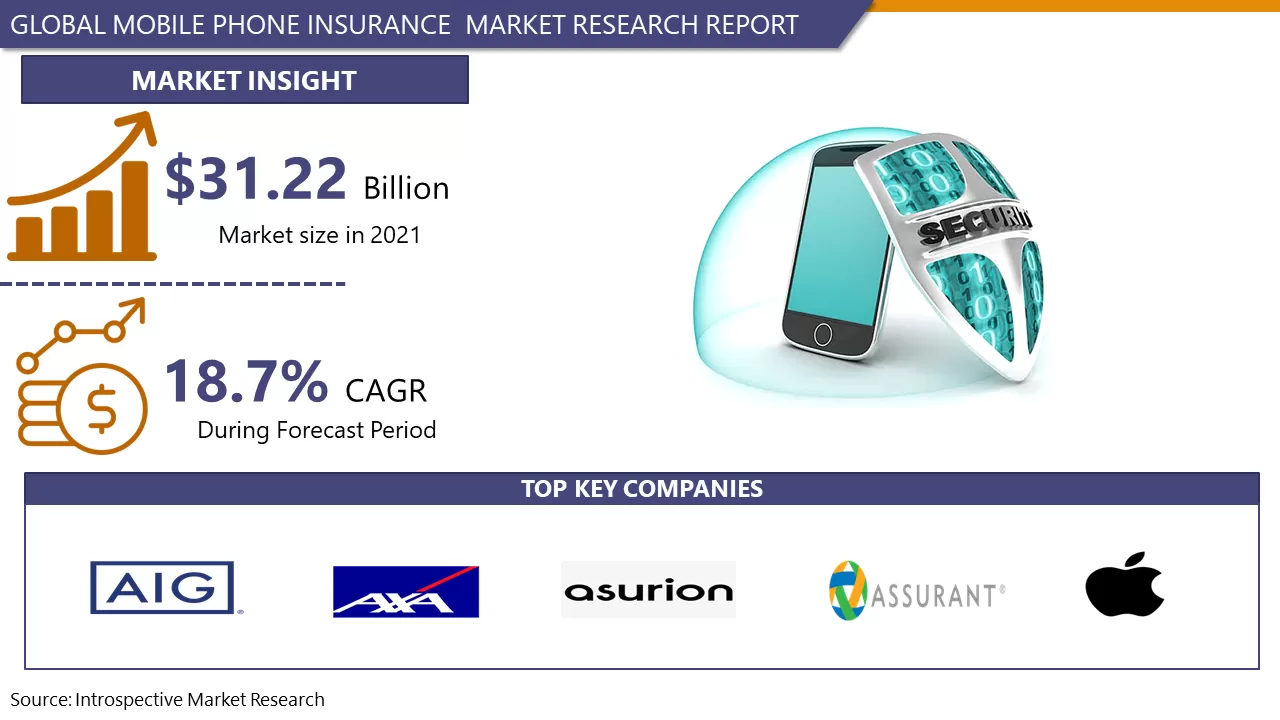

Market Overview:

Mobile phones easily get prone to technical and physical damages, such as crack in circuit board, excessive dust and dirt, or damaged casing which may further affect the Coverages and Printed Circuit Board (PCB). Damages by technical or physical issues can cause severe losses for the end users, and thus many users opt for mobile phone insurance for the safety purpose. Mobile phone insurance is nothing but the service contract, which offers component fix repairing for mobile phones that are sold by retailer or service providers. Mobile phone insurances provide additional coverage of phones like malicious damage, the unauthorized usage, e-wallet payments, or theft. It also covers the cost as well as inconvenience of electrical or mechanical failures.

Major Key Players for Mobile Phone Insurance Market

Market Dynamics and Factors

Mobile phone users often show concerns about the security and safety of their phones post the expiration of their warranty. The costs associated with the maintenance and repair of damaged smartphones are quite expensive after the warranty expires. Thus, providing an insurance cover to mobile phones saves a lot of money as the burden of cost for repairing them is delegated to insurance providers, which further drives the growth of mobile phone insurance market. Further, the simplification of conditions and terms as well as the claiming procedures is anticipated to give rise to the adoption of mobile insurance plans among users worldwide. In addition to this, factors like the accidental damage, incidents of phone thefts, device malfunction or virus infection and rise in rapid adoption of high-quality mobile phones are some of the key factors, which are expected to boost the mobile phone insurance market growth over projected period.

Mobile Phone Insurance Market Report Highlight

- By Phone type, premium smartphone segment dominated the mobile phone insurance market in the recent years. Premium smartphones when exposed to physical and technical damages, may cost high price for repair. To protect such high budget phones, users opt for insurance, which leads to the segment growth.

- By Coverage type, physical damage segment holds the largest market share. Physical damages such as damage of screen, damaged casing, cracks in circuit board or others have led to rise in adoption of mobile phone insurance amongst users.

- By Sales channel, retail segment is anticipated to dominate the market growth. Owing to the ease, convenience and trust on specific retailers, users primarily opt for mobile phone insurance through retail segment.

- By End users, individual segment witnesses the highest growth in the market of mobile phone insurance. Owing to the safety and prevention from any type of damage, individuals all around the world, opt for insurance on mobile phones

- By Region, North America is expected to dominate the Mobile Phone Insurance market, during the projected period. The high growth is due to the presence of large number of insurance providers in the region.

Key Industry Development

- In October, 201, the general insurer, Go Digit announced a launch of its product of mobile insurance cover. The insurance covers expenses for used and old as well as new mobile screens with premium rates kept as low as any screen guard would cost.

- In March, 2019, AXA Partners has declared its first entry into the UK region and Irish mobile phone insurance market through a new partnership with Pier Insurance.

Mobile Phone Insurance Market Segmentation

By Phone type

- Budget Phones

- Mid & High-End Phones

- Premium Smartphones

By Coverage type

- Physical Damage

- Internal Component Failure

- Theft & Loss Protection

By Sales channel

- Retail

- Online

By End users

- Business

- Individual

For this report, Introspective Market Research has segmented the Mobile Phone Insurance Market based on region:

Regional Outlook (Revenue in USD Million; Volume in Units, 2022-2028)

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Turkey

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Vietnam

- Thailand

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- Iran

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of LATAM