Xanthate Market Synopsis

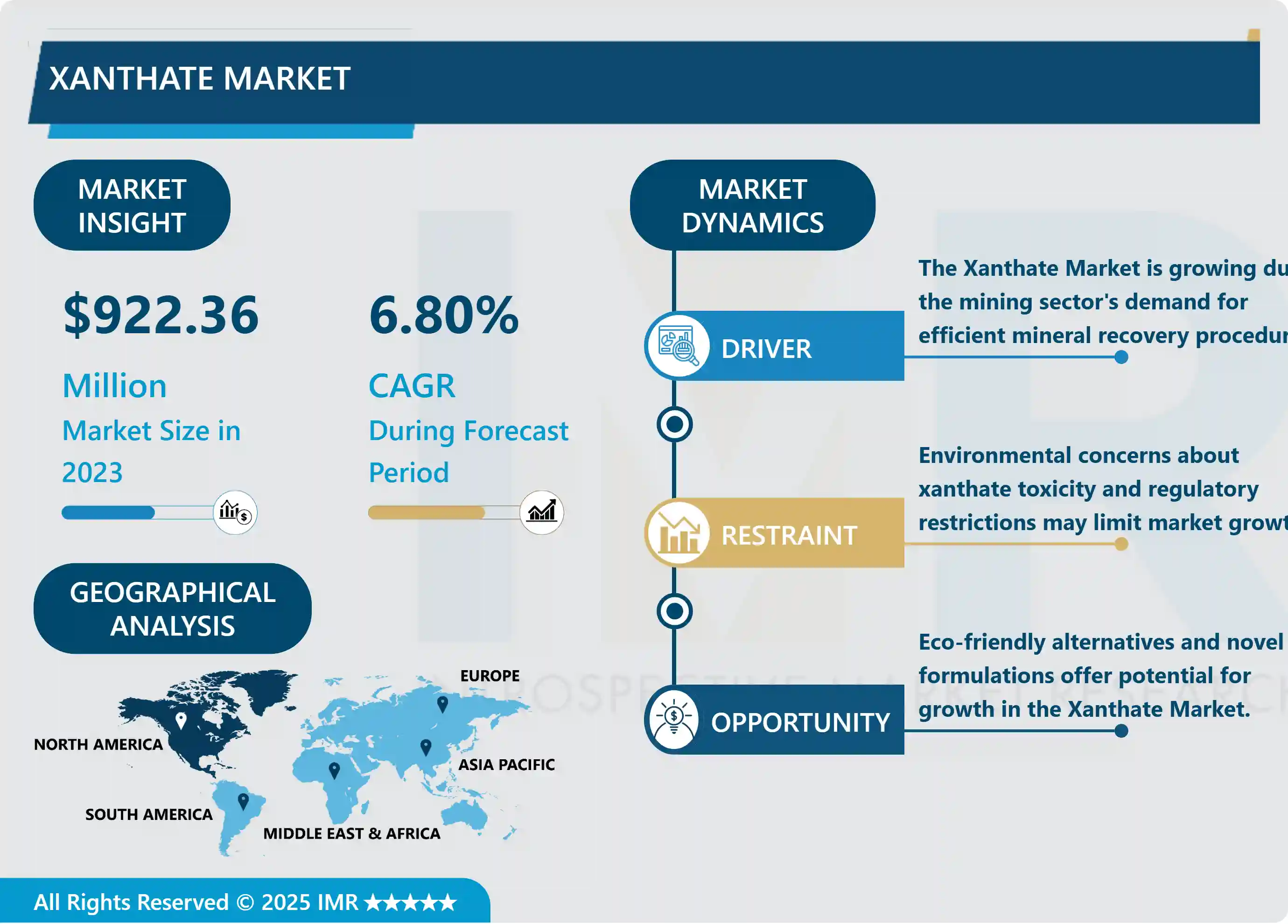

Xanthate Market Size is Valued at USD 922.36 Million in 2023, and is Projected to Reach USD 1561.21 Million by 2032, Growing at a CAGR of 6.80% From 2024-2032.

The Xanthate Market is performing well because of the increased usage of xanthate compounds in multiple industries especially in chemical intermediate and mineral processing industries. Xanthates are a category of chemicals which has found wide application in the field of flotation in the mining industry. They are strictly required in a process that would involve the identification of the richer minerals from rocks. They play a major role in the process of minerals extraction because of their efficiency in increasing the ratio of metals including copper, lead and zinc. It is expected that the demand for xanthate compounds will rise significantly with the further development of mining industries throughout the world.

The growing interest in the effectiveness and efficiency of mining is one of the main sources driving the Xanthate Market. Due to pressures of improving resource recovery, coupled with rising mineral prices, mining companies are already adopting advanced processing technologies including the use of xanthates in flotation. The selectivity of xanthates to adhere to certain minerals is very useful in the enhancement of operational efficiency and minimization of costs since it boosts rates of recovery. It is more common in areas that have relatively big reserves of mineral, such as Oceania, South and North Americas.

Bearing in mind that the Asia Pacific area is likely to experience growth in industrialization and mining businesses over the next few years, we anticipate that it will account for a large share of the xanthate market. Civil construct and resource exploitation continuous investing in developing countries this is why China and India high demand for xanthates. In addition, because many mining operations are located in these countries, we expect continued growth in the market. North America and European countries are also major markets mostly because of the existing mining operations and the already incorporated policies that support the utilization of environment friendly chemicals.

Xanthate Market Trend Analysis

Shift Towards Eco-Friendly Alternatives

- In the Global Xanthate market the shift towards greener products is gradually gaining pace due to rise in strict environmental policies over the products and usage along with increase in factor such as green consciousness among the population and businesses.. While the traditional xanthates have been used as flotation agents for minerals, they are toxic to humans and the environment. Manufacturers are now paying much attention to formulating biodegradable and less hazardous flotation agents that can deliver similar effectiveness at a lower environmental cost. This change not only solves the regulatory crises but also aligns with mining business milestones of sustainable resource exploitation and management.

- There is also the drive created by the need to operating legally and sustainably, thus keeping the social license to operate in the industry.. This has led to more emphasis on the search for durable green xanthate substitutes because companies in the mining industry are gradually beginning to appreciate the importance of sustainability. These new materials can allow companies to enhance their corporate image and ensure compliance with new environmental requirements in their business. It is widely believed that the inclination towards sustainability will revolutionize the Xanthate Market in the manner that encourages the use of the innovative flotation agents and create a more sustainable outlook on mineral extraction.

Technological Advancements in Mineral Processing

- The development in minerals processing is substantially having an impact on the Xanthate Market as it has increased the efficiency and effectiveness of flotation. The modern mining operations are gradually adopting new technologies such as automated flotation and control systems and monitoring systems. Such developments also imply that the specific controlling of the flotation conditions ensures that the chemicals, particularly the xanthates are used efficiently and that the effective recovery of valuable minerals is achieved. Additionally, research into new xanthate formulations for appropriate ore types also improves that of xanthates as well. This results into a higher general recovery in mining processes and better sorting of minerals.

- Furthermore, artificial intelligence and data analytical methods in mineral processing are redefining the application of xanthates. By mining the various variables such as the type of ore and flotation conditions type, managing large data enables formulation of the right xanthate for use. This approach is inharmonious with the advanced importance on sustainability in the industry because it not only increases the recovery rates but also diminishes waste and negative effects on the environment. In the context of the escalating market needs for new products that meet the requirements of advanced mineral processing, the report predicts the growth of the Xanthate Market and optimises the efficiency of the relevant field as technologies develop further.

Xanthate Market Segment Analysis:

Xanthate Market Segmented on the basis of By Product Type, and Application

By Product Type, Sodium Isopropyl Xanthate [SIPX] segment is expected to dominate the market during the forecast period

- The Xanthate Market is characterized by a highly diversified product segment, with each product being developed to meet certain functions within the chemical and mining sectors. The present market share of Sodium Ethyl Xanthate (SEX) is sizable due to its application in the flotation of metals in the mineral processing plants. It is the most-used method among all the many methods applied in the mining industry because of superiority in the separation of the sulfide minerals. Similarly, Sodium Isopropyl Xanthate (SIPX) and Sodium Isobutyl Xanthate (SIBX) are slowly being adopted due to the fact that they boast of some special features that make them preferable in the flotation of some minerals such as selectivity, high recovery rates among others. Another interesting feature of the product is that potassium Amyl Xanthate (PAX) can also be used for many other types of mineral flotation hence making the xanthate product line very versatile.

- The rise in demand for various xanthate types is enabled by the need to develop specific xanthate reagents for specific flotation uses and to meet the developments in the mineral processing industry. The choice of the right xanthate products that would give the needed efficiency and recovery is a growing factor due to the complexity of the mining processes. By following this trend, innovation and formulation of specialized formulations specific to the types of minerals and the conditions of mineral processing are being developed by manufacturers. Therefore, it can be expected that the market will see steady increase in demand across all of the segments as manufacturers continue investing in initial research in improving xanthate formulas for numerous applications in various industries.

By Application, Mining segment held the largest share in 2023

- The Xanthate Market finds the most usage in the mining industry as xanthates act as flotation agents for mining valuable minerals. In the froth flotation process, they are widely used to achieved the purification of ores such as copper, lead and zinc so that they can be separated from other unwanted materials. The most significant factor in mineral processing is xanthates, which have extensive applicability and high selectivity in the process of attaching itself to the targeted mineral particles to optimize the desired recovery. There is likely to be further demand for highly specific xanthate formulations to improve the efficiency of flotation as the global levels of mining and the uses of minerals and minerals products steadily strengthen and advance.

- Apart from mining however rubber processing and agrochemicals are becoming more used for xanthates.. It has roles of accelerating agents in the vulcanization process in the rubber manufacturing to enhance the performance characteristics of the rubber products. In the agrochemical sector, the market demand for xanthates is also related to their application in the intermediate of numerous pesticides and herbicides. The diversification of xanthate application is expanding growth in numerous sectors because of the high demand for quality rubber products and increased efficiencies in agriculture. This trend is highlighting the ability of xanthate compounds both in other than mining industries making it to become fundamental materials in some of the important markets.

Xanthate Market Regional Insights:

Asia-Pacific is expected to dominate the Xanthate Market.

- The major driver for growth in the Xanthate Market shall be the Asia-Pacific area and this shall be due to a higher activity in mining and-fast industrialization. This is especially that country like China, India, and Australia, etc those are abundantly rich in mineral resources and are investing in the growth of mines and minerals sector. This article states that with increasing consumption of metals and minerals particularly in construction and electronics industries rising demand for effective flotation agents like xanthates is required. The use of xanthates in mining as communication and processing efficiency improves with increasing expansion and modification to the mining business.

- In addition to this, the ore mining and mineral processing enterprises in the region are benefited from the favorable regulation policies for the market. With governments of Asia-Pacific countries emphasizing the development of mining as a critical source of growth, there has been growing exploration and exploitation of minerals. Further, there is investment being made into the enhancement of mining techniques to enhance productivity and reduce the effects on the environment. Mining companies are striving to reap maximum benefits and minimize their expenses and owing to the enhanced use of xanthate compounds, the Asia Pacific market will remain dominant in the future.

Active Key Players in the Xanthate Market

- Humon Chemical Auxiliary (China)

- CTC MINING (Australia)

- Orica Limited (Australia)

- Tieling Flotation Reagents Co., Ltd. (China)

- Coogee (Australia)

- R.T. Vanderbilt Holding Company, Inc. (U.S.)

- BASF SE (Germany)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Others

|

Global Xanthate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 922.36 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.80% |

Market Size in 2032: |

USD 1561.21 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Humon Chemical Auxiliary (China), CTC MINING (Australia), Orica Limited (Australia), Tieling Flotation Reagents Co., Ltd. (China), Coogee (Australia), R.T. Vanderbilt Holding Company, Inc. (U.S.), BASF SE (Germany), Merck KGaA (Germany), Thermo Fisher Scientific Inc. (U.S.), Others. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Xanthate Market by Product Type (2018-2032)

4.1 Xanthate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sodium Ethyl Xanthate [SEX]

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sodium Isopropyl Xanthate [SIPX]

4.5 Sodium Isobutyl Xanthate [SIBX]

4.6 Potassium Amyl Xanthate [PAX]

4.7 Others

Chapter 5: Xanthate Market by Application (2018-2032)

5.1 Xanthate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mining

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rubber Processing

5.5 Agrochemicals

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Xanthate Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HUMON CHEMICAL AUXILIARY (CHINA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CTC MINING (AUSTRALIA)

6.4 ORICA LIMITED (AUSTRALIA)

6.5 TIELING FLOTATION REAGENTS COLTD. (CHINA)

6.6 COOGEE (AUSTRALIA)

6.7 R.T. VANDERBILT HOLDING COMPANY INC. (U.S.)

6.8 BASF SE (GERMANY)

6.9 MERCK KGAA (GERMANY)

6.10 THERMO FISHER SCIENTIFIC INC. (U.S.)

6.11 OTHERS

6.12

Chapter 7: Global Xanthate Market By Region

7.1 Overview

7.2. North America Xanthate Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Sodium Ethyl Xanthate [SEX]

7.2.4.2 Sodium Isopropyl Xanthate [SIPX]

7.2.4.3 Sodium Isobutyl Xanthate [SIBX]

7.2.4.4 Potassium Amyl Xanthate [PAX]

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Mining

7.2.5.2 Rubber Processing

7.2.5.3 Agrochemicals

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Xanthate Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Sodium Ethyl Xanthate [SEX]

7.3.4.2 Sodium Isopropyl Xanthate [SIPX]

7.3.4.3 Sodium Isobutyl Xanthate [SIBX]

7.3.4.4 Potassium Amyl Xanthate [PAX]

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Mining

7.3.5.2 Rubber Processing

7.3.5.3 Agrochemicals

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Xanthate Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Sodium Ethyl Xanthate [SEX]

7.4.4.2 Sodium Isopropyl Xanthate [SIPX]

7.4.4.3 Sodium Isobutyl Xanthate [SIBX]

7.4.4.4 Potassium Amyl Xanthate [PAX]

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Mining

7.4.5.2 Rubber Processing

7.4.5.3 Agrochemicals

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Xanthate Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Sodium Ethyl Xanthate [SEX]

7.5.4.2 Sodium Isopropyl Xanthate [SIPX]

7.5.4.3 Sodium Isobutyl Xanthate [SIBX]

7.5.4.4 Potassium Amyl Xanthate [PAX]

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Mining

7.5.5.2 Rubber Processing

7.5.5.3 Agrochemicals

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Xanthate Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Sodium Ethyl Xanthate [SEX]

7.6.4.2 Sodium Isopropyl Xanthate [SIPX]

7.6.4.3 Sodium Isobutyl Xanthate [SIBX]

7.6.4.4 Potassium Amyl Xanthate [PAX]

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Mining

7.6.5.2 Rubber Processing

7.6.5.3 Agrochemicals

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Xanthate Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Sodium Ethyl Xanthate [SEX]

7.7.4.2 Sodium Isopropyl Xanthate [SIPX]

7.7.4.3 Sodium Isobutyl Xanthate [SIBX]

7.7.4.4 Potassium Amyl Xanthate [PAX]

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Mining

7.7.5.2 Rubber Processing

7.7.5.3 Agrochemicals

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Xanthate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 922.36 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.80% |

Market Size in 2032: |

USD 1561.21 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Humon Chemical Auxiliary (China), CTC MINING (Australia), Orica Limited (Australia), Tieling Flotation Reagents Co., Ltd. (China), Coogee (Australia), R.T. Vanderbilt Holding Company, Inc. (U.S.), BASF SE (Germany), Merck KGaA (Germany), Thermo Fisher Scientific Inc. (U.S.), Others. |

||