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sales & Marketing

4.5 Human Resource

4.6 Supply Chain

4.7 Others

Chapter 5: Business Software And Services Market by Service (2018-2032)

5.1 Business Software And Services Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Consulting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Managed Services

5.5 Support & Maintenance

Chapter 6: Business Software And Services Market by Deployment (2018-2032)

6.1 Business Software And Services Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 On-premise

Chapter 7: Business Software And Services Market by Enterprise Size (2018-2032)

7.1 Business Software And Services Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Large Enterprises

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Small & Medium Enterprises

Chapter 8: Business Software And Services Market by End-use (2018-2032)

8.1 Business Software And Services Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Aerospace & Defense

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 BFSI

8.5 Government

8.6 Healthcare

8.7 IT & Telecom

8.8 Manufacturing

8.9 Retail

8.10 Transportation

8.11 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Business Software And Services Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ACUMATICA INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DELTEK INC. (USA)

9.4 EPICOR SOFTWARE CORPORATION (USA)

9.5 INTERNATIONAL BUSINESS MACHINES CORPORATION (USA)

9.6 INFOR (USA)

9.7 NETSUITE INC. (USA)

9.8 MICROSOFT CORPORATION (USA)

9.9 SAP SE (GERMANY)

9.10 ORACLE CORPORATION (USA)

9.11 TOTVS S.A. (BRAZIL)

9.12 UNIT4 (NETHERLANDS)

9.13 SYSPRO (SOUTH AFRICA) OTHER ACTIVE PLAYER

9.14

Chapter 10: Global Business Software And Services Market By Region

10.1 Overview

10.2. North America Business Software And Services Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Software

10.2.4.1 Finance

10.2.4.2 Sales & Marketing

10.2.4.3 Human Resource

10.2.4.4 Supply Chain

10.2.4.5 Others

10.2.5 Historic and Forecasted Market Size by Service

10.2.5.1 Consulting

10.2.5.2 Managed Services

10.2.5.3 Support & Maintenance

10.2.6 Historic and Forecasted Market Size by Deployment

10.2.6.1 Cloud

10.2.6.2 On-premise

10.2.7 Historic and Forecasted Market Size by Enterprise Size

10.2.7.1 Large Enterprises

10.2.7.2 Small & Medium Enterprises

10.2.8 Historic and Forecasted Market Size by End-use

10.2.8.1 Aerospace & Defense

10.2.8.2 BFSI

10.2.8.3 Government

10.2.8.4 Healthcare

10.2.8.5 IT & Telecom

10.2.8.6 Manufacturing

10.2.8.7 Retail

10.2.8.8 Transportation

10.2.8.9 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Business Software And Services Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Software

10.3.4.1 Finance

10.3.4.2 Sales & Marketing

10.3.4.3 Human Resource

10.3.4.4 Supply Chain

10.3.4.5 Others

10.3.5 Historic and Forecasted Market Size by Service

10.3.5.1 Consulting

10.3.5.2 Managed Services

10.3.5.3 Support & Maintenance

10.3.6 Historic and Forecasted Market Size by Deployment

10.3.6.1 Cloud

10.3.6.2 On-premise

10.3.7 Historic and Forecasted Market Size by Enterprise Size

10.3.7.1 Large Enterprises

10.3.7.2 Small & Medium Enterprises

10.3.8 Historic and Forecasted Market Size by End-use

10.3.8.1 Aerospace & Defense

10.3.8.2 BFSI

10.3.8.3 Government

10.3.8.4 Healthcare

10.3.8.5 IT & Telecom

10.3.8.6 Manufacturing

10.3.8.7 Retail

10.3.8.8 Transportation

10.3.8.9 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Business Software And Services Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Software

10.4.4.1 Finance

10.4.4.2 Sales & Marketing

10.4.4.3 Human Resource

10.4.4.4 Supply Chain

10.4.4.5 Others

10.4.5 Historic and Forecasted Market Size by Service

10.4.5.1 Consulting

10.4.5.2 Managed Services

10.4.5.3 Support & Maintenance

10.4.6 Historic and Forecasted Market Size by Deployment

10.4.6.1 Cloud

10.4.6.2 On-premise

10.4.7 Historic and Forecasted Market Size by Enterprise Size

10.4.7.1 Large Enterprises

10.4.7.2 Small & Medium Enterprises

10.4.8 Historic and Forecasted Market Size by End-use

10.4.8.1 Aerospace & Defense

10.4.8.2 BFSI

10.4.8.3 Government

10.4.8.4 Healthcare

10.4.8.5 IT & Telecom

10.4.8.6 Manufacturing

10.4.8.7 Retail

10.4.8.8 Transportation

10.4.8.9 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Business Software And Services Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Software

10.5.4.1 Finance

10.5.4.2 Sales & Marketing

10.5.4.3 Human Resource

10.5.4.4 Supply Chain

10.5.4.5 Others

10.5.5 Historic and Forecasted Market Size by Service

10.5.5.1 Consulting

10.5.5.2 Managed Services

10.5.5.3 Support & Maintenance

10.5.6 Historic and Forecasted Market Size by Deployment

10.5.6.1 Cloud

10.5.6.2 On-premise

10.5.7 Historic and Forecasted Market Size by Enterprise Size

10.5.7.1 Large Enterprises

10.5.7.2 Small & Medium Enterprises

10.5.8 Historic and Forecasted Market Size by End-use

10.5.8.1 Aerospace & Defense

10.5.8.2 BFSI

10.5.8.3 Government

10.5.8.4 Healthcare

10.5.8.5 IT & Telecom

10.5.8.6 Manufacturing

10.5.8.7 Retail

10.5.8.8 Transportation

10.5.8.9 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Business Software And Services Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Software

10.6.4.1 Finance

10.6.4.2 Sales & Marketing

10.6.4.3 Human Resource

10.6.4.4 Supply Chain

10.6.4.5 Others

10.6.5 Historic and Forecasted Market Size by Service

10.6.5.1 Consulting

10.6.5.2 Managed Services

10.6.5.3 Support & Maintenance

10.6.6 Historic and Forecasted Market Size by Deployment

10.6.6.1 Cloud

10.6.6.2 On-premise

10.6.7 Historic and Forecasted Market Size by Enterprise Size

10.6.7.1 Large Enterprises

10.6.7.2 Small & Medium Enterprises

10.6.8 Historic and Forecasted Market Size by End-use

10.6.8.1 Aerospace & Defense

10.6.8.2 BFSI

10.6.8.3 Government

10.6.8.4 Healthcare

10.6.8.5 IT & Telecom

10.6.8.6 Manufacturing

10.6.8.7 Retail

10.6.8.8 Transportation

10.6.8.9 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Business Software And Services Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Software

10.7.4.1 Finance

10.7.4.2 Sales & Marketing

10.7.4.3 Human Resource

10.7.4.4 Supply Chain

10.7.4.5 Others

10.7.5 Historic and Forecasted Market Size by Service

10.7.5.1 Consulting

10.7.5.2 Managed Services

10.7.5.3 Support & Maintenance

10.7.6 Historic and Forecasted Market Size by Deployment

10.7.6.1 Cloud

10.7.6.2 On-premise

10.7.7 Historic and Forecasted Market Size by Enterprise Size

10.7.7.1 Large Enterprises

10.7.7.2 Small & Medium Enterprises

10.7.8 Historic and Forecasted Market Size by End-use

10.7.8.1 Aerospace & Defense

10.7.8.2 BFSI

10.7.8.3 Government

10.7.8.4 Healthcare

10.7.8.5 IT & Telecom

10.7.8.6 Manufacturing

10.7.8.7 Retail

10.7.8.8 Transportation

10.7.8.9 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Business Software And Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 648.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.90% |

Market Size in 2032: |

USD 1,933.02 Bn. |

|

Segments Covered: |

By Software |

|

|

|

By Service |

|

||

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||