Automotive ADAS (Advanced Driver Assistance Systems) Market Synopsis

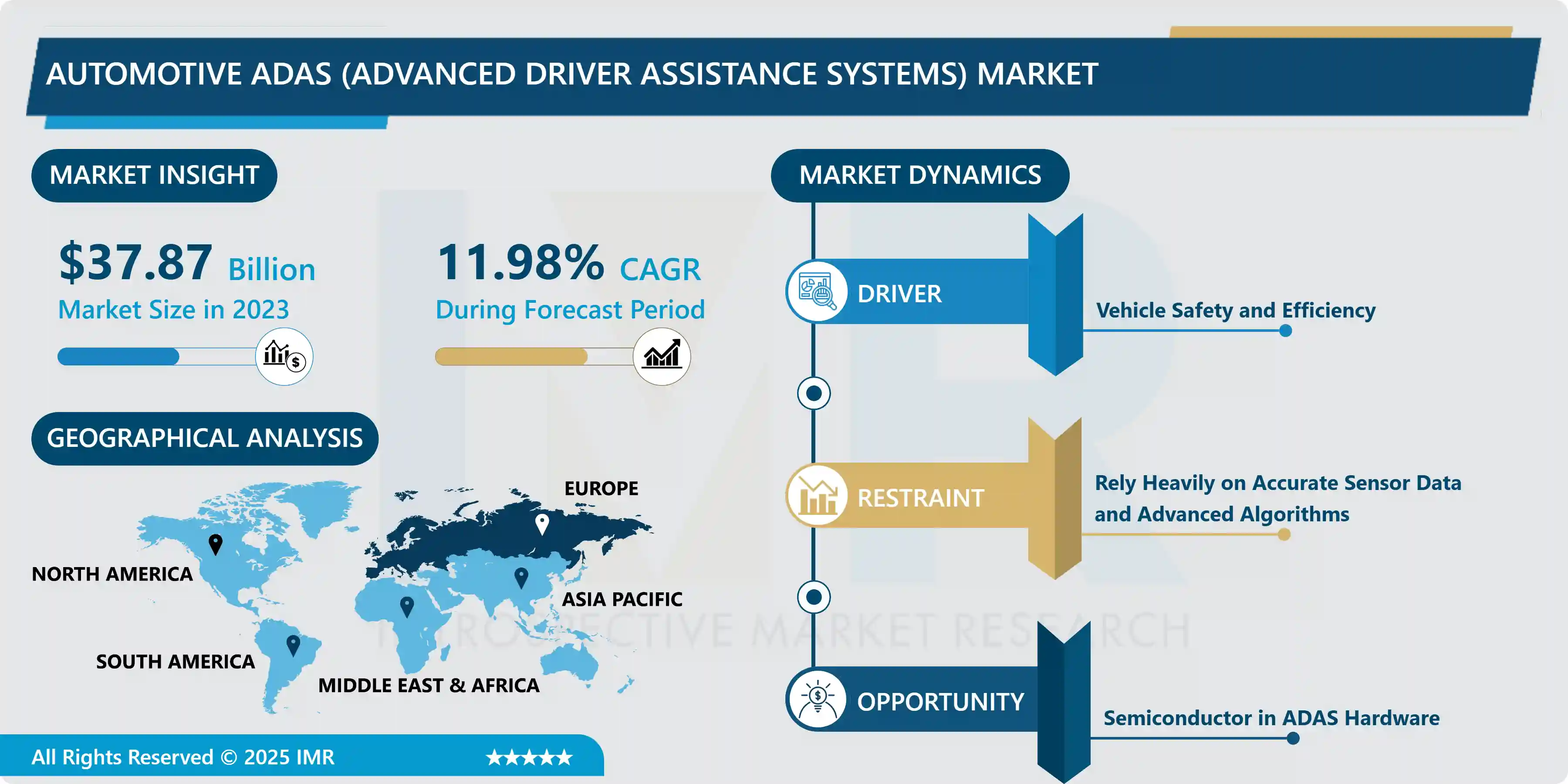

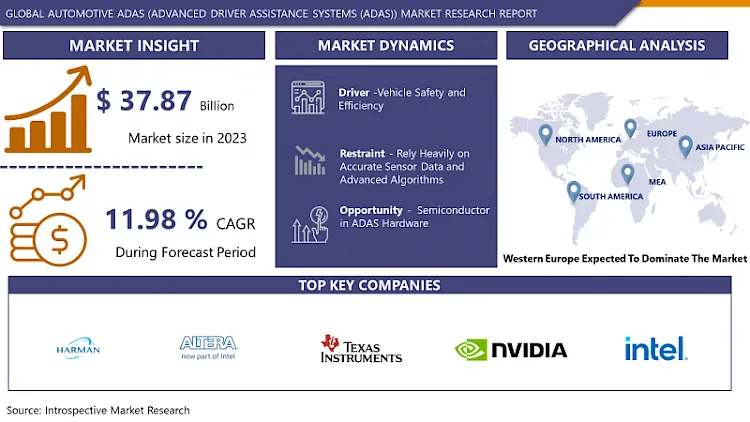

Automotive ADAS (Advanced Driver Assistance Systems) Market Size Was Valued at USD 37.87 Billion in 2023 and is Projected to Reach USD 74.75 Billion by 2032, Growing at a CAGR of 11.98 % From 2024-2032.

Advanced driver-assistance systems are tech tools that help drivers safely operate their vehicles. ADAS improves car and road safety via a human-machine interface. ADAS relies on automated technology like sensors and cameras to identify nearby obstacles.

Critical safety features in ADAS, like pedestrian detection/avoidance, lane departure warning/correction, traffic sign recognition, automatic emergency braking, and blind spot detection, are crucial for improving road safety.

ADAS features such as automatic emergency braking, pedestrian detection, surround view, parking assist, driver drowsiness detection, and gaze detection aid drivers during safety-critical moments, ultimately decreasing car accidents and preserving lives.

Self-driving cars use various apps and technologies to obtain a full 360-degree view, including objects nearby and far away. This shows that hardware designs are progressing towards more advanced process nodes to achieve higher performance goals, while simultaneously reducing power and footprint needs.

Automotive ADAS (Advanced Driver Assistance Systems) Market Trend Analysis

Vehicle Safety and Efficiency

- The implementation of ADAS in modern vehicles represents a major change in emphasizing driving safety. These systems help reduce the chance of accidents and give drivers more information to make better decisions while driving. ADAS decreases the chance of accidents by using features such as automatic emergency braking and forward collision warning, preventing collisions, and enhancing night-time safety by addressing human errors.

- Furthermore, ADAS improves drivers' awareness of their surroundings by utilizing thorough monitoring and predictive analytics, allowing them to foresee possible dangers and make necessary changes promptly.

- Instant alerts are given by feedback mechanisms like auditory signals and haptic feedback to prompt quick corrective actions. With the ongoing advancement and increased adoption of ADAS technology, we can expect to see enhancements in road safety measures, resulting in a more secure and productive future for transportation on the road.

Semiconductor in ADAS Hardware

- Semiconductor in ADAS Hardware plays a significant opportunity in powering Advanced Driver Assistance Systems (ADAS), which include features like adaptive cruise control, lane-keeping assist, and automatic emergency braking in the automotive industry.

- These systems depend greatly on a complex network of sensors, cameras, and radar units, all linked through advanced semiconductor processors. These processors are crucial for improving vehicle safety and driving forward the progress of autonomous driving technology.

- A primary illustration of excellence in semiconductors for ADAS applications can be found in the NVIDIA Drive AGX platform. Using advanced semiconductor processors, this system is valuable for multiple ADAS features such as autonomous driving, adaptive cruise control, and lane-keeping assistance.

- The merging of semiconductors with ADAS hardware creates a large opportunity for progress and ingenuity in the automotive sector. With ongoing advancements in semiconductor technology, ADAS features are set to become more advanced and capable, which will enhance vehicle safety standards and speed up the journey toward fully autonomous driving.

Automotive ADAS (Advanced Driver Assistance Systems) Market Segment Analysis:

Automotive ADAS (Advanced Driver Assistance Systems) Market is segmented based on Type, Technology, Vehicle Type and Level of Autonomy

By Type, Advanced Automatic Emergency Braking Systems segment is expected to dominate the market during the forecast period

- Advanced Automatic Emergency Braking Systems (AEB) is a major leap forward in vehicle safety technology. It is designed to prevent accidents or lessen their impact by automatically engaging the brakes when the driver doesn't react quickly enough.

- These systems are created to step in when the driver fails to heed warnings, applying full brake power to reduce the chance of a crash. AEB systems can identify obstacles in the path of the vehicle and respond quickly to prevent possible accidents with the help of sensors like radar and cameras.

- One difference between AEB systems is their capability to identify different kinds of obstacles while driving. Some systems only pay attention to other vehicles, whereas others can also detect cyclists and pedestrians.

- Advanced Automatic Emergency Braking Systems could transform safety standards in various sectors of the automotive field. Manufacturers are including AEB technology in a variety of vehicles, from small city cars to big SUVs, to offer drivers an extra level of safety while driving.

By Level of Autonomy, the Level 4 (High Driving Automation) segment held the largest share of 46.65% in 2023

- Level 4 autonomy marks a major advancement in car technology, offering the potential for vehicles to function without human control under specific circumstances. Automotive Advanced Driver Assistance Systems (ADAS) are the main technology used in this level of automation, utilizing various sensors, cameras, and AI algorithms to detect and react to the surroundings.

- The rise of Level 4 autonomy has resulted in partnerships among traditional carmakers, tech behemoths, and new companies. NAVYA, Waymo, Magna, and Volvo are leading the way in the development and implementation of self-driving technology.

- Level 4 vehicles currently operate in geofenced areas and under specific conditions, but progress in legislation, infrastructure, and technology are leading to wider deployment. Level 4 autonomous vehicles have the potential to transform transportation with safer, more efficient, and more accessible on-demand mobility solutions as public acceptance increases and regulatory frameworks develop.

Automotive ADAS (Advanced Driver Assistance Systems) Market Regional Insights:

Western Europe is Expected to Dominate the Market Over the Forecast Period

- Germany's emphasis on precision engineering and meticulousness aligns perfectly with the demands of ADAS technologies, which necessitate reliability, accuracy, and high performance. German automakers leverage their expertise in sensor fusion, computer vision, and machine learning to develop sophisticated ADAS solutions that enhance both vehicle safety and driver comfort.

- In addition to technological prowess, Germany benefits from a proactive regulatory environment that incentivizes the adoption of ADAS technologies. Government initiatives, such as incentives for self-driving and electric vehicles, encourage innovation and investment in ADAS research and development.

- Collaboration among industry stakeholders, academic institutions, and government entities plays a pivotal role in Germany's dominance in the ADAS sector. Partnerships between leading research institutions like RWTH Aachen University and industry players facilitate the exchange of knowledge and expertise, driving innovation within the ADAS industry.

Active Key Players in the Automotive ADAS (Advanced Driver Assistance Systems) Market

- Harman International Industries (USA)

- Altera Corporation (Intel Corporation) (USA)

- Texas Instruments (USA)

- NVIDIA Corporation (USA)

- Intel Corporation (USA)

- Magna International (Canada)

- Hella Kgaa Hueck & Co. (Germany)

- Infineon Technologies AG (Germany)

- Aisin Seiki Co. Ltd. (Japan)

- Panasonic Corporation (Japan)

- Renesas Electronics Corporation (Japan)

- DENSO Corporation (Japan)

- Hitachi (Japan)

- Delphi Automotive PLC (UK)

- Valeo SA (France)

- Ficosa International S.A. (Spain)

- Mobileye (Israel)

- NXP Semiconductors NV (Netherlands)

- Garmin Ltd. (Switzerland)

- Aptiv Plc (Ireland)

- Veoneer Inc. (Sweden)

- Autoliv Inc. (Sweden)

- Wabco Holdings Inc (Belgium) And Other Major Players

Key Industry Developments in the Automotive ADAS (Advanced Driver Assistance Systems) Market:

- In April 2024, Microchip Technology Inc. declared the finalized purchase of VSI Co. Ltd., situated in Seoul, Korea, a leading provider of high-speed, asymmetric, camera, sensor, and display connectivity technologies and products following the Automotive SerDes Alliance (ASA) open standard for In-Vehicle Networking (IVN). Through this purchase, Microchip expanded its dominance in the automotive networking market by incorporating VSI's knowledge and skills.

- In April 2024, Mobileye Global Inc. agreed to provide advanced driver assistance technology for Mahindra & Mahindra Ltd.'s future vehicles to capitalize on the growth of India's automotive market. The firms partnered to work on a self-driving system for India, as revealed by Mobileye at CES in Las Vegas. This collaboration sought to utilize Mobileye's knowledge of ADAS technology to improve the safety and efficiency of Mahindra & Mahindra's vehicles while also accessing the growing automotive market in India.

|

Global Automotive ADAS (Advanced Driver Assistance Systems) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.98 % |

Market Size in 2032: |

USD 74.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Vehicle Type |

|

||

|

By Level of Autonomy |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market by Type (2018-2032)

4.1 Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Parking Assist Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Adaptive Front-Lighting

4.5 Night Vision Systems

4.6 Blind Spot Detection

4.7 Advanced Automatic Emergency Braking Systems

4.8 Others

Chapter 5: Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market by Technology (2018-2032)

5.1 Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Radar

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lidar

5.5 Camera

Chapter 6: Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market by Vehicle Type (2018-2032)

6.1 Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Radar

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Lidar

6.5 Camera

Chapter 7: Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market by Level of Autonomy (2018-2032)

7.1 Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Level 1 (Driver Assistance)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Level 2 (Partial Driving Automation)

7.5 Level 3 (Conditional Driving Automation)

7.6 Level 4 (High Driving Automation)

7.7 Level 5 (Full Driving Automation)

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ARENA SOLUTIONS INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ASSURX INC. (USA)

8.4 AUTODESK INC. (USA)

8.5 CORITY (FORMERLY MEDGATE) (CANADA)

8.6 DASSAULT SYSTÈMES (FRANCE)

8.7 HONEYWELL INTERNATIONAL INC. (USA)

8.8 IBM CORPORATION (USA)

8.9 INTELEX TECHNOLOGIES INC. (CANADA)

8.10 IQMS (USA)

8.11 MASTERCONTROL INC. (USA)

8.12 METRICSTREAM INC. (USA)

8.13 MICROSOFT CORPORATION (USA)

8.14 ORACLE CORPORATION (USA)

8.15 PILGRIM QUALITY SOLUTIONS INC. (USA)

8.16 PTC INC. (USA)

8.17 SAP ARIBA (USA)

8.18 SAP SE (GERMANY)

8.19 SIEMENS AG (GERMANY)

8.20 SPARTA SYSTEMS INC. (USA)

8.21 UNIPOINT SOFTWARE INC. (CANADA)

8.22 OTHER KEY PLAYERS

Chapter 9: Global Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market By Region

9.1 Overview

9.2. North America Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Parking Assist Systems

9.2.4.2 Adaptive Front-Lighting

9.2.4.3 Night Vision Systems

9.2.4.4 Blind Spot Detection

9.2.4.5 Advanced Automatic Emergency Braking Systems

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Radar

9.2.5.2 Lidar

9.2.5.3 Camera

9.2.6 Historic and Forecasted Market Size by Vehicle Type

9.2.6.1 Radar

9.2.6.2 Lidar

9.2.6.3 Camera

9.2.7 Historic and Forecasted Market Size by Level of Autonomy

9.2.7.1 Level 1 (Driver Assistance)

9.2.7.2 Level 2 (Partial Driving Automation)

9.2.7.3 Level 3 (Conditional Driving Automation)

9.2.7.4 Level 4 (High Driving Automation)

9.2.7.5 Level 5 (Full Driving Automation)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Parking Assist Systems

9.3.4.2 Adaptive Front-Lighting

9.3.4.3 Night Vision Systems

9.3.4.4 Blind Spot Detection

9.3.4.5 Advanced Automatic Emergency Braking Systems

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Radar

9.3.5.2 Lidar

9.3.5.3 Camera

9.3.6 Historic and Forecasted Market Size by Vehicle Type

9.3.6.1 Radar

9.3.6.2 Lidar

9.3.6.3 Camera

9.3.7 Historic and Forecasted Market Size by Level of Autonomy

9.3.7.1 Level 1 (Driver Assistance)

9.3.7.2 Level 2 (Partial Driving Automation)

9.3.7.3 Level 3 (Conditional Driving Automation)

9.3.7.4 Level 4 (High Driving Automation)

9.3.7.5 Level 5 (Full Driving Automation)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Parking Assist Systems

9.4.4.2 Adaptive Front-Lighting

9.4.4.3 Night Vision Systems

9.4.4.4 Blind Spot Detection

9.4.4.5 Advanced Automatic Emergency Braking Systems

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Radar

9.4.5.2 Lidar

9.4.5.3 Camera

9.4.6 Historic and Forecasted Market Size by Vehicle Type

9.4.6.1 Radar

9.4.6.2 Lidar

9.4.6.3 Camera

9.4.7 Historic and Forecasted Market Size by Level of Autonomy

9.4.7.1 Level 1 (Driver Assistance)

9.4.7.2 Level 2 (Partial Driving Automation)

9.4.7.3 Level 3 (Conditional Driving Automation)

9.4.7.4 Level 4 (High Driving Automation)

9.4.7.5 Level 5 (Full Driving Automation)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Parking Assist Systems

9.5.4.2 Adaptive Front-Lighting

9.5.4.3 Night Vision Systems

9.5.4.4 Blind Spot Detection

9.5.4.5 Advanced Automatic Emergency Braking Systems

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Radar

9.5.5.2 Lidar

9.5.5.3 Camera

9.5.6 Historic and Forecasted Market Size by Vehicle Type

9.5.6.1 Radar

9.5.6.2 Lidar

9.5.6.3 Camera

9.5.7 Historic and Forecasted Market Size by Level of Autonomy

9.5.7.1 Level 1 (Driver Assistance)

9.5.7.2 Level 2 (Partial Driving Automation)

9.5.7.3 Level 3 (Conditional Driving Automation)

9.5.7.4 Level 4 (High Driving Automation)

9.5.7.5 Level 5 (Full Driving Automation)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Parking Assist Systems

9.6.4.2 Adaptive Front-Lighting

9.6.4.3 Night Vision Systems

9.6.4.4 Blind Spot Detection

9.6.4.5 Advanced Automatic Emergency Braking Systems

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Radar

9.6.5.2 Lidar

9.6.5.3 Camera

9.6.6 Historic and Forecasted Market Size by Vehicle Type

9.6.6.1 Radar

9.6.6.2 Lidar

9.6.6.3 Camera

9.6.7 Historic and Forecasted Market Size by Level of Autonomy

9.6.7.1 Level 1 (Driver Assistance)

9.6.7.2 Level 2 (Partial Driving Automation)

9.6.7.3 Level 3 (Conditional Driving Automation)

9.6.7.4 Level 4 (High Driving Automation)

9.6.7.5 Level 5 (Full Driving Automation)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive ADAS (Advanced Driver Assistance Systems (ADAS)) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Parking Assist Systems

9.7.4.2 Adaptive Front-Lighting

9.7.4.3 Night Vision Systems

9.7.4.4 Blind Spot Detection

9.7.4.5 Advanced Automatic Emergency Braking Systems

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Radar

9.7.5.2 Lidar

9.7.5.3 Camera

9.7.6 Historic and Forecasted Market Size by Vehicle Type

9.7.6.1 Radar

9.7.6.2 Lidar

9.7.6.3 Camera

9.7.7 Historic and Forecasted Market Size by Level of Autonomy

9.7.7.1 Level 1 (Driver Assistance)

9.7.7.2 Level 2 (Partial Driving Automation)

9.7.7.3 Level 3 (Conditional Driving Automation)

9.7.7.4 Level 4 (High Driving Automation)

9.7.7.5 Level 5 (Full Driving Automation)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automotive ADAS (Advanced Driver Assistance Systems) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.98 % |

Market Size in 2032: |

USD 74.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Vehicle Type |

|

||

|

By Level of Autonomy |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||